Nearly three years have blown by during which the security industry has endured wild supply chain swings and extremes that pressure tested the very limits of the manufacturing, distribution and installation of security and fire/life-safety wares.

Only in recent months has the tumult-filled ecosystem begun to see a gradual return to some semblance of normalcy and into better sync. Although equipment lead times in the fire alarm and access control sectors generally continue to lag behind video surveillance gear, industry professionals are by and large feeling better about the global supply chain’s prospects to continue stabilizing in the near term.

For instance, in the Security Industry Association’s 2023 Security Megatrends report — based on responses from hundreds of SIA member company executives on what factors are shaping their business decisions and what trends they are watching — “supply chain assurance” dropped from No. 3 in 2022 to No. 8 in the latest top 10 ranking.

Yet, caution and vigilance abound. While factors such as component procurement, shipping and transportation costs, and the availability of finished goods are on improving trajectories, the focus has turned to other considerations that could throw the supply chain back into utter disarray. To name only a few: recovery from record inflation; threat of recession; unknown coronavirus impacts, such as new variants; ensuring cybersecurity chain of custody; and geopolitical strife.

Through all of the chaos, companies have been reconsidering their supply chains and executing changes to make them more resilient. This has resulted in major shifts in the way business is now being conducted, and could very well represent permanent modifications to the way installing security contractors, distributors and manufacturers all interrelate.

John Loud, founder and president of Kennesaw, Ga.-based LOUD Security, points to one of the major upshots to arise from the upheaval is how his company now interacts with supply chain stakeholders. Getting everyone on the same page is imperative nowadays.

“In my first 20 years or so in business I don’t think we ever discussed the term supply chain. Now, in the last three years, we talk a lot about it. And the word that ties in with it all is communication,” he says. “That is the key communication with not only our sales team and our system designers, but clearly with our customers. We can’t be designing solutions we know are going to present challenges from a supply chain standpoint.”

Improved supply chain visibility is another such development. Investments in digital technology are helping companies better communicate with suppliers and assist in heading off potential disruptions. Artificial intelligence is being leveraged to make better purchasing decisions and realize new efficiencies. PSA, the world’s largest systems integrator consortium, developed an algorithm for its buypsa.com portal to generate a product delivery estimation based on recent purchasing activity. The idea for the algorithm sprang from a dire need to provide integrators better insight on product availability so they could plan out manpower allocation for installations.

“That was a big issue that we had to overcome,” says PSA CEO Matt Barnette. “It’s been our customers’ — the integrators — biggest challenge. Now we are doing that calculation in the background and providing that when somebody looks up a particular product in the store. We find that that information a lot of times is more accurate than the data we get directly from the manufacturer.”

Notably, inventory playbooks have been ripped up. For decades the security industry has relied on the “just-in-time” delivery strategy of having low or even zero inventory. For dealers and integrators, the practice helped minimize storage costs and yield higher profits. But during the supply chain disruption it also exposed them to months-long delays for products, causing project postponements. If you aren’t receiving materials, you can’t invoice for said materials. So, companies are pivoting to carry more inventory in a shift from just-in-time to a “just-in-case” model.

To better understand these implications and how the supply chain is currently performing, SDM consulted with more than a dozen security industry executives to tap their insights on a range of topics. Ahead, we examine their expectations for 2023, what concrete supply chain improvements have emerged and how companies are minimizing risk. Also, in a sidebar, Barnette addresses a particular quality assurance issue that could portend trouble for the industry.

A technician from Per Mar Security’s Midwest Alarm Services business retrieves product from a storage facility. The super-regional security provider has worked to standardize on products across its branch offices to achieve more consistency. // IMAGE COURTESY OF MIDWEST ALARM/PER MAR SECURITY SERVICES

Pinpointing Supply Chain Improvements

Coping with the dislocations wrought by the COVID-19 pandemic may not be behind us — and still other concerning factors are stacking up — but supply chain conditions are improving on many fronts.

As Paul Rawlinson, supply chain and quality director at access control manufacturer Paxton, Greenville, S.C., explains, prior to 2020 the lead times to order electronic components were generally one week.

“In the past couple of years, we’ve seen lead times as high as 52 weeks. However, longer term, with the level of investment being made for new semiconductor fabrication plants in the U.S. and Europe, it should soon start to ease,” he says. “There is now much more certainty with key supply chain partners. At Paxton, we have continued to maintain a large stock buffer to support our customers globally.”

