Ed Newman of Universal Security Systems says he

is beginning to see stabilization of profit margins on video projects, as the

competitive dynamics have settled, separating competent integrators from the

incompetent.

This dome is looking over the Beau Rivage Resort

and Casino, Biloxi, Miss., which at 32 stories is the tallest and largest

building in Mississippi.

Some dealers and integrators are reporting that it’s difficult to make a sale because customers frequently will price equipment on the Internet or in video catalogs. These conflicts in the channel put pressure on their profits from video surveillance systems. So dealers and integrators are emphasizing their expertise, maintenance, customer service — even monitoring — in installations.

Edward Newman, vice president of Universal Security Systems Inc., Hauppauge, N.Y., says he finally has seen a leveling off of the drop in profit levels his company had been experiencing over the last few years that he attributes to new, inexperienced competitors.

“A variety of different types of contractors — electrical, general, defense, telephone, and computer contractors — all viewed the security market as billions of new dollars being spent,” Newman lists. “It tends to drive prices down.

“The fourth quarter of 2007 was the first time we’ve seen some stability in the market,” he reports. “Many of these contractors that had won jobs suffered significant losses on them as a result of a lack of experience. Now they are deciding maybe they will go back to doing what they do best.”

Doing what they do best is the marketing tactic that Universal Security Systems has been using to win against those competitors. “One of our marketing pitches to customers is that we don’t sell telephone systems, we don’t install lights and outlets, we don’t build airplanes or missile systems, we do electronic security work!” Newman emphasizes.

A trend that Newman is observing is the combining of several security jobs into one massive one. Although this may reduce paperwork for the customer — especially if it is a government agency — it makes it difficult for small or medium-sized integrators to bid competitively on such large jobs, he maintains.

On one recent sale, work at seven or eight sites was consolidated into a single project. “We could easily have done one, two or three a year,” Newman relates.

“None of the local security integrators were able to go after it competitively, and it goes to an electrical contractor instead,” he recalls. “We’ve seen a number of those in the last couple of years.

“I think there’s a certain critical mass with this type of work, that the cost of doing all those projects together ends up being more than if you did them as separate projects, but I don’t think they’ve quite come to realize that yet,” Newman notes.

Data Video Systems, Muskogee, Okla., also has been feeling pressure on profits lately. “We’re running into a lot of competitive bids where they’ll bid the equipment from all over the world, and we’ve had to sharpen our pencils a lot more to get some of these contracts that used to roll our way,” admits Gary Wilson, CEO.

Dan Hobbs, vice president of sales and marketing for Data Video Systems, concedes, “We have to find more creative ways to increase our overall profit. Today, we’re making less margin than two years ago.”

They are working to obtain more recurring revenue from maintenance. Another strategy Hobbs is using is to circumvent traditional methods of product distribution. “As direct dealers, we’re able to have a little more margin than if we went through a distributor, so that in the last two years has been a part of our business model,” he reveals.

In this company’s experience, government funding is becoming harder to secure because of budgetary constraints. “We’ve had to be very creative in finding other ways to help them find those moneys,” Hobbs says of government buyers. “For instance, for fragmentation retention film, many times they may not have the money for that through physical security, but they might have that through the energy budget, because of lower electric bills they have.”

The capabilities of large enterprises’s video

surveillance systems such as Pelco’s Endura make control rooms the hub of

security information throughout a company.

STILL GROWING

Despite pressure on profits, security dealers, systems integrators, distributors and manufacturers are reporting that video surveillance work and product manufacturing levels are growing.“We’ve probably got double the number of new CCTV jobs on the market in 2007 over 2006,” reports Robert Birley, central Oregon operations manager for Selectron Inc., Portland, Ore. “We are getting more and more requests for high-definition and IP video. In fact, two-thirds if not more of our systems are IP-based.”

The company also is experiencing growth in high-definition video from megapixel cameras. Profit is at the same levels as expected, Birley maintains.

“We haven’t seen a hit in profits based on competition because I think the market expanded, and then our company differentiates itself from other companies to keep our profits,” Birley continues. “We’re not having to lowball a bunch of jobs; they’re holding their own.”

