|

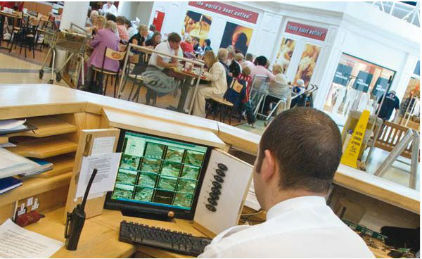

| Every loss prevention executive surveyed for the “CCTV in Retail 2012” study uses video in his or her company’s efforts, and nearly two-thirds use some form of IP-connected system. Courtesy of Axis Communications |

Retail organizations are increasingly adopting IP-based video surveillance technology and are showing a growing interest in cross-functional uses of digital video systems, such as video analytics and point-of-sale integration to improve sales, marketing and operations. That’s according to the Loss Prevention Research Council’s “CCTV in Retail 2012” study, released last week at the National Retail Federation’s BIG Show in New York.

For the report, loss prevention (LP) executives from 47 national and regional retailers completed an online survey about their company’s use of video surveillance, their perceptions of the effects of video surveillance and additional uses of IP-based digital systems beyond security and LP. About one-half of respondents work for a retailer with more than 500 stores, while nearly one-third operate between 101 and 500 stores.

When it comes to using video in their stores, size doesn’t matter, as all respondents’ companies are doing just that, with nearly 64 percent having some form of IP-connected system. In a similar LPRC study, conducted in 2010, only 31.3 percent of respondents were using IP cameras or a combination of IP and analog in their stores. Similarly, use and awareness of intelligent applications for purposes beyond security and LP has grown. Also of note is the fact that nearly three-quarters of the executives who participated in the study use covert cameras for LP.

High-level results of the “CCTV in Retail 2012” report, commissioned by Axis Communications, include:

Migration to IP Video:

- In 2010, two-thirds of respondents said they use analog-only systems, as compared to about one-third who have analog-only today;

- Of those who use analog-only systems, 43percent said they have an IP migration strategy in place, while 21.4percent would like to create a plan in the future;

- The main drivers for the adoption of IP video solutions are better image quality/HDTV and integration with other business systems and intelligent video;

- Only 38.5 percent of respondents with IP-connected digital systems have access to live surveillance footage via a mobile device, yet 87.5 percent would find it beneficial;

- “Cost of technology refresh” remained the biggest obstacle for the adoption of IP video, yet the rise of cross-functional uses of digital video for improved sales, operational efficiencies and new revenue opportunities could lead to budget contributions by other departments.

Intelligent Video for Sales, Marketing and Operational Efficiency:

- Of the retailers who use IP-based video systems for cross-functional benefits outside of security and LP, 93 percent have seen a positive impact on operations, while 40 percent have seen a positive impact on merchandising;

- Nearly one-quarter named “integration with business intelligent video, such as analytics and POS integration” as a main driver for adopting a network/IP system;

- People-counting was by far the most used non-LP analytic application, with 46.3 percent of respondents deploying this feature, up from 27 percent in 2010;

- Dwell time analysis (20 percent) and heat map or hot/cold zone (18.2 percent) usage increased in 2012, while 38.3 percent of respondents use video analytics to detect POS fraud;

- Queue-counters are used by less than 10 percent of companies surveyed, yet 50 percent said they may use this application in future. Similarly, while no respondents said they utilize out-of-stock alerts today, more than 56 percent say they may use them in the future;

- Nearly 32 percent of respondents utilize surveillance to help analyze “shopping and buying behavior,” with 20 percent using video to measure shelf- and product-placement effectiveness;

- More than 60 percent of respondents said that having no one to monitor or analyze video data was the biggest drawback of a video surveillance system, suggesting the need for improved intelligence and proactive alerts.

“Our most recent survey of leading retail asset protection decision-makers indicates the wants are driving the needs for retail video surveillance, as intelligent applications and additional uses of video are opening new doors for the shift to IP solutions,” said Dr. Read Hayes, director, LPRC, and a research scientist at the University of Florida. “Retail executives are telling us IP video gives them greater resolution, flexibility and a much better future upgrade path.”

Perhaps more important is the potential for non-traditional uses for those IP video systems, which can open up new markets for intelligent solutions.

“The need for cameras in stores for LP and security is a given. It’s the cross-functional uses of digital IP video that will propel the industry into the next phase of retail surveillance,” said Jackie Andersen, business development manager for retail at Axis. “There are many greenfield opportunities ranging from IP migration strategies — video encoder solutions, hosted video, edge storage, etc. — to looping in POS and video analytics data that are taking IP video mainstream for retailers with a quantifiable impact on sales and operations.”