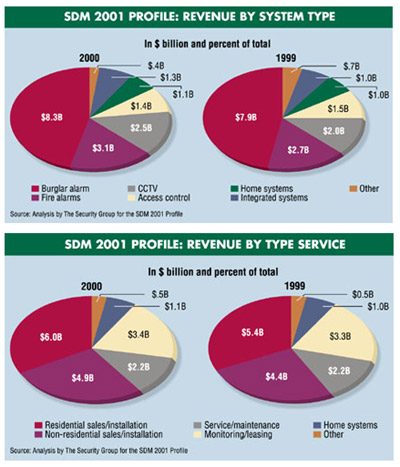

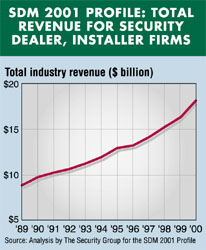

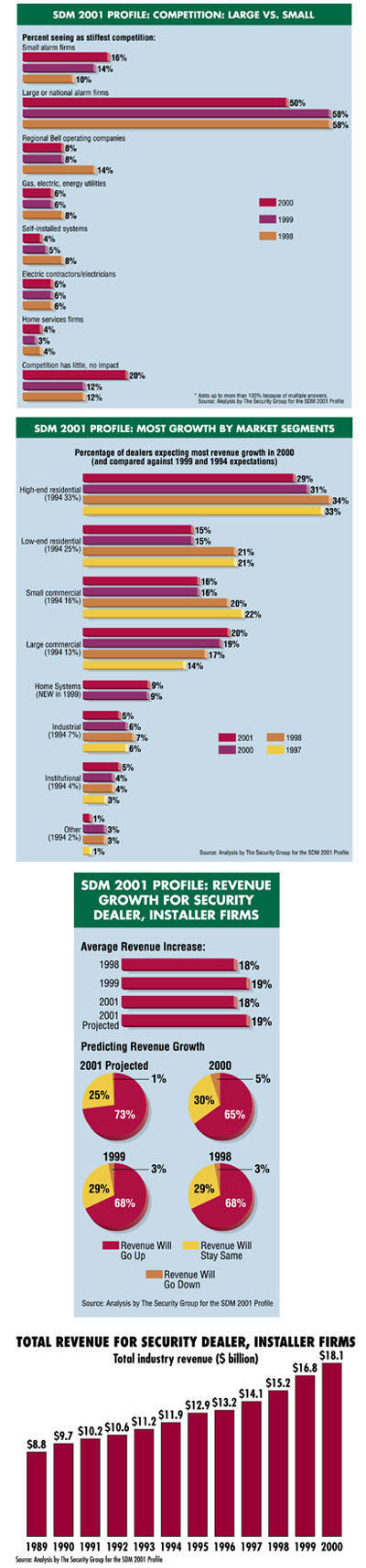

The good times kept rolling along last year, with revenues by security dealer firms hitting $18.1 billion. In 2000, the bread-and-butter burglar and fire alarm business once again grabbed lion’s share of total dollars, thanks to the continuing strong U.S. economy, robust new home construction, strong existing home sales and powerful business and government new building construction.

Diversification

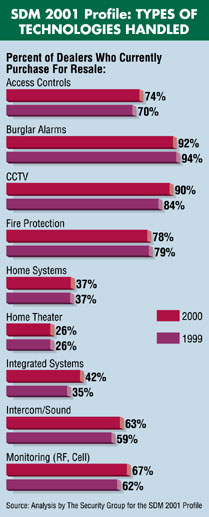

Dealers also have settled into a diversity of products and services outside burglar and fire alarms. This is especially true of the growth of CCTV video surveillance — handled by more dealers than ever before and a continuing hot purchase by end user buyers, mostly, of course, at nonresidential sites.It is an important indication of the influence of technology within the security business that dealers, for the first time in the nearly two decades of the SDM annual business activity survey, rank “keeping current with technology†among the top four challenges they will face over the next several years.

The annual SDM Magazine survey of business activity is the oldest such continuing industry research.

On an annual basis, SDM surveys a large, representative sampling of all types and sizes of security dealer and installer firms. This annual survey provides valuable insights into current condition and future trends.

Mailed Questionnaire

In October 2000, SDM mailed out a questionnaire to 2,000 top executives at active dealer, installer and systems integrator firms. There was a total of 14% responses that were usable.Survey results cover myriad topics. Included among them are dealer response about such factors as industry consolidation and use of the Internet by dealers.

There’s no doubt, of course, that a small group of the largest security firms control a sizable portion of the total dealer market. SDM ranks these largest dealers that install in its SDM 100 report.

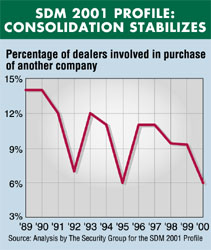

That mix of sizes of businesses and market share is a fairly common situation in many industries. So is the push for consolidation, which, according to the SDM study, has slowed significantly.

About 6.5% of dealers report they have been involved in the purchase of another company in 2000 as compared to 9.3% the year before.

