Time and time again we hear about the ways in which the pandemic has reshaped our way of thinking about a topic, and that sentiment rings again true for multifamily access control. For starters, we now live in the delivery age of Amazon, DoorDash and Shipt making, visitor management an integral part of the multifamily space. Some residents have held onto habits and expectations from the days when they were told to socially distance themselves and to work from home. Additionally, the lifting of those orders also shaped what other residents expect out of their buildings. This has led to the rise of the mixed-use space, where developers are adding gyms, restaurants, and co-work and commercial spaces to their buildings.

And as the world becomes more aware of the mobile, smart and cloud-based solutions available to them, residents’ expectations have exceeded that of a brass key and lock. According to a 2023 report from Allegion, renters are willing to pay 82 percent more for mobile access control to monitor entry and guest access. In the same report, Allegion found that the use of electronic door locks that are connected to the internet and app-controlled has increased by 140 percent. For these reasons — and more that will be soon discussed — multifamily access control is seen by many industry experts as a vertical with tremendous growth potential — both in new construction and in retrofit situations.

And, according to the experts, it’s a vertical with an impressive amount of opportunity for growth. “We are bullish on our outlook for the multifamily market,” says Michael Rooney, director, business development multifamily, ASSA ABLOY Door Security Solutions, New Haven, Conn. “The vertical continues to outpace most other real-estate verticals and offers excellent opportunities for security integrators.”

Post-Pandemic Expectations

Today more than ever, the multifamily residence is an ecosystem with maintenance staff, delivery people and guests of the residents coming and going. “One of the things that you quickly realize in multifamily is that it’s a live building,” says Robert Gaulden, go-to market director, Zentra Access, at Allegion Carmel, Ind. “There is no shelter and shutter in place. You still have to deploy people to manage that building. You have maintenance that has to go inside that building. You have people still moving in and moving out.”

Gaulden continues, “The industry almost went through a 10 year acceleration during the pandemic to look for technology, and those things have not really gone away. If you think about self-guided tours, they’ve accelerated the ability for their next generation renter to be able to view a property and gain access, not only to see the unit, but see the amenities — the gym, the common areas. All of that’s shaped coming out of the pandemic around this technology’s ability to drive more operational efficiency.”

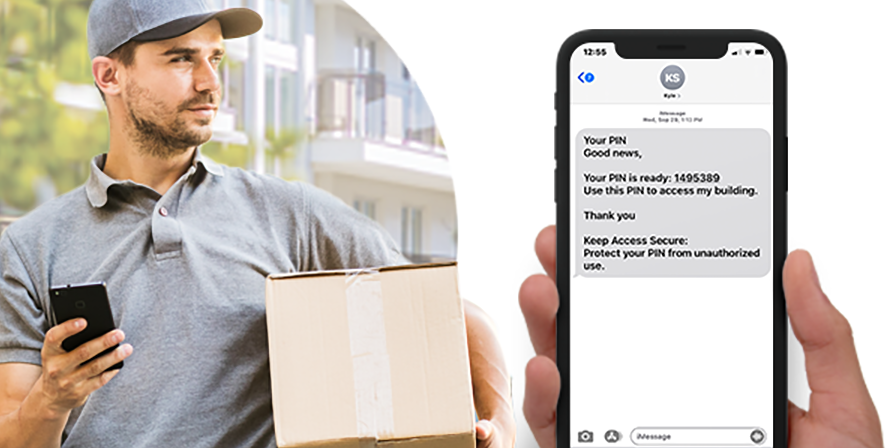

That sentiment was echoed many of the experts in the market. “During the pandemic, we saw people realize that having an on-prem system that couldn’t be controlled remotely was a big problem,” says Lee Miller, senior director of multifamily sales, Brivo, Bethesda, Md. “There’s a need to manage FedEx, Amazon, and everybody else stepping into deliveries. Then there’s a need to be able to send guest passes out and be able to get people in and out of that property efficiently.”

Efficiency is ultimately what the pandemic’s forced technological advancement increased for multifamily. “It’s also made it more important to integrate with many different platforms to create a cost effective, smart-style living space where people are more comfortable in their homes than ever,” says Brach Bengtzen, vice president of marketing at ProdataKey (PDK), Draper, Utah.

