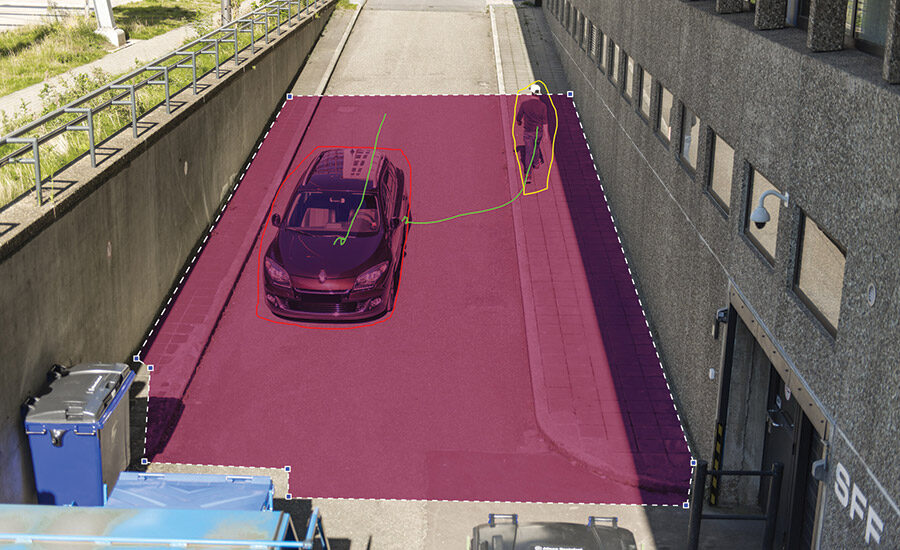

When it comes to new advances in video analytics, it’s not so much a question of what but more a question of how — as in how the technologies changed and how they’re being used for innovative applications.

“I think that the market has matured to where vendors are offering what end users are requesting. When it comes to accuracy, the main differentiator that vendors can bring to the market is whether they’re developing application-specific algorithms or whether they’re using a simple algorithm that they use for their main business but extending it to a different application,” says Derek Arcuri, product manager, Genetec, Montreal.

This is the state of analytics today, as evidenced by the number of “older” technologies, such as intrusion detection, facial recognition, object detection and license plate recognition, which have been around the block a few times but have recently found new life.

“The change is that these applications aren’t just security functions anymore,” says Alex Walthers, business development manager, ADP, Axis Communications, Chelmsford, Mass. “For example, using facial recognition to perform demographics analysis and display an appropriate advertisement or connect to other network equipment and play certain music for a customer. Audio is also popular as it helps make the video smarter and provides context for what is happening in a scene.”

MEETING EXPECTATIONS

The elephant in the room, of course, is the major setbacks video analytics experienced in the technology’s infancy when capabilities simply weren’t able to deliver the level of performance end users were led to expect.

“As you know, the security industry had a major problem starting about 15 years ago where video analytic capabilities were oversold by certain manufacturers,” says Steve Bocking, project manager, software, Hikvision USA, City of Industry, Calif. “After that false start, it has taken integrators and end users a number of years to really trust video analytics.”

While some still have a bad taste in their mouths because of this false start, video analytics for the most part seem to have finally overcome that negative perception. Capabilities have improved significantly and perhaps most importantly, integrators and manufacturers have learned valuable lessons about expectations.

HOW ANALYTICS WORKS TODAY

At the most basic level, there are few differences between how the various analytics work; the real difference is in what they do, but all are based on the same technologies.

“When you think about how video analytics works, fundamentally, the algorithms are trying to do the same thing, which is separate events from background continually as the scene keeps changing,” says Joel White, regional marketing manager, Bosch Security, Fairport, N.Y.

Most of today’s security cameras have at least some basic video analytics capabilities built in, whether that’s motion detection, auto-adjustment or other technologies. Some are more advanced than others and can be updated with new features and capabilities as they are released, but the level of intelligence depends largely on cost, says Jeff Whitney, vice president of marketing for Glendale, Calif.-based Arecont Vision.

