All of the usual factors fueling demand for integrated security systems were at play in 2006, and they joined with an exceptional focus on converged solutions to form a highly robust market, evidenced by a 7 percent improvement in revenue forSDM’s 2007 Top Systems Integrators.

This exclusive report ranks by revenue the largest firms that contract electronic security projects for commercial, industrial, institutional, government, and other non-residential markets.

In fact, an observation on the market made by one integrator seems to succinctly sum up the direction in which integrated systems are headed:

“We are seeing our market change from just security to technology,” notes ATC International, Miami, Fla., ranked No. 48. One of ATC’s recent projects is a citywide wireless infrastructure for high-speed internet access, and licensed use of 4.9GHz for public safety.

Starting at the top, No. 1-ranked Siemens Building Technologies comments that systems integration is an expanding industry with many varied opportunities.

“Our business not only expanded with existing customers, but we won significant new business across a wide range of enterprises, public and private,” Siemens notes.

In the city of Chicago, for example, more than 225 police cameras are wirelessly linked to all 25 police districts and the 911 Center, providing a surveillance network that integrates public safety and homeland security under one system. Siemens explains in its report form that it helped the city lead that initiative by winning the contract for the pilot program, which set standards for the city-wide integration of the security system. During the pilot project, Siemens installed a network of more than 60 surveillance cameras that uses intelligent software that can differentiate between suspicious and routine activities and then alert authorities.

Convergint Technologies LLC, Schaumburg, Ill., ranked No. 10, stated on its report form that, “Integrated security systems sales for 2006 were strong compared to 2005.

“Customers continue to integrate enterprise applications such as HR database, card access, IP video and other disparate systems. More and more customers are looking for converged solutions involving identity management and card access. The strongest business segment for integrated solutions was the corporate (Fortune 1000) customers.

“The weakest business segment for Convergint, as it relates to integrated solutions, was hotel/ hospitality.”

VERTICAL OPPORTUNITIES & CHALLENGES

While opportunities in vertical markets varied by systems integrator, many common markets that integrators found success in in 2006 include property management, retail, gaming, education, industrial, transportation, municipal, and utilities.Geographically, some markets were not as robust, including the Detroit area, which local integrators attributed to the economic influence of the automotive market. But this depression appears to be isolated, with the security market generally holding up extremely well in all other areas of the country.

COMPETITIVE LANDSCAPE

The market for integrated systems is clearly in an expansion mode, and that opportunity is bringing new contenders to the ring. Those new contenders include start-up systems integration firms, security dealers who have redefined their businesses as systems integrators, and value-added resellers (IT VARs).How has this dynamic affected traditional security systems integrators?

“We view the market as becoming extremely crowded, with countless companies springing up overnight, looking to steal market share,” notes No. 20-ranked Initial Electronics, Chicago, which was named SDM’s Systems Integrator of the Year in 2006. “These newer companies present challenges, but also offer the top integrators an opportunity to sit back and really focus on what makes them unique.

“In the case of our Chicago office, we estimate that more than 50 firms or individuals are now trying to compete against us. Rather than try to match the low prices of rookie companies, we focus on adding resources that no one can match — an enhanced IT services group, Web interfaces, first-rate client social events, and premium programs,” Initial explains.

“The market in 2006 was characterized by increased competition — resulting in softer margins — due to an influx of start-up companies,” relates ArCom Systems Inc., North Little Rock, Ark., ranked No. 90.

No. 74, Benson Security Systems Inc., Gilbert, Ariz., said its market is stronger than last year, “even with the emergence of more competitors that could have had an impact on our business this year.

“The strongest growth markets were in the video arena, specifically IP-based video. We also have seen a surge in our IT and communications division business and are providing network infrastructures, network security and storage applications that stand alone and/or supplement our security business.”

