Talking about the connected home today can be a challenge when you are faced with the question “What is the connected home?” Is it an “interactive service” plus one? A “smart home?” Is it the Internet of Things (IoT), or the concept of home automation brought down to a more affordable scale? For many, the answer to these questions is “yes.” Others acknowledge the difficulty of pinning it down but say in the end it doesn’t matter what you call it, only what the benefit is to the industry and the homeowner.

“I wish I had a great, simple definition for the connected home, or smart home,” says Ryan Petty, vice president of product and innovation, ADT, Boca Raton, Fla. “The way we think about it is the ability for an ADT customer to be able, regardless of where they are located on planet Earth, to have awareness of what is going on at home. We can achieve that through various sensors and devices, but the ability to talk to the home is at the core for us and the way we approach it and think about it.”

Research firm IHS, Englewood, Colo., defines the connected home as simply having connectivity outside the home, says Blake Kozak, principal analyst. “It could be a point device or a whole ecosystem, but really nothing is all that smart unless it can be connected in a mesh network or by having a true IoT format where the individual doesn’t have to do anything — there are simply scenes happening automatically.”

The definition of the connected home may be different inside the security industry, says Warren Hill, product marketing leader, intrusion & smart home, Interlogix, a Lincolnton, N.C.-based part of UTC Climate, Controls & Security, a unit of United Technologies Corp. “As far as the security industry goes, interactive services has evolved into the connected, or smart home. But outside the security industry they have come about it from a different angle and they just call it the connected or smart home.”

Others suggest the connected home is a point along the continuum from an interactive security system (which is table stakes for any new installation today) to full home automation and beyond to the Internet of Things. And that continuum may break along price lines.

“As newer platforms and technologies hit the market they are trying to design for the mass market at a much lower price point,” says Kris Kaymanesh, president, Sight and Sound Systems Inc., Dulles, Va. “By driving the price down, since it is not as complex a program as home automation it brings mass market pricing. It’s a process of evolution, not revolution. To me the smart home would be the bridge between home automation and the connected home. Home automation is already connected, but a connected home might not be described as full automation.”

Technology innovation plays a big part, but the other factor that has changed things for the connected home is the rapid rise of the smartphone in the past decade. “Manufacturers are producing technology that is more affordable even for the bells and whistles,” says David Hood, director of business development, EPS Security, Grand Rapids, Mich. “There is also the experience through the apps. The mobile phone is attached to us; it has become a part of us. If we can leverage that to interact with our homes, man that is so appealing.”

This leads to a “stickier” customer, says Pat Callanan, president, Hawkeye Communications, Hiawatha, Iowa (featured on this month’s cover). “The sticky is huge. We are selling and installing these products and making money on that, but the sticky is a lot of the benefit for us.” While he has been involved in the connected home space for several years, Callanan says that now more people are “getting it” than before. “All of a sudden it is starting to hit and we are selling a lot more devices now. People know about it and want it on their phones.”

The smartphone is a great analogy for what is happening in the connected home market overall, says ADT dealer Reed Peru, CEO, RK Marketing, Tempe, Ariz. “We used to have flip phones and when the first smartphone came out, many people were reluctant to change. Then a few years ago, people started seeing more and more benefit and now it is a necessity. I am starting to see that same type of organic growth in the connected home space.”

THE CONNECTED HOME MARKET TODAY

When asked to describe the overall connected home market today words like “fragmented,” “infancy” and the “Wild West” are frequently bandied about. With many approaches to coming at this market, from the traditional security provider adding connected home services, to retail DIY products, to cable companies and MSOs, Amazon, Apple and Google all providing widely varying levels of experiences, it can quickly get overwhelming. However, when you look beneath the surface of the turmoil, there is a slow and steady pace that is both familiar and promising to those in the security industry.

“While the last few years have been heralded as the break-out year for the connected home, the actual growth direction is steady, incremental growth in adoption,” says Brad Russell, research analyst for Dallas-based Parks Associates. “Almost 20 percent of U.S. broadband households own at least one smart home device. Several devices are getting close to the 10 percent adoption mark, including thermostats, networked cameras, smart door locks, smart garage door openers and smart smoke detectors. Half of all security system households report ownership of some smart home device.” (See “Hot, or Not?” on page 59 for more on the individual technologies.)

Even more telling, so far professional security companies command the lion’s share of sales for smart home security and safety devices, Russell adds. Parks Associates reports that 80 percent of U.S. security dealers currently install smart home devices as part of their services.

This is not surprising to Dave Mayne, vice president of marketing, Resolution Products Inc., Hudson, Wis. “Security is the only proven business model that can monetize the connected home. We see a lot of convergence between the security industry and the adjacent IoT space and an opportunity to bridge those two and provide growth for all.”