Hobbs predicts a 20 percent increase in video surveillance jobs in 2008. “The number of projects have stepped up, and we have more work on the boards for 2008 already than we did in 2007,” he asserts.

Wilson adds, “Usually at the end of the year, it slows down for us, but this was a good year. The last quarter was up 20 to 30 percent.”

He says the sophistication of the company’s video surveillance jobs has ramped up. “In some cases, it seems the systems we’re installing are a little bit more advanced than we’ve done in the past, rather than just a few video cameras,” Wilson relates.

Tom Cashman, general manager of global product management for video, GE Security Inc., Bradenton, Fla., envisions worldwide demand for video surveillance products. “I’ve always enjoyed the security market because it seems like it’s almost recession-proof,” Cashman declares. “We see opportunity for growth in 2008 in the U.S.”

This Bosch AutoDome camera in use at Eagle’s

Nest at the ski resort on top of Vail Mountain in Colorado can provide more

than just security information.

MORE THAN JUST SECURITY

There are so many different uses for video equipment beyond pure surveillance needs, which also has contributed to a surge in the business. Management of retail operations, manufacturing processes, customer services, and even safety are now in the spotlight of a video camera.Birley reports that manufacturing and process industries are having video surveillance equipment installed. “We’re used a lot for process controls with companies that build structural materials and produce fluid metals to make sure no accidents happen, and also for the productivity of a product line, to make sure the line stays moving,” he explains.

“We have 12 clients who are extremely happy and buying cameras like they’re out of style,” Birley continues. “They said basically with the production level that they want, they can pay for a camera in three to four months, because of the increased production they get out of their employees.

“Also, if a machine is broken, they can get it fixed immediately,” he notes. “So it’s very encouraging for them when we put the first six or seven in, and now it’s on the way up.”

Michael Godfrey, chief technology officer at Visual Defence, Richmond Hill, Ontario, Canada, offers additional uses for surveillance video.

“At Heathrow [Airport], the baggage handling group is using it,” he reports. “If they have a problem with baggage handling, they can pull up the cameras and see if a bag fell off, or if there is a problem with a conveyor belt. The airlines are using it for their operations to know if planes are at the gates, if the catering truck has pulled up, if the cleaning crew is there.

“The Zurich airport is using it for security waiting lines — they have a policy that lines have to be 15 to 20 minutes long,” Godfrey continues. “They’re using it to manage crews and see if they have to open up more security checkpoints. Subways monitor the number of people on platforms for safety issues to see if they become overcrowded.”

Chuck Hutzler, vice president of R&D for video systems, American Dynamics, Lexington, Mass., a brand of Tyco International, Boca Raton, Fla., believes additional uses of video surveillance equipment is adding to its expansion.

“We’re seeing significant growth in the marketplace — security remains a significant concern for all our customers and their organizations,” Hutzler confirms. “In addition, we’re starting to see video surveillance expand out and being viewed as a tool for business intelligence and workflow improvement, thereby creating some additional market opportunity.

“Customers in the retail space are looking for payback on their video security purchases, so to the extent that you can show them how they can leverage video security into other areas, like merchandising and workflow management, is a large benefit to them,” he points out. “This is where analytics begins to become of age.”

Scott Schafer, senior vice president of sales and marketing for global and North American sales, Pelco Inc., Clovis Calif., agrees on the effect of these new uses for video products.

“One of the industry analysts and I were talking about how video security systems were in some ways considered a grudge purchase, in that you had to buy it because the old one died and it was time to get another one, as opposed to buying it because there’s really business value,” Schafer remarks. “As some of the retailers and manufacturers and others that are using these products find new uses for that video data, there is a whole new return on investment opportunity that some end users are starting to ask about.”

More than nine out of every 10 security dealers

and integrators rated the state of the video surveillance market and the

potential for sales in 2008 ‘good,’ ‘very good’ or ‘excellent.’ Respondents to

this question rated the potential of the video surveillance market higher than

the access control, burglar alarm and fire alarm markets.