“Where vendors differ on video analytics is in how much intelligence they believe should be put into the edge device, in this case a megapixel camera, and how much should be in a server or other device,” he says. One approach potentially requires more expensive components in the camera; the other may require more bandwidth to transmit data.

“These applications allow end users to be smarter about day-to-day processes,” Walthers says. “Alerting guards when and where to react to a situation, and allowing them to see what is happening before they rush in, allows them to make responsible decisions.”

The emergence of thermal imaging as a more affordable solution has driven this push, and these types of applications have been embraced for critical infrastructure, including electrical plants and substations, nuclear facilities, ports, rail, water treatment and other markets. Some of the most mature applications, says David Stanfield, product manager, solutions, Hikvision USA, have been in solar and data farms, which are often in remote locations with minimal on-site staff. A number of providers have taken note of and have focused on making the most of these thermal imaging opportunities.

“Some of these analytics companies are singularly focused on how their technology works with thermal cameras in perimeter applications. They spend a lot of time dialing in their algorithms and a lot of time tweaking performance on-site after installation,” he says.

SELLING ANALYTICS

The ROI of thermal and analytics, Stanfield says, is in the ability to provide more accurate alerts in low-light and adverse conditions with fewer false alarms than traditional cameras, which reduces the amount of time spent on response.

“The best integrators understand this, the two technologies, their limitations both singularly and in combination, how to specify and deploy them, how to set the expectation of performance, and can ultimately deliver a system that works for their customer,” he says.

The most important thing, Arcuri says, is to remember that you’re selling solutions, rather than simply products as may have been the case in the past.

“As long as systems integrators know how to sell the product and actually sell the solution — meaning they understand their end users very well and they’re able to sell the application and not the technology — that’s one asset,” he says. “The second asset is how systems integrators can understand the video analytics world, meaning they need to ensure that the vendor is not being blamed for poor performance when it’s actually poorly installed. The challenge for manufacturers is how do we train integrators not to oversell the solution and see that the physics within the setting is not appropriate?”

A LOOK AHEAD

As video analytics continue to evolve and mature, the combination of advancements and creativity will create more broad-based opportunities for integrators.

“In the future, we will see other smart add-ons to monitor camera performance — CPU load, SD card, bandwidth, etc. — cyber-hardening applications, and tighter integration between other smart devices on the network, such as lights sensors, displays, etc., become more popular,” Walthers says.

The next big thing, Bocking says, will largely be tied to another well-known trend: Big data.

“We are working on ways to gather more automated statistics from the analytics for reporting across large pools of cameras,” he says. “We are also working on ways to collate analytics together for more accuracy. By doing this you can ensure that, for example, an operator would only be presented with an alarm if there was line-crossing and face-detection within the five seconds in same region of interest. If only one or the other happen, they will be indexed, but no alarm will appear.”

Another development, which White says Bosch is already working on, will be the availability of on-camera analytics.

“Analytics in cameras is going to be standard — not optional and not something we charge extra for. As more cameras have the processing capability, we’re going to put analytics on there,” he says. “This makes analytics available for all customers and as more people start to use what video analytics can do in more scenarios — and the more integrators play with it and experience it in small bites — the more they can use and deploy analytics for their customers.”

Arcuri warns that manufacturers have to be mindful of not putting the cart before the horse when it comes to new video analytics technology and applications.

“There are a lot of technologies that haven’t matured yet. We’re hearing about facial recognition and I think that’s sort of following the same fate as VA in general where it’s oversold. I strongly feel that airports still can’t use object detection in a crowded area, which would be the perfect application. If we can detect luggage that’s unattended in a crowded area and keep a false positive low, we have to work on enhancing the algorithm to achieve that before we can find different applications and different ways to be creative.”

Despite some continued skepticism, Jordan Heil-weil, president of integration firm Total Recall Corp. of Suffern, N.Y., says he is optimistic that technologies will one day get to a point where they’ll be more practical for more end users. n

An Integrator’s Perspective

After its dreaded — and widely regretted — false start years ago, video analytics is finally experiencing tremendous growth. This is mainly down to improvements in accuracy and an expansion in the types of applications for which the technology can be deployed.

