Click here for the Online Exclusive Sidebar

VSaaS: More Viable in 2015? | A Billion Reasons to Watch DIY Surveillance | Changing the Model | Legislative Impact on Video Surveillance | SDM Asks: "Which vertical markets will offer the best opportunities for systems integration in 2015

In January of each year, the President of the United States delivers the annual State of the Union address, without fail declaring the union to be strong. In security, the same can be said for the state of the video surveillance industry in recent years. Strong growth has become a hallmark of this segment for the last several years, and there’s no reason to think that won’t continue to be the case.

“It’s been an incredible year,” says Rob Hessel, president and CEO of Largo, Fla.-based security integrator Source 1 Solutions, featured on this month’s cover. “Our video business grew just short of 300 percent. Those are staggering numbers, and we don’t see business slowing down. With IP, there’s tremendous opportunity in video surveillance — bigger than ever.”

At Salt Lake City-based Stone Security, CEO David Edmunds concurs with the tangible growth happening in video surveillance revenue. “Our sales of video surveillance equipment were up about 20 percent over last year, and we expect more of the same in 2015,” Edmunds says.

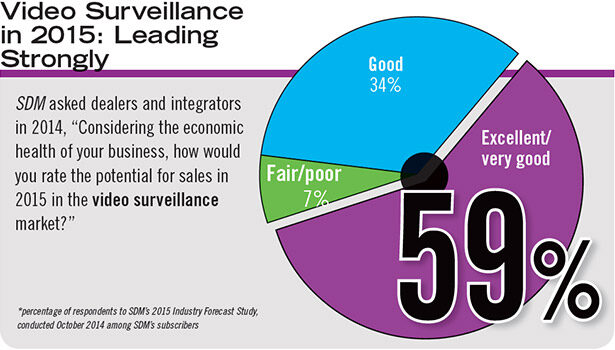

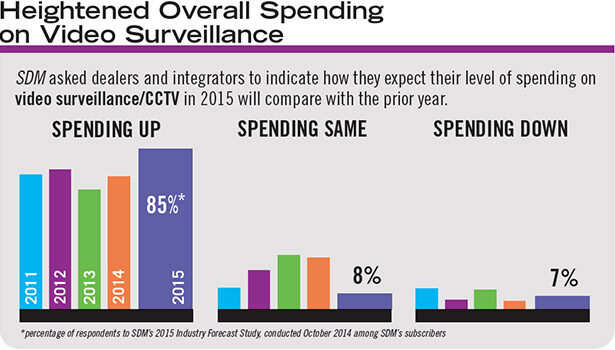

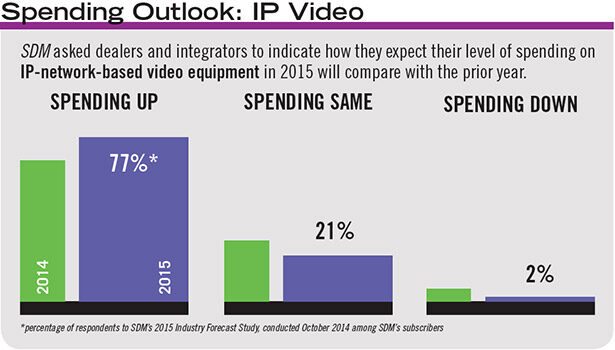

This kind of confidence in the video surveillance market is apparent inSDM’s 2015 Industry Forecast Study, where more than nine out of 10 dealers and integrators reported high expectations for a good, very good or even excellent year (see chart below, left). So in many ways, it could be argued that video is leading overall industry growth in general. Historically, greater adoption of IP and increased migration to IP from analog have been main drivers behind growth in the video segment, which will continue to hold true as IP leads the way for growth in sales of video systems.

Despite the growth opportunities brought about by IP-based technology, analog-based video surveillance products continue to hold on; in many cases, it is still the technology of choice for end users, based mainly on budgets and pricing.

