Although some entities exist only in the memories of today’s security dealers, it is encouraging that many of the companies ranked 18 years ago still rank among the largest today.

In May 1991, the first annual SDM 100 had total annual revenue of $2.32 billion. This year’s 18th annual SDM 100 brings the total to $7.58 billion.

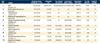

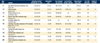

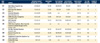

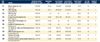

The primary objective of the SDM 100 is to measure consumer dollars gained by alarm companies, in order to present an account of the size of the market captured by the 100 largest security providers. SDM 100 firms are actually ranked, not by their total gross revenue, but by their recurring monthly revenue (RMR). RMR is the amount of contractually recurring revenues due from customers, for such services as monitoring, contracted service, system maintenance and leasing of security systems.

RMR is typically the basis for valuation of an alarm company. The amount of RMR, along with other factors, is assigned a multiple, such as 40 times RMR, to determine a firm’s value in an acquisition. RMR is the language of alarm company executives and is meaningful in comparative analysis among industry peers.

Only 28 companies on the SDM 100 earned more than $1 million in recurring monthly revenue in 2007. Overall, it appears that the 100 firms collectively grew RMR by less than 1 percent. However, that number is misleading due to an adjustment of ADT’s recurring revenue. (In 2007SDMprovided an estimated figure for ADT of $240 million; in 2008, ADT reported its own RMR of $219 million, causing an effect on the total SDM 100 figures that appear to show flat growth.) If ADT is omitted from total figures, then growth in RMR for the other 99 companies proves to be a healthier 14 percent.

The health of the security installation and monitoring industry also was proven by the addition of nearly 5,000 more people employed by these 100 largest firms in 2007.

No. 3 – Protection One – $3.6 million RMR is from non-owned accounts.

No. 4 – Monitronics International Inc. – $300,000 RMR is from non-owned accounts.

No. 5 – Stanley Convergent Security Solutions Inc. – Formerly ranked as HSM Electronic Protection Services Inc.; SDM’s 2005 Dealer of the Year.

No. 7 – Vector Security Inc. – $53,000 RMR is from non-owned accounts. SDM’s 2003 Dealer of the Year.

No. 9 – Guardian Protection Services – SDM’s 1999 Dealer of the Year.

No. 15 – Guardian Alarm Co. – $1,100 RMR is from non-owned accounts.

No. 16 – Interface Security Systems & The Greater Alarm Co. – $3,734 RMR is from non-owned accounts.

No. 18 – CPI Security Systems Inc. – SDM’s 2000 Dealer of the Year.

No. 19 – AFA Protective Systems Inc. – $25,000 RMR is from non-owned accounts.

No. 22 – ACA Security is operated by Alarm Capital Alliance II LLC.

No. 25– ADS Security – $46,505 RMR is from non-owned accounts.

No. 27 – Per Mar Security Services – $18,902 RMR is from non-owned accounts.

No. 28 – General Security Inc. – $127,572 RMR is from non-owned accounts.

No. 30 – Kimberlite Corp. – doing business as Sonitrol of Fresno, Sonitrol of Stockton, Sonitrol of Modesto, Sonitrol of Bakersfield, Sonitrol of NW Los Angeles/Ventura Co., Sonitrol of San Francisco, Sonitrol of Marin/Sonoma Cos., Sonitrol of Napa/Solano Cos., Sonitrol of Oakland, Sonitrol of So. Alameda Co., Sonitrol of Contra Costa Co., Sonitrol of Berkeley/Richmond.

No. 32 – Mountain Alarm – $205,000 RMR is from non-owned accounts. SDM’s 1996 Dealer of the Year.

No. 33 – New York Merchants Protective Co. Inc. – $59,251 RMR is from non-owned accounts.

No. 34 – First Alarm Security Services – Less than $5,000 RMR is from non-owned accounts.

No. 36 – Safeguard Security and Communications Inc. – SDM’s 2002 Dealer of the Year.

No. 37 – Alert Alarm of Hawaii – $1,530 RMR is from non-owned accounts. SDM’s 2006 Dealer of the Year.