MORE EFFICIENT PRODUCT DESIGN

Erik Bertel, senior product manager for IP at distributor ADI, Melville, N.Y., and John Sullivan, ADI’s vice president of sales, see IP video and hybrid products as being growth areas.“What we’re seeing is a trend in growth in the IP world, so we’re watching this transition phase from analog to IP. It’s a very interesting time for everybody,” Sullivan says.

“The big deal is really getting IP into the correct cost structure. We have to help dealers understand why they should be selling IP over the analog cameras. So we have to help them make that transition through training to become more knowledgeable about IP,” he relates.

Sullivan and Bertel think sales of hybrid products — mostly NVRs, DVRs and cameras — will achieve growth to ease the transition to IP. Because manufacturing efficiencies are lowering the cost of cameras, dealers’ profitability is being affected.

One-fourth of respondents to SDM’s

Industry Forecast Study indicate that they offer remote video monitoring

services to their customers, a number that has not changed significantly in the

past three or more years. Among those dealers and integrators, the average

monthly monitoring price for this service is $220.

“The traditional box camera sales are starting to fall off as users migrate to other solutions, such as domes and bullet cameras,” he observes. “Dealers are looking for ease of installation nowadays. Trying to install cameras that have lens kits and mounting kits makes each install that much longer and less profitable for the dealer.”

Wilson agrees. “We’re getting away totally from the box cameras with the lens, the separate heater and blower, and having great success,” he relates. Wilson’s company is relying more on domes and bullet cameras. “The manufacturers have got the reliability built in. In the last year or so, they are holding their own against typical old box cameras.”

“Our focus is definitely to cut down on the length of time it takes to do that install by using the right products,” Hobbs agrees.

Video is integrated with access information

using Continental Access’ CardAccess 3000 video and DVR/NVR integration.

PROSPECTS FOR VIDEO IN THE RESIDENTIAL MARKET

Once thought of as primarily the domain of non-residential, video surveillance is now beginning to make inroads into the residential market — particularly when tied with remote monitoring. Today’s technologies certainly make it more affordable.One manufacturer that can attest to its healthy prospects is Napco Security Group, which is strongly marketing a product called iSee Video.

“Video surveillance as an industry market segment is particularly robust, with 2007 estimates attributing up to 20 percent to video surveillance and the average number of video surveillance installs reaching all-time highs for a 17 percent increase — a 40-percent increase over two years ago,” reports Judy Jones, vice president of marketing for the Napco Security Group, Amityville, N.Y.

“While surveillance systems were until recently largely reserved for commercial sales, today remote video is affordable enough for every kind of residential application, high- to low-end, even though intrusion system sales as a category are somewhat depressed with the slump in new housing starts, ” Jones maintains.

Residential video can be sold as a retrofit to existing customers, she points out. “This indicates a new incremental recurring revenue offering for dealers to capitalize upon while improving their accounts’ overall security and peace of mind,” she declares.

“We’ve all seen video statistics, that dealers now attribute approximately 10 percent of their video revenue to the residential market,” Jones notes. “We believe that number will rise substantially in coming years with more economical, easily implemented video solutions.”

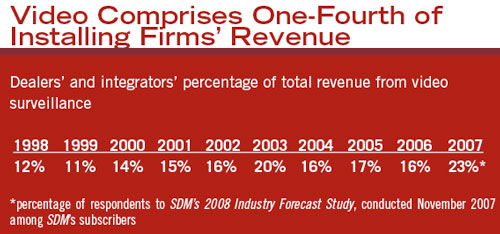

Of dealers’ and integrators’ total annual

revenue, an average of 23 percent is derived from video surveillance projects

and jobs, according to SDM’s Industry Forecast Study. The

remainder comes from burglar and fire alarm, access control, and residential

systems such as audio/video.

HAVE VIDEO ANALYTICS ARRIVED?

In the non-residential sectors, another segment of the video industry that experts think is on the verge of exploding is analytics, but when?Tyco’s Hutzler reports the best growth has been in the company’s DVR storage, but there has been disappointment in the growth of video analytic software.

