With recessionary fears subsiding and continued supply chain improvement, most fire alarm industry stakeholders are expressing a lot of positivity. According to SDM’s 2023 Industry Forecast, 43 percent of security professionals consider the state of the fire alarm market to be very good or excellent, while 41 percent consider it to be good, and 16 percent believe the state of the market is poor or fair.

The forecast also found nearly 60 percent of contractors either currently offer/sell/install fire alarm products or plan to in the next one to two years. Another 13 percent are discussing offering them in the next three to five years.

Ahead, subject matter experts from the manufacturing and integration communities help bring focus to current and upcoming trends in the fire alarm systems market, shedding light on the key developments and innovations that are shaping the industry’s future.

Positive Market Trends

Future Market Insights (FMI), a Newark, Del.-based market research firm, is projecting the global fire alarm systems market size to be valued at $24.1 billion in 2023, rising to $40.6 billion by 2033. Fire alarm systems have emerged as one of the significant requirements among various verticals and sectors in recent years. Factors propelling the demand for fire alarm systems are numerous. FMI cites increasing commercialization, industrialization and urbanization as having increased the use of various electronic devices and other power and electricity-based equipment, thereby increasing the risk of fire accidents.

In particular, an increasing emphasis on safety and regulatory compliance across residential, commercial and industrial sectors has driven higher demand for advanced fire detection and notification solutions. Additionally, the growing awareness of the devastating impact of fires, both in terms of human lives and property damage, has heightened the need for advanced fire alarm systems. Technological advancements, such as the integration of smart and IoT-based features, have also made these systems more efficient and effective, further fueling market expansion.

Kartik Kumar, global P&L leader for Edwards’ commercial fire business, Bradenton, Fla., expresses a positive trajectory for the company following strong performance in 2022 vs. 2021. While the Americas region was the primary growth driver by delivering high, double-digit growth year-over-year performance, he says the company also saw broad-based growth overall across all its segments, driven by strong commercial building construction and upgrade activity.

“We believe that our segment continues to be supported by macro trends such as urbanization and digitization resulting in increased demand for infrastructure and campus-style sites, as well as investment in data centers, warehouses and distribution centers,” Kumar adds.

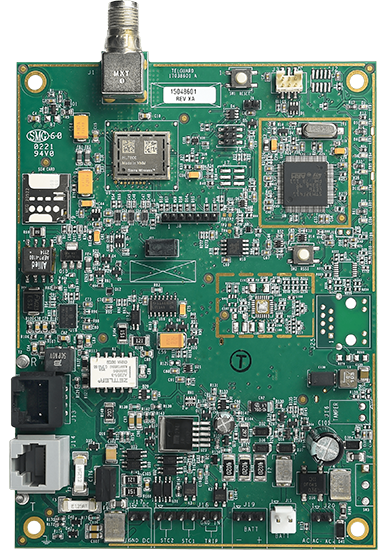

The fire alarm market is one of the fastest growing and important market segments for NAPCO Security Technologies, Amityville, N.Y., says Judy Jones-Shand, vice president of marketing. Through cell network sunsets and ongoing retirement of damage-prone POTs lines, the company’s universal StarLink Fire and new 5G-version StarLink Fire MAX Cellular/IP Commercial Fire Communicator Series have continued to grow rapidly in sales, she says.

“The market adoption is due to their universal support of any brand 12V or 24V fire alarm control panel, ease of installation, equipment and labor cost-savings, plus end-to-end life safety code compliance, as well as rapid acceptance of the technology by AHJs,” she says. “Its market adoption has also given rise to NAPCO’s growing line of FireLink FACU’s with StarLink built-in, including an onboard LCD touchpad and cloud programming.”

Current State of the Market

SDM asked, “How would you rate the current state of the market for fire alarm/emergency communications?”

Source: SDM 2023 and 2022 Industry Forecast Studies

Thomas Dennis, director of sales at Hochiki America Corp., Buena Park, Calif., says the company posted a record year of sales in 2022, with growth in both its OEM and direct markets, including international. Among key factors driving sales, Dennis cites competitor supply chain issues, competitor instability with direction of strategies, and industrywide personnel changes in the upper management arena.

“We expect 2023 to be only slightly better than 2022 due to competitors becoming more stable,” he adds.

Technology advances in the fire alarm communication segment with cloud-based software integration of Telguard cellular and dual path commercial fire communicators helped fuel strong sales in 2022, explains Telguard President George Brody. POTS replacement, he adds, also is contributing to the positive performance in the marketplace as dealers upgraded 3G and CDMA communicators to LTE-5G technology.

Brody describes a fire alarm systems market in which demand is consistent and on the upswing as new construction, facility upgrades and changes taking place in the commercial real estate market are all having a positive, enduring impact.

“The fire alarm business is performing very well for the first half of 2023 and Telguard expects an excellent year in 2023,” he says. “Industry key trends will continue the positive performance in the balance of 2023 and continue on into 2024.”