So far, it seems to be working, albeit slowly. Parks estimates that ownership of smart home products increased from 16 percent to 19 percent of U.S. broadband households in the last year — and 44 percent of households that do not have a smart home device plan to purchase one in 2016.

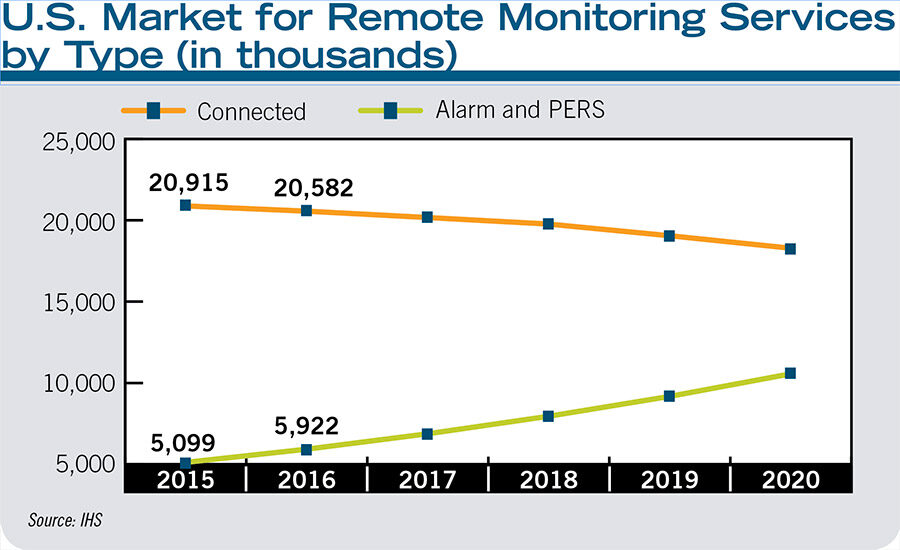

IHS puts the connected residential monitored security market in the Americas at $3.1 billion in 2015, about one-third the size of the traditional monitored security market, which is valued at $9.4 billion. This traditional market is expected to decline as services transition more and more to connected systems. IHS predicts the two markets will reach equivalent sizes by 2020.