Consolidation Shifts

Based on SDM survey follow-up interviews, consolidation has, in many ways, instead concentrated among manufacturing firms and through the global arena.If there is any element more important to dealers than the impact of consolidation, according to survey respondents, it is the growth of revenue and the keen need to protect and grow profit margins.

When dealers were asked to project revenue growth for 2001, they are very bullish. Nearly three-quarters of dealers (73%) believe their revenues will go up this year as compared to those who reported revenue growth last year.

They are just as sure when asked to rank whom they consider their stiffest competition.

Less Concerned about Competitors

While about half of the SDM survey respondents see large or national alarm firms as the most important competitors (a drop of eight points), a significant 20% now believe that competitors have little or no impact on their own business. Another 16% see other small-sized alarm firms as the prime competitor.With so much good news — higher revenues, more diversity of business, a more stable business environment, more growth this year, it's ironic but not surprising that dealers face troubling Year 2001 signs.

Foremost are the state of the U.S. economy and its "twin sister," the high price of energy.

It's also obvious that the slowing U.S. economy may not impact every business and every region in the same way.

Impact of High Energy Costs

But equally troubling — at least in a macro way — is the feeling that sustained high cost of energy could spur a harder "landing" of the economy.There is some historic truth to such concerns.

Recent previous U.S. economic recessions had — at their heart — escalating energy prices. There is more than just a feeling that the U.S. economy is slowing down.

Slowing of Housing Sector

On the residential side, sale of existing homes and new housing starts slowed a bit in 2000, with most housing analysts predicting a continuing slowdown through at least mid-2001. It is important, however, to note that last year proved the second best year on record for new home construction and home resales in the U.S. And, again depending on the hard or soft landing of the slowing economy, homebuilders should have a reasonably solid year 2001 nonetheless.When viewing the dealer sector from the standpoint of residential versus nonresidential business, the SDM survey discovered factors proving both consistency and change.

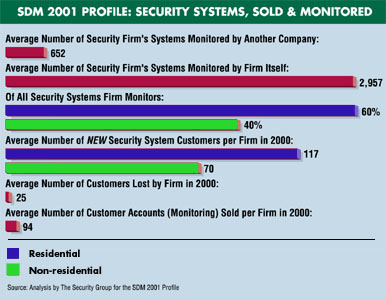

Consistently, for example, the sector as a whole divides up business with 60% coming from residential and 40% from nonresidential. The change? Fewer dealers are involved in high-end residential (29% in 2001 as compared to 34% in 1998) and low-end residential (15% compared to 21%) while there’s growing involvement in so-called large commercial business (20% compared to 17%).

Seeking Niches and Specialties

In follow-up interviews with respondents, the large national and regional dealer firms were more involved in mass-market residential while builders of luxury homes are more often in tighter relationships with fewer home security dealers who also provide structured wiring, home network and home systems work.The allure of larger, commercial jobs also is rather obvious: larger margins and often a longer, deeper client-to-dealer relationship.

Over the past year, there has been a lot of talk and media coverage about home systems (the new political correct phrase for “home automationâ€) and home network technologies, including structured wiring, home broadband and wireless as well as home theater. The annual SDM survey found, however, the number of dealer firms working this area hasn’t increased.

In ways similar to home security, some of the largest dealer firms have relationship agreements with new homebuilders for structured wiring and low-volt home networking. Of course, home systems beyond security are not every security dealer’s cup of tea.

Home Networking Evolution

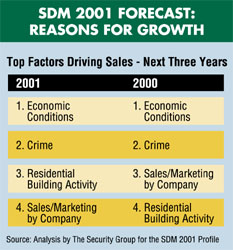

Further, the slowing U.S. economy could have significant impact here. Already the sale of home personal computers fell off the table during the close of 2001. Home PCs are the heart of many home automation designs. Some observers now feel that home broadband may also be more hype than real business — at least at this time.According to the SDM survey, when asked to name top factors driving security sales for the next three year, dealers consistently list “economic conditions†in the top spot, following by “crime.†This year, dealers ranked “residential building activity†as the third most important factor driving security sales while placing “sales and marketing†in fourth place.

The SDM survey also provides valuable insight into the top challenges that dealers believe they face.

Reflecting the tight labor market generally, dealers for the second straight year ranked “finding and retaining employees†as their top challenge. And, for the first time in a decade, dealers ranked “keeping current with technology†among the top four challenges.

In survey follow-up interviews, dealers report that their product and service offerings now are much more dependent on computer and communications technologies as well as niche technologies such as CCTV, smart cards and biometrics. So it is natural for dealers to see “keeping current†so much more important.

Additional Charts and Graphs

About the SDM Survey of Business Activity

To determine total revenue and growth, the SDM survey employs a consistent formula that accommodates large firm revenues and growth projections without destabilizing the entire respondent base with regard to the vast number of small firms.The SDM survey, with breakdowns by type, size and location of the dealer firm, is for sale at $150 per copy. Contact: The Security Group, SDM Year 2001 Profile Research, BNP Media, 1050 IL Route 83, Suite 200, Bensenville, IL 60106 or email SDM@bnpmedia.com and mention the Year 2001 SDM Industry Profile.