|

| Mergers and acquisitions spur use of security system integrators. Different systems need to be brought together. Pictured is a Comerica Bank sign unveiled at a former Sterling Bank location. Photo courtesy PRNewsFoto/Comerica Incorporated |

Take Willie Sutton’s advice.

When the infamous robber was asked why he targeted banks, he said, “That’s where the money is.”

Of course, Willie never said that. And, ironically, in his after-jail years, Sutton earned a nice living from the bankers, specifically with New Britain Bank and Trust of Connecticut, starring in a television commercial to promote the bank’s then new MasterCharge credit card that boasted a cardholder photo for additional security.

Bank security has evolved since those days and so has the business of integrating the people, processes and technologies that protect bank employees, facilities and, oh yes, the money.

Today, there are a number of security integrators who target banks and financial institutions. With bank bail-outs a political debate during election season, don’t jump to the conclusion that these organizations are in the red. There is ongoing business for security integrators. And, with mergers and acquisitions, and the comings and goings of branch stores, business can easily turn to new security technology or upgrading of legacy systems. Regulations, federal and varying by state, mandate a certain level of security.

Then there are unique and emerging opportunities that can range from migration from analog to digital video and headquarters card access controls to ATM protection, biometrics and man traps. In pilot programs, next generation ATMs, for instance, are live action interactive and video centric.

So if you think that banking and the financial industry are on the ropes, thanks to the economy, think again.

No doubt, there is less than half as many total number of bank and savings institutions (7.357) in 2011 as compared with 15,158 in 1990. But there are more than 99,000 bank facilities last year as compared to 82,000 or so in 1992. There also are 7,535 credit unions, a growing sector. And, when it comes to the money, banking has never been more flush, boasting deposits of $10,183 billion last year, nearly twice as much as in 2002. Bank and credit union profits are soaring. See a “By the Number” article below for a profile of the industry.

According to Jackie Grimm, vice president of security services at Diebold of North Canton, Ohio, “A key to success [in the banking sector] is a commitment to customers. It is important to cover the diversity of products and security services across a wide geographic area of North America. We have invested in people, process and technologies to bring solutions to customers.”

Adds Marty Patnaude, senior security consultant with American Alarm of Arlington, Mass., “I think what’s important is a combination of top-tier customer service, and understanding the specialized needs of the banking industry. Not every industry is dealing with large sums of cash and is subject to robbery on a daily basis, so we work hard to understand their needs.”

In many ways, the industry “has stabilized because of those mergers and acquisitions,” points out John Stemno at Sierra Group, Glendale, Calif. And that has helped some integrators who specialize in banking and financial clients.

“When working with a client, an important element is subject matter expertise. You have to understand this industry,” says John Nemerofsky, vice president of market solutions at Stanley Convergent Security Systems, Naperville, Ill.

“This is one of our fastest growing areas. The bigger banks are spending dollars to upgrade and maintain their systems. New technology and solutions are lowering their costs and our costs, too,” says Nemerofsky. One trend, according to the Stanley executive: More hosting or managing through the cloud. “There is also increased interest [by bank security] in mobile devices that connect into security systems.”

The “banking space is a unique space. It is a secure environment but you invited customers in. There also are backrooms where customers are not invited in. It’s a matter of the appropriate level of security,” says Grimm.

Like other retail operations, banking has common and distinctive security needs. “Staff turnover on the end user side makes for a fluid labor pool,” says Drew Chernoy of Scarsdale Security Systems, Scarsdale, N.Y. In new construction, remodeling or for merger and acquisition changes, integration “schedules run at a very quick pace,” Chernoy says, and adds that regulations, compliance and insurance also impact needs.

|

| Video plays a growing role in new bank services. For example, Dollar Bank customers can conduct a wide range of transactions with a live, remote teller using video enhanced ATM machines from NCR. Photo courtesy Marketwire |

Nemerofsky agrees that speed is important, including service. “There are limited times in which branches are open so response time is very important.” He adds, “There is always the need to have the right person arrive at the right time with the right gear.” When it comes to retrofitting, “we have to work as customers come and go and with employees also working there.”

Integrators can find opportunity in the need for both high-quality equipment and the experience to integrate a comprehensive security system. “All the typical elements of physical security for buildings are important, and video surveillance plays a very large role. Banks are looking for high quality video systems that capture good images, because they are often needed to investigate robberies or incidents of fraud. Also, redundant communications is a must for bank security systems, as are panic buttons, both hard-wired and wireless, that are available in many locations so employees can signal for help,” says Patnaude.