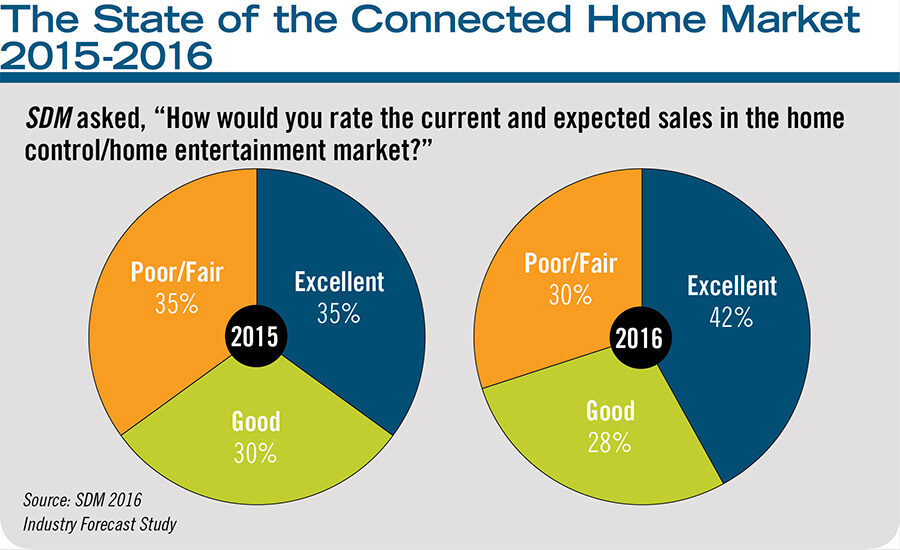

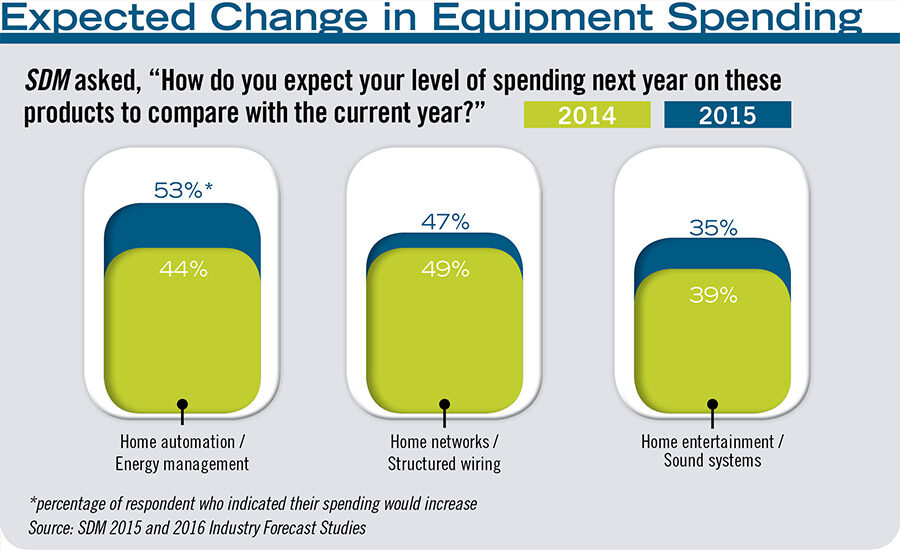

In SDM’s own research, the 2016 Industry Forecast Study, conducted in the fall of 2015, SDM readers were asked about their experiences in 2015 and their expectations for 2016. The home control and home entertainment category exceeded the respondents’ expectations from the previous year, with 65 percent stating their sales were good to excellent in 2015 — 8 percentage points higher than predicted and a 7 percentage point increase over the actual 2014 numbers. More interestingly, 70 percent of dealers expected sales in this category to be good or excellent in 2016. And expected equipment spending in the home automation/energy management category also increased, from 44 percent in the 2015 study to 53 percent in 2016. (See charts, pages 58 and 66.)

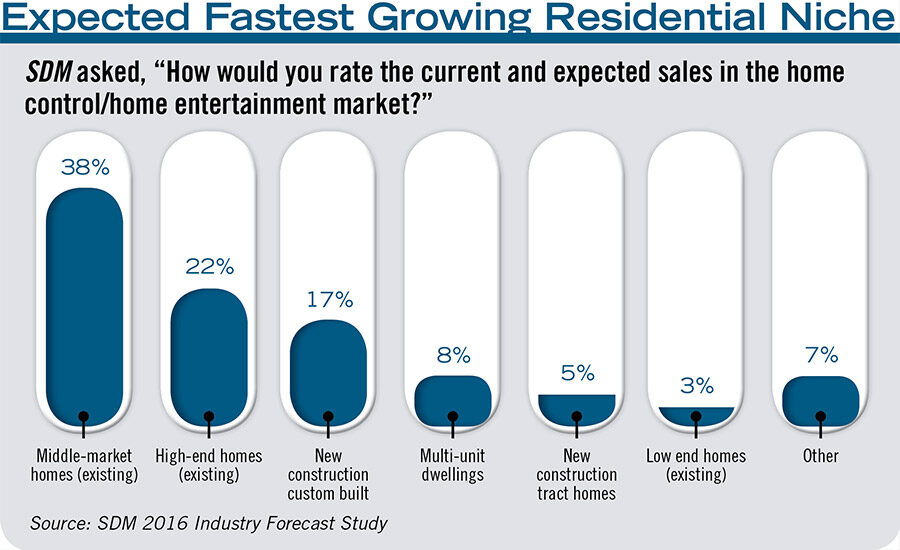

With a broader definition of connected home, incorporating interactive services and perhaps one or two “connected” devices beyond the alarm system (the classic lights, locks and thermostats), security dealers and manufacturers report steady, if not yet rapid, growth in 2015 and are optimistic for 2016 and beyond.

Manufacturers such as Melville, N.Y.-based Honeywell and Tysons, Va.-based Alarm.com report healthy growth and interest from their dealer partners in their connected offerings. “Traditional security companies are transitioning to offer this, driving more business and better engagement,” says Inder Reddy, general manager for intrusion and residential solutions at Honeywell Security and Fire.

“We have been on a significant trajectory as a company, driven by our dealers who are standardizing more and more and seeing more new accounts created as consumers become more aware of this technology,” adds Jay Kenny, senior vice president of marketing for Alarm.com.

“For us the connected home started slowly, probably five or six years ago,” Callanan reports. “It has been very steady growth. Now we are starting to see more and more people instead of just talking about it, really wanting to know about these things and how they can benefit their lifestyle.”

Callanan reports that, of new customers, the take rate for connected home services (an alarm system plus one or two) is as high as 55 percent to 60 percent, and he is far from alone in that estimation. Most dealers report anywhere from 50 percent to 90 percent as an average.

Peru says since starting with the ADT Pulse (which is sold as a building block approach to the connected home) a year-and-a-half ago his company has gone from the lower 10 percent in connected home and video to mid-60 percent. “The fact that we can give the customer that connectivity with their home and create a form of true home automation really has increased our sales, whether that is for basic connected security or complete automation,” he says. “We are committed to getting it to 75 percent by this time next year.”

Jeff Bates, COO, Vector Security, Warrendale, Pa. (SDM’s 2015 Dealer of the Year) sees a slow and steady rate over the past three years and all high numbers: “For the last 35 months I can confidently say the take rate on the connected home has been relatively consistent and I don’t believe this is just for us. The technology has stabilized and there are even more offerings to throw into that mix of interactivity. We have hovered around the 80 percent mark consistently for the last three years.” He adds that of that 80 percent, better than 50 percent of those accounts have multiple devices they are connecting.