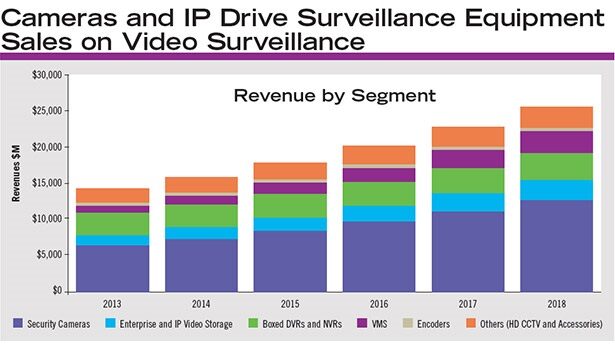

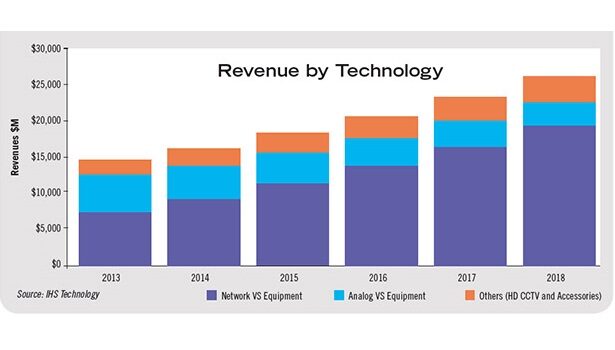

Historically, security cameras have accounted for the bulk of equipment revenues, and research firm IHS expects that trend to continue as the market for video surveillance hardware climbs from just under $13 billion in 2013 to an expected $25.6 billion by 2018. During this same time, IHS says, network-based equipment is rapidly replacing analog as the predominant technology choice for video surveillance systems, eventually accounting for about 75 percent of that $25.6 billion market.

These are very encouraging numbers that definitely reflect what manufacturers are seeing in their businesses, says Jeffrey He, president of Hikvision USA, City of Industry, Calif., and president of the newly formed Hikvision Canada.

“IP cameras are driving the industry away from the analog market to IP. There’s been a major shift over the last two years very quickly,” he says. “Today, IP sales are on par with or exceed the analog business. We anticipate another five years of growth, at least.”

But as IP becomes more de rigeurin our everyday lives, awareness of the benefits of increased resolution is pushing this shift, which should turn the current ratio on its ear in the not-so-distant future. This is good news for manufacturers and integrators alike.

Some integrators, including Stone Security, have abandoned analog altogether. “Our model has not changed much over the last few years,” Edmunds says. “We continue to focus entirely on IP-based products, and we continue to stay very loyal to proven partners. We install 100 percent IP — 0 percent analog — and we do not foresee this changing at all in 2015.”

As in any industry or market, increased opportunity also increases competition, some of which comes from “outsiders” looking to capitalize on those opportunities. That’s something integrators have to be prepared for, Hessel says. “With IP video, there’s tremendous opportunity in video surveillance, bigger than ever. Given the fact that we’re living in an IP world, there will be more competition from IT-based companies getting into security,” he says. “You have to have an understanding from an IT perspective. For any integrator who doesn’t embrace IT, it’s going to be more challenging to win business or even stay in business.”

For example, although Source 1 Solutions is heavily involved in IP, 60 percent of the systems the company sold in 2014 were analog. Hessel attributes most of this to customers’ budgets. As IP evolves and prices continue to decrease, more customers will go to that level, but at the moment the price gap between IP and analog is still too great for a lot of end users, he says. And for security integrators who lack IT knowledge and understanding, it’s often the “extras” that come back to haunt them.

“The total cost of ownership is much higher for IP than for a camera-and-DVR system,” he says. “Any changes or additions are going to affect the network on the back end. There are more real costs in IP than what’s in the quote you hand to customers. You may have to improve their network or at least do some strategy planning around the network. The IT department is going to trust you a lot more when you understand the network. We take a holistic approach and realize the impacts of surveillance on the network, so we get a little more leash to play with.”

Source 1 was Honeywell’s Commercial Security Systems Dealer of 2014. The company is ISO9001:2008 Certified and Service Disabled Veteran Owned.

Challenges Ahead

In politics, security or any other area, “strong” is hardly synonymous with “perfect.” So it stands to reason that even the strongest of markets isn’t without its challenges, and security is no exception. One such challenge is the trend toward lower prices, which is not unrelated to increased levels of competition in the video surveillance market.

“Everything you read shows large growth in relation to digital video, and at NAV we certainly see that expansion in the market,” says Jason Oakley, president and CEO of North American Video (NAV), Brick, N.J. “At the same time, you have Moore’s Law and the associated downward pressure on pricing, which puts pressure on both revenue and profitability. For the foreseeable future we see the expansion of the market continuing to more than offset the negative price impact.”

Peter Botelho, executive vice president and general manager for Amityville, N.Y.-based Speco Technologies, doesn’t believe that increased competition and greater market penetration will be positive for manufacturers’ bottom lines.

“Video surveillance will continue to be a hot market, but until there is widespread economic recovery, the market will not realize its full potential,” Botelho says. “Last year was flat. Unit volume remained strong, but price erosion from Chinese competitors offering low-end products certainly had an effect on the whole market. Low-voltage distributors’ rapid move toward a discount flyer model, coupled with promoting house brands has resulted in an inevitable channel shift for most equipment suppliers. Confusion around compatibility will deter the market from fully embracing IP products.”

The effects of steadily declining prices can be extrapolated from SDM’s Industry Forecast Study. While more than nine in 10 respondents believed video surveillance sales will be “good” or “very good/excellent” in 2015, only 11 percent feel spending in that area will increase more than 20 percent this year over 2014.

This continued downswing poses challenges for all levels of the security industry.