AES Corp., Peabody, Mass., a manufacturer of wireless communications products that create private mesh networks, experienced slight growth in 2022 compared to 2021, explains Laura Wall, vice president of product development. As dealer partners continue to focus on training and getting their employees up to speed with AES systems, Wall says in addition to new fire installations, more alarm dealers are concentrating on commercial opportunities, which continues to drive growth for AES.

We are expecting 2023 sales to remain slightly above 2022 levels,” she adds. “The industry is starting to see a shift with new technologies being implemented for fire alarms. AES is planning on developing new products that will incorporate these technologies.”

On the integration side of the fire alarm sector, Custom Alarm, Rochester, Minn., is experiencing steady growth in 2023, mainly in the healthcare and K-12 verticals, explains Sales Manager Brandon Clig. Among the company’s largest end customers is a prominent medical center undergoing a lot of expansion to serve the growing region.

“They are pushing a lot of money out into the economy, and we’re growing with them with a lot of the new technology, incorporating a lot of different systems including the fire alarm system,” Clig says.

Multifamily housing, another key vertical for Custom Alarm, seems to have entered a sluggish period, Clig says, with the building community leery of the economy and the political calendar.

“Some of the developers are a little bit cautious in putting up new buildings, just with the word recession and going into an election year in 2024,” he says. “They are a little hesitant to be dumping millions of dollars into these new buildings with high interest rates, even though we still do need housing here in our area. But overall, it’s been a successful year.”

Revenue Change Expectations

SDM asked, “Compared to this year, how do you expect your company’s revenue in each of the following categories to change next year?”

Source: SDM 2023 and 2022 Industry Forecast Studies

Remote Diagnostics on the Rise

Remote diagnostics in fire alarm panels have emerged as a game-changing innovation in the industry. These advanced capabilities now enable technicians and facility managers to assess and troubleshoot fire alarm systems from a distance, significantly enhancing efficiency and reducing response times.

As Kumar explains, for years the fire industry has faced challenges with facility shutdowns, reduced staff and effectively managing incidents with a shortage of skilled resources and information. Despite developments made in safety products and emergency response, the greatest challenge fire technicians still face today are the unknown factors they will have to deal with when they arrive on site, where the risks remain the same no matter the occupancy level.

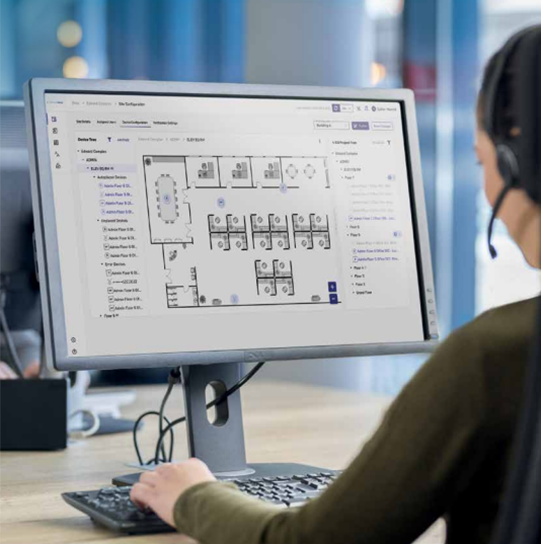

“The advancements in the connected safety offerings can alleviate some of these challenges by equipping facility managers and fire technicians with high fidelity information that allows them to ‘know before you go,’” he says. “Our recently launched Edwards ConnectedSafety+ site and system management software application provides remote diagnostics, maintenance and trouble-shooting capabilities resulting in numerous cost efficiencies and reduced site disruptions.”

Remote diagnostics can pinpoint issues such as faulty sensors or system malfunctions in real time, allowing for immediate corrective action without the need for physical on-site inspections.

Moreover, these systems often incorporate predictive maintenance algorithms, which can proactively identify potential problems before they escalate, further minimizing downtime and ensuring the reliability of fire alarm systems. With the integration of remote diagnostics, the fire alarm industry is witnessing a transformative shift toward proactive maintenance and heightened system reliability, ultimately bolstering safety and peace of mind for end users.

84%

The percentage of security professionals who consider the state of the fire alarm market to be excellent, very good or good.

Source: SDM 2023 Industry Forecast

“We’ve seen two of our largest customers really jump on board, which has helped put our minds at ease when we have two of our largest accounts that have really dove into this,” Clig comments.

Custom Alarm is installing the NOTIFIER system with multi-criteria addressable detectors and the Honeywell Connected Life Safety Services (CLSS) Gateway. For its large medical center end customer, Clig said they will also soon be deploying CLSS Horizon, a graphical display software that will provide the next generation in life safety management for on-premises and remote visibility of the fire alarm system.

“Just looking at other technologies in the industry with security systems, it’s been many years that end users have been able to pull up an app on their phone and see the status of their system and see what’s going on with it,” Clig explains. “We’re finally there now with the fire alarm systems. You can see an active alarm that’s going off. You can see what kind of trouble or supervisory signal is going on right from a mobile app on your phone.”