While these numbers are exciting, Bates and others are quick to say these are the new customers, and most can’t say definitively how many more of those the connected home offering is bringing in. Bates thinks the numbers will continue to climb, however. “Eighty percent of our new customers are taking and our new customers accounts are growing. We are seeing larger new acquisition numbers.

Vivint Smart Home also performed around that 80 percent mark in 2015, reports Colby Winegar, senior director of innovation for the Provo, Utah, dealer. “In 2016 we will get closer to 90 percent. Our RMR has gone up even more this year.” Winegar agrees that, overall, the connected home market is still in the early stages, but adds that the connected home can be a big boon to the security dealer in a market where it is getting harder and harder to differentiate.

“The security alarm industry has overshot. There is more commoditization in that space and it can be hard to show you are better than the competitor. Everyone has the typical hub, door and window sensors, motion detectors and the performance is pretty similar.” By contrast, he says, the connected home space is still undershot, with a lot of players trying to win in the space and demand that is only increasing. “Eventually the connected home will reach a commoditized point and we will see price erosion, but we are far away from that.”

Bates and others believe the connected home will give the security industry the ability to finally exceed the 20 percent market penetration that most experts postulate. “The lifestyle trend gives the security companies the ability to finally find more market share.”

While Mayne describes the overall connected home market as one of “activity but uncertainty,” he is hopeful that the security industry is on the right track. “We have a very strong and robust market and I really like the fact that we exist in the professional security channel because the connected home is trying to figure out how to accomplish what the security industry has been doing for years. As much as there is uncertainty, we are coming from a position of strength.”

Growing the market is the hope, but the other side of the coin is keeping the customers they already have. Many dealers have been slow so far to go back to existing customers, but that is starting to change. EPS’s Hood says his company has started reaching out to these customers to offer connected technologies, which is providing them a better retention rate and increasing that stickiness factor. “Our incoming leads year-to-date are up 28 percent,” he reports of the efforts to reach back to customers.

This is in line with Parks Associates numbers, which report about 25 percent of security replacements or upgrades include at least one smart home device. Parks research also finds that nearly three-fourths of security dealers offer interactivity with devices through smartphones, tablets and computers — but this may not reflect actual numbers of dealers truly getting involved with connected or smart home sales. Empirically, this number may be smaller and growing more slowly as dealers weigh the costs and benefits, and figure out how to do it.

Dealers who are flexible and adapting to the connected home are doing well, but there is still some resistance, Kozak says. “A lot of dealers might be slow to deploy smart home solutions and still going with traditional systems and RMR. The market has been a bit slow, but we see a lot of new things coming to market. The key takeaway is those companies that are more rigid might be struggling and those that are flexible and adapting to changing smart home demands might be

seeing more value.”

Kozak says the market is still not moving as fast as predicted. “The smart home should be a selling feature right now, but the question is, Is it being pushed through or pulled through? I think right now it is being pushed through. It requires a lot more selling and understanding and tailoring it.”

This is something that manufacturers such as Napco acknowledge. “Although we offer marketing support and field and online trainings, and work hard every day to make our products easier to install, alarm dealers’ adoption, or eagerness to change, isn’t a fast pace either,” says Judith Jones-Shand, vice president of marketing, Napco Security Technologies Inc., Amityville, N.Y. “But we are confident that pace, too, will continue to escalate with the proven success of others.”

MARKET DRIVERS & CHALLENGES

There is a lot of good news for the security industry in the connected home research, such as overwhelming evidence from multiple sources that security and peace of mind are what is driving the connected home today. Redwood City, Calif.-based Icontrol Networks’ “2015 State of the Smart Home Report” found that 90 percent of consumers say personal and family security remains one of the top reasons to purchase a smart home system. But there are concerns as well — from the MSOs (multiple system operators) to DIY/MIY (do-it-yourself/monitor-it-yourself) and the uncertainty over what the role of mega players such as Apple and Google will play.

“There is more market awareness around the smart home and consumers are asking more questions about how to connect their devices and home systems,” says Greg Blackett, strategic marketing manager, Tyco Security Products, Westford, Mass. “The main advantage a dealer offers is he can equip a household with a fully connected solution, eliminating the burden of the consumer having to install the system himself.”

There are a host of providers of professional security solutions that offer packages to consolidate the security elements and many of the key elements of the connected home experience all under one cohesive app with — and this is key — all the service and support the industry is known for on the alarm side. This is something that other players have yet to entirely figure out and is a significant advantage to dealers right now. However, no one can say how long that will last.