“The low-end camera market has created downward pressure on the amount of money distributors, manufacturers and integrators can make. Is that healthy for the industry? Probably not for the integrator,” says Jim Coleman, president of the board of directors of Security-Net and president of Atlanta-based Operational Security Systems. “Historically, when the money is knocked out of any industry, people start doing things differently.”

Playing in the MArgins

Doing things differentlymay become the new mantra for integrators who are looking for ways to offset these shrinking margins to maintain and grow their profits.

For starters, a subtle change in how you view cameras themselves can open up new ways to take advantage of their capabilities.

“Video surveillance products are becoming more like streaming devices than simply recording or displaying video. Additional services that can be run on streaming devices like health status checks and reporting will be one of the key benefits integrators can utilize for customers, which in turn becomes profit,” says Albert Lin, senior director, strategic sales, for Hikvision USA. “It becomes more about how you utilize the additional information video surveillance can provide and turn it into additional value to your customers.”

It may help to look at the camera as a component of an overall system that provides functionality and benefits beyond simply video.

“This is a very aggressive market and there’s pressure everywhere. As an integrator, you want to differentiate yourself through value-added services that go above and beyond just CCTV,” says Chris Koetsier, director of product marketing for video systems, Honeywell Security, Melville, N.Y. “A large portion of these systems are integrated to something, and the more integrations you can perform, the better. Not everybody has those capabilities.”

While equipment prices may be falling in general, more specialized and customized solutions continue to offer integrators attractive profit margins.

“There’s always going to be a need for niche products, and high-end cameras for certain applications offer good margins because there’s not a lot of competition out there,” says Tom Cook, vice president of sales, North America, for Samsung Techwin America, Ridgefield Park, N.J. “These products can definitely help profit-wise. As long as it’s something the market needs, there are definite market areas with niche products.”

New and innovative technologies also can help protect margins.

“It’s a fundamental fact of technology that the more you can stay on the forefront, you tend to get more margins than legacy, so integrators should be offering leading-edge technology,” says Sean Murphy, regional marketing manager for video systems, Bosch Security, Fairport, N.Y. “Integrators typically mark up what they install, so it comes down to how much a camera, for example, can be marked up at a specific price point.”

In an unusual twist, analog technology could potentially contribute to larger profit margins. In the shift toward IP video surveillance, more integrators may move away from analog, leaving less competition for 35 to 40 percent of the video market, which could go as low as 25 percent, says Scott Schafer, executive vice president of sales and marketing for Glendale, Calif.-based Arecont Vision. “Having fewer competitors means you can charge more. It’s supply and demand, and systems integrators should be in the catbird seat because they can charge more,” he says.

Unfortunately, the opposite may be true for manufacturers.

“Lower prices are going to hurt manufacturers more than integrators because there has been a great deal of penetration in the U.S. by companies who have entered the low-end market with extremely low pricing and decent products,” Cook says. “A lot of manufacturers can’t compete at those extremely low prices. So while an integrator might enjoy better profit margins with lower-priced cameras, for manufacturers it’s much more competitive.”

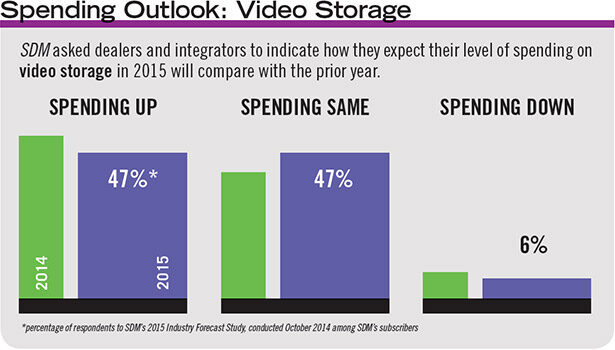

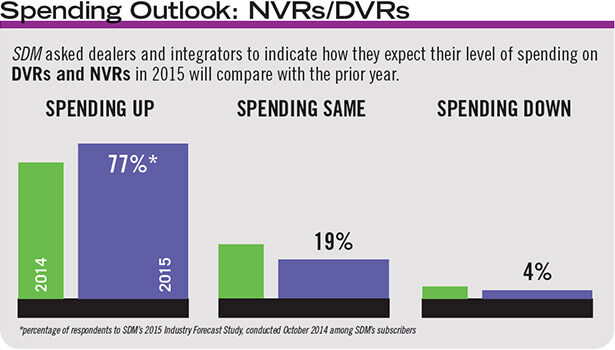

Rather than continue to chase shrinking margins on equipment, many people suggest it is time for integrators to consider a change in the mix of their business. For many years now, industry leaders have been pushing the security integrator into services that generate recurring monthly revenue (RMR), such as cloud-based storage, maintenance contracts, network-health monitoring, and the like.

“A more long-term solution would be to enter where you can grab hold of RMR. Maybe you take less money for an installation and add an RMR stream, which is more stable over time,” Bosch’s Murphy says. “IP equipment needs longer-term maintenance, and with hardware you inevitably have to perform software updates. A value-added service might be to perform these updates for a customer to ensure that nothing bad happens once they’re completed.”

