After difficult years for all businesses active in the housing market, including security, stabilization is emerging. Residential security, long having a dotted line to new starts, moving households and owned homes, has suffered. But good news is now more frequent.

Security dealers report high optimism for 2013 sales in Parks Associates’ 2013 2Q Security Dealer Survey. They also report more often offering and selling smarthome options with their security systems sales. This has five key benefits:

- First, it enhances the value proposition for householders considering security adoption;

- Second, it may encourage a faster replacement or upgrade rate; even a one-to-two year acceleration offers good news for the industry;

- Third, monthly revenues for householders adopting smarthome components with security systems will be higher than fees for households with only professional monitoring – at least for several years;

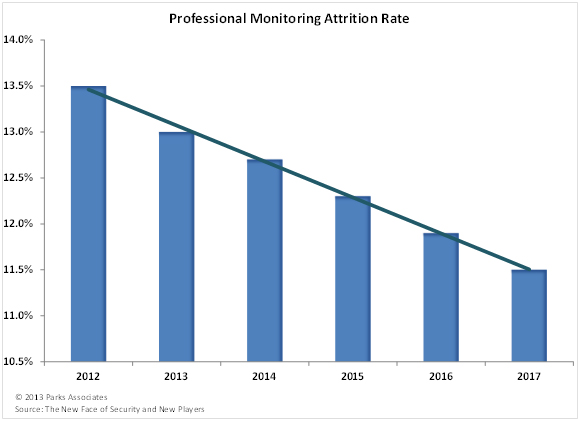

- Fourth, attrition remains a thorny and expensive issue for the security industry. Parks Associates believes that adding smarthome components (and continuing to upgrade benefits) will improve stickiness and gradually reduce attrition. New research shows a marked decline in attrition continuing. See the graph Professional Monitoring Attrition Rate (below).

- Fifth, and not unimportant, will be the coming opportunity to gain householders living in condos, high rises and the like as customers. This won’t happen overnight, but as functional benefits increase, smarthome will become more appealing – with or without professional monitoring.

And just imagine if attrition decline even exceeds Parks Associates’ forecasts. That alone would be great news for the industry!

Parks Associates’ report, The New Face of Security—Forecasts and Players examines the trends now offering the promise of moving the security industry to a multi-benefit system with security as its anchor. This 4Q 2013 report is now available from Parks Associates; it defines smarthome, examines the motivations of both traditional security providers and new broadband service entrants, and recommends approaches for the near term. For more information, please email eli.lund@parksassociates.com, call 972/490-1113 for Eli, or visit www.parksassociates.com.