The cable companies and MSOs have been offering bundled home security for a while. But while they are considered competition, most security dealers and manufacturers feel their overall presence is more of a help than a hindrance at this point.

“Cable/MSOs have about a 5 percent share of the monitored security market in general right now and all of their service offerings include connected home services,” Russell says.

“It’s actually pretty exciting for us,” Hood says. “Sure, the cable companies are in the space, and they will bundle security and connected technologies with their cable; but they also bring an awareness to our end user with a multi-million dollar marketing spend that we don’t have. If the cable companies can help get the security industry to 40 percent penetration in the next 10 years, that would be great for the entire industry, regardless of how it is accomplished.”

Mayne agrees. “It is both a threat and an opportunity. Is it possible for one of these companies to come up with a security service offering that disrupts our market? There is a chance that could happen. But in the short term there are plenty of opportunities because they are helping to educate consumers in ways dealers would struggle to do, which increases sales.”

Callanan says he has had customers call and ask if his company has the type of systems they are seeing advertised, which is a boost for his company. “This is right in our wheelhouse. I think it will only grow and I do think it will come back to the security industry. Most customers and people don’t want to work with some big monster company where they aren’t getting the tech support. If the big companies get the word out and our potential customers think of us, it is a good thing.”

Many dealers bank on two big advantages: the ability to give personal and local service, and expertise in installation and making things work together.

Craig Leyers, senior vice president, sales and marketing, for ADS Security in Nashville, found that the largest group of customers they were losing was due to moving. “I believe some of the cable MSOs are getting more and more savvy about engaging a customer when they call to activate service and we see some loss there. But I am also very aware of a number of situations where a client has come to or come back to us because of a concern about the level of service provided by these folks.”

While MSOs may be trying to copy the security model, there are other reasons Kaymanesh believes they have not been as successful. “Their concept is based on RMR. Their executives aren’t looking at onesies and twosies, but millions of immediate accounts. They keep trying to go at it, but every time they come up to a road block it is not because they aren’t doing it right, but because they don’t have the patience. Their experience of RMR in this market is nowhere close to what they are used to. They come up with new products and abandon them six months later, then people get upset and come back to us because we will stay with the client until we get it right.”

But there are some red flags on the horizon. While some customers do come back to the professional security provider, many are staying — whether due to price or an improving service effort. “Think about yourself as a consumer: If Verizon offers me a bundle for only $5 more a month, there is a pretty good chance I am going to go with them,” says Blake Deal, sales director, residential systems, Lutron Electronics Inc., Coopersburg, Pa. “They will figure out how to capitalize on this connected home stuff. They are in every home already and it is important that the security trade pay attention to that.”

Even more concerning may be efforts on the part of the MSOs to improve their own customer service efforts. “I called Verizon last November and I was blown away,” Deal recalls. “I had a live person within about two minutes on the phone and it was a very pleasant experience. As a consumer, if I had a pleasant experience dealing with my phone and cable company I would be happy to pay them a little bit more money every month. The better they get, the more competitive they become.”

In fact, the 2016 “Do it for Me Smart Home Study” (DIFM) conducted by Icontrol Networks, asked 550 customers of seven different professionally installed and monitored smart home systems to share insights on their satisfaction with the DIFM system. It found that customers were just as satisfied with the MSO-offered systems as the professional security ones, says Greg Roberts, vice president of marketing for Icontrol Networks. “There is a significant amount of customer satisfaction with those solutions. There are a portfolio of very strong, very viable offerings in the marketplace and it appears based on our research they are all doing an above-average job of driving customer satisfaction.”

While the MSOs are a relatively known quantity right now, a bigger concern to many is what impact the tech companies like Google, Apple and Amazon will have as they seek to also get into this market. “They represent vast ecosystems of users and partners with strong brand ID and loyalty,” Russell says. They are deeply capitalized for research and development and skilled at bringing new technology products and services to market. Their scale can be leveraged to become the trusted user interface across a variety of devices and services so customers can enjoy a seamless experience.”

These companies might be even tougher to compete with because of their very high consumer satisfaction ratings, adds Greg Simmons, owner/vice president of Eagle Sentry, Las Vegas. “The consumers like them. They are investing in their stock. In my opinion, that is going to be the real heavy competition.”

For some in the security industry that is the worst-case-scenario. But not everyone believes it will happen, or even be a bad thing if it does.

“Folks like Google, Amazon and Apple may be uniquely positioned to cast a much broader net to provide that unified app experience, but they haven’t gotten there yet as it pertains to security,” Leyers says. “Personally I don’t think security will have the upper hand for long with app aggregation, but the more interesting piece is the professional security aspect. It is clear that Apple is heading down that path with Apple Home Kit, but I am very curious what the future will hold with these bigger, technology focused companies when it comes to monitoring. It could be that they will establish a relationship with a security company, or buy or partner with a dedicated monitoring station. At that point I will be curious to see what that does to our market. Even tech companies will have to charge for those services. Does it come full circle?”