Read more about evolving business practices in “Changing the Model” on page 56.

Technologies to Watch in 2015

There are a number of new and improving technologies in the video surveillance industry, but for many, their day in the sun is still far away. Below are a handful of technologies that are expected to have a significant impact on the video surveillance sector in 2015.

4K Resolution— The last 12 months saw the introduction of the first 4K Ultra HD surveillance cameras, followed by a spate of 4K cameras coming to market from a range of manufacturers. It’s all part of the resolution race that has been going on within the industry for the last few years.

“In IP video, we tend to think more resolution is better. Eight megapixel cameras are not unique anymore, but 4K is coming,” says Fredrik Nilsson, general manager for Chelmsford, Mass.-based Axis Communications.

“The expansion in resolution continues, with end users pushing that growth. Integrators understand how to install 5 megapixel, 8 megapixel, 4K and more, so this trend will have a definite impact on sales in 2015,” says Cook of Samsung Techwin America.

This year and beyond, 4K is expected to take off, but adoption may not happen as quickly as manufacturers might hope, for several reasons.

“Five megapixel cameras sell quicker at the moment, and 4K is slower because of bandwidth and other concerns. You need much more to make it work; you really need H.265. That will start creeping in,” Cook says. “It comes down to the VMS: Who can handle it? Maybe by the end of the year, we’ll see greater adoption of 4K but for now, 5 megapixel is becoming the norm, with 3 megapixel and 2 megapixel still delivering the best bang for your buck.”

HD TVI & IP over Coax— Transmitting IP signals over existing coax cable is far from new. What earns IP over coax and the newer HD TVI technologies a mention as a technology to watch is their widespread use within the industry.

“HD over coax is one of the most significant changes in the industry in more than a decade,” says Chris Koetsier of Honeywell Security. “It’s very easy to install and a very compelling technology.”

With end users converting their video systems from analog to high definition (HD) in growing numbers each year, the ability to take advantage of existing infrastructure rather than rip-and-replace cable has the potential to become a major disruptive force in video surveillance.

“There is a shift to HD over analog coax, which may extend the life of some systems; however, there are drawbacks. The use of encoders allows end users to convert to IP using their existing analog infrastructure, which in turn provides integrators with the opportunity to upsell their existing customer base with quick retrofits that are cost-effective,” says Murphy of Bosch Security.

Body Cameras — Body-worn cameras should gain traction in 2015, with three main caveats.

The first is the differing statutes and other requirements that vary from state to state. “With body cameras, the camera is only half the system. Law enforcement desires these all over the place but there are differences between locations. For example, notification requirements vary from state to state, so the first million body cameras essentially are beta,” Cook says.

The second potential stumbling block would be how quickly the technology itself can mature and reach a point where body camera systems are a viable option. “A lot of times there are configuration issues or issues with movement or things like that. The technology is very immature, so a lot of people are cautious about jumping in right away,” Cook says.

Finally, in order for sales of body cameras to grow, one or more manufacturers are going to have to take the lead. “This is going to be big but who will get in right now?” Cook asks.

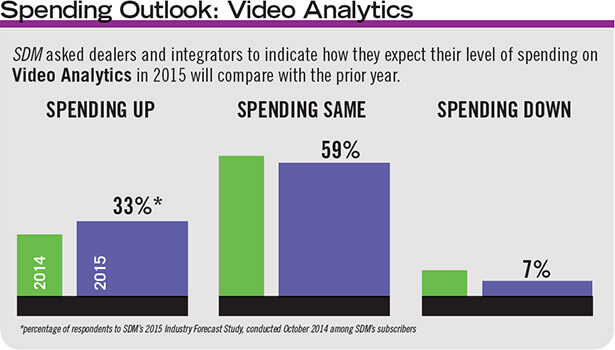

Video Analytics — If you’re thinking that video analytics have been a “technology to watch” for several years, you’re absolutely right; and there’s a good reason for that. In the early days of video analytics, the technology’s shortcomings and failure to deliver expected levels of performance were well-documented. It’s only in the last few years that that perception has started to change, because analytics have matured to the point where the technology has caught up with the promise, and performance continues to improve each year.

“We’re seeing a re-emergence of video analytics, with more customers interested in deploying analytics based on the maturity of the technology and a certain level of reduced cost to end users,” says Steve Carney, senior product manager for IP cameras, Tyco Security Products, Westford, Mass. “I don’t think we’ve reached the peak of adoption.”

Bosch's Murphy agrees. “Analytics are finally at a point where the technology has caught up with the promise and the expectations the technologies will meet. It’s at a robust enough point that if delivered, installed and tuned correctly, analytics can be a very powerful tool.”

A major factor in both the maturity and interest in analytics is the breadth of applications the technology can be used for, beyond the security functions for which it was originally designed.