Some of the pandemic’s negative effects — like that of ongoing staff and talent shortages — have also helped push forward innovation and integration. “The Holy Grail for the multifamily end user is one single dashboard for everything,” says Paul Comfort, co-owner, Comfort Technologies, an integrator based in Winter Haven, FL. “App fatigue is a real thing for these staff members. Because we’re throwing dashboard after dashboard after dashboard at them. The move-in and move-out processes have become more complicated because, in some instances, we could have seven or eight different dashboards for one property. There’s a huge push to reduce that, and that’s part of that standardization too.

Comfort continues, “You’re seeing a lot of standardization and you’re seeing a lot of cloud-based solutions. And there’s a reason for this. Standardization is so they have a home office that knows all the products that are deployed on their sites. Therefore, they can support minimal or new staff along the way. People are trying to put minimal staff on-site and run everything remotely — those cloud based solutions — and that’s directly from the pandemic.”

Here is a smattering of recent multifamily related security products from the experts interviewed for this article:

Allegion has recently introduced its multifamily access solutions suite. Zentra’s suite of solutions offer the following benefits: one system to unify and manage complete property access; mobile authentication for authorized individuals; real-time perimeter access management supported in the cloud; API integrations with property technologies beyond access; easy upgrades (mechanical to smart lock retrofit); and a dedicated customer success team. // IMAGE COURTESY OF ALLEGION

ACCENTRA is ASSA ABLOY’s multifamily solution. Some recent enhancements include mobile credentials for use with smartphones (in addition to cards and fobs), resident managed access, and more. There are also numerous enhancements actively being developed now. Many of these enhancements are designed to expand the solution’s footprint beyond the reader or lock on the door. These include integrations with other ASSA ABLOY products, such as DoorBird IP video door stations for intercom/visitor buzz-in capabilities and Control iD long-range parking readers, as well as integrations with third-party Property Management Systems (PMS) software. // IMAGE COURTESY OF ASSA ABLOY

Community is dormakaba’s latest web-based access management software offering property managers key control from anywhere. Designed specifically for multi-housing properties, Community provides multi-housing property employees with a robust, user-friendly tool to intuitively manage authorization to common areas and residence doors and control perimeter access points throughout the property, providing security, convenience and operational efficiency. // IMAGE COURTESY OF DORMAKABA

ProdataKey (PDK) recently introduced PDK.io 2.0, which expands features, functionality and scalability to support enterprise installations managed across multiple buildings and sites. With version 2.0, doors connected to disparate PDK Cloud Nodes can be managed as a single customer system, and credential holders can reside in a single database and be distributed across one or many locations. Other enhancements include: System and Health, which provides an at-a-glance view of how the entire system is functioning, and Early Configuration and Extended Management so that system setup can begin before installing PDK hardware. // IMAGE COURTESY OF PDK

New Development & Retrofit Opportunities

There’s a trend in multifamily of developers repurposing the unused office spaces that dot the map, which is further addressed in a sidebar in this article. In both repurposed residences and in new construction, developers and property managers are seeing the benefit of adding common areas, and commercial and co-work spaces. “They have statistics that say if a resident meets a friend on site, they’re more likely going to renew their lease,” Miller says. “So they are trying to drive people into these common areas, like game rooms or clubhouses that weren’t being used in the past. Those areas are actually being repurposed for workspace, because that is how people want to get out of their apartment now.”

And that’s not seen as just a value add for the property manager, but also an opportunity for security installers and integrators. “Catering to that ultimate end user — which is the resident — by putting in mixed-use spaces is a value add for that resident,” Comfort says. “And in these repurposed spaces, they’re putting in smart locks, and they’re putting in a smart, all-in-one app experience on-prem. If they don’t do that, they can’t really compete because they’re trying to get the same rent."

Derek Coats, national systems/integration specialist, multifamily housing access solutions, dormakaba, Indianapolis, Ind., says, “One of the biggest growth opportunities is to own the entire project — installation to service and maintenance — from an access control solutions perspective. Traditionally access control system unit locks were also sold through door hardware Division 8 professionals (more traditional door hardware supply channels). That’s moving to Division 28 (security, access control, fire integrators) because developers want one person to handle the access solutions and make sure all systems integrate.”

This means locks are becoming more of an integrated or system based device and systems integrators are now handling more of that business. Building owners now want a single source for these products and for it all to work together seamlessly. These often takes a little more knowledge or systems than the traditional Div. 8 side has always done.

