To tweak a line from a famous Frank Sinatra song: 2017, it was a very good year. It was a very good year for connected homes, that is. Massive amounts of advertising from big players inside and outside the security space, a rapidly advancing technology landscape, and an avid interest from homeowners at all economic levels led to a connected home space that is growing by leaps and bounds.

The question becomes, what is the role of the traditional security dealer in this market, both today and going forward?

“By all measures, 2017 was a very good year; better than 2016, which was also a good year,” says Nick English, North American sales manager, Kwikset, Lake Forest, Calif. This phrase was echoed again and again by the manufacturers, dealers and others interviewed for this, SDM’s last installment of 2018’s State of the Market article series.

“It was a better year than 2016,” says Joe Liu, CEO, Mivatek Smart Connect, Fremont, Calif. “Our sales have mirrored the consumer’s growing interest in the connected home.”

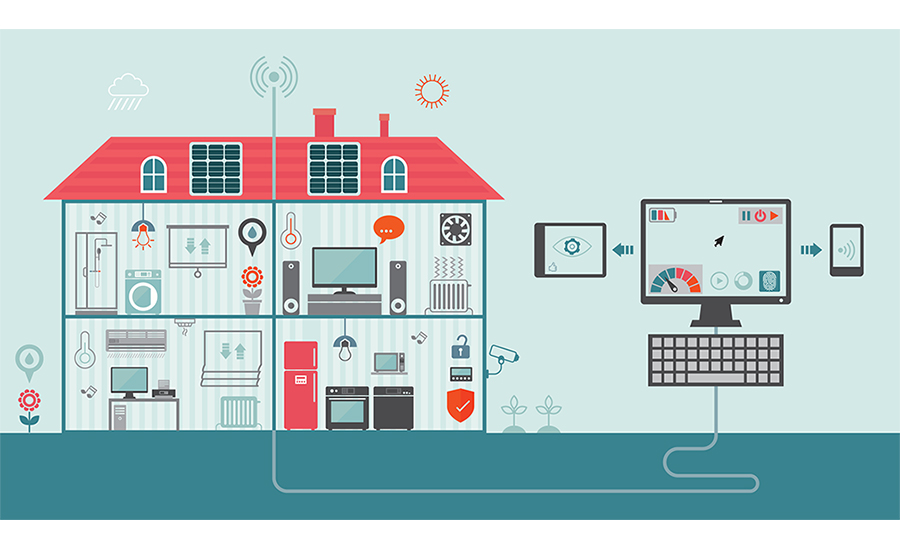

Mitchell Klein, executive director, Z-Wave Alliance, Austin, Texas, is not surprised. “One thing is for certain; everyone is talking about it. The rise of the IoT in various facets of our life is undoubtedly contributing to the general acceptance from consumers, and therefore, impact on business in the connected home space. As technology like mobile phones, computers, banking and the various other ways we are connected … become a greater part of everyday life, getting folks to open up to smart home technology is coming more naturally. ... This is a huge business opportunity for the smart home and installation industry in general.”

Parks Associates’ 4th annual Security Dealer Survey backs this up, showing an industry in a growth cycle, with strong 2017 sales and more small, local dealers participating, the research firm said in a press release. However, it noted, “Dealers will continue to have to fight for their sales; industry consolidation such as the merger of Protection 1 and ADT and Amazon’s acquisition of video doorbell manufacturer Ring packs a wallop.”

Despite the cautionary note, the study also found that nearly 40 percent of security dealers offering interactive services reported that half of or more of their sales also included at least one smart home device. Ninety percent of dealers currently offer some form of security interactive service, according to the study.

About 30 percent of professionally monitored residential security systems in the U.S. are “connected,” according to IHS Markit, a global research firm based in London. “In general, the connected home space performed well in 2017,” says principal analyst, smart home and security technology, Blake Kozak. “The strong performance was the result of major brands launching new products, from security sensors and video cameras to smart speakers that can control connected home devices directly. ... Moreover, the professional security market continued to see strong growth in connected homes compared with traditional alarm monitoring (with no mobile app).”

SDM’s own research, the 2018 Industry Forecast Study, conducted in November 2017, showed a healthy optimism about 2017, with 80 percent of respondents describing the “home control/home entertainment” market as good to excellent, up from 73 percent the previous year.