“The analytics market was significantly hyped 12 to 18 months ago, but the sales of analytics have not been as robust as we anticipated and as all the market data suggested,” Hutzler asserts. “There is more of a wait-and-see attitude with analytics than 12 to 18 months ago. I wouldn’t say there is declining growth in that area, but the sizable growth is still to come.”

Steve Birkmeier, vice president of video analytics supplier Arteco, St. Louis, sees a “perfect storm” for video analytic acceptance. “A lot of the perceptions that have held back video analytics are finally going away,” Birkmeier maintains. “The No. 1 thing is seeing analytics installed in markets we’ve never seen before. Our dealers are putting in analytics systems in any number of applications.”

Unit shipments of video analytic systems have been increasing by 50 percent every six months, Birkmeier reports, although he concedes new entries into the market over the last 18 to 24 months have confused dealers, integrators and end users.

“Video motion detection systems are being placed under this umbrella of intelligent video,” he complains. “From a marketing standpoint, what the industry needs is some type of standardization for video analytics, so it makes it more clear for the end users and integrators to understand how the different products compare to each other.”

Waste Management uses Honeywell’s Intelligent

Video Analytics, Active Alert in its command and control center.

Universal Security Systems’ Newman is less positive about analytics. “Video analytics is in the chaos stage,” he maintains. “The biggest problem I see with video analytics is a lack of a clear-cut definition of what video analytics is.

“We see manufacturers selling products we call more intelligent motion detection as video analytics,” he observes. “Not that there’s anything wrong with that, but it’s a completely different product than a true video analytics product, which often costs 10 or 100 times as much to deploy.

“The end users are often left confused by the barrage of people trying to sell dissimilar products to serve the same need,” Newman asserts. “We sell both ends of the product spectrum, and there are different things for different applications, but the customers are the ones who are getting beat up on that.”

But Chris Loeffler, marketing executive for Virage, San Francisco, thinks video analytics have arrived as a technology that can turn a profit. “Video analytics has passed the point of being an investment without return,” he declares. “We see a very strong potential for growth in the next few years.”

Scirica is seeing early adopters applying video analytic technology. “We would agree with industry reports that show a slow adoption, and heavier adoption within certain verticals, where they really do have some very distinct and visible issues that video analytics can solve today,” Scirica reports, such as perimeter security. “There’s been a lot of interest within retail, but they are a little slower to adopt.

“There’s still a bit of a hangover from earlier hype, but we definitely see our technology solving the problems that customers have today,” Scirica asserts. “It’s becoming more and more viable, and there definitely is a market out there.”

Loeffler stresses that smaller organizations are able to consider video analytics now. “The hardware itself is becoming so much of a commodity that it’s easy to get — it’s the software side that is still very unique to the industry,” he points out.

“The video analytics market is still growing and developing,” Loeffler emphasizes. “The players in the market are not as mature and still fighting for that market space. So a small purchaser can buy a few cameras and because the hardware has dropped in price, they now can afford the software.”

A negative that Loeffler sees is the idea that video analytics is still an immature market, “the idea that the technology itself is not yet mature — the idea that it’s something that if you wait a few years, it might be even better,” he complains.

Godfrey thinks video analytics have many applications for additional uses in retail. “Analytics are getting a lot better and more intelligent, and they’re working quite well now,” he maintains.

Eric Cechak, vice president of western sales and key accounts at Bosch Security Systems Inc., Fairport, N.Y., is enthused about video content analysis (VCA), but thinks more work needs to be done on it.

“Possibly the strongest trend is intelligent video analytics, where the camera is intelligent enough to come to conclusions without human assistance,” Cechak asserts. “For VCA to become mainstreamed, the technology needs to improve to meet customer expectations while becoming more cost-effective per channel.”

Scirica agrees. “Some of the electronic components are just starting to catch up to where we need them to be able to provide a cost-effective and easy-to-deploy system,” he observes. He adds that increased processing power is needed to push intelligence out to the component level so the system’s architecture is more distributed rather than centralized, as it has been in the past.