Clint Choate, senior director-security market, for Snap One, Charlotte, N.C., notes that ocean freight times and costs are moderating to pre-COVID levels while air freight is seeing a partial recovery. Moreover, COVID-related factory shutdowns are less common and not having a significant impact on manufacturing capacity or delivery dates.

“There’s a general improvement on component availability with a few pain points where specific chip suppliers are still constrained, mostly related to components consumed in EV [electric vehicle] manufacturing,” Choate adds.

Steve Luther is vice president of operations for Fremont, Calif.-based Identiv, a manufacturer of physical access control, identity management and radio frequency identification (RFID) systems. He is seeing significant reductions in logistics costs from Asia to the port in Long Beach, Calif.

“We are also experiencing a reduction in the door-to-door transit times for most Asia to West Coast routes,” he says. “There’s been a slight improvement in certain integrated circuits in which allocations are being released and lead times are improving.”

In Genetec’s view, while the world has mostly moved on from the pandemic, the new socio-economic situation and uncertainty triggered by current geopolitical conflicts continue to put a strain on the global supply chain, explains Nadia Boujenoui, vice president, customer experience.

The Montreal-based company develops unified security solutions that combine IP-based video surveillance, access control and automatic license plate recognition (ALPR). With the actions taken in the past two years to mitigate supply chain shortages, Boujenoui says Genetec is already in a good position to meet its company needs on most product lines. If the supply chain recovery continues, notwithstanding unforeseen crises, it expects to be in a solid position for all product lines in the next year or so.

Boujenoui adds early indicators point to supply chain bottlenecks slowly easing in 2023. “Suppliers are seeing some improvements in raw material and electronic component availability. These improvements aren’t only being reported in the security industry but also in other major ones, such as the automotive industry.”

Generally speaking, diligence among all supply chain stakeholders continues to yield improvements, says Fredrik Nilsson, vice president, Americas, Axis Communications, Chelmsford, Mass. As a result, the company — a manufacturer of network cameras, access control, and network audio devices — is seeing improvements across the line, with more stable and steady output from suppliers and manufacturers.

“It is important to remember that we operate in a dynamic global marketplace with geopolitical challenges and a degree of financial uncertainty,” Nilsson says. “So, companies must continue to proactively manage their supply chain, concentrate on continuous improvement and remain focused on the long term.”

Although the supply chain situation is slowly improving in many areas, Brad McMullen, president of 3xLOGIC, a provider of intelligent video surveillance software and hardware, Westminster, Colo., cautions there are still challenges for some critical components.

“Component manufacturers have increased production and are able to bring back a larger portion of their workforce, thereby slowly regaining their footing and returning to more normal lead times,” he says. “Visibility to lead times remains the biggest improvement that the industry is seeing as manufacturers are better able to predict supply and demand.”

From the installing security contractor perspective, Brian Duffy, CEO of Per Mar Security Services, Davenport, Iowa, says as of late the company is experiencing far fewer severe back orders.

“Products are coming much closer to on time or what we’re used to, at least on timelines that put us in a position to get things done in the way that our customers expect,” he says. “Most of that is from actual supply chain improvement. But part of it, too, is from us just adjusting our practice more as time has gone on.”

Upbeat Expectations & a Wary Eye on 2023

Barnette of PSA says the general feeling around the industry is that the supply chain will be much improved in 2023, in part because chip manufacturers are making higher quantities than they were in the recent past. While demand has slowed overall somewhat, there is also less chip hoarding by companies across various industries.

Still, like other sources for this story, his optimism is not without strong caveats.

“The hole is so deep for some of the manufacturers to get out of that it’s going to take the better part of 2023 before they get to a pre-pandemic type of delivery standard,” Barnette says. “It’s just going to take a long time to catch back up. There is only so much production you can pump out at most of these places and by the time you spin up additional production, six to nine months have gone by. So, easier said than done.”

Vector Security established regular internal communications with a select cross-functional team to keep them updated on the product availability, as well as mitigation efforts to identify available product alternatives. // IMAGE COURTESY OF VECTOR SECURITY

Persistent supply chain issues throughout the industry could lead to challenges for many manufacturers, which then trickle down to integrators and end users, says Miguel Lazatin, senior director, marketing, Hanwha Techwin America, Teaneck, N.J.