“The connected home space is growing and consumers are becoming increasingly reliant on their home technology and adding devices at a rapid pace,” says Colin Barceloux, CEO and founder, Axius, San Francisco.

But it’s not just about devices. The “Smart Home Security” study from The Freedonia Group found that demand for all-in-one home security systems and kits was expected to increase 26 percent from 2017 to $3.4 billion by year-end 2018, and will reach $4.8 billion by 2025.

There is growth at all levels of the connected home market — from more small and independent dealers, to MSOs, online retail providers and the high-level smart home automation providers like Control4, Draper, Utah. “Control4 has been growing steadily in the last few years, with over 350,000 connected homes and counting,” says Brad Hintze, senior director of product marketing. “In 2017 we grew 19 percent quarterly year-over-year, with our total revenue growing 17 percent over the previous year.”

ADT, Boca Raton, Fla. (SDM’s 2017 Dealer of the Year), had similar experiences. “There is no doubt that the connected home space is very hot right now and ripe with competition and the entrance of new technology like the coming ubiquity of voice assistants,” says Robin Stennet, vice president of emerging markets for ADT. “The fact is that consumers want options in security and ever-updating technology.”

Manufacturer Qolsys describes 2017 as a record year, according to Mike Hackett, executive vice president of sales and marketing for the San Jose, Calif.-based company, which bills itself as a provider of “quality-of-life” systems. “Traditional security dealers are quickly adopting modern technology to compete in the marketplace; many of our dealers reported 25 to 50 percent year-over-year growth. ... Security dealers are no longer the expert service provider entrusted to install a burglar alarm. Today’s dealers are in the center of the consumer residential IoT wave.”

Comcast Xfinity Home, too, had a great year in 2017, says Dennis Mathew, vice president of the Philadelphia-based MSO and security provider. “Launched in 2012, we have been able to grow in five years faster than any other home security business, possibly ever,” Mathew adds. “We are bullish on 2018.”

Dealer Robert McDonald, district general manager, Baltimore/Washington area, for Vintage Security, Jessup, Md. (a division of ADT operating under its own name), says his company had double-digit growth in every channel in 2017, and attributes much of his success to his work with the residential builder market, which also has had a good few years as the economy improved and more houses are being built.

McDonald, featured on this month’s cover, says, “Builders today want home automation included in their homes and we are having conversations with builders on a weekly basis. Home buyers expect certain pieces to be there.” McDonald says his company did 2,500 new homes in 2016 and expects to double that number by 2019.

Despite competitive challenges, there is more good news for residential security dealers, whether they focus on builders, takeovers, retrofits or existing homes. “There are a lot of different ways to measure the market,” says Scott Harkins, general manager for Honeywell’s Connected Home Organization, Melville, N.Y. “In the security world, in particular, I think about attach rates — how many are getting attached to the connected-home cloud — and we saw a pretty nice increase in that market [last year]. That tells me consumers want it, which we already believed, and that our security dealers are moving into that market. For a very long time those attachment rates languished in the 30 percent of installations range. Now it is 50 to 60 percent. It has about doubled and it is jumping month over month. That is a really good sign for the industry. Security companies now see themselves as the go-to provider for smart homes.”

The big question facing the industry, Harkins adds, is how do security dealers ensure they are the ones that get the calls? There are more competitors than ever before and security dealers must find a way to grow the market, he says.

Dealer Alexandra Curtiss, vice president, Alarm New England, Boston, thinks she has found one way. Her company focuses exclusively on online sales, and DIY or supported DIY installation, while keeping the monitoring RMR. “Our growth in 2017 was 350 percent and 40 percent the next year. We are growing really quickly. ... We saw a tremendous opportunity in the marketplace. There is a lot going on that is very scary for the residential dealers, but if you can get past that there is a strong demand and supply for all the things they want, which is low-cost equipment, high quality and a local central station.”

3 Market Differentiators: No. 1 — Monitoring

While the connected home market is getting more crowded seemingly every day from competition outside the traditional monitored security space, there are still some advantages the security dealer can bring to the market, both now and in the future. The top advantage continues to be the RMR-based monitoring model that has been the mainstay of the security industry.

Monitoring continues to be a strong business offering, and one the security industry is loath to give up to DIY products that feature self-monitoring or MIY. That is why many dealers and providers are starting to offer DIY-hybrid solutions to give the customer the DIY experience but keep the RMR for monitoring, as well as changing the way they offer monitoring contracts.

