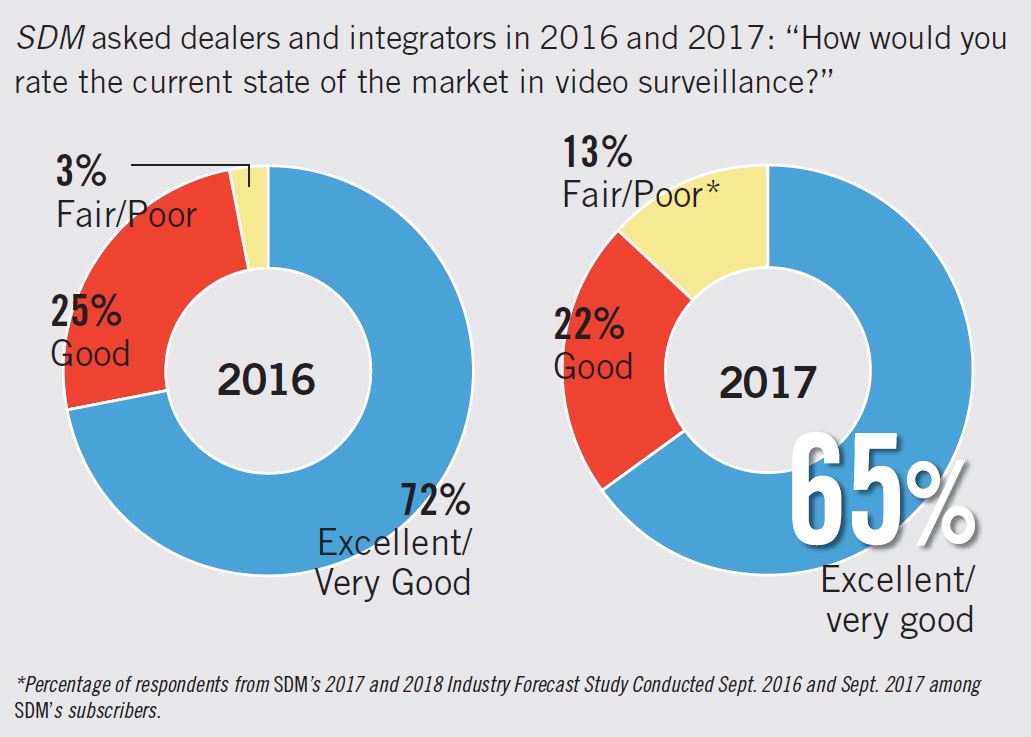

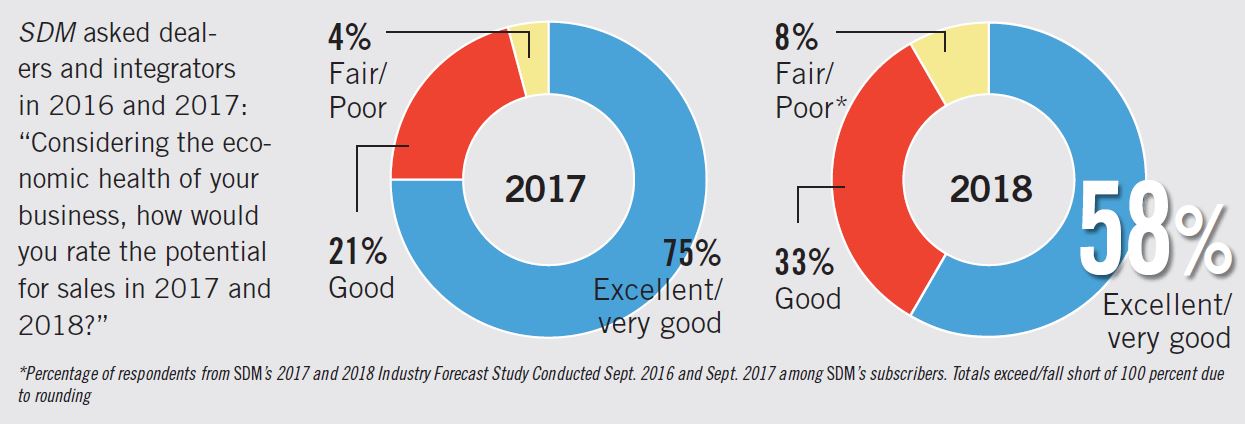

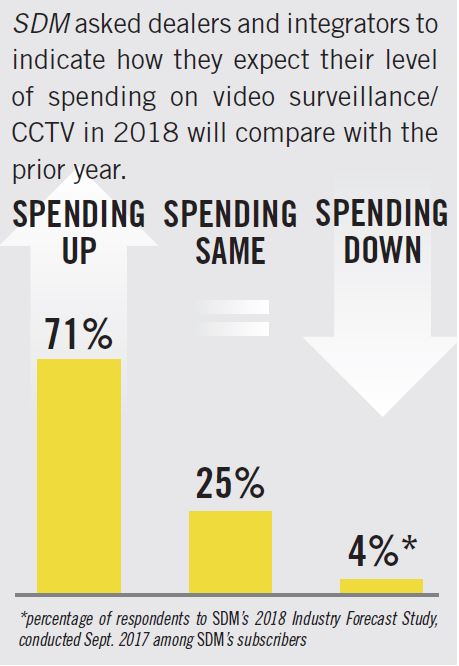

The overwhelming consensus among security professionals interviewed for this first in SDM’s 2018 series of State of the Market articles, is that the video surveillance market remains strong and will continue to grow. Several factors driving that growth are a greater number of applications for video, or increased integration, and several technologies that are starting to become more mainstream, such as analytics, big data, and others.