Vivint’s Winegar compares the concern now about the major tech companies to the way the industry worried about MSOs a few years ago, noting that those worst-case-scenarios didn’t come to fruition. “We were more nervous about what they were doing a year-and-a-half ago, but less so today. Yes, there is a threat there and probably more than the MSOs, but at the same time these companies won’t get into things like selling and installing and servicing customers. We think those things are really important and will keep them from being a serious threat.”

This is important, says Art Miller, vice president of marketing for Vector Security. “Some of these solutions sound great, but in practicality, who am I going to call when my lock doesn’t work? Am I going to go to the Apple store to get it fixed? These are the kinds of things that need to be worked out. We have had a single app for many, many years and that is why we [in the security industry] are seeing better adoption rates. We have the service model figured out.”

There is not going to be world domination by Google, Apple or Amazon, Deal says. “All three of those companies are going to create tremendous opportunities for the smart trade person to leverage and capitalize on.”

One thing that could become a threat is DIY systems, if the security industry doesn’t figure out how to either beat them or join them, Kozak believes. “If they can become more reliable and easier to install, that could reduce the need for professional systems. There are a lot of solutions coming out that circumvent the need for a dealer.”

In fact, a recent Parks Associates survey found that almost 50 percent of smart home devices are self-installed by the owner, a friend or family member. But security dealers are starting to figure out the monetizing of the DIY space, offering monitoring solutions for DIY-installed security systems. (See www.SDMmag.com/diy-the-security-market for more on this.)

But the nature of connected homes may make DIY a little tougher as it takes hold. With so many things to make work together, once a homeowner gets beyond one or two things, they may naturally look to a “consolidator” such as a security dealer to make the experience smooth and seamless rather than using an app for each feature.

“The early adopters of the connected home, the DIY’ers, the self-professed ‘geeks’ have tried as they might to create their own do-it-yourself smart homes, but have stumbled upon fragmentation and gaps in intelligence or openness among devices they have tried to connect together, hitting router and competitive ecosystems issues, and Wi-Fi setup and maintenance hurdles,” Jones-Shand says. (See “Connected Home Protocols” on page 67.) “Even DIY security system users have been found to prefer and seek professional security monitoring.”

However, like the DIY’er that has to figure out each technology as they go, offering a full connected home experience also requires the dealer to become educated and knowledgeable about technologies outside the usual scope of security, such as thermostats and garage doors, for example.

“The business challenge is the ability to keep up with the market and the new products,” Kenny says. “It is a real consideration of ‘How do I support a garage door if I am not that experienced with it?’ The dealer needs to spend time getting trained on these new sets of products.”

Kaymanesh believes the very survival of the security sector is at stake. “Even though some manufacturers try to portray that it is easy to integrate, we know the real story is quite different. We invest a major amount of resources towards constant training.

“Every one of these disciplines — lighting, garage doors, HVAC, audio, even networks — could be a potential broken link. The security background companies have been used to a single discipline. You could have 5,000 security accounts and two technicians to service. But if you have 5,000 connected home accounts you need at least 50 technicians to make sure you are maintaining everything, because there are more disciplines and things that are interacting that could be broken and all of these are designed to operate on a strong network, which is itself a difficult beast.”

Security has been and will continue to be a driver toward the realization of the smart home, ADT’s Petty predicts. “There have been vectors around lighting and energy management and entertainment. The North Star around home automation has been security and I don’t see that changing. I think these companies like Google and Apple and others just create more oxygen and excitement around this, but at the end of the day the customer has to ask themselves, ‘Why am I doing this?’”

DEALER OPPORTUNITIES

As much as there is uncertainty and competition in the connected home space, there is also significant opportunity, particularly to press the advantages the security industry has before the competition catches up.

Now is the time to act, Vector’s Miller says. “I don’t think it is a race to be first, but you have to be engaged and offer it. If you take the stance of not now, maybe later, you will be the one left out.”

Jason Williams, general manager, Yale Residential, a subsidiary of ASSA ABLOY, New Haven, Conn., agrees. “The more products they can get connected in a particular home, the stickier that customer will be and the less likely they will be to move platforms. It is critical for them to get the door locks and the lighting and the thermostats quickly. They have the head start now and have to take advantage of it.”

Simmons says to “go big or go home” is the best way to keep the advantage. “A lot of the dealers are afraid of moving to the full connected home. We are a cross between a security company and a full CEDIA-type company and I believe it has to go way beyond security, starting with a strong wireless network. To truly connect the home you have to have seamless interaction between the security elements, the wireless network and all the AV elements.

“I believe if you provide a few more things like the lights and shades and AV, now you are providing a little more than the cable provider can.”