The Station Operation Center (STOC) at Air

Canada uses the Command and Control Center (3C) from Visual Defence. Other

airports use surveillance systems to check on baggage handling and the length

of security waiting lines.

IP VIDEO

Further ahead in its acceptance in the market, however, are IP-based video products.Universal Security Systems’ Newman sees IP video as growing in 2008. “In 2006 and 2007, we still saw a reluctance by the end user to move to IP video,” he reports. “We also saw a number of systems that were installed by competitors that were not successful.

“While they understood security, they lacked the IT background, particularly as the system got larger,” Newman stresses. “The demands of a 300-camera system are tremendous, and they need to be ready to handle that or they unfortunately will fail miserably.”

Scott Wulforst, integrated sales manager for A-1 Security Inc., Sparks, Nev., estimates that up to 80 percent of his company’s jobs include some portion of IP.

“There is tremendous opportunity for manufacturers that have the right structure in place to help their dealers win new IP video business and support technicians throughout the installations,” Cechak maintains.

“The rapid growth in adoption of NVR-based recording that we saw two years ago has dropped dramatically, replaced by direct-to-iSCSI recording, where the IP cameras or encoders record directly to the disk array or storage area network (SAN), bypassing the need for an intervening NVR PC,” Cechak adds. “In some states, regulations for gaming and corrections have mandated the use of digital recording or long-term retention rates for video.”

Visual Defence’s Godfrey agrees. “Casinos are accepting digital surveillance, where they didn’t two or three years ago even, and that’s a very large market,” he points out.

Wireless video is making sales inroads for ADI. “We’ve done very well, when you consider the conservative nature of our dealer base, bringing what I’ll call radical new technologies, wireless mesh networks that typically are associated with Wi-Fi municipal installations,” Bertel relates. “It appears our dealer base is finding these to be a great solution for wireless video. Our sales have improved greatly over the last year.”

IP video is all Data Video Systems does. “I know wireless is one of the new buzz words, but the bulk of our installations with the digital systems are pretty much the plain old vanilla hardware system,” Wilson declares. “We haven’t done an analog system in over five years.

“We do some maintenance for a few analog systems, and even in those places we are rolling them around to digital,” Wilson continues. “Some of the business clients we have are government and correctional facilities, and they don’t give them a lot of money. So they’re slow to adapt to digital; they want to adapt, but they just don’t have the dollars yet.”

Birkmeier also has recognized the trend: security installation companies that are driving a phase-out of analog technology and a phase-in of digital IP.

He also relies on training dealers to sell intelligent video. “We’ve had a great response with our dealer development program implemented one year ago,” Birkmeier declares.

A Mirtech technician installs new domes as part

of a totally networked video system in the downtown core of London, Ontario,

Canada.

TRAINING AS AN ANTIDOTE

Jay Ward, CEO of Mirtech International Security Inc., Toronto, sees employee training as the antidote to commodity pricing of video equipment.Training in IP is key to its growth, Cechak thinks. “Sales would accelerate faster if security installers’ IP networking technical knowledge could grow as quickly as the market is demanding,” Cechak suggests.

Training for IP video is up at ADI, Bertel reports. “We offer a Security Networking 101 IP class that is an eight-hour introductory course for security experts learning networking IP,” he relates.

“We literally doubled the attendance in that class in 2007,” Bertel reveals. “So there’s definitely the interest in it. Their interest is proven because they’re paying for the training!”

Pelco’s Schafer also relies on training as an integral part of dealer development. “One of the hallmarks here we continue to improve is better selling, better support of our customers, providing more training and education to them so they can be more successful,” Schafer relates.

Robert Birley, central Oregon operations manager

for Selectron Inc., tests video cameras at the company’s headquarters in

Portland, Ore.

Cashman doesn’t want his enthusiasm for IP video to overshadow his company’s legacy analog business. “I wouldn’t want to give you the message we’ve abandoned analog,” he declares. “I’m bringing on IP cameras because we’re giving our customers the choices they want.