Sidebar: 2006 Top Systems Integrators: Achievements

Even though a change in reporting structure was instituted for the Top Systems Integrators report this year — limiting the revenue reported to North American revenue from security-related systems only — this group continued to show improvements. North America’s largest security systems integrators gained 7 percent overall, and improved the number of new system starts from 43,103 in 2005 to 46,433 in 2006.Source: SDM Top Systems Integrators Report, July 2007

Source: SDM Top Systems Integrators Report, July 2007

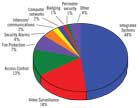

Sidebar: Integrators Reveal How their Revenue Is Split by Technology Type

Top Systems Integrators were asked to break down their 2006 sales revenue by product type. Choices included Integrated Systems and the stand-alone technologies of access control, video surveillance, alarms, fire protection, etc.A significant increase was revealed in the percentage of total revenue from integrated systems — up from 41 percent in 2005, to 48 percent in 2006. Clearly this demonstrates market demand for security efficiency, as well as the rising skill levels of systems integrators to offer fully integrated solutions.

Combined, integrated systems, video surveillance and access control accounted for 79 percent of Top Systems Integrators’ sales revenue in 2006. This is six percentage points higher than in 2005.

Sidebar: Editor’s Note:

SDM’s Top Systems Integrators Report employed a new basis of reporting in 2007. Integrators were asked to confine their reported revenue — for purposes of this report — to North American revenue only, whereas in the past integrators were allowed to include worldwide revenues, if applicable. Additionally, ranked firms were asked to exclude revenue related to stand-alone non-security products, such as energy management/HVAC control systems. If these systems were part of an integrated security solution, however, then they were allowed to be included in the reported revenue.Firms that did not complete Top Systems Integrator surveys were ranked using SDM estimates. These estimates were derived using a number of formulas; in some cases, firms were ranked based on their prior-year results.

Some companies ranked in this report are part of larger corporations that encompass more than security systems integration. In these cases, the reported revenue reflects only the systems integration portion of that company’s business.

Sidebar: Strongest Vertical Market for Integrators:

Corporate/Property Management

Asked to rank the markets that provided the most significant portion of their 2006 revenue, more integrators chose corporate/property management as their top market than any other vertical, followed closely by education.Source: SDM Top Systems Integrators Report, July 2007

- Corporate/Property Management

- Education

- Healthcare

- Financial/Banking

- Government

Sidebar: Top 10 Largest Project Winners

Johnson Controls Inc. $119,000,000*SimplexGrinnell LP $20,000,000

National Security Systems Inc. $18,650,000

FirstService Security (dba SST - Intercon Security $13,000,000

North American Video $10,000,000

ATC International $8,700,000

Adesta LLC $8,102,000

Tech Systems Inc. $7,566,986

Henry Bros. Electronics Inc. $7,500,000

Sigcom $7,400,000

*Note: Johnson Controls’ largest project reported exceeds total revenue reported for systems integration

Source: SDM Top Systems Integrators Report, July 2007

Sidebar: How the Top Systems Integrators Report Is Compiled

SDM’s Top Systems Integrators Report is compiled from a survey completed by more than 100 companies, which then are ranked by their 2006 total annual revenue. Data included in the table beginning on page 57 are:- Rank

- Company name and headquarters location

- Other names under which the company does business

- 2006 gross annual revenue

- Number of new systems started in 2006

- Sizes of the integrators’ largest and smallest new projects

- Percentage of jobs funded by Homeland Security

- Number of full-time employees

- Number of business locations operated, including headquarters

Source: SDM Top Systems Integrators Report, July 2007

Sidebar: Systems Integration Revenue Climbed 7 Percent in 2006

Total annual revenue from systems integration grew nearly 7 percent in 2006. Although a year-to-year comparison showing how many firms improved versus declined is not practical because ranking criteria was changed with this edition, many noted having an exceptional year in 2006. In addition, when asked about their revenue expectations in 2007, 84 percent of integrators expect 2007 revenue to increase, 10 percent expect it to remain the same, and 6 percent expect a decline.Sidebar: More from the Report

To gain additional information beyond that published in this issue and online, the completeSDMTop Systems Integrators Report and Database is available in Excel format. Included are contact names, mailing addresses, telephone numbers, Web site URLs, branch office locations, and more.SDM’s Top Systems Integrators Report and Database contains the data needed to target products and services to the systems integration market.