“At Brinks we don’t think you have security unless you have professional monitoring,” says Jeffrey Gardner. While companies like his won’t be offering an MIY solution, they are changing how they approach traditional monitoring, he adds. “We do have no-contract monitoring. We aren’t flexible on whether you have to do the monitoring, but you don’t have to commit to a long-term contract anymore. With the new brand (Brinks rebranded from MONI in early 2018), we are not offering any contract over 36 months in duration.”

Alexandra Curtiss of Alarm New England may have set up her company as a DIY provider, but she makes a clear distinction when it comes to the monitoring component. “We are a professional security company and we will never offer MIY. But we want to meet the customer wherever they are. It is not that hard to build new business models. We offer three-year terms and lower cost up-front, or month-to-month monitoring as long as you pay for your equipment. We have found that most people will still choose long-term once they realize it will save them money.”

The idea of giving options to grow the market is in line with research from Parks Associates, which found that of the 73 percent of broadband households without a home security system, 19 percent would be very likely to buy one if it didn’t require a long-term monitoring contract.

MARKET SNAPSHOT

In the connected home market, the players change frequently, whether from mergers or new entrants, or even existing ones deciding to be more competitive. The connected home market in 2018 is a complex picture of alliances, partnerships and competitors.

“The overarching trend in the connected home space in 2017/2018 is around a dual approach of ecosystem buildup (either organic or through mergers/acquisitions) and interoperability,” Kozak says. “For example, companies such as Nest and Ring will be compatible with more devices and services by more closely working with their respective smart speakers, but each company also made big moves into the security market in 2017, both launching keypads and security sensors with professional monitoring options. ... Furthermore, service providers such as ADT launched a video doorbell but also partnered with DIY platforms such as SmartThings. Vivint launched Streety, which can bring in other camera manufacturers into the platform.”

High-end home automation companies and their dealers were first to this space many years ago. While these dealers still describe themselves as being at the top end of the market, they too are feeling the shifting competition.

“Generally we do high-end homes, but in the last year we are tapping into the mid-range homes with 2,000 to 3,400 square feet,” says Tommy Bartnick, co-founder, Malibu Wired, West Hollywood, Calif. “We rarely do just security. Homeowners usually already have an alarm system or camera 90 percent of the time. But that has definitely changed a lot. Alarm systems now are so affordable. At those prices safety is a no-brainer.”

Accordingly, while Bartnick’s company might have done, on average, one out of 10 homes with a security system in 2016, now they are at eight out of 10, he says. “In the last 90 days every project has had some level of security.”

Eric Joy, general manager, Georgia Home Theater, Marietta, Ga., a home automation dealer, has seen similar trends. “That can be driven from something as simple as a Nest thermostat or a Ring doorbell, DIY products that get people thinking about smart technology within their home. We have been doing automated home systems for a good number of years and in the early days it used to be a lot more complicated … and costly. Now devices have gotten smarter, easier to use and much more cost-effective for people.”

Companies such as Control4 have begun to look at the rest of the market as an opportunity, offering lower-priced entry-level systems that can start a homeowner off small and allow them to grow into a full smart home. “A new addition in 2018 was the CA-1 controller, which starts at $350 to give homeowners who prioritize security, convenience and comfort features, the ability to get started with a smart home,” Hintze says.

But if the high-end manufacturers are having some success with mid-market, it works both ways. “We used to do millions with [the high-end home automation companies]; we still do the high end but some of those have moved over to the Alarm.com platform,” McDonald says.

3 Market Differentiators: No. 2 — PERS

Another market advantage the professionally installed and monitored security industry has is in the burgeoning PERS (personal emergency response system) industry. Many in the security industry identify PERS as an up-and-coming opportunity in general; but it is also a connected home opportunity. Particularly with an aging baby boomer population, the opportunities for anything that helps them age in place is vast and some providers are already starting to capitalize on it.

Joe Liu, Mivatek Smart Connect, says, “As more and more seniors look to remain in their homes as long as they can, the need for technological assistance to ensure their safety and independence grows. ... While convenience is a significant benefit of connected home technology, it is areas like aging-in-place where the connected home industry can effectively position its technology as a necessity rather than a luxury.”

Honeywell’s Scott Harkins adds, “Technology today is advanced enough that we now know where all the people are in the home. Why not allow that to keep an eye on them?”