“We’re going to see a huge growth in analog equipment,” Cashman forecasts. “It has not gone away, because of the sheer size of that market and installed base. The rate of growth is slowing for the analog installed base, but it still is huge in absolute dollars. What’s growing faster is IP.

“We’re staring at another five years of transition, and then we’ll say, ‘Remember those old CCTV cameras?’ but I don’t think we’re going to be saying that at the end of 2008,” Cashman predicts.

Sidebar: End to Budget-cutting?

Edward Newman, vice president of Universal Security Systems Inc., Hauppauge, N.Y., sees his customers’ imprudent budget-cutting ending.“Based on speaking to a number of our long-term customers, many of them faced smaller budgets in 2007, but often as a result, saw some decreasing performance of their system, and as such, went back to get larger budgets for 2008 and were granted that,” Newman reports. “We’re also seeing many of the customers as they reevaluate their needs getting back to basics and saying that good CCTV coverage is first and foremost what they have to have before they get into some of the more exotic technologies.”

Among these are perimeter security, biometric access control and video analytics.

Sidebar: Edge Recording Gaining Adherents

IT specialists are among the greatest proponents of edge recording devices, maintains Robert Birley, central Oregon operations manager for Selectron Inc., Portland, Ore.“I think one of the largest areas of growth will be in devices that don’t touch someone’s network, versus those constantly streaming video over the network,” Birley asserts.

“I see IT guys lighting up when you bring in edge recording solutions,” he reports. “We get more IT buy-in, which allows more money to be spent, because it gets more funding than security.”

With edge recording systems, camera output is recorded directly on a hard drive through Cat 5 cable without having to go onto a network. The video only is sent over the network when it is requested, thereby saving bandwidth.

“We push hard and show clients what it can do for them,” Birley concludes.

Sidebar: Which vertical markets do you think will offer the greatest potential for sales in the next 12 months?

“With economic conditions currently, any commercial enterprises – financial, hospital – are all going to be very tight, so I think the only safe bets are the government work primarily driven by regulation, such as TWIC and MARSEC maritime security. Anybody who falls into those regulations is going to have to spend money in 2008 budget or no budget, so to speak. The education market probably also is a pretty good bet in 2008.”— Edward Newman, Universal Security Systems Inc., Hauppauge, N.Y.

“One are the casinos, and hand-in-hand with that are the Native American tribes, which goes much deeper than casinos. We’re working very hard at the Department of Defense and GSA. Law enforcement and correctional installations are big for us, and then a lot of the courthouses and federal buildings, and things of that nature.”

—Dan Hobbs, Data Video Systems, Muskogee, Okla.

“Definitely the convenience stores, small retail, even the municipalities. I think those have been pretty good for us lately. Anyway, we’re kind of driven in our market by the hospitality industry. We don’t see that to be a big strength in ’08. Casinos are not as strong in ’08, just looking at the market.”

—Scott Wulforst, A-1 Security Inc., Sparks, Nev.

“We are strong in hospitals. I think hospitals will be a good vertical market and the health-care industry as a whole, along with process control and production lines.”

—Robert Birley, Selectron Inc., Portland, Ore.

“Probably the one I mention first off is border services. We think a lot of the condo market. The other one we’re looking at is property management companies. A lot of smaller companies are being bought by bigger companies. Also, health care is another market, and we do a lot with corrections, like jails and correctional services.”

—Jay Ward, Mirtech International Security Inc., Toronto, Canada

“We’re seeing surveillance needs increasing for small businesses – restaurants, grocery stores – and we have products that will fit very nicely.”

—Erik Bertel, ADI, Melville, N.Y.

“Lots of airports have to be upgraded, a lot of the ports really haven’t seen enough attention and transportation – mass transport, bus and railway systems and the subway. We’re looking to put cameras in train cars – part would be live for train engineers so they can see if there are any safety issues as they pull into the station, but it mostly is being recorded for investigation afterward. We have one project for over 2,000 buses. They have the same video system used in subway stations.”

—Michael Godfrey, Visual Defence, Richmond Hill, Ontario, Canada