The cost of the report is $595. It may be ordered by contacting Heidi Fusaro at (630) 694-4026 or e-mailingfusaroh@bnpmedia.com.

Alphabetical Index to Companies

Company 2007 Rank

Access Control Technologies Inc. 56

Adesta LLC 14

ADT Security Services Inc. 3

Advance Technology Inc. 89

Advanced Control Concepts Inc. 80

Advanced Electronic Solutions Inc. 52

Advantor Systems Corp. 40

All Systems Designed Solutions Inc. 81

Allied Safe & Vault Co. Inc. (dba Allied Fire and Security) 25

Alscan Inc. 98

ArCom Systems Inc. 90

ARK Systems Inc. 29

ASG Security (formerly AccuTech Systems Inc.) 70

ASSI Security Inc. 27

ATC International 48

Atlantic Coast Alarm Inc. 83

BCI Technologies Inc. 28

BCM Controls Inc. 58

Benson Security Systems Inc. 74

CompuDyne Corp. 11

Convergint Technologies LLC 10

Corbett Technology Solutions Inc. (dba CTSI) 43

D/A Central Inc. 73

Dallas Security Systems Inc. & DSS Fire Inc. 35

Deterrent Technologies Inc. 41

Diebold Inc. 4

Egan Company 65

Electronic Sales Company Inc. 99

Electronic Security Services Inc. (dba ESSI) 88

Electronic Security Systems 82

Energy Control Inc. (ECI) 61

Facility Robotics Inc. 100

Ferndale Electric Co. Inc. (dba ASG, Automation Systems Group) 66

Firstline Security Systems Inc. 78

FirstService Security (dba SST - Intercon Security 7

Genesis Security Systems LLC 44

Henry Bros. Electronics Inc. 15

Idesco Corp. 42

IEP Ltd. (dba International Electronic Protection Ltd.) 39

Infrastruct Security Inc. 46

Ingersoll Rand 6

Initial Electronics 20

Integrated Controls USA Inc. 71

Intelligent Access Systems Inc. 72

Intelligent Systems & Controls Contractors Inc. 75

Intelli-Tec Security Services 79

InterTECH Security LLC 33

Jacksonville Sound & Communications Inc. 34

JBP Security Systems Inc. (dba Security By Design) 94

Johnson Controls Inc. 60

Kastle Systems 13

Koorsen Protection Services Inc. (dba Koorsen Fire and Security) 31

Life Safety Engineered Systems Inc. 95

MAC Systems Inc. 37

MidCo Inc. 32

MSE Corporate Security 55

National Security Systems Inc. 19

NetVersant Solutions Inc. 16

North American Video 12

North American Video Corp (dba NAVCO Security Systems) 17

Operational Security Systems Inc. 53

PEI Systems Inc. 54

Pro-Tec Design Inc. 76

Red Hawk Industries 8

RFI Communications & Security Systems 18

SecureNet Inc. 30

Securitas Security Systems USA Inc. 9

Security and Data Technologies Inc. (dba SDT) 51

Security Corp. 26

Security Design Inc. (dba EO Integrated Systems Inc.) 57

Security Equipment Inc. 64

Security Solutions Inc. 67

Sentinel Security & Communications Inc. 86

SFI Electronics Inc. 36

Siemens Building Technologies 1

Sigcom 50

SimplexGrinnell LP 2

Simpson Security Systems Inc. 84

SNC Inc. 93

Sound Inc. 38

Sport View Television Corp. (dba Sport View Technologies) 97

Stanley Security Solutions 5

T&R Alarm Systems Inc. 85

TAC 22

Tech Systems Inc. 23

Tele-Tector of Maryland Inc. (dba TTM) 59

TEM Systems Inc. 63

The Protection Bureau 45

Thompson Electronics Co. 69

Trans-American Security Services LLC (dba Trans-Alarm Inc. and Automated Entrance Products Inc.) 47