Research firm IHS sees PERS as an emerging opportunity for the professional security space, says Blake Kozak. “IHS expects that the market opportunity for independent living remains subdued. To date, the number of alarm monitoring and other providers of independent living solutions is niche. ... [But] although this market has been slow through 2017, in 2018 there will likely be major announcements and increases in penetration. IHS Markit estimated there were only 245,000 independent living accounts in the U.S. in 2017. In 2022, the number of accounts will increase to nearly

1 million.”

This is the least of the worries for most professional security companies, however. “The competition is fairly heavy in our market,” says Joe Roberts, executive vice president of marketing and innovation, Nortek Security & Control, Carlsbad, Calif. “It’s not just the competition we saw five years ago. We have significant new entrants with Amazon and Google and Apple joining our market and coming into our space. What that does is raise awareness to our categories. More people know about this and look for solutions. ... But it makes us have to work harder and pricing has to be competitive.”

One of the biggest changes this year has been the shift from the biggest companies with the deepest pockets becoming more competitive. Amazon first purchased Ring Doorbell in April 2018, then later this summer quietly rolled out a professionally monitored security system. (See related article, “Ring Since Amazon; What’s in It for Security Dealers?” at www.SDMmag.com/ring-since-amazon.)

“Amazon in particular has been fairly aggressive in the last year in providing pieces of solutions to homeowners, whether that is surveillance, doorbell cameras, etc., Roberts says. “What they are doing now is putting more of it together to really go into the sold-through-retail, professionally monitored security space. That will be disruptive for sure.”

Most security industry insiders consider this trend a double-edged sword, with a bump in marketing and awareness on the one hand, but a formidable competitor on the other. In addition, many dealers and manufacturers also have partnerships with Ring and Amazon, Google and Nest.

“[These companies] are big factors for dealers to assess and overcome, says Judith Jones-Shand, vice president of marketing, NAPCO Security Technologies Inc., Amityville, N.Y. “But the upside of this is that security has never had such mass consumer market exposure or interest, which should really pretty dramatically continue to move the needle on U.S. household market penetration.”

On the flip side, Jones-Shand continues, “There are still some very well-known and adept security companies that can’t be underestimated. Before a year or so ago ADT was the omnipresent 800-pound gorilla in the industry; but today we have some of the world’s preeminent tech and marketing companies in Security — i.e., Amazon and Google. What was once a smallish, very traditional security marketplace for decades is now a dynamic technology haven and hot spot, changing and reinventing itself every other day.”

That Amazon is starting to compete with its partners is not necessarily surprising. “I would say their history is they are really good friends until they figure out there is a business model there, at which point they become a competitor,” says Shawn Welsh, senior vice president, product line management and marketing, Telguard, Atlanta. This is one reason why Telguard has taken the approach to the connected market that they can be either a hub or a spoke on the wheel, Welsh adds. “We can be brought to any party. That is the way the market is heading, APIs and open hub architectures. If you are a walled garden you are selling against companies like Amazon or Samsung. We can plug into any architecture; but we also have a hub if you want to do a curated system.”

Other security providers today look to be the hub, at least until the customer reaches the point that they want to fully move to a smart home or automation system. Most security-based hubs can take the user up to the point they want to start controlling things like audio and visual or other home theater and entertainment components. Lights, locks, temperature and other components can be managed by either a security system or an automation system, so it often depends on what the user ultimately wants.

Harkins puts connected-home buyers into three general groups: single-device purchasers, some level of connectedness with a security system, and whole-house automation. Often these are stages. “What I call connected home is not really what is happening in the consumer’s mind. The majority of ‘connected home’ purchases are devices. They may buy a lock or a thermostat that happen to be connected to the cloud, but really it is a one-purpose device. When I use that term I mean things that work together within a home to control an environment to 1.) make you safe,

2.) make you comfortable, and 3.) make you aware. From the consumer perspective nobody wakes up and says, ‘I am going to buy a connected home today.’ They say, ‘I am having a party tonight and wouldn’t lighting or sound be cool?’” Where and how far they go from there is still an open question.

Another market trend this year is traditional security dealers starting to move into the connected home space in a bigger way than previously. For example, more dealers are looking into DIY and hybrid DIY solutions, says Brian McLaughlin, CEO, Alula, with offices in Hudson, Wis., and Sugar Land, Texas. “The two biggest strategies are looking at dealer DIY programs where the buyer goes to the dealer online but still gets that extra layer of support and the dealer still gets that ongoing relationship. These programs are starting to pick up and be successful. ... The other big idea is moving from traditional security into home automation. We talk to a number of dealers that are now home automation dealers that also offer security. Connectivity, which was once a side dish, is now a lead-in or free offering. These are becoming center-of-plate to become that hub.

