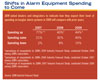

SDM checked in with more than a dozen stakeholders, including alarm dealers, equipment manufacturers, and distributors — and they were a bit more optimistic than the research shows. Most of them expect sales to be flat in 2009 — or to grow, but at a slower rate than the market has grown over the previous two years. Several said their numbers were down for fourth quarter of 2008 — no surprise considering that’s when the Wall Street meltdown happened. Nevertheless, almost everyone we spoke with expects 2009 to be at least a “good,” or even a “very good” year for monitored intrusion alarm system sales.

SecureNet Alarm Systems, a regional alarm dealer based in Maize, Kansas, actually saw sales increase between the third and fourth quarters of 2008. “And with what we have in the works, we have a good quarter coming,” comments SecureNet president, Randy Rosiere.

The number of systems that SecureNet installs today is about the same, or up only slightly, from six months to two years ago. But the company now generates more revenue per job. Part of that is because SecureNet has been selling a higher percentage of commercial jobs in response to increased concerns about crime. “The worse the economy gets, the higher crime is going,” Rosiere describes.

SecureNet also has been generating higher perjob revenue by selling more equipment for each installation. “Our business used to be to simply protect the building, but now we’re expanding and protecting other parts of the property,” Rosiere relates.

For example, a new item the company sells is a device to secure air conditioning units located on a building’s exterior. “One customer had several outdoor air conditioning units stolen just for the copper inside them,” recalls Rosiere, adding that SecureNet has had a strong response from a mailing to pre-existing customers promoting air conditioning protection as an add-on.

INGENUITY LEADS THE WAY

Joe Nuccio, president and chief executive officer (CEO) of ASG Security, a Beltsville, Md.-based security dealer SDM’s 2008 Dealer of the Year, expects 2009 to be “good,” but he cautions, “It’s not good all by itself. You have to be more maneuverable and work harder for the same results.”

Mike Miller, vice president for Pasco, Wash.-based Moon Security Services, agrees. “We will have to work a lot harder to maintain the same numbers,” predicts Miller, who is president of the National Burglar & Fire Alarm Association. “We recognize we have to look at the market and pick where we want to go.”

While still targeting the residential alarm market, Miller says, “We try to augment that business by making sure we’re talking about life safety and adding smoke detection and emphasizing our ability to do medical monitoring.”

Rosiere, Nuccio, Miller and other dealers say their per-job margins have remained steady over the last year or two, and most don’t expect that to change in 2009. But companies may have to work harder to achieve that goal as well — and they will need to be particularly vigilant about keeping tabs on volatile fuel prices.

The increase in gas prices in mid-2008 was “hard to absorb — we couldn’t forecast it,” notes Gerald Minnick, owner of Fastech Alarms & Telecommunication Services, a Cincinnati-based alarm dealer.

Despite such challenges, Fastech actually managed to improve margins during 2008. Minnick says he has achieved that with the help of his sons. Together the three of them have kept tighter controls on expenses. Minnick also notes that his technicians are more experienced and efficient than they were a few years ago.

Where Minnick has seen the impact of the economy is on the accounts receivable side. “We get the sale, but we get stretched out on terms,” he says. “A lot of people are taking 90, 120 or 200 days to pay.”

Another company that has benefited from an improvement in the skill level of its technicians is American Alarm & Communications of Arlington, Mass. “We’re at record efficiency levels for projects,” notes American Alarm president Wells Sampson. “We’ve worked very hard on that part of our business. If we hadn’t done that, the market challenges would have hurt us.”

An apprentice program that the state alarm association put together a few years ago has been an important contributor to American Alarm’s gains. “This is the first year in the last 10 that we were not limited by a lack of skilled technicians,” Sampson comments. “We were limited by the market itself.”

Not every alarm dealer has written off the new construction market. Steve Browning, owner of Grand Rapids, Mich.-based Browning Detection Systems, is working with new home builders more now than he did in the past. The builders, he explains, “are selling less, so they’re giving smaller companies like us a shot to do the work.”

The downside is that Browning’s revenue-per-job has decreased. The company breaks even on the new construction work with the goal of gaining the monitoring business when the home is sold.

RMR PROTECTION

As finances get tight, some security customers could seek to reduce expenses by canceling their alarm monitoring service.

Most of the dealers SDM interviewed for this article haven’t had that happen yet, but they’re being careful not to take customers for granted.

