The security industry's largest systems integrators have effectively adapted to the certainty of an uncertain economy and overcome ambiguity with nimble business strategies.

This is evidenced by SDM's 9th annual Top Systems Integrators Report–a ranking by revenue of the largest firms that contract electronic security projects for commercial, industrial, institutional, government, and other markets.

The data reveal evidence of more streamlined business operations in 2003.

Undoubtedly the result of the struggling economy, the total number of full-time employees was down significantly, as was the cumulative number of business locations. Yet collective gross revenue continued to climb. This strongly suggests that integrators have pared down their operations and are getting more for less.

While the number of employees and business locations fell, the number of new systems jumped dramatically, from more than 28,000 last year to more than 52,000 this year. One factor contributing to this growth is the increased number of companies reporting new system starts compared with previous years. However, this factor alone does not account for the striking 86 percent growth rate in new systems.

Meanwhile, the total gross revenue escalated just over 20 percent, from $3.4 billion in 2002 to $4.1 billion.

Comparing the exponential growth in new systems with the more modest, by comparison, growth in revenue strongly suggests that 2003 revenues were the result of a larger number of less expensive systems than in previous years, when a lesser number of more expensive systems was the norm.

As expected, integrators’ strengths continued to come from the staples of electronic security: access control and video surveillance.

Collectively, integrators continued to experience double-digit growth in 2003, and individually, nearly all of the Top Systems Integrators anticipate continued double-digit growth for 2004. After being somewhat tentative last year, hopes seem high for the future of SDM’s Top Systems Integrators.

| 2004-Cast |

|

SDM asked systems integrators: “How do you anticipate your revenue will change in 2004 as compared with 2003?†|

“We forecast our revenue will double in 2004 because of an expanding customer base, more federal funding, and more spending.†– Adesta LLC “We expect growth of approximately 10 to 20 percent via acquisition, organic growth, and maturity in new market initiatives, particularly in the retail and government sectors.â€â€“ Diebold Inc. “We expect continued growth in our revenue to exceed 15 percent from market emphasis on new security technologies and entry into new geographic markets.†– Red Hawk Industries LLC “Revenue in 2004 should remain comparable to 2003. This year’s projects seem to be equivalent to last year’s.†– SCI Inc. “Revenue will be down by as much as 20 percent. This is consistent with trends in the security system and electrical contracting industries in our market area for 2004.†– Pro-Tec Design Inc. “We anticipate significant growth in our electronic security services segment of the business due to increased sales to federal and state governments. Additionally, we see a greater penetration of this core service offering within our branches that have previously focused more on the network infrastructure side of the low-voltage business.†– NetVersant Solutions Inc. “We expect to grow at about 30 percent in 2004 due to a need for solid regional and national integrator coverage throughout the U.S. Corporations are looking for more options.†– BCI Technologies Inc. |

Integrators’ Revenue by System Type

Integrators were asked to segment their revenue streams by system type. Integrated systems, CCTV, and access control again combine for almost 80 percent of business. Integrated systems represents the lion‘s share, but that figure has receded from nearly half in years past, while CCTV and access control systems continue to battle for second and third. Compared with last year’s results, minor losses in integrated systems were matched by minor gains in both CCTV and access controls.Source: SDM Top Systems Integrators Report, July 2004

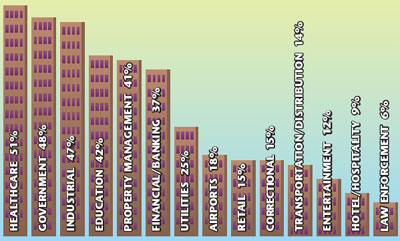

Integrators’ Revenue by Vertical Market

Integrators were asked to segment their revenue streams by vertical market. For a majority of Top Systems Integrators, the healthcare market presented the greatest opportunity. Other active markets include government, industrial, education, and property management. The following are percentages of integrators that confirmed a particular market as a significant source of 2003 revenue:

Top Systems Integrators: More Money, Less Presence

Total gross revenue (2003) $4.1 billionNew systems started in 2003 52,344

Total full-time employed 77,210

Business locations operated 1,176

The Top Systems Integrators collected $4.1 billion in revenue in 2003, up from $3.4 billion in 2002. Also, more than 52,000 new projects were started last year (compared with more than 28,000 the previous year), which suggests that the Top Systems Integrators generally are doing more projects of a smaller nature.

Although the ranked firms reportedly employ more than 72,000 full-time workers, (compared with 175,910 reported one year ago), no employee data was provided by Siemens or SimplexGrinnell, which accounted for almost 18,000 employees in last year’s report. Even so, it appears that the Top Systems Integrators have collectively pared down the workforce over the past year.

This is true, too, of the number of business locations. Last year’s report showed that the Top Systems Integrators collectively operated more than 1,600 business locations compared with less than 1,200 this year. Even though SimplexGrinnell’s approximately 200 locations are unaccounted for on this year’s list, the numbers still suggest a significant decline in business locations.

Source: SDM Top Systems Integrators Report, July 2004.

Revenue Growth: Building on a Strong Foundation

Tracking the Top Systems Integrators from year to year reveals less than 21 percent growth from last year, which is the second lowest growth rate over the last five years (second to 1999-2000, which measured just over 12 percent). This year’s growth rate is only about half of last year’s 41 percent growth rate, from $2.4 billion in 2001 to 3.4 billion in 2002. Still, 21 percent annual growth is phenomenal in any industry, and reflects the continuing boom in systems integration.More From the Report

Would you like more information about each of the 100 firms ranked here?The SDM Top Systems Integrators Report and Database, available in Excel format, contains additional information beyond that published in this issue and online: contact names, mailing addresses, telephone and FAX numbers, web site URLs, branch office locations, and more.

SDM ‘s Top Systems Integrators Report and Database is a useful marketing tool for companies with products and services targeted to systems integrators.

Cost: $595. May be ordered directly from SDM’s web site at www.sdmmag.com (click on Exclusive Industry Research), or by calling Donna Edwards at (248) 244-6428.

Making the Most of the Rankings

SDM’s Top Systems Integrators Report includes 100 firms ranked in order of their 2003 total annual revenue (rounded to the nearest hundred-thousand), beginning on p. 40. The table includes selected information about each firm, gathered through an annual survey. Each entry includes:• 2004 rank and 2003 rank

• Company name and headquarters location

• 2003 gross annual revenue. (The letter “v†next to the revenue indicates that the firm submitted a separate document, such as an income tax form or a reviewed or audited financial statement.)

• Number of new system starts in 2003, plus the largest and smallest new system starts

• Number of full-time employees

• Number of business locations operated, including headquarters

CLICK HERE to view the SDM Top Systems Integrators List