“In my own study of about 50 dealers, about half are going with connected home as part of their positioning and about the same for DIY; they are either implementing it or planning on it,” McLaughlin says.

This was the thinking behind Curtiss’ company, she says. “Our overall organization is 47 years old; we do about $1 million a month in RMR and are about 60/40 commercial/residential. My division operates very differently. I built this team in November 2015 and now there are about 10 of us. We sell over the phone. We custom design and execute over the phone. We only call on leads we generate online. Our original intent was to only do DIY but we found that over 50 percent of customers wanted us to install it for them so we have a very heavily supported self-installation model.”

3 Market Differentiators: No. 3 — Cyber Security

The third potential differentiator for the security industry may come as a surprise to some: cyber security.

“Anyone that manufacturers a connected device has to be very aware to consciously design systems to protect what you are building,” says Dave Mayne of Alula. Mayne says Alula’s recently combined entity of Recognition Systems and IP Datatel allows the company to provide end-to-end encryption.

The issue of cyber security is in very early days when it comes to homeowners pushing for it; but many see this as a potential opportunity for security dealers willing to delve into solutions.

“There are a number of services available that watch for activity on the network and create alerts,” Mayne adds. “The security industry is already looking at ways to become network aware and we are seeing some major players going down that path to become the network watch guard. It hasn’t taken off en masse yet, but it is a starting point.”

One of these providers is ADT, which announced a new portfolio including cyber security offerings targeted at the consumer market, slated to launch later this year, Robin Stennet says.

Robert McDonald, Vintage Security, sees cyber security as a definite opportunity. “Everything we are doing in the home is networking now. If we install a piece of electronic equipment today it is IP-based. We are not going into a house and seeing 10 devices anymore; we are seeing up to 100 sitting on a network. As IoT devices come into the network, cyber security will become real for all of us helping manage that network. ... This could be a differentiator for the security industry.”

Honeywell’s Scott Harkins thinks the opportunity is great for dealers that can get into cyber. “Cyber could and should be a selling point for the security dealer. Times have changed. When we started jumping into the connected world we found dealers hesitant. They didn’t want to mess with the customer’s Wi-Fi network. Today they are the CIO for the homeowner. Now there is an opportunity to take that to the next level, provided you have the skillset and mindset. Security is the first name of our industry and the last name of cyber security. It feels like a spot where we should be the experts.”

Napco Security’s Judith Jones-Shand agrees. “Cyber is the next frontier for residential security. Once you connect the house and make it smart, you have to double back and make sure the network is secure — not just the security network of devices but that of the whole home. Cyber security offerings will likely be the next great complementary service for our industry and our security providers to get into.”

Jeffrey Gardner, president and CEO of Brinks Home Security, Farmers Branch, Texas, agrees. “Our direct-to-consumer business grew 20 percent year over year,” he says. “The category is getting a lot of exposure. It is the most aggressively advertised category in the consumer area with companies like Google and Amazon and us and Vivint. Many more customers understand the smart home space and that smart home and security go together.”

Anne Ferguson, vice president of marketing, Alarm.com, Tysons, Va., says consumer expectations will be reaching a tipping point soon. “The consumer is definitely looking for more smart home technology, but we haven’t quite gotten to the shift where the consumer is necessarily understanding how these technologies can and should work together. The consumer expectation around that has grown, however. The big guys are definitely helping our channel. They are raising consumer awareness of what smarter security looks like and showing an app-like experience. That is a good thing. ... That said, I don’t know if they have necessarily done a great job of explaining what the connected experience looks like.”

That is one reason that the majority of consumers are still in the first group, acquiring devices, and maybe connecting a few of them together but not yet looking for whole-home automation. Another reason is cost, Kwikset’s English says. “Despite the emergence of connected devices that can deliver almost as much functionality as their predecessors at a lower cost, there remains a segment of the population unwilling to pay for what they consider a luxury item. What’s more, while some individual devices may be coming down in price, it still takes a decent capital investment to create even a modest smart home ecosystem.”