“One challenge will be sourcing components to provide high-end functions, such as AI, WDR and high frame rate, while at the same time keeping prices manageable,” Lazatin explains. “That means we must get more creative and resourceful in our manufacturing process to keep meeting customer demand, which Hanwha is already succeeding at.”

ASSA ABLOY is forecasting supply chain volatility to continue in the near term but hopefully to a lesser extent than the recent past, says Jody Paviglionite, vice president, supply management, Americas Opening Solutions business for the New Haven, Conn.-based company. Maintaining close supply partnerships while working hand in hand to secure supply to best serve customers will be an imperative, she says.

“We anticipate electronic constraints will continue through the first half of 2023,” Paviglionite says. “We will continue to keep abreast of all factors that would typically disrupt a global supply chain, including geopolitical events and labor strikes. We will also continue to meticulously follow metal and electronic markets to anticipate and address any risk,” she adds.

“We are seeing some encouraging early green shoots in global supply chains, but there is no doubt that 2023 will be a challenging year,” comments Jody Ross, vice president of sales for Hawthorne, Calif.-based AMAG Technology, a manufacturer of access control and unified security solutions.

Supply chains are still recovering from the impacts of the pandemic and are highly vulnerable to the effects of geopolitical disruption, including the situation in Ukraine, she says. “We remain engaged with overall technology consumption trends, as changes in consumption patterns for different technologies allow us to streamline our focus.”

While some impacts from COVID still linger, Jason Burrows, sales director, IDIS America, Coppell, Texas, has observed other problems accumulating in its wake. “The cost of living crisis, rising inflation and the wider impact of Russia’s invasion of Ukraine is impacting consumer demand, market confidence and the viability of many businesses, particularly SMEs,” he says.

Most smaller businesses are focused on remaining profitable and staying afloat, and their purchasing decisions are currently driven very much by operating expenditure rather than just upfront cost, Burrows explains. “IDIS’s response to this has been to continue educating our systems integrators that price comparisons, even for smaller scale video surveillance systems, should be made over the full system life cycle, not just the initial equipment cost. We are supporting our partners in the market to get this message across, and it is working.”

As far as what areas of the supply chain to watch for signs of improvement or regression, Nilsson says it is essential to monitor the markets for raw materials and electronic components, which have a ripple effect throughout the chain. He also stresses the importance of maintaining a level of awareness around COVID lockdowns and regulations within various markets, which can interrupt the supply chain and the availability of necessary materials.

“Along with these restrictions, labor shortages are impacting transport capacity and reliability, so it’s important to keep an eye on this sector,” Nilsson continues. “Of course, all of these factors create competition in the market, so costs become a factor that everyone must closely track and actively manage.”

Snap One, a manufacturer and distributor of smart solutions for homes and businesses, is projecting the supply chain will continue to be challenging in 2023, driven by semiconductor shortages, as well as COVID mitigation and response policies in China, according to Choate.

“We are monitoring inflation very closely as it relates to supply chain. We have witnessed cost increases on nearly all components and services in the supply chain. Labor, fuel and general operating expenses are growing at or above the overall inflation rate,” he continues. “These operating costs are having a greater negative impact on the industry and our partners than actual product costs, as there are real inflationary costs now locked into finished goods purchase price from manufacturers.”

3xLOGIC expects to see many component issues resolving in the first half of 2023, McMullen says. For any chip-related items, he does not anticipate that the recovery will approach 100 percent until early 2024.

Like so many other industry watchers, McMullen cites geopolitical unrest — including uncertainty surrounding China’s implicit threats to invade Taiwan — as factors that could negatively affect the supply chain moving forward. He also remains concerned about global labor shortages: Any areas that are forced into more restrictive working environments can have a dramatic impact on the supply of components.

“If a chip factory, for example, is forced to reduce its workforce due to a rise in COVID infection rates, the downstream effects often are not felt for weeks or months,” he explains. “Conversely, when the factory comes back to more normal production levels, downstream supplies recover very slowly and all of this will hamper other manufacturers’ ability to supply finished goods.”

Thomas Henderson, senior director of procurement for Vector Security, Warrendale, Pa., would like to suggest the industry will “come out of the woods” in 2023; however, his previous professional experience informs him otherwise.

“I think there are probably some more issues lurking out there that will hit us during the year,” he says. “I used to work at a manufacturing company, and my experience has been when you throttle back — whether it’s your choice or not, and then you throttle back up — you find other challenges that maybe you didn’t have when you were at steady state.”