But others caution that too much, too soon could also turn some customers off. “What we try to instill in our dealer partners is sell the customer the services that best fit their needs and not try to offer them more than they would use and be engaged with,” says Bruce Mungiguerra, senior vice president, operations, Monitronics International, Dallas. “If you put in too much equipment they are not engaged with and they are paying a higher amount, they may become less interested due to the cost.”

Callanan stresses the need to emphasize the local community aspect of the security dealer. “Our best defense against the big players is to make sure we are answering the phones, staying busy in the community and make sure people know we are here. We continue to look at ways to get out into the community and sell it. Our success goes up the more we do it, whether it is a home show or a volunteer project. We have gotten quite a few calls because people want to use us when they see we are doing good things.”

One thing most agree on: it is an opportunity that is the security industry’s to lose. “If anyone can maximize the value of the connected home it would be the people in the security industry,” says Keith Jentoft, director of Dragonfly sales, Honeywell Security and Fire. “We are the ones with the great foundation. We are well positioned and I think it will be a great year.”

Kenny says it is a “land grab” right now for households that want smart homes. “The biggest opportunity is to get out there and deliver on it and not let it be taken away by cable or someone buying a connected thermostat and feeling they have everything they need. Everything that looks like the Wild West is actually very positive for the dealer, who has the ability to take advantage of consumer interest and the shortfalls of the consumer products. Those products will get better over time. Now is the time the security dealer can establish themselves and expand to take advantage of this opportunity.”

Hot, or Not?

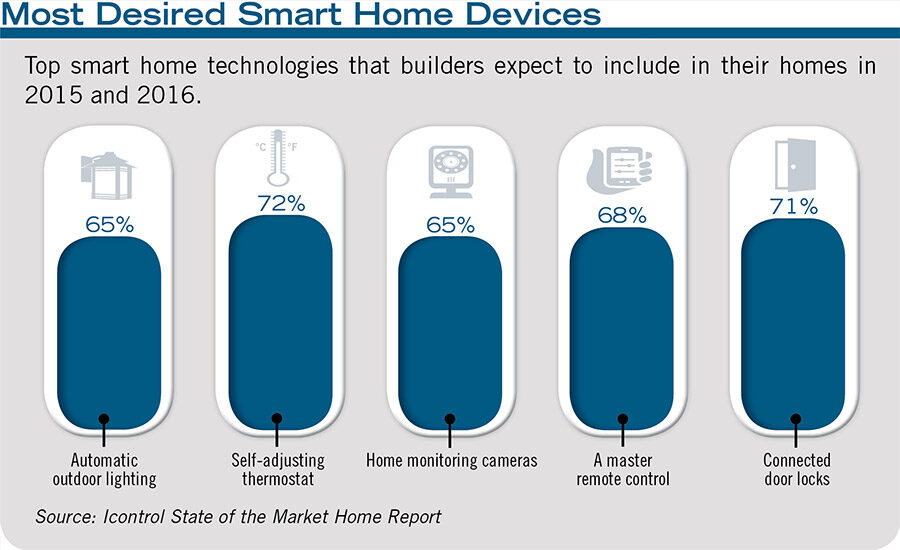

When it comes to connected home technologies the big three are “lights, locks and thermostats,” most say. But there are new technologies that may — or may not — drive sales forward.

Video cameras are probably the most recent and exciting entry in the connected home space. “Video doorbells really came into their own in 2015,” says Brad Russell of Parks Associates. “2016 will see several new upgrades of popular models and the introduction of new ones with rapidly improving video quality, more HD and analytics-driven features.”

A Parks Associates survey of broadband households found that of those with professional security monitoring, 32 percent also own a networked security camera. And 44 percent of networked camera owners access or control their device remotely on a daily or almost daily basis.

“We are seeing more of a focus on video than in the past because connected doorbells and video throughout the home are now more affordable thanks to the introduction of lower cost cameras,” says Tyco Security Products’ Greg Blackett.

The Amazon Echo is another interesting use case. Many security manufacturers are now compatible with it — or are incorporating their own voice control — but the question remains whether in the future it will be a cool toy or a must-have component.

“We are starting to see some traction with voice control,” says Inder Reddy of Honeywell Security and Fire. “That has matured significantly and I think we will see more of that in the connected home going forward.”

But others aren’t quite as keen on the technology. “Voice control is so unreliable,” says Eagle Sentry’s Greg Simmons. “Just think about when you are trying to talk to Siri. It’s cool if you are trying to find the closest restaurant on your phone, but I believe we are going to move past voice straight to proximity control. Amazon Echo is great for information. It may get to that point, but are you really going to be reliant on that and how many devices can you connect? Voice control will come into play, but I just don’t see it being super reliable — yet.”

On the connected lock side, things continue to move forward. Many dealers report that, while in the past a homeowner would put a connected lock on just the front door, now they want them on all doors.