Security Networks, a West Palm Beach, Fla.- based company that targets the residential market nationwide, is “very focused on customer retention,” comments president and CEO, Richard W. Perry. Good retention begins at the time of sale, he says. “If you had solid underwriting and value in the system, it will help you down the road,” he says. “Beyond that, you employ good basic retention methods. When they call to cancel, you’re constantly recalling them and reselling the need for the system.”

One market trend that could cause attrition to increase is the overall shift towards alternative forms of communication such as cellular service and voice over Internet protocol (VoIP) service from companies such as Vonage and Skype. When customers realize the only reason they have a traditional landline phone is to support their alarm systems, they may consider canceling both. But dealer sources say that hasn’t been a problem. Several say they are generally successful at converting customers to either cellular or IP communications when they want to cancel their landline phones.

Customers switching to cellular communications pay an extra $5 or so a month to their wireless carrier to have their alarm monitored over the cellular network, notes Matt Schaberg, product marketing manager for intrusion products at Bradenton, Fla.-based equipment manufacturer GE Security. But that cost is more than offset by the $40 or $50 a month those customers save by not having a traditional landline.

Customers also may pay a bit higher monitoring charge when they convert to cellular or IP — and some dealers say that’s caused their average recurring monthly revenue (RMR) to increase. ASG’s RMR has climbed steadily over the past three years as more and more customers have opted for cellular communications. Today, about two out of three systems have that capability, Nuccio notes, including some customers who still have a landline phone but want to future-proof their system.

THE MANUFACTURERS’ VIEW

Security manufacturers underscore some of the same trends that dealers are seeing. “We’re not seeing a slowdown, just a shift in emphasis,” notes Jonathan Klinger, director of marketing for Melville, N.Y.-based Honeywell Security and Communications. “We’re seeing a shift of emphasis from new homes to existing homes and from residential to small commercial.”

The shift towards pre-existing homes is driving up sales of products that work well for retrofit applications, such as self-contained keypad/panels and wireless systems, manufacturers say. Like SecureNet, security and low-voltage equipment distributor ADI also has made a big push on perimeter protection. “Theft is at an all-time high on construction sites,” notes Scott Sturgess, director of product marketing for intrusion and fire products for Melville, N.Y.-based ADI. Other growing product areas, he says, are personal emergency response systems, home automation and wireless.

Certain vertical markets also may have greater potential. “Homeland Security continues to be an opportunity,” says Tom Mechler, product marketing manager for Fairport, N.Y.-based equipment manufacturer Bosch Security. “Petrochemicals and infrastructure also seem to be weathering the storm of the economy.”

Judy Jones, vice president of marketing for Amityville, N.Y.-based equipment manufacturer Napco Security, expects to see increased interest in equipment that can help provide verified alarm response. “When police budgets get cut, the first thing they look into is reducing unnecessary dispatches,” she says.

Changing habits and preferences of end users also are creating new opportunities. Although recent consumer research conducted by Honeywell showed that some characteristics of security system buyers have remained constant, there are also some important changes, Klinger reveals.

“Some fundamentals are unchanged,” he says. “Buyers tend to be homeowners with kids with upscale demographics. What’s changed is that people are used to having access to a wealth of information at their fingertips, enabled by mass-market adoption of broadband and 3G wireless. Applications such as Skype videoconferencing, Facebook and YouTube are creating an appetite for rich interactive services connected to the alarm system.”

The tough economic climate also could create opportunities for alarm dealers that like to grow through acquisition. “We’ve got acquisitions falling out of the woodwork,” says Rosiere. “As smaller companies are having more trouble surviving, they’re figuring they may as well cash out now before it gets too bad. We will probably close on three companies in the first quarter of 2009.”

SIDEBAR: Marketing Spending Still Strong

Not every alarm dealer relies heavily on marketing and advertising. But those that see a return on their promotional spending expect to continue to make that investment, despite the economic downturn.

Amherst Alarm of Amherst, N.Y. periodically does radio advertising which, as CEO Tim Creenan explains, “is focused on reinforcing the brand within the market and our longevity and various things we do.” The company plans to continue with that approach for 2009, Creenan says, because calls to the company typically increase threefold when the ads are running.

Dealers that advertise should benefit from falling ad prices, says Richard W. Perry, president and CEO of Security Networks of West Palm Beach, Fla. “The cost per lead should be going down because advertising is just cheaper right now,” he says.

Some dealers may shift where they spend their marketing dollars, however. ASG Security now emphasizes its search engine-optimized marketing. “It gives customers the ability to find us through global searches,” explains ASG president and CEO Joe Nuccio. “We’ve optimized the Web site to have click-throughs translate into quality leads for our sales reps.”