The technology also leverages public safety answering points (PSAPs), delivering signals from the fire alarm system directly to emergency responders. This allows first responders to access real-time data from the fire alarm system, such as the location of the alarm, the type of detected fire and the status of building occupants. These critical details now enable them to quickly assess the situation before arriving on the scene.

“They know exactly what smoke detectors are going off, so they don’t have to get to the building not knowing what they’re going to be walking into,” Clig says. “They have all these visuals now with the maps and everything that are going to be loaded onto the CLSS Horizon with the graphics and the workstation.”

Apprising the Smoke Detector Sector

In a 2021 report, the National Fire Protection Association (NFPA) said almost three out of five home fire deaths in the United States resulted from fires in properties with no smoke alarms (41 percent) or smoke alarms that failed to operate (16 percent).

When present, hardwired smoke alarms operated in 94 percent of the fires considered large enough to trigger a smoke alarm. Battery-powered alarms operated 82 percent of the time. Power source issues were the most common factors when smoke alarms failed to operate, according to the report.

“The past few editions of NFPA 72 have added requirement for smoke alarms and detectors to be listed for a resistance to common nuisance sources when installed near cooking appliances.”

—Shawn Mahoney

Recent advances in smoke detectors have transformed fire safety by introducing cutting-edge technologies that enhance detection accuracy and responsiveness. Traditional ionization and photoelectric sensors have been augmented with multi-sensor technology, combining both detection methods to reduce false alarms while swiftly identifying various types of fires, from smoldering to fast-flaming ones.

Moreover, interconnected smart smoke detectors now form part of integrated home automation systems, providing real-time alerts to homeowners via mobile apps and enabling remote monitoring. Some models even incorporate advanced features like self-testing capabilities and the ability to distinguish between real emergencies and non-threatening conditions such as cooking smoke. With these innovations, smoke detectors are becoming increasingly reliable and effective tools in safeguarding lives and property from the dangers of fire.

As of January 2023, NFPA 72 requires smoke alarms and detectors within 20 feet of cooking appliances be listed for resistance to common nuisance sources from cooking, replacing common alarms with smart multicriteria smoke detectors and smoke alarms that can distinguish between a true fire or burning toast and nuisance sources.

“The past few editions of NFPA 72 have added requirement for smoke alarms and detectors to be listed for a resistance to common nuisance sources when installed near cooking appliances,” says Shawn Mahoney, technical services engineer for NFPA, Quincy, Mass. “Typically, these nuisance alarms are set off by common cooking appliances. One of the biggest issues is if there are frequent nuisance alarms in a residential occupancy, the occupant may be inclined to disable the alarm, causing a failure to perform as intended during a true emergency.”

According to India-based market research firm Mordor Intelligence, the global smoke detector market size is forecast to grow from $2.8 billion in 2023 to $3.97 billion by 2028. That amounts to a compound annual growth rate of 7.13 percent. North America accounts for the largest market share.

“Some of the developers are a little bit cautious in putting up new [multi-family] buildings, just with the word recession and going into an election year in 2024.”

— Brandon Clig, Custom Alarm

The COVID-19 pandemic adversely impacted the smoke detector industry as many organizations worldwide were compelled to shut down. This resulted in a demand-supply gap, a lack of workers, a delay in manufacture, and a postponement in the shipment of supplies and other parts of smoke detectors, according to Mordor Intelligence. However, the restoration of production activity has resulted in a large increase in the deployment of smoke detectors in the residential, healthcare and production industries.

Adding Fire Services

SDM asked, “Are you offering, or planning on offering, fire alarm products and services?

// SOURCE: SDM 2023 INDUSTRY FORECAST STUDY

6.7%

The forecasted compound annual growth rate (CAGR) of the global fire automation system market to reach $130.4 billion in 2030.

Source: Adroit Market Research

Advancing technologies are also propelling growth across a range of sectors and end-user types. For example, wireless fire alarm systems and aspirating smoke detection are experiencing significant growth, according to Kumar.

“The installation, programming and maintenance of traditional wired alarm systems remains a labor-intensive process,” he says. “The adoption of wireless technology can greatly improve the installation and maintenance of fire alarm systems. Typical customers of smaller hotels, businesses, temporary construction sites, heritage buildings, etc., are looking for a flexible system that can be rapidly deployed with minimum building and occupant disruption.”

“We believe that our segment continues to be supported by macro trends such as urbanization and digitization resulting in increased demand for infrastructure and campus-style sites, as well as investment in data centers, warehouses and distribution centers.”

— Kartik Kumar, Edwards

Industry and infrastructure is another segment that is growing much faster than residential and commercial retail and office space, Kumar says. Key verticals like data centers, warehouses and manufacturing units are experiencing phenomenal growth, he says. Although these sites are not heavily populated, they are just as important due to the high value of the property, infrastructure and contents. The higher the value of properties and assets, the more damaging a fire can be.

“Active smoke detection or aspirating smoke detection is a highly effective way to protect these critical assets,” he continues. “Because ‘active’ detection systems acquire an air sample from the surrounding monitoring area and immediately assess threats, customers are expected to invest heavily in them.”