“With more branches, there is more volume” when it comes to security integration, adds Stemno. There are more store front retail operations and enhanced alarms for ATMs.

“The financial industry is very signal intensive,” says Grimm. Diebold, for example, has a CSAA Five Diamond central station.

According to Patnaude, “An important differentiator is that we have our own UL certified, state-of-the-art central station, which is dedicated only for monitoring our customers’ systems. This gives our banking customers an added level of comfort because they know we don’t outsource this vital piece of their security package.”

For technologies in banking and financial enterprises, it’s obvious that intrusion detection, access controls and security video are the big three, according to Alan Kruglak of Genesis Security Systems, Germantown, Maryland. The biggest of the three, for integrators working this sector, is video. “The major challenge is the transition to a digital platform,” says Kruglak. As compared to some other verticals, banks have been somewhat slower to move from analog.

Beyond the threesome, Nemerofsky sees value in physical security information management for situational analysis and command and control. “You can collect security information and work on an all-in-one GUI. It also helps with video resolution and incident reporting.”

There is also interest in more sophisticated credential management, that goes beyond typical card access control, says Nemerofsky.

There, however, is an appetite for new technology that has a return on investment. “We are not ‘me too,’” says Bill Hemminger, executive vice president at Bank Design & Equipment, Waynesboro, Va. The important integrator element is the ability to bring diverse systems and processes together, he adds. “We often act as a beta testing arena,” says Troy Keller, Bank Design’s director of engineering.

Software analytics is playing a greater role as integration moves through human resources to operations to access control and video, contends Hemminger. “Video storage is important for forensics. Right now we do about 50 to 50 analog to IP video.” For Keller, the key is open systems as well as appropriate application of video, for example, use of 360 degree cameras in addition to cameras aimed at teller windows.

Access controls have grown beyond a bank’s headquarters doors. Stemno observes that, today, “there is card access in the branch banks, in cash rooms and ATM room.” This includes physical access and auditing in the backroom and IT rooms, too.

Then there is “biometrics on the card,” adds Kruglak. With the growing risk of cybercrimes, financial institutions have or are upgrading access controls into their data centers and their outsourced facilities.

Concerning installation challenges, Patnaude comments that the “challenges we face have to do with aesthetics. Our banking customers want their facilities to look great, so we work very hard to have our systems blend in with the décor so they are almost be invisible to the customer. We’ve had cameras wrapped in wallpaper, integrated behind signs, painted specialized colors to blend in with lighting fixtures or wood work. You name it, we’ll do it, to customize as best we can to meet the clients aesthetic expectations.”

The future? “There will be advancement of analytics, tighter integration across all the various platforms. Technology keeps evolving. There is more connectivity and a push to bring video right to tellers,” comments Hemminger. His firm has established a modified mesh network, for instance, so that law enforcement approaching a bank incident can connect into the facility’s video system.

Patnaude adds that “there is a clear trend for better quality video systems, more powerful cameras, and having them all networked. Also, I expect we’ll see increasing use of biometric means of identification, both for bank employees and for customers, to guard against internal fraud and identity theft. Also, the level of security at standalone ATM kiosks will continue to become more sophisticated, with technology aimed at preventing ‘sniffing’ of account information and other electronic threats.”

Even as banks and financial institutions rebuild and reconfigure, they haven’t taken their eye off of their own spending. Integrator “margins have been severely compressed,” comments Kruglak.

“Our clients are concerned about performance” when asked about profits and margins, says Hemminger. One strategy he sees value in is a quantity purchase agreement with established discounts. “We have to make a profit. We tell them our margin and they are happy.”

Banks are always looking at budgets. But integrated services for security shift things from capital expense, points out Diebold’s Grimm.

|

|

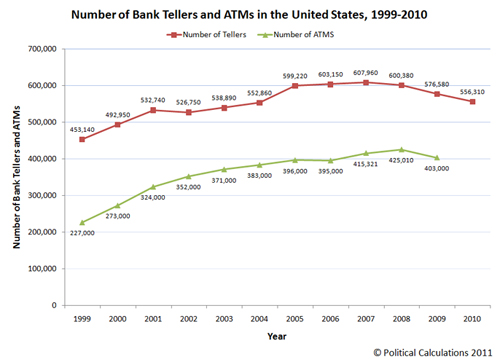

There are more tellers than ATMs. Most banks deploy one camera per teller but with the advance of megapixel cameras there are fewer cameras per teller. |