No. 40 – Supreme Security Systems Inc. – $1,054 RMR is from non-owned accounts.

No. 43 – Security Equipment Inc. – $2,520 RMR is from non-owned accounts.

No. 44 – Doyle Security Systems Inc. – $29,251 RMR is from non-owned accounts. SDM’s 1997 Dealer of the Year.

No. 46– Custom Security Systems – Monitors an additional 25,445 subscriber accounts owned by other dealers, resulting in $190,831 RMR.

No. 47 – Sonitrol Security Systems of Buffalo, Rochester, Toronto – $8,000 RMR is from non-owned accounts.

No. 60 – Electronix Systems Central Station Alarms Inc. – $82,000 RMR is from non-owned accounts.

No. 63 – Blue Ridge Security Systems Inc. – $69,886 RMR is from non-owned accounts.

No. 65 – A-Com Protection Services Inc. – $40,833 RMR is from non-owned accounts.

No. 66 – A-1 Security Ltd. – On April 1, 2008, Stanley Convergent Security Solutions Inc. announced the acquisition of A-1 Security.

No. 67 – Scarsdale Security Systems Inc. – $7,200 RMR is from non-owned accounts.

No. 70 – Richmond Alarm Co. – $81,354 RMR is from non-owned accounts.

No. 75 – Safe Systems Inc. – $178,455 RMR is from non-owned accounts.

No. 76 – Security Systems of America – $37,986 RMR is from non-owned accounts.

No. 84 – CIA Security – $6,000 RMR is from non-owned accounts.

No. 89 – Dehart Alarm Systems Inc. – $1,200 RMR is from non-owned accounts.

No. 90 – Custom Alarm – SDM’s 1995 Dealer of the Year.

SDM 100: Growth in Action

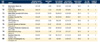

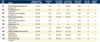

The table, right, presents aggregate figures for the SDM 100 group of companies, which are ranked by their recurring monthly revenue — an industry standard of valuation of a security monitoring business. Most of the SDM 100 firms are privately held. Submitting recurring monthly revenue is required for ranking; other figures are not required but mostly provided. Most firms — but not all — also reported their total annual revenue, number of subscribers, and installation volumes. Therefore, one should exercise caution in using this information to extrapolate industry totals or to benchmark. (See footnotes above for more detailed information.)

RMR Adjustment

Recurring monthly revenue (RMR) improved less than 1 percent in 2007; however, what appears to be flat growth is actually an adjustment made for one company, ADT, which reported significantly lower RMR in 2007 than SDM had estimated for ADT the prior year. If ADT’s recurring monthly revenue were removed from the growth calculation, then RMR improves by 14 percent for the remaining 99 companies. RMR is derived from customer billing for services such as monitoring, contracted maintenance, and leasing of security systems.

Dealers' Eggs in Several Baskets

Security alarm companies derive their revenue from a wide variety of product categories, including the most sizeable, burglar alarm systems, which comprised 44 percent of dealers’ revenue in 2007 — the same as in 2006.

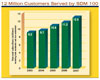

12 Million Customers Served by SDM 100

SDM 100 firms in aggregate have 12.5 million customers under contract, an improvement of nearly 11 percent from 2006 to 2007. The No. 1 firm, ADT Security Services, stands at approximately 6 million subscribers (estimated), while No. 2, Brink’s Home Security, reported 1.2 million, and No. 3, Protection One, reported 1.7 million customers.Based on responses from, or estimates of, 97 firms. Not included: Safeguard Security and Communications Inc.; SDA Security; and SSD Alarm Systems, Kern Security Systems & Alpha Burglar & Fire.

Source: 2008 SDM 100, SDM Magazine, May 2008

Total Revenue Surges 10 Percent

The SDM 100 grew their total annual revenue by 10 percent in 2007 to reach $7.58 billion. One-by-one, the SDM 100 firms illustrated their remarkable ability to top their prior-year results. Among 96 out of 100 firms for which year-to-year revenue could be compared, 87 companies improved their total revenues, many by double-digits.Source: 2008 SDM 100, SDM Magazine, May 2008

Top Companies Ranked by Residential Customers

Rank by Non-Residential Installation Revenue

Rank by Total Annual Revenue

SDM 100 Alphabetical Index to Companies

Notable Achievements

- No. 2, Brink’s Home Security, achieved greater than 12 percent RMR

growth in 2007. The firm added 300 full-time positions in 2007.