“It’s been an interesting evolution,” says Net Payne, chief marketing officer for March Networks, based in Ottawa, Ontario, Canada. “Years ago, we saw a majority of organizations deploy video surveillance for security purposes. Many forward-thinking retail and banking organizations took that a step further and implemented software that could integrate that same surveillance video with point-of-sale or ATM/teller transaction data. The integrated data and software tools enabled dramatically faster loss and fraud-prevention capabilities, as well as much stronger case evidence that included the data plus the associated video.”

Today, operations and marketing groups within these organizations are realizing how video can help them improve sales, customer service and a range of other functions.

“When used properly, video analytics can significantly impact operating costs and provide valuable information for making informed business decisions,” Murphy says. “More and more video cameras are put up every day, and there are just not enough people to monitor and filter them.”

Residential Uses

The use of video surveillance in the home has come a long way in a very short period of time, and there is no reason to think that trend won’t continue in 2015 and beyond.

“Five years ago, there was less than 1 percent penetration of video surveillance in residential. Now we’re selling 4,000 to 5,000 kits a month through Costco and Sam’s Club, and we’re expanding into Home Depot and Lowe’s,” says Samsung Techwin America’s Tom Cook. “We’re even seeing contractors who are building communities offering video surveillance in new homes.”

Today, video is often the centerpiece of a residential or smart home offering, as Rob Hessel of Source1 Solutions reveals. Every few weeks he participates in a local real estate radio show as part of a rotation of professionals from different fields who act as consumer advocates. “When I go on the show, I always do an offer. When I would offer a free smart home system, we had no real success. I just think people hear that too much; it’s a buzzword,” he says. “But when I talk specifically about video in the home — as part of that smart home system — we max out our giveaway.”

On the manufacturing side, residential surveillance has been a boon to many businesses.

“Our residential business is phenomenal. I can tell you it’s growing more than our B2B business. Companies that ignore the market are foolish because the line between commercial and residential is getting grayer and grayer,” Cook says. “It’s really a matter of finding a balance between a Costco and an ADI to bring out your products effectively without affecting the other side of the business.”

To illustrate how successful his company’s residential business has been, Cook shares an anecdote: “We went on the Home Shopping Network and sold our entire inventory of 15,000 kits in an hour. There’s definitely a thirst for, number one, video surveillance in the house, whether to monitor the front door, the dog, the baby or the kids. Second, it’s very competitive; there’s so much business to be had,” he says.

For others, the residential market isn’t a major factor today, although that could certainly change in the future.

“Market data show that the residential side is not growing as well as other verticals, although we certainly see an upside in the future,” says Carney of Tyco Security Products. “We have experienced increasing adoption of camera systems in homes over the last 12 months, though, thanks to price decreases and lower cost of connectivity, particularly to the cloud.”

At the most basic level, end users choose video surveillance systems to provide an increased level of security, and integration with alarm systems to ensure alarms are valid; the speed of police response will play a major role in greater adoption of video in the residential sector.

“Police response issues have helped underscore the value of video-verified alarms,” says Keith Jentoft, president of Vadnais Heights, Minn.-based Videofied–RSI Video Technologies. “I believe that video verification will be the mainstream approach for residential alarms in the next 12 months.”

In the residential market, DIY video surveillance kits, such as those Samsung and others sell direct to consumers, are a part of the equation.

“Ease of use is a top priority for residential systems,” says Speco Technologies’ Botelho. “DIY products will add to the penetration rates, but true professionally installed security systems will remain the cornerstone of the market.”

For more on the potential impact of these systems on the market, see “A Billion Reasons to Watch DIY Surveillance”

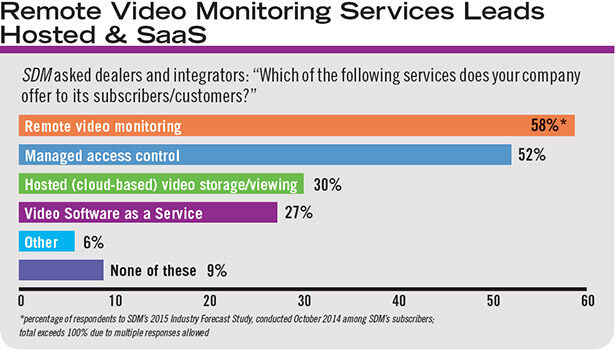

Of the many value-added services integrators can offer their customers, video-surveillance-as-a-service (VSaaS) may be the most talked about. But while the concept of VSaaS (storage in the cloud, in particular) has been around for a long time, it hasn’t been as widely adopted as some might have hoped.

That may be about to change. According to a report by Research and Markets, double-digit annual growth is expected to push the VSaaS market to more than $5.18 billion by 2020.

Supporting this forecast, Fredrik Nilsson says that while Axis Communications has offered a solution for VSaaS for several years, it’s only been in the last year or so that Axis has seen its partners make real breakthroughs with it.