While there is still a ways to go, there was significant forward motion in 2017, Kozak concludes. “Although ‘true’ smart homes are still uncommon, the connected home market now offers reliable products across all device categories, allowing consumers to start with what makes sense for them and build out from there.”

TECHNOLOGY DRIVES THE MARKET

Perhaps more than any other security-related segment, the connected home market is very driven by technology innovations, which often occur at lighting pace.

If 2016/2017 was the year of the smart speaker (such as Alexa and Google Home), 2017 into 2018 and beyond is shaping up to be the year of video.

“Perhaps the biggest contributing factor over the past 12 months has been video surveillance, especially video doorbells,” Kozak says. “Consumers appear less concerned with privacy and those that have cameras or video doorbells will likely start wondering what else they can do with those devices, driving additional growth across device types.”

One good thing about video for security dealers is that, outside of DIY point solutions, it is still more complex to integrate with other home systems, says Mike Putman, director of operations, Priority One Security, Greenville, S.C. “Video still requires some technical expertise to install and integrate as part of a security system.” Another positive for the security dealer, Putman adds, is that customers already associate video with security. “They understand the benefit of video combined with alarms.”

Mathew of Comcast Xfinity Home says video is the number one incremental device being added from Xfinity. “People are adding on average about 1.5 cameras and also purchasing 24/7 recording. ... It is really the highest purchased device after actual security sensors.”

Gardner points to the improvement of the cameras themselves as one major reason for their increased popularity. “The biggest trend overall was the continued development of the video market. It is a much more important part of systems with our customers. Seventy-five percent of our customers are now signing up for video. Technology with AI [and analytics] has been pretty amazing and is driving the penetration of video products.”

This is why video business is up 30 percent at McDonald’s company, he says. “The video side has jumped up because the customers’ expectation on what they think that camera ought to do has hit the threshold and crossed a sweet spot where customers are willing to spend money on that camera that is now meeting their expectations. Besides that, people want to know what is going on in their home.”

Smart speakers are also still a popular technology and an important driver of the connected home, says Johan Pedersen, product marketing manager, Z-Wave, Silicon Labs, Austin, Texas. “We see the smart speaker segments as the gateway device to people’s homes. Once they start to be able to voice-control music they also see the benefit of controlling lights at the same time. It has been a key driver for Z-Wave.”

This is supported by a recent study by comScore, which found smart speakers are currently in 19 million homes, or about one-fifth of U.S. broadband households, Hintze says. “Homeowners are leveraging Alexa devices in Control4 systems to control lights, music, TV, thermostat, door locks and hundreds more devices with voice commands.”

There is an overall increase in connectivity, more sensors and even emerging artificial intelligence, or AI, McLaughlin says. “We are seeing more and more end user-driven use cases for more connectivity and connecting in many different data points and sensors. They want it to be rendered in one single, unified interface. They don’t want a separate app for lights, security, stove, etc.”

The curated experience is expanding in both availability and customer awareness, Jones-Shand says. “One of the hurdles that connected home faced only a few years ago was the multitude of unrelated apps everywhere by everyone — and simplicity and intuitiveness were largely lost as a result. Today, robust ecosystems are combining. There is more universality with devices and technologies integrating and supporting multiple brands, and there are fewer, better, more powerful ecosystems. Today’s consumer sees new convenience, utility, ease-of-use and improved reliability for the IoT things to actually consistently work. That all translates to market growth.”

What’s next? AI will continue to advance, Klein predicts. “It will be interesting to see how technologies like AI and machine learning will begin to further permeate the connected home market. ... Understanding context is the most promising step in AI in the short term, such as asking your system to ‘turn on the lights’ and the system knows which room you’re in and adjusts the lights appropriately, even knowing how much adjustment based on time, location, weather, etc.”

Jason Williams, president, ASSA ABLOY U.S. residential group, New Haven, Conn., says voice assistants will continue to play a big role, increasingly assisted by this type of automation. “Voice assistants have been a huge priority for us and our partners. Automations are also huge for customers right now, whether they are consciously aware of that need or not — it’s there. Customers don’t want to have to generate automations for their home; they want the products to be intuitive enough to perform the actions on their behalf, without being intrusive.”

Pedersen predicts the next biggest category will be sensors themselves. “We believe the sensors will be a very important category in the next couple of years. Expect the average smart home to go from a handful to 10/20/50 devices per home.”

