The Millennial Myth — Who is Really Buying DIY?

Does DIY Cause More False Alarms?

What are the Challenges?

|

|

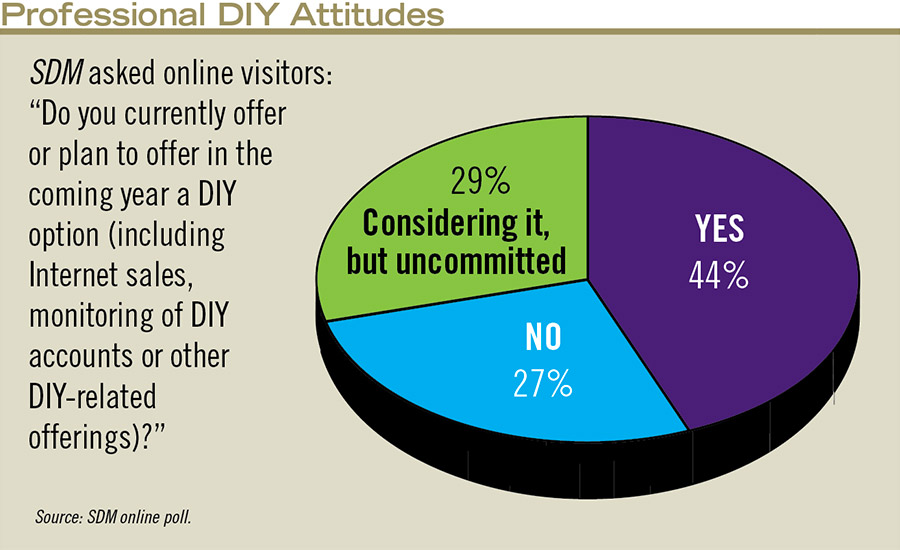

| A large majority of respondents are either offering or considering offering DIY security. |

There are certainly a lot of positives about DIY, but there are still some potential hurdles to clear.

The base of established DIY companies who have already put in place the processes and procedures for this format is formidable. Just because a professional security company may have a better product, doesn’t mean the delivery system and marketing is up to snuff.

“They are going to have to employ SEO professionals to compete on a level against an established base of companies,” says USA Central Station Alarm Corp.’s Bart Didden. “All of these companies have an established program and name recognition and have spent a ton of money. What is an alarm dealer going to do to compete against that?”

As one of those “established” players, LiveWatch (purchased by Monitronics last year) has a lot of business efficiencies in place that have been there for years, agrees Christopher Johnson. “Even though the manufacturers have made significant progress in making the hardware more user friendly and adaptable to the DIY model, it is not as easy as just sending people a box and they are on their own. We have spent years training our people, developing support tools and documentation, and all of the value-added things that contribute to our success in DIY. Part of the risk for someone as a new entrant is to develop those things and incur those costs.”

Ironically, he says, the very technology that is making it easier for a traditional dealer to offer DIY is also making it harder to break in to that market. “The cost of marketing and delivering these more advanced and elaborate products has driven the creation cost to the point where it is similar to a traditional dealer for a new entrant. I would not want to be a new entrant in the DIY space today. The competitive landscape is such that the cost to create leads is just as high, if not higher, and the cost to deliver the products has increased because the manufacturers are creating more advanced products and customers are demanding more of them. It is kind of a catch-22 in terms of innovation because demand continues to drive the costs up.”

He also points to Google and Apple in the wings as a potential threat for anyone in the DIY space, whether already established or not. “There is certainly a disruptive element right around the corner for this industry. What we have to do is ask what value we can bring to that ecosystem.”

Johnson suggests dealers focus on core competency of security to compete. “Things are coming full circle where as an industry we have to focus on the things we do best like 24-hour monitoring, communication during an emergency, dispatch and good response.”

DIY is not easy, says Megan MacDonald of My Alarm Center, a company that just went through a roll-out of a professional DIY offering last year. “DIY is not a magic bullet. It takes a lot of time and investment from the company to accomplish it. We built an internal team to support this operation because it is very high-touch. To service and sell to a customer setting it up themselves is not the same as a professional install. We wanted to have a team specifically dedicated to the DIY customer, making sure we provided a world-class experience. There is a lot of time, training and money required to make sure you are allocating the right resources to support this business.”

This is one reason Creed Anderson of San Diego Security and Fire quickly switched his focus to all professional DIY just a few months after starting his security business. “If you have one foot in with pro and one foot in with DIY, which one are you most comfortable with? I decided to focus on the few and not the many. If you focus on the many you may spread yourself too thin and end up not committing to anything.”