“Integrators planning for the future should expand their services to include all low voltage installations, including access control solutions on common areas and unit doors,” Coats continues. “With today’s technologies, integrators will not be spending eight hours on a traditional hard-wired door. Unit door locks can be installed in about five to 10 minutes per door, allowing companies to service more doors in less time.”

Alternatively, retrofit can also provide just as much of a growth opportunity. “One of the big opportunities I see in multifamily today is not new construction,” Gaulden says. “New construction is already going out with access at both the unit and the perimeter. It’s the existing buildings today. There’s over 22 million plus existing units that are professionally managed in the portfolio today.”

Gaulden adds, “One of the stories that really resonates with me was a property manager ownership group that I worked with a couple of years ago that said, ‘Four years ago, my building was the newest building in the zip code. In the last three years, three more buildings went up. We all have the same amenities. We all have beautiful gyms and granite countertops. The main difference is, they have smart access all the way down to the unit. I do not.’ So the pressure is on to keep up with what everyone else is building today.”

While the trend of repurposing unused office spaces into multifamily residences has continued post-pandemic, it presents some unique challenges. “It really started off as a hot trend during the pandemic,” says Robert Gaulden, Allegion. “Especially when you think about the number of units that are available out there today. We saw office vacancies start to spike as well as the work from home versus return to work conversation. I’m not sure everyone’s figured out how that’s going to pan out just yet.”

Gaulden continues, “It’s a great thought; there’s a lot of vacancies out there. But converting those commercial buildings into residential spaces and making all that work from an investment perspective is pretty challenging. I think the industry has experimented with it. It did not take off the way everyone thought it would. It does not seem to be the silver bullet that the housing industry would like it to be from the shortage perspective. I mean, rerouting plumbing, rerouting doors and HVAC: All of that’s pretty challenging when you get into those buildings.”

Primarily the challenge is that the infrastructure for an office is fundamentally different than a living space. “Your challenge would be infrastructure — plumbing and electrical,” says Dan Comfort of Comfort Technologies. “An office building is wired and plumbed for one bathroom per floor — maybe two. Now you’re talking about plumbing in every apartment. So that’s some major renovation there. The recent one that we looked at was a motel — a two-story motel. It’s not such a big deal, but they did have their challenges because they’re having to get different technologies in there like air conditioning because the window air conditioner doesn’t fly with an apartment.”

Sometimes there’s some infrastructure in place from previous security installations. “There was an office space that we dealt with that had Johnson Controls on the perimeter,” says Paul Comfort of Comfort Technologies. “So there was some perimeter infrastructure in place, which helped.”

While some experts did say that it did not take off like everyone thought it would, most experts agree that this trend isn’t going away. “There’s a lot of challenges, but apparently they feel like it’s worth it,” Paul Comfort says.

Advice: Educating, Demonstrating Value & Servicing

There were a few pieces of advice that seemed to appear again and again when speaking with these multifamily experts. One of them is a good reminder — most developers and property managers are not security experts. “It is important to know what they want, but also what they need,” says Dan Comfort, co-owner, Comfort Technologies. “We need to be able to tell them and explain to them what it is they are after. A lot of them will say, ‘We don’t know, we just want security.’ We are tasked with the responsibility of attempting to explain to them all the different options that they have.”

Dan Comfort continues, “If a developer or a property management team is not informed properly, then that’s a major problem. … The exposure is not getting with the developer and helping them make the right decisions about their products.”

And once informed, the biggest hurdle can be cost. “When it comes to the installation, repair or the retrofitting or anything like that — most challenges are cost-related,” Bengtzen says. “Being able to show value is very important.”

Miller offers a solution to budgetary concerns — staggered integration. “My biggest advice is when you do get in with these properties, they don’t have the budget to rip and replace all of the technology on site. Generally in one year, the majority of them are going to ask for a phased approach. … You’re looking at it as a rollout over time. This year we’re going to handle common area access. Next year we’re going to handle locks, depending on what their needs are.”

Ultimately, the biggest piece of advice is to maintain a relationship with the customer after the installation. “In a word — service,” says Luis Martinez, vice president customer experience, for integrator GoKeyless, Miamisburg, Ohio. “It sounds simple but is very strategic. There are many access solutions out there that are easily accessible. Companies that excel at service will be at the top of this list of providers. This is an industry where some companies sell and install products and then walk away. That approach is going away. End users expect systems to work. Integrators must establish a customer service experience that is positive, seamless and successful.