Kozak agrees. “Over the next 12 to 24 months the devices that will see the biggest positive increase in adoption will include air-quality sensors, radiator valves and appliances,” Kozak says. “Although connected security devices will not decline in growth over the next five years, their proportion of the market compared with other connected devices will start to decrease; as such, video doorbells are the only security device type that is expected to increase in market position over the next five years.

“Alarm monitoring companies that will gain the most market share over the next two years will be the companies that evolve into tech companies. This means offering AI and video analytics. Alarm companies that do not offer these types of technologies will likely start to lose share as companies such as Amazon and Google/Nest get more involved in professional monitoring.”

MARKET CHALLENGES & OPPORTUNITIES

There are no shortage of challenges in the connected home market — from pricing to competition to customer expectations. But there is also great opportunity for those dealers that are increasingly rising to these challenges.

“One of the main businesses challenges is pricing,” Kozak says. “Connected home technology is not cheap so dealers must decide if they want to go premium or go low. It is expected that some of the higher-priced items will not remain high-priced due to rebates and other partnership discounts. ... Another business challenge for dealers is simply keeping up with the changes in the market. With rapid consolidation, partnerships and new device features, it can be overwhelming.”

Ackerman Security made the choice to go with competitive pricing and simplicity for the customer, says Christopher Bean, general manager, Ackerman Security Systems, Atlanta, Ga. “Connected home customers prefer all-in-one backend app control for all their smart home devices, so we align our product and service menu to satisfy that desire. By additionally providing a competitive edge in pricing against other full-service providers, Ackerman is flourishing.”

Dennis Holzer, executive director, PowerHouse Alliance, Pittsburgh, says there is another challenge as well. “The biggest competition we have today is misinformation. As distributors, we must prioritize getting the right information to our customers on what they really need, in order to have an effective and fulfilling smart home system. The extent of inaccurate information online and in the connected home space in general, leads consumers down a path of confusion in many cases.”

This is why many in the professionally installed security space believe that their greatest strength lies in service rather than price. “The more smart ‘stuff’ we put into the consumer’s home, the greater the importance of good service,” says Kevin Bish, vice president of marketing, Guardian Protection Services, Warrendale, Pa. “If you are going to be in the connected home business you must be ready and willing to take time with your customers, to educate them, to set correct expectations, and to be there for them when they need additional support or want to add even more smart devices. A satisfying connected home experience is directly proportional to the quality of service we provide, and if done right will differentiate us in the marketplace.”

It is not always easy to communicate the benefits of a truly connected home, however. “It’s not enough just to say, ‘Hey, check out this cool device that will turn your lights on,’” Klein at Z-Wave Alliance says. “Consumers need to be able to visualize themselves using the technology regularly and how it benefits the way they live their lives.”

Many providers including Xfinity, Alarm.com and others are trying to help the consumer better understand the experience by offering physical locations the customer can come to, and see and touch and truly understand what a connected or smart home feels like.

“I am really excited about our retail presence,” says Xfinity’s Mathew. “It allows customers to touch and feel products in person.”

Another way traditional security dealers are starting to get more on top of the competition is by joining the DIY (or do it with me) trend. “We are launching our own DIY product to remain competitive in the market,” says Steve Baker, CEO, GHS, Woodland Hills, Calif. “Previously our competitors did it but we did not. It is being beta tested now.”

DIY represents both one of the biggest challenges and biggest opportunities for security dealers, Klein says. “DIY products are not going anywhere. Their low price-points and accessibility are key for consumer adoption and acceptance. However, because many consumers struggle with setup and maintenance, dealers have the opportunity to lend a helping hand to step in and install the products for them and provide ongoing support.”

Telguard’s Welsh cautions dealers, however, that “security first” should be top of mind. “Security dealers are challenged by articulating life safety’s role in the ecosystem of the smart home,” he says. “Dealers must reorient their message toward being the definitive source of life safety solutions that can still support lifestyle upgrades and integrations for their customers’ convenience. They need to realize that the never-ending stream of new consumer gadgets is an opportunity for them to shine. The safety they provide isn’t transient like the latest hot product.”

Harkins says that the security industry has to continue to adapt. “That 20 percent or so penetration rate hasn’t changed and what I think the industry has to do is we have to work to find a larger audience. Some new entrants have come in and disrupted the consumer acquisition model. Cable companies and DIY have gotten to the customer first and they have taken a bigger chunk of those 4 million customers than they had in the past. If you look at the biggest security dealers in the country plus cable and DIY, that captures almost half of the market. Ten years ago it was 25 percent.