“Locks, truthfully, have been one of our most recent items people are starting to embrace,” says Pat Callanan of Hawkeye Communications. “The biggest drive we have seen is when they go to arm their system all the doors can automatically lock if they forget.”

Garage doors also are becoming a popular recipient of connected home products, and a potential entrée into the home, says Cory Sorice, vice president of marketing and connected products for the Chamberlain Group (Liftmaster), Elmhurst, Ill. “The garage door is the front door for many people’s homes. People with attached garages use this door 70 percent of the time.” What’s more, garage door openers wear out, and as they do, more and more homeowners are turning to connected options, which then lead to more security desires.

No matter what the next hot thing is, the building blocks are starting to be in place, says Jay Kenny of Alarm.com. “I think most of the market doesn’t even have a connected lock or thermostat yet. But when you look at the average consumer adopting this stuff, everything is available today that will drive the purchase of the system for the next few years. We are in the very early innings of really getting a core smart home product. But the cool thing is once we get the system in the home you can build it up over time.”

Connected Home Protocols: Apples & Androids or Beta & VHS?

A connected home cannot happen without the protocol or language to make everything work together. From proprietary protocols from specific manufacturers to open standards such as Zigbee and Z-Wave, to next-generation offerings such as Google Thread/Weave and Apple’s Home Kit, the field keeps growing and will likely have to narrow at some point. The question is will there be two or more equally popular standards such as Apple and Android or will one push out another as VHS did with Betamax? And does it even matter?

“There is likely more market and technological consolidation coming, because devices have to work together more smoothly to truly connect,” says Napco’s Judy Jones-Shand. “Disparate, closed and proprietary ecosystems will only stave off the mass consumer adoption needed to make the connected home a real success.”

Within the security industry, Z-Wave is the predominant ecosystem, although Wi-Fi is still the most popular communications standard, with 34 percent of companies supporting it, according to IHS. Z-Wave followed with 18 percent, and of the 410 companies surveyed who actively promote smart home services, more than half (228) supported more than one protocol.

“Z-Wave is an open protocol and a lot of manufacturers have embedded that in their products,” says Kris Kaymanesh of Sight and Sound. “Zigbee is somewhat more closed. A very simple comparison is Zigbee is more like Apple and Z-Wave is more or less like Android. Each has its own advantages and disadvantages. Zigbee is very controlled so there are not as many products and the cost is higher. But we have fewer issues with compatibility. Z-Wave is open, but how they decipher the communication varies from one to the other so there are a lot more issues and complex hand-offs, and it is not quite as smooth.”

Dave Mayne of Resolution Products sees a big potential with Thread. “Zigbee is widely used by the cable industry. I really like Thread, which is based on what Zigbee has to offer but uses more IP addressing. It is more like what all our connected devices speak to and for that reason I believe it will gain broad adoption.”

However, Mayne adds that whichever protocol or protocols “win,” the effect may be negligible in the end. “Technology will be selected based on how well it works and the total cost of ownership. If Thread proves to be lower cost, the industry will adopt that.”

Alarm.com’s Jay Kenny says in the end that standards may not actually matter that much. “Google is promoting one; Apple will be promoting another. The dream is to have a single [protocol]. But we are able to obscure a lot of that complexity from the end user. We support Z-Wave, Zigbee, direct to cloud over Wi-Fi or IP, cloud-to-cloud. We believe we can manage the complexity by making everything work together at the cloud level and as soon as something becomes more of a standard we can easily adopt it.”

Vivint’s Colby Winegar says his company is agnostic to technology, working with several different protocols. “If Thread comes along and works, we are happy to adopt that and add it to our panel.”

Icontrol’s Greg Roberts similarly is not concerned about protocols. “I think it is a land grab right now, with several protocols taking advantage of the momentum in the marketplace. But every one of them is in a position to switch gears if they need to. We don’t believe there will ever be one standard because the use cases for the smart home are so diverse that one standard cannot accommodate everything. The standards for a Wi-Fi camera are very different from those of a lamp module.”

The consumer doesn’t really care, says Blake Deal of Lutron Electronics Company. “The reason it doesn’t matter is what does the homeowner want? As a consumer do you care about the standard? No. You just want it to work.”

But others see too many protocols as a potential negative to the consumer. “There are still a lot of islands of ecosystems that don’t talk to each other and that will be true for a while,” says Ryan Petty of ADT. “That will drive some concern and angst in the consumer market. ‘Do I buy this thing? Will it talk to my other thing?’”

However, Petty adds that it can be an advantage for the curated security ecosystems that are designed to do just that. “ADT has been a big adopter of Z-Wave. We enforced interoperability of devices. This thing works because we have put a lot of effort into making it work. I don’t see things getting simpler over the next few years. The only way it resolves is in the cloud or over the Internet where you talk there.”