In spite of these advancements, Jordan Heilweil, president of Total Recall, says manufacturers still have some work to do to overcome the skepticism many integrators still have toward analytics after having been burned in those early days.

“I’m sure the manufacturers’ opinions are very different from the integrators’ opinions,” he says. “I would say that analytics are still the most over-sold and under-delivered category in the security industry.”

The main challenge, he says, is the vast difference between testing environments and the actual settings in which analytics are used.

“It works in the lab but in the real world not so much,” he says. “Some of the things you expect to work are not as robust as you would want. In one case, facial recognition recognized a forklift as a face because it had cutouts that kind of looked like eyes. Once you have false positives like that, everyone’s confidence goes down.”

In a control room setting where operators are asked to monitor live video, accuracy is especially critical.

“If they’re reacting to every alarm, the number of false detections translates into wasted time,” Heilweil says.

The good news is that providers recognize this and continue to work to improve the effectiveness and accuracy of their analytics. Only time will tell if these efforts will pay off for integrators in the end.

The Sweet Spot for Analytics

Without question, the retail market has been one of the biggest adopters of video analytics. In fact, according to Transparency Market Research, retail is the chief driver in the growth of the technology, which is estimated to expand at a combined annual growth rate of 20.6 percent, with the global market reaching a value of more than $9 billion by 2023.

In terms of video analytics applications themselves, the report finds that people recognition is the most widely deployed, accounting for about 30 percent of the total revenue in the analytics market, with Transparency projecting this specific segment to grow at about 20 percent through 2023. The most significant factor in this growth in people-counting is the demand for analytics that can determine how many people are entering, exiting and moving through a location.

In light of these factors, it’s important for integrators to recognize the potential of video analytics in both security and non-security applications. Those who take time to get to know their customers will have a better grasp on pain points and will be well positioned to deliver customized systems that meet customers’ specific needs beyond security.

Case in point is retailers’ shifting focus from reducing shrink to increasing sales, says Alex Walthers of Axis Communications, which transforms this security-focused technology into a valuable business partner that can directly contribute to the bottom line.

“Being able to work with an end user’s IT, security, and marketing departments starts the conversation about cross-functional video,” he says. “Using cameras in a retailer for safety and security as well as marketing operations opens up budgets and helps provide the right solution — not just the one that they can afford.”

It’s important to note that there is no cookie-cutter or standard approach to deploying analytics in retail. For example, those that tend to carry higher-margin items are focused on doing whatever it takes to offer the best in-store experience, says Genetec’s Derek Arcuri.

“The luxurious brands are more concerned about making sure no customer is ever looking around saying, ‘Wow, I’m spending 80 percent more than I should be spending here and I’m not even getting the attention I need — I’m out of here,’” he says.

On the other end of the spectrum are bulk retailers. For them, having customers walking out without making a purchase isn’t such a big deal, so their focus is on optimizing their labor cost, which Arcuri says is often their biggest expense.

Uses that increase business efficiencies are a great starting point for expanding applications for analytics, Walthers says.

“For example, if you know what time of the day a store is busiest or what merchandise is most popular, you can make educated business decisions,” he says.

There is a very good chance that the way retailers are deploying and using video analytics today will end up serving as a blueprint for how these technologies will eventually be deployed in general in the future,” says Total Recall’s Jordan Heilweil.

“There have been great improvements in analytics on retail side of things. In this kind of controlled environment, they work great,” he says. “The future of analytics is that it’s going to be used more for customer service applications than security applications.”

MORE ONLINE

For more on video analytics visit SDM’s website, where you’ll find the following articles:

“Finding & Selling the Value of Analytics”

www.SDMmag.com/selling-the-value-of-analytics

“ROI Reinvented: The New Business Models for All Things Security”

www.SDMmag.com/the-new-business-models-for-all-things-security

“Software and Technology are Moving Video Monitoring Forward”

www.SDMmag.com/software-technology-moving-video-monitoring-forward

“Own the Store — or as Much of it as Possible”

www.SDMmag.com/own-the-store

“3 Video Analytics any Retailer can use to Boost Their Bottom Line”

www.SDMmag.com/video-analytics-any-retailer-can-use-to-boost-their-bottom-line