“Our channel has to find a way to adapt and expand the size of the market. ... Certainly if what you are doing today is working, don’t change it. But if you want to grow the market start calling on consumers that would not normally fit into your segments. ... Embrace and create DIY business models,” Harkins says.

While some dealers have already started this, Harkins says it needs to become even more pervasive. “The people that buy online never get to our market. They end up on someone else’s website.”

One way to even the playing field is to work with builders, which is something the security industry has done for many years. Today’s builders are more interested than ever before in building homes that are pre-configured for connectivity.

“We have met the customer before they even call [the cable company],” McDonald says of his company’s builder program.

What’s more, some of the connected home platform providers such as Alula and Alarm.com have recently rolled out builder programs for their dealers to make it easier for them to work with builders, even if they haven’t in the past.

Whether DIY or builder programs, or something else, the good news is more security industry providers and dealers are starting to try to do something different to compete.

“Things are changing so quickly,” says Brinks’ Gardner. “We have to come to work every day and recognize that the world is changing faster than ever and we have to be on our A game and not presume tomorrow is going to look like today. We have to be innovative every day to stand up to new competitors.”

McDonald agrees. “It is a full-time job to keep up with technology, training, etc. Our security offering evolved in the last three to five years with more changes than the 25 to 30 years prior to that,” he says. And it doesn’t show signs of slowing down. “Samsung bought Smart Things. Google bought Nest. We are looking at Amazon because they are making a play into the builder market with the acquisition of Ring. But the [good news] is we have a workforce already established and used to going out in front of people, which is something those others don’t have.”

Silicon Labs’ Acquisition of Z-Wave: What Will It Mean for the Connected Home Industry?

In April 2018, Silicon Labs purchased the Z-Wave Business Unit and popular Z-Wave technology from Sigma Designs. While there are several different communications protocols that are prevalent in the connected home — including Z-Wave, Zigbee, Bluetooth and Wi-Fi as probably the top four — until this purchase there was no single provider that could leverage all of the major ones under one umbrella. With Sigma portfolio including Wi-Fi, Zigbee, Thread, Bluetooth and proprietary protocols, SDM spoke with Johan Pedersen, product marketing manager, Z-Wave, Silicon Labs, Austin, Texas, to learn where the company plans to go from here.

SDM: Why did Silicon Labs purchase Z-Wave?

Pedersen: Silicon Labs was great within IoT outside of Z-Wave. They have a very respected hardware platform that supports proprietary wireless, Zigbee, Wi-Fi, Bluetooth and all the other wireless IoT solutions. They were just missing that last piece, which was Z-Wave, to have all solutions available for their customers.

By acquiring Z-Wave they are really interested in growing the ecosystem, growing Z-Wave technology and learning from Z-Wave. Z-Wave has been laser-focused on the smart home and has driven that market, and now they want to try to leverage some of those capabilities to the other technologies. There are a lot of stakeholders in these consortiums. There are several suppliers of Bluetooth or Zigbee but Silicon is the only one with Z-Wave now. They can offer their customers unique solutions.

SDM: What does this mean for your customers today?

Pedersen: In this industry if you are making a door lock you most likely want to use Bluetooth but you also want it to be on the Z-Wave network. By having both technologies we can support customers even better. There are tremendous opportunities to improve interoperability.

This acquisition means we have gathered a lot of smart people who know the industry all in the same house. We have very unique knowledge from all the different technology areas and are in a position to guide our customers through product development and ensure they get the best solutions. We are also in position to grow the ecosystem together with our partners. That is definitely the intent. It is still the very early days. We have a lot of opportunities so we need to choose what to do first.

SDM: What are the plans for the future now that you have all these different protocols in one house?

Pedersen: We know that we intend to grow the Z-Wave business. There won’t be any drastic changes with Z-Wave. Then you will see when we start leveraging some of the other technologies how we will do that. On the business development side of things we will start to collaborate with partners about how to provide products that can support even broader markets.

So in ‘X’ years it will be possible to have a device that you bring to your home. You don’t know what connectivity it has. You just turn it on and it works because it has the right parts and the right smarts so it can connect to whatever is there. We are in a position to do such a thing because we cover them all. I can’t promise when, but in the future it will happen.