Nevertheless, Henderson remains bullish on the industry’s ability to remain resilient and continue fulfilling its obligations to end customers’ well-being and success. He’s especially encouraged by conversations with manufacturers that are taking novel approaches to bring products to market. Some of them are designing new wares that feature, what Henderson calls multiple component tolerance.

“They can produce a product that might use chip A and chip B from different manufacturers. And through manipulation of the firmware, regardless of which one of those products you get, our technicians and the end customer don’t see any difference whatsoever,” he explains. “But it allows the manufacturer to have flexibility should chip A become the hottest thing on the market and Ford buys them all up or supply goes away because of a factory burning down.”

Henderson continues, “This design tolerance that several of them have talked to us about, especially on key products within their product line, really makes a lot of sense to me. So when you talk about long-term ramifications and what might come out of the supply chain challenges, I think we’re seeing manufacturers try to have more flexibility in the design of their products, which is great.”

The Good to Arise From All the Chaos

Many security businesses across the ecosystem have been forced to rethink their supply chain strategies to ensure business continuity. Amid all the planning and pivoting has emerged fundamental ways the industry has evolved for the better.

Burrows at IDIS explains the pandemic has shone a bright light on the fact that organizations need to be more adaptable and flexible, which has strengthened the case for building more robust infrastructures and keeping contingency plans current.

“This is making it easier for risk managers to win support for more ambitious upgrade programs, with integration projects bringing together core systems, designed to deliver a new level of centralized oversight and control,” he says. “A key element of these projects is video because it’s one of the technologies with the most proven value.”

Snap One has leaned into more strategic partnerships with its suppliers, working to identify and remedy risks as early as possible, Choate says. “This spans production capacity [labor], component-level availability and lead times [supply], all while adhering to our high-quality standards,” he adds. “In many cases, our engineering teams have also been agile in redesign efforts to enable alternative components and sourcing where possible.”

Over the past three years, Paxton has built even stronger relationships with global electronic component manufacturers, according to Rawlinson. This puts the company in a great position to pre-order components based on its projected global market growth.

“We have developed tools to validate and track all of our stock buffers, both at Paxton and directly with our suppliers,” he says. “This gives us an even more robust and resilient supply chain for Paxton and minimal disruption for our customers.”

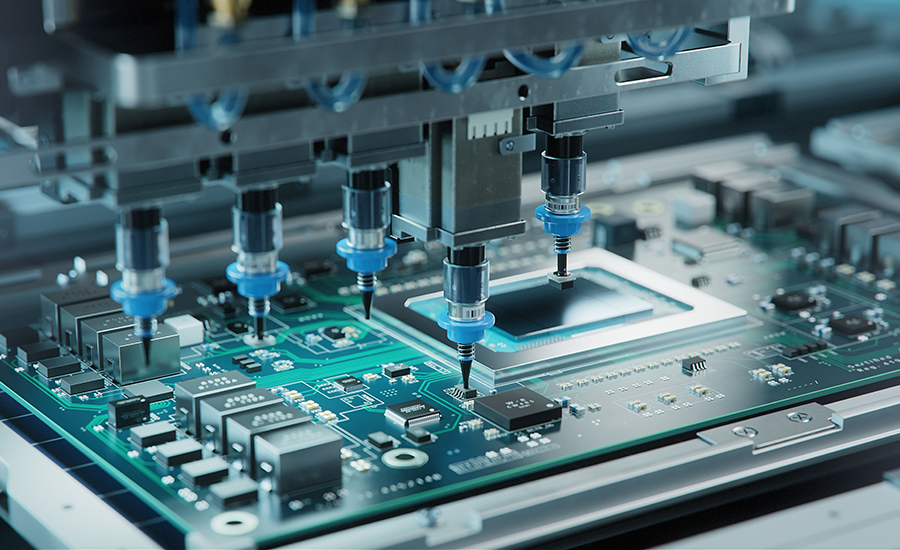

The global shortage of semiconductors is projected to ease in 2023 after years of disruptions to supply chains that made them a scarce resource. // SWEETBUNFACTORY/ISTOCK / GETTY IMAGES PLUS VIA GETTY IMAGES

The supply chain headwinds of the past few years have amounted to a stress test that has provided Identiv with valuable insights into how the company develops products, forecasts and plans supply, Luther says.

“We’ve gained valuable insight into the importance of having mature, accurate information systems to analyze and quickly pivot on supply issues. It has also forced us to have risk mitigation plans which include overdependence on one geographical supply base,” he says.