“It’s less about technology and more about pricing and contracting,” he says. “From an RMR standpoint, the ones we see succeeding are the ones that already had an RMR model in place, such as central stations. I would recommend that if you have not done RMR business in the past, don’t try to do it just with video.”

Albert Lin of Hikvision USA agrees. “VSaaS becomes an additional available service. We see those services not completely utilized by integrators,” he says. “It takes education to provide dealers with a clear picture of how much money they can make and what additional benefits end users can utilize. How to develop VSaaS for integrators will be a challenge and a key factor for growth in 2015.”

Some integrators, such as Stone Security, find the concept interesting but are taking a wait-and-see position for now.

“Hosted video is something we have kept our eye on for some time now,” says Stone Security’s David Edmunds. “We are very interested in the opportunities that it represents to our company, but we have yet to see the overwhelming demand from customers, or the right product offering from service providers. The costs and quality of the hosted video product don’t quite seem to meet customers’ expectations at this point. In other words, the resolution quality of video recordings and the retention periods just aren’t good enough for the cost.”

Competition among providers also may help determine how the VSaaS market grows in 2015 and beyond.

“People want it, but there are going to be a limited number of winners in this,” says Bob Ehlers, vice president of marketing and development for Alameda, Calif.-based RGB Spectrum. “The cost of broadband, particularly with bandwidth caps, means that large carriers have a distinct advantage. I expect that Verizon, Comcast, Time Warner, Cox and Charter will win this unless the government forces regulation on Internet Service Providers (ISPs). If this happens, then pricing will become the biggest issue as taxes will make bandwidth more expensive.

“There is a short window of opportunity for integrators/VSaaS providers to install and build up a presence to sell to carriers,” he ventures.

For several years, do-it-yourself video surveillance has been available to consumers, mostly through big box stores such as Costco, Sam’s Club, Home Depot and Lowe’s. And for as long as these DIY solutions have been available to consumers, the industry has been debating whether they are more of a threat or a complement to professionally installed systems.

Whichever side of the debate you are on, one thing is for certain: this is a growing business. According to IHS, the market for all video surveillance equipment sold through in-store and online retail channels was poised to cross the $1 billion mark globally for the first time in 2014, at the time the study was completed. That’s billion, with a capital B. Sales in the U.S. account for almost 65 percent of the total.

“It’s all about convenience. The simplicity of analog cameras has been at the forefront of the residential market, and now IP kits are starting to enter into the market,” says Tom Cook at Samsung Techwin America. “Even a non-technical person can have a system working within minutes. Younger consumers are incredibly savvy; they understand that everything is an appliance and everything is wireless. They get it.”

Historically aimed at mainstream residential applications, DIY surveillance also finds its way into the small and medium business (SMB) market on occasion.

“Everybody is more comfortable with the technology, but the general feedback I hear is that it’s easy to get working but doesn’t live up to expectations,” says Bosch Security’s Sean Murphy. “That’s where a professional comes in. It’s the job of an installer or dealer to figure out how to get past any issues and meet customers’ goals, or to set realistic expectations.”

According to Videofied–RSI Technologies’ Keith Jentoft, “The ease of install and smartphone apps will become a sizable part of the residential market. DIY and MIY (monitor it yourself) using the cloud is a threat to traditional dealers/integrators.”

For the majority of applications, especially non-residential, DIY surveillance simply isn’t a viable option — unless the end user has some unique security requirements.

“With DIY, you get what you pay for. Generally, you’re working with lower-quality cameras and systems, trying to do it on the cheap,” says Arecont Vision’s Scott Schafer. “That said, we do see some high-end jewelry providers that will install their own systems because they don’t want someone in their safe because they don’t trust an outsider. They don’t want anyone knowing the location of things. There are some government agencies like that as well.”

Today’s DIY market is very different than it was a couple years ago, says Hikvision USA’s Albert Lin. The perception that these technologies are low cost and low quality and provide fewer features may not be such a valid one. “The Internet of Things has blurred the line between video surveillance systems and the connected home business,” Lin says. “These have been very different but are kind of the same now, so when people are looking for a residential security system, they’re not necessarily going to a traditional DIY product. They’re looking at Belkin or other fancier consumer electronics. Commercial customers, however, need the assurance and quality of installation, as well as a professional to handle integration with other systems.”

The current DIY surveillance trend is reminiscent of changes in the IT world many years ago, says Fredrik Nilsson of Axis Communications. For example, an IT manager used to be needed to install a network switch or connect a laptop to a network, but now a lot of that is either done by users themselves or outsourced. Nilsson suggests embracing end users’ ability to self-install smaller systems as an opportunity to ensure recurring revenue.

“Instead of seeing it as a threat, integrators can work their way from being an installation company to becoming more of a service company,” he says. “You can take responsibility to maintain the system over the next X number of years. This can be a great opportunity. I look at it as a potential customer of security surveillance systems and for me, the less I have to take on and the more I can have outsourced, the better. It’s much better to pay a monthly fee for maintenance.”