Tri-Electronics 62

Tri-Signal Integration Inc. 21

Universal Security Systems Inc. 68

Unlimited Technology Inc. 77

Utah Controls Inc. 49

Videotec Corp. 96

VideoTronix Inc. (dba VTI Security) 24

Vision Southeast Inc. 92

Visual Management Systems Holding Inc. 91

Will Electronics 87

Access Control Technologies Inc. 56

Adesta LLC 14

ADT Security Services Inc. 3

Advance Technology Inc. 89

Advanced Control Concepts Inc. 80

Advanced Electronic Solutions Inc. 52

Advantor Systems Corp. 40

All Systems Designed Solutions Inc. 81

Allied Safe & Vault Co. Inc. (dba Allied Fire and Security) 25

Alscan Inc. 98

ArCom Systems Inc. 90

ARK Systems Inc. 29

ASG Security (formerly AccuTech Systems Inc.) 70

ASSI Security Inc. 27

ATC International 48

Atlantic Coast Alarm Inc. 83

BCI Technologies Inc. 28

BCM Controls Inc. 58

Benson Security Systems Inc. 74

CompuDyne Corp. 11

Convergint Technologies LLC 10

Corbett Technology Solutions Inc. (dba CTSI) 43

D/A Central Inc. 73

Dallas Security Systems Inc. & DSS Fire Inc. 35

Deterrent Technologies Inc. 41

Diebold Inc. 4

Egan Company 65

Electronic Sales Company Inc. 99

Electronic Security Services Inc. (dba ESSI) 88

Electronic Security Systems 82

Energy Control Inc. (ECI) 61

Facility Robotics Inc. 100

Ferndale Electric Co. Inc. (dba ASG, Automation Systems Group) 66

Firstline Security Systems Inc. 78

FirstService Security (dba SST - Intercon Security 7

Genesis Security Systems LLC 44

Henry Bros. Electronics Inc. 15

Idesco Corp. 42

IEP Ltd. (dba International Electronic Protection Ltd.) 39

Infrastruct Security Inc. 46

Ingersoll Rand 6

Initial Electronics 20

Integrated Controls USA Inc. 71

Intelligent Access Systems Inc. 72

Intelligent Systems & Controls Contractors Inc. 75

Intelli-Tec Security Services 79

InterTECH Security LLC 33

Jacksonville Sound & Communications Inc. 34

JBP Security Systems Inc. (dba Security By Design) 94

Johnson Controls Inc. 60

Kastle Systems 13

Koorsen Protection Services Inc. (dba Koorsen Fire and Security) 31

Life Safety Engineered Systems Inc. 95

MAC Systems Inc. 37

MidCo Inc. 32

MSE Corporate Security 55

National Security Systems Inc. 19

NetVersant Solutions Inc. 16

North American Video 12

North American Video Corp (dba NAVCO Security Systems) 17

Operational Security Systems Inc. 53

PEI Systems Inc. 54

Pro-Tec Design Inc. 76

Red Hawk Industries 8

RFI Communications & Security Systems 18

SecureNet Inc. 30

Securitas Security Systems USA Inc. 9

Security and Data Technologies Inc. (dba SDT) 51

Security Corp. 26

Security Design Inc. (dba EO Integrated Systems Inc.) 57

Security Equipment Inc. 64

Security Solutions Inc. 67

Sentinel Security & Communications Inc. 86

SFI Electronics Inc. 36

Siemens Building Technologies 1

Sigcom 50

SimplexGrinnell LP 2

Simpson Security Systems Inc. 84

SNC Inc. 93

Sound Inc. 38

Sport View Television Corp. (dba Sport View Technologies) 97

Stanley Security Solutions 5

T&R Alarm Systems Inc. 85

TAC 22

Tech Systems Inc. 23

Tele-Tector of Maryland Inc. (dba TTM) 59

TEM Systems Inc. 63

The Protection Bureau 45

Thompson Electronics Co. 69

Trans-American Security Services LLC (dba Trans-Alarm Inc. and Automated Entrance Products Inc.) 47

Tri-Electronics 62

Tri-Signal Integration Inc. 21

Universal Security Systems Inc. 68

Unlimited Technology Inc. 77

Utah Controls Inc. 49

Videotec Corp. 96

VideoTronix Inc. (dba VTI Security) 24

Vision Southeast Inc. 92

Visual Management Systems Holding Inc. 91

Will Electronics 87