- No. 3, Protection One grew its RMR by 34 percent compared with the

2007 SDM 100 report, and added 600 employees.

- No. 6, Slomins Inc., broke the $10 million mark in RMR in 2007.

- No. 7, Vector Security, added 40 new full-time employees in 2007.

- No. 9, Guardian Protection Services, added 133 full-time positions.

- No. 10, Bay Alarm Company, operating since 1946, broke the 100,000 mark

for total customers. It also added 40 full-time employees in 2007.

- No. 11, Apx Alarm Security Solutions Inc., rose up from a ranking of

No. 18 last year; the firm reached more than 100,000 subscribers.

- No. 12, ASG Security, gained more than 37,000 accounts through

acquisition in 2007, helping to grow its RMR by 53 percent to $3.8 million. The

firm now employs nearly 600 people.

- No. 16, Interface Security Systems & The Greater Alarm Co. (in Calif.), broke the $3 million level in RMR.

- No. 17, Central Security Group, broke the 100,000 mark for total

customers.

- No. 20, Alarm Detection Systems Inc., improved its RMR by more than

14 percent, breaking the $2 million mark in monthly recurring revenue.

- No. 23, Security Networks, improved RMR by 24 percent (compared with

2007 SDM 100 report), to $1.53 million.

- No. 28, General Security Inc., broke the $1 million mark in RMR in

2007.

- No. 31, Ackerman Security Systems, of Atlanta, was chosen as SDM’s 2007 Dealer of the Year.

How to Purchase the SDM 100 Directory

Wouldn’t it be useful to have more information about each of the 100 firms ranked here? The 2008 SDM 100 Directory includes contact names, mailing addresses, telephone numbers, Web site URLs, branch office locations, product buyer names, installation data, revenue sources, and more.The SDM 100 Directorycomes in Microsoft Excel format. To order the SDM 100 Directory, contact Heidi Fusaro at (630) 694-4026 or by e-mail tofusaroh@bnpmedia.com.A Guide to Reading the SDM 100

The 2008 SDM 100 ranks U.S. companies that provide electronic security systems and services to both residential and non-residential customers. This ranking is based on information provided to or, in a few cases, estimated by SDM. Ranked companies were asked to submit either an audited or reviewed financial statement, or a copy of their income tax return showing total gross receipts for the stated period. A vast majority of the firms ranked are privately held.The main table, which begins on page 42, ranks 100 firms by their recurring monthly revenue (RMR) of December 31, 2007. The firm with the highest RMR is ranked as No. 1, and so on. For each of the 100 companies, the following information is provided, from left to right:

- Current year rank, which is based on December 31, 2007 RMR. (If two firms have identical RMR, then the total

gross revenue for 2007 is the second determining factor used for ranking.)

- Company name, as used in the marketplace, and headquarters location.

- Amount of recurring monthly revenue (RMR) billed on December 31, 2007. An (est.) following the figure indicates it is an

SDM estimate.

- Number of subscribers (recurring-billable customers) that each firm counted

at year-end 2007.

- Amount of sales revenue from residential system installations in

2007.

- Amount of sales revenue from non-residential system installations in

2007.

- Total gross revenue in millions of dollars. This number represents

total revenue in calendar-year or (the company’s) fiscal-year 2007 from

security system sales/installation, service, leasing, and monitoring.

- Number of full-time employees.

- Number of business locations, including headquarters.

- n/a — not available, or not applicable

Questions about the SDM 100 must be sent in writing to: SDM Magazine, attention Editor, BNP Media, 1050 IL Route 83, Suite 200, Bensenville, Ill. 60106. Questions and comments also may be e-mailed to the Editor atstepanekl@bnpmedia.com.