At the beginning of the year most of the state legislatures started their individual sessions. The Electronic Security Association (ESA) is very active in monitoring and promoting video surveillance bills through state chapters and members as an RMR or sales and marketing opportunity. We have found that elementary and secondary schools purchase video surveillance along with other technologies to prevent unauthorized access and address public safety concerns. Most of the bills last year, and the ones we expect to see this year, will provide monies for school districts for this purpose.

Another issue that utilizes video surveillance is the voluntary installation of CCTV systems in patient rooms by the families or guardians in nursing homes. Last year Oklahoma and Virginia passed laws permitting these systems. There is already a bill that has been introduced in South Carolina to do the same and the Illinois Attorney General is supporting a state senator’s introduction of a bill there. We anticipate video surveillance bills at the state level in many venues relating to shopping centers, businesses, and in some localities, video verification.

At the start of the 114th Congress, ESA is monitoring any federal bills that relate to video surveillance such as anti-terrorist, Homeland Security system purchases; federal agency mandates for public safety purposes; new efforts that might be included in legislation relating to police body cameras; and school security technologies, mostly for state grant opportunities. ESA is working with SIA to secure more funding for school security system grants, some of which, if passed, will permit acquisition of video surveillance units. — By John Chwat, director of government relations, Electronic Security Association

Sidebar: Changing the Model

With more systems moving from analog to IP, there is an increasing emphasis on networks, which brings more people into buying decisions. As a result, integrators have to retool the way they sell surveillance systems, particularly for larger customers.

“The sales process has changed dramatically over the last five years. At the enterprise level it’s a high-dollar-value technology purchase, and that means a rigorous approach from the entire customer organization — including business leadership, security and surveillance leadership, IT and sourcing professionals,” says NAV’s Jason Oakley. “We are frequently involved in RFQ processes that run to hundreds of pages of detailed information not just on the technology provided but on our business processes, culture and strategy. To win business in today’s market you need a cross-functional team that includes engineers, IT, operations and business development.”

For some, making the sale and installation are the main goal, but with margins shrinking, integrators need to think about post-sale revenue as well. The biggest opportunity lies in providing service, which may be more difficult than it sounds.

“When it comes to service, you have to figure out that you have intellectual property rather than taking for granted what customers have been willing to pay in the past,” says Scott Schafer of Arecont Vision.

Another key component to the success of a service-based model is to educate end users that video surveillance systems are crucial for organizations of all types. “We need to think of surveillance as being as mission-critical as networks became. In 1995 or 1997, two days’ response time was ok for network problems. Can you imagine that today?” Schafer says. “Cameras are viewed as mission-critical at casinos, so why not in parking lots or city surveillance? You can charge for that, whether it’s remote or on-site service. We haven’t convinced people of that. Airports get it, but chicken processing plants and others need to get on the treadmill and recognize that it’s mission-critical.”

Developing a successful strategy requires determining the right services for the right type of customer.

“A recurring revenue model in the right space offers recurring revenue, but in the VSaaS environment, the cost to install goes down and profit goes up. That’s critical to the four- to eight-camera jobs, where working with networks can bog down your time,” says Steve Carney of Tyco Security Products. “For larger customers, there’s a similar trend of services becoming an increasing growth opportunity — not necessarily VSaaS, but the ability to monitor the status of the hardware and the network to manage uptime more efficiently or proactively.”

Source 1 Solutions has found the right mix for its customers, which are either enterprise-level or multi-site organizations.

“We tried selling maintenance on video surveillance systems similar to what you would see on a data network. We’d tell customers, ‘If it breaks, you’re going to get it replaced, and there’s no cost to you for labor and materials.’ It was a fixed cost, but that didn’t fly because there’s not enough value,” says integrator Rob Hessel of Source 1 Solutions. “Now we do it in a different way using proactive, preventative maintenance. Either quarterly or monthly — whatever the customer wants — we commit a certain amount of time to readjusting or refocusing cameras, cleaning housings and looking for potential issues before there’s a problem.”

In the end, integrators who want to be successful in the ever-evolving video surveillance market will need to be willing to make changes.

“If you just keep trying harder doing the same thing you’ve done over the last 15 years, it’s not going to work,” says Jim Coleman from Security-Net and Operational Security Systems.

There are many reasons why public bus and passenger rail agencies are adopting video surveillance in increasing numbers each year. Surveillance cameras promote a heightened sense of safety and security for riders and employees, and capture valuable evidence in cases of customer complaints, vandalism, crimes and accidents. Recorded video helps transportation agencies defend themselves against false liability claims and deter frivolous lawsuits. Today’s more advanced video solutions also integrate with technologies such as computer-aided dispatch/automatic vehicle location (CAD/AVL) to help speed investigations and provide a more comprehensive view of operations.