Paul Garms, director of regional marketing – video systems, Bosch Security and Safety Systems, Fairport, N.Y., says high-performing and robust supply chains are now being seen as a competitive advantage versus an overhead cost. For example, Bosch worked to proactively communicate to customers which camera models were in stock and available for immediate shipments.

“Integrators were able to meet end-user timelines for projects using Bosch cameras, which helped us grow market share and attract new partners to our ×2 Connect Video Partner Program,” Garms explains. “We also worked closely with customers to plan for large product orders to help them meet project deadlines.”

Barnette expresses there is a valuable lesson to learn from all the supply chain upheaval: while the just-in-time manufacturing process was a great revolution in the manufacturing world, it has now been proven to be highly problematic.

“That didn’t happen just during COVID,” he says. “It was already happening with the tariffs that were put on by a previous president. And so there were already things that were going to cause disruption; but I don’t think a lot of companies did anything different until the supply chain issues really smacked everybody right in the face.”

Barnette now expects there will be an emphasis on security integrators to maintain more inventory and be smarter about how many different SKUs they carry.

“Integrators are now — based on our financial data that we’ve analyzed from our channel — carrying more inventory than ever,” he says. “Some of that’s because they’ve ordered product for a job, and they can’t actually deploy because they don’t have all the product they need to deploy. And so they just wait till they have it all in their shop, and then bring it all out at once and do it all in one fell swoop. But largely, it’s because they’re ordering product now for stock, which they hadn’t been doing in a large scale forever.”

As is often the case, adversity sparks innovation and Nilsson believes that’s true for the global supply chain. Over the past few years, governments, industries and individual businesses have all been intensely focused on this issue, he says.

“Global events like this serve to unify people with a common cause and a mutual benefit,” he explains. “As a result, we will experience positive changes to the global supply chain that will have a lasting impact. Similarly, for Axis, positive outcomes will endure, including strengthened relationships with our partners and customers, business with new suppliers, more efficient product redesigns, new inventorying standards and even more rigorous supply chain metrics — resulting in a more robust supply chain with greater resiliency for the future.”

Ken Francis, president of Eagle Eye Networks, Austin, Texas, points out the supply chain crisis illuminated the importance of flexible systems. “We saw that newer technologies can ease the supply chain blues, especially cloud technologies that are flexible,” he says. “During the pandemic, security integrators were contending with camera shortages, and they found that cloud video surveillance easily solves that problem. If one camera manufacturer is not available — or is restricted — other readily available cameras can be substituted and will work with their cloud video management system.”

Ross of AMAG expresses most challenges are also opportunities, and the disruptions related to the pandemic and general global supply chain instabilities are not an exception to this.

“We have pressure tested our key partnerships and been able to see how both our partners and our own teams can manage these situations. We have also been able to forge new relationships and work collaboratively with our customers and supply partners to develop innovative solutions to unprecedented challenges,” she says. “The experience we have gained from doing this will strengthen us as we move forward and make us better able to meet and exceed the expectations of our customers.”

Learning to work together more collaboratively is one of the positive outcomes, Lazatin of Hanwha cites. Supply chain management is a team effort, he explains, and no one can achieve success without the close collaboration among factories, headquarters and regional offices, partners and customers.

“Establishing this type of network is an invaluable resource for keeping a supply chain moving smoothly, and also helping in every aspect of project design, system installation and product delivery,” Lazatin continues. “Maintaining open and direct communications with customers also helps, as well as choosing your partner companies carefully.”

Loud of LOUD Security is quick to highlight how he has seen open and direct consultation among fellow — even competing — dealers blossom in his market and across the nation.

“We’ve had times where I’ll have many other security dealer-integrators from here locally in the Georgia marketplace, or across the nation when we may be on calls together, and start talking about different pieces of equipment that we’re trying to find or identify,” says Loud, who currently serves as chairman of ESA. “It shows the value of dealers working together with dealers, either within dealer networks or within ESA or other state associations.”

Loud says it has been heartwarming to see competing dealers and integrators help each other obtain products in moments of particular need. Not only has his company helped other dealers in his market, but he too has leaned on others “a time or two” as well.

“The collaboration, the communication with the competition has been a significant change as to where things once were,” he says. “I’ve seen that working spirit rise to a whole new level over the past 24-30 months, because everybody’s realizing, ‘Hey, we’re all in this together. Let’s take care of the consumer.’”