Mike Hackett of Qolsys says doing DIY requires a mental shift on the part of the professional dealer. “The whole mindset of a hybrid DIY dealer is very different from a traditional dealer who then gets into this hybrid model. If you have 10 trucks in your parking lot and your mental model is ‘phone rings, roll truck,’ you are likely to continue to do that, even though the value proposition we are presenting is to reduce that truck roll. We have a customer that installs thousands of units a month and never rolls a single truck because they don’t own them. If you don’t have a truck but know you are going to get phone calls, how does that force you to adopt new practices and change old ones? Whatever the problem is in that home you need to be prepared to fix it right from your desktop.”

However, while there is a “healthy mix” of dealers who are struggling with this shift, Hackett sees a silver lining. “They are not struggling and getting frustrated and leaving, but instead realizing they need to hire people with different skill sets and learning to quickly adapt and implement new processes. That isn’t easy to do, especially if you are running a more traditional business as well. But it is possible.”

Anytime the term “DIY” comes up, particularly when it comes to electronics, the term Millennial tends to be liberally used. The perception is that the younger generation wants to buy differently, install it themselves and doesn’t have the patience to wait around for hours for an installer to come to their home — nor do they want someone in their home. All of those may be true statements. But they also lead to a misperception about the potential DIY buyer.

And in fact, when talking to professional DIY dealers, many do say the Millennial market is their main focus. Creed Anderson of San Diego Security and Fire reports most of his customer base is under 40 and buying online. “I would say a good 30 percent of our customer base is 27 and under,” he says.

But others report a broader appeal.

My Alarm Center’s MacDonald, for example, says that Millennials are not the majority buyer for her company’s LiveSecure professional DIY offering. “We had strong direction from resources we were using that the target was Millennials and that is actually not who is buying this product. There is a pre-conceived notion that the person buying DIY is younger, has less money and is living in an apartment or condo. But if you look from a marketing perspective who is searching terms like ‘DIY security’ and coming to sites like ours it is married, expecting a child or with a kid, homeowners with higher incomes. It skews a lot closer to the professional market than you might think.”

MacDonald theorizes that Millennials are buying but what they are buying is “smart things,” like Nest and light bulbs. “They are not necessarily in tune with home security in its truest form, which is more of what we are than a gadget,” she says.

Tricia Parks of Parks Associates says the focus on Millennials is understandable, because they are frequently in or just coming out of apartments or rental homes and they are tech savvy. “But I also happen to personally know two older households that went to DIY. They could have afforded it, but didn’t want to pay that much. So I agree that older households should be considered in the mix. After all, the professional industry has 80 percent of all households they have never touched.” And that number includes all the demographics.

Mike Hackett of Qolsys says the nature of online buying today means DIY goes far beyond just Millennials. “If you are online, you are a potential customer. We get a lot of emails from customers and what I find is these people cross every segment of the population. You can tell by their language, or they reference themselves [a certain way]. I don’t have a data-driven answer, but anecdotally I would say it appears these customers are of every age and demographic and they represent the online consumer — which is everyone.”

Many professionals in the security industry point to one potentially huge downside to DIY security — false alarms. The theory is that if an amateur is installing it, then the potential for industry-damaging false alarm rates goes up.

“I have the same concerns that new DIY entrants will actually increase false alarms,” says Live Watch’s Christopher Johnson. “Our false alarm rate is on the low end of the spectrum and false alarm reduction was an important part of our marketing strategy. I am concerned that someone who decides to go full force or even just dabble in DIY will not only give the niche a bad name but also be harmful to the industry.”

That is why it is crucial to hold DIY to the same standards as professionally installed systems, something that most professional DIYers say they are not only doing, but they argue the nature of professional DIY may make the false alarm issue less likely, not more.

“First, designing the experience from the business perspective to mitigate that is key,” My Alarm Center’s Megan MacDonald says. “We download a template onto the panel that we pre-set. We don’t leave things like entry and exit delays up to the customer. We pre-configure the system to security industry recommendations, which comes from our professional side. The second piece is making sure you are managing and measuring your activation process. We require of all our customers, prior to being professionally monitored, that we check the system. It is a stop gap. If we can’t see all your points are responding we aren’t going to turn it on. The third thing is making sure the customer understands what is happening. What I have seen anecdotally is self-install customers are more in tune with how the system actually works so if something goes awry they are more able to troubleshoot or fix it.”

Systems simple enough to self-install may also be simpler to understand and fix, says San Diego Security and Fire’s Creed Anderson. “There are a lot of poorly professionally installed systems out there that also create false alarms. With wireless and screw-less systems, that eliminates a lot of those issues. I think I have seen fewer false alarms in my account bank than in my professionally installed base because the systems work more simply.”

Honeywell’s Inder Reddy says with a professional DIY offering there should be no difference in false alarm rates. “Whether self or professionally installed we believe the methods and protocols are the same. We want to make sure the installation is done properly and the way the service providers respond is consistent. We expect the same level of false alarm prevention with self-install. The quality of service should not be any different.”