There is considerable opportunity for systems integrators able to serve this market. The global transportation safety and security market is expected to grow to $62.9 billion by 2018, with North America identified as the greatest revenue contributor, according to MarketsandMarkets, “Global Forecasts and Analysis 2013-2018.”

March Networks has worked with some of the world’s largest transit agencies in this area. Thanks to more than a decade of experience, the company has developed a deep understanding of the market’s requirements and offers these key tips to systems integrators looking to expand into the transportation sector.

-

Understand what high-performance means for transit. System reliability is a top priority for every customer. What is unique, however, is the harsh environment a video recording system must withstand on a bus or rail car. Look for ruggedized mobile video recorders that meet international standards for dust and water ingress (for example, IP65), as well as shock and vibration (SAE J1455 and MIL-STD-810). Internal battery backup systems are also ideal to ensure video isn’t lost during temporary power failures.

Another key performance feature is the recorder’s ability to support both analog and IP surveillance cameras. This allows agencies to continue using analog cameras already installed on a vehicle or in a station, and makes it easier for them to migrate to high-definition IP cameras as time and budgets permit. A choice of models able to support a few to as many as 20 cameras per mobile recorder delivers the additional flexibility transportation agencies require. - Enterprise-level video management is a must. For fleet managers, the ability to rapidly download recorded video over Wi-Fi or cellular networks is critical. Wireless downloading eliminates the need for the manual removal of a hard drive every time video evidence is needed and keeps vehicles in service longer. The wireless connection also allows agencies and even law enforcement to view live video on demand in an emergency situation.

- Integration is another important feature to look for in a video management system (VMS). A single software solution that can manage video systems on vehicles and in wayside environments is best, as it allows agencies to easily administer upgrades, download recorded video and conduct investigations across all of their locations and assets simultaneously. A standards-based VMS able to integrate with existing GPS, CAD/AVL and fare systems and provide synchronized video and vehicle metadata is also essential for rapid search and investigation.

- Remote health monitoring keeps systems running optimally. A VMS solution that offers remote health monitoring capabilities helps ensure optimum system performance. It allows transportation agencies — or security integrators, as the preferred services providers — to manage system health alerts, conduct troubleshooting remotely and proactively address potential issues (such as a pending hard-drive failure) before they affect performance. In addition to the gamut of services you would typically provide to customers, remote health monitoring opens the door to expanded service offerings and more potential recurring revenue.

Transportation security is a specialized market that requires a solid understanding of customers’ requirements, as well as specific installation expertise. These are just a few guidelines for consideration as you build your business plan for 2015 and beyond. — Contributed by Keith Winchester, director of North American Transit for March Networks (www.marchnetworks.com).

SDM Asked: “Which vertical markets will offer the best opportunities for systems integrators

in 2015?”

“There’s a pent-up demand in banking, retail, city surveillance, healthcare and education — K-12 and higher education. Those are five markets that every city and town has available as opportunities for systems integrators.” — Scott Schafer, Arecont Vision

“Education is accessible to a lot of integrators because there’s no need for specialized knowledge. In retail, a lot of integrators cater specifically to retail. It requires a focused knowledge that’s good for those involved.” — Fredrik Nilsson, Axis Communications

“Education is accessible to a lot of integrators because there’s no need for specialized knowledge. In retail, a lot of integrators cater specifically to retail. It requires a focused knowledge that’s good for those involved.” — Fredrik Nilsson, Axis Communications

“We do not target one or two vertical markets specifically. We really find ourselves working in many verticals with good success, but education has historically been a strong market for us and we see that continuing. We also feel like the public safety vertical — cities and municipalities — will be very strong in 2015.” — David Edmunds, Stone Security

“We see strong growth in the retail and education segments. These two have shown very good numbers, particularly in 2014, and we expect those numbers to grow significantly in 2015. We also see city surveillance as a good opportunity. With improvements in technology and lower-cost IP, more cities and governments are looking to upgrade their systems.” — Albert Lin, Hikvision USA

“There’s no specific market we focus on, but we do have a targeted customer: large enterprises or multi-site opportunities. With our IT background, we understand how to manage those markets, and we’re also not competing against 10,000 people. If we chased all the pizza places, we’d probably lose 80 percent of the deals.” — Rob Hessel, Source 1 Solutions

“In utilities, we’ve never seen the kind of growth we’re seeing now. The marijuana industry has also been a boon for surveillance. With warehouses, growth farms and dispensaries, there are multiple new markets.” — Tom Cook, Samsung Techwin America

See related article, “Recreational Marijuana Outlets: A New Vertical Market?” at www.SDMmag.com/recreational-marijuana-market.

“NAV was founded to serve the gaming industry and we continue to drive our strategy to build on our market leadership position. Outside of gaming we favor markets and customers where, like gaming, the security and surveillance function is considered mission-critical; in particular we have found success in financial services, retail, transportation and utilities.” — Jason Oakley, North American Video