“It’s been a terrific industry,” says Tony Varco, vice president of the security division for Convergint Technologies, Schaumburg, Ill., “and I don’t see this slowing down anytime soon. The industry is incredibly healthy right now.”

Meng Chhun, marketing manager, VIVOTEK USA, San Jose, Calif., agrees: “2017 was a great year for VIVOTEK, and we will carry this momentum into 2018 with great excitement.”

Yet while there is plenty of cause for optimism and confidence, growth may have slowed slightly this year, due in part to dropping camera prices, saturation and a leveling off of the transition from analog to IP technologies.

Market Drivers

One thing that always drives a market is compliance, specifically when end users are up against requirements. “We have seen a lot of traction there and in those particular verticals because of the compliance requirements,” Varco says. He says many compliance drivers exist in verticals such as utilities and healthcare.

Varco says that while the Trump Administration seems to be relaxing many business regulations, security is one thing it is not compromising. “We see it as more of a continuation of the last administration as we look certainly in this year and well into the future.”

The new president and political issues did have an impact on capital spending, though, says Sean Murphy, director of regional marketing – video systems, Bosch Security Systems, Fairport, N.Y. “Also, in several vertical markets, there was a pause in spending, which caused pent-up demand followed by a surge of demand.”

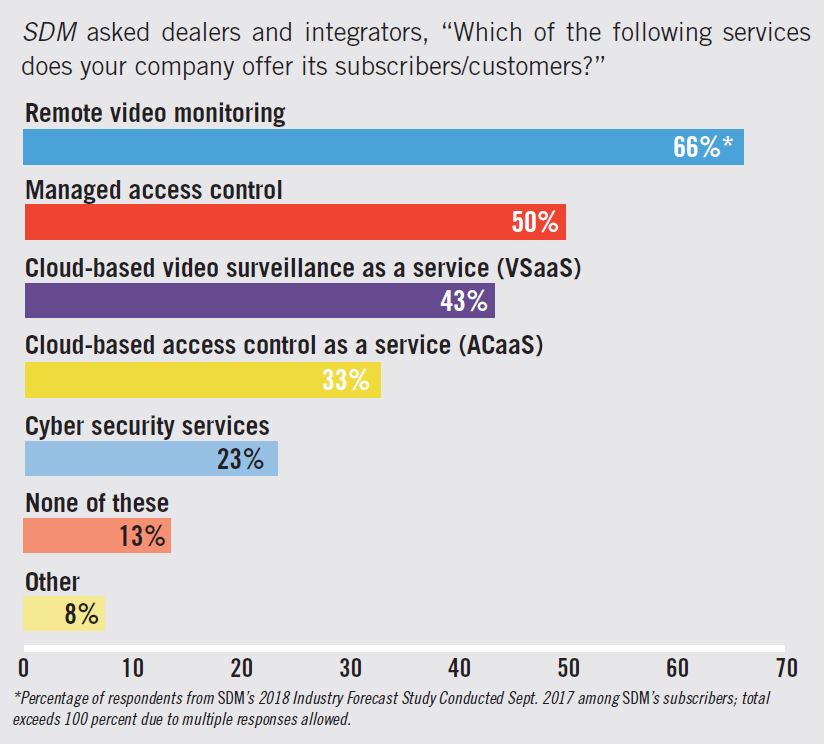

Another driver in the video surveillance market is technological advancements and the interconnectivity of different technologies that never used to cross paths with each other. Varco says it is the ability to leverage sensors and devices on the Internet of Things to provide customers with some actionable intelligence that is really driving the market. Andrew Elvish, vice president of marketing product management, Genetec, Montreal, says, “I think people are getting fed up with maintaining disparate systems across video, access control, license plate recognition, building automation — especially video and access control, because so many features are common between the two. Especially in the large-scale enterprise space, we saw demand growing in the unified sector of our business.”

Ongoing threats, whether they be crime, terrorism or cyber security (for more about the state of cyber security in the security market, read “All Aboard the Cyber Train” on page 49) represent a third driver. “Every unfortunate event we hear about, whether it’s cyber-related or just flat out terrorism, these are drivers for our business. It’s unfortunate that they are and that they happen, but they do drive this industry and this market.”

There is an acute awareness for the need for better security and perimeter protection, agrees John Distelzweig, vice president and general manager of the security segment, FLIR, Beaverton, Ore.

“For this reason, we anticipate 2018 to be another year of growth and new business opportunities for FLIR and our intrusion detection technologies.”

Elvish adds, “Cyber security was on a lot of people’s minds this year. I think we saw evidence that physical security systems are an excellent, and in many ways, an unprotected vector for attacks. So I think they were thinking safety within companies that put a higher premium on things like cyber security and features that would help them manage their complex systems better.”

But are we close to a saturation point with video surveillance? “We are nowhere near the saturation point with video surveillance,” says Ken Francis, president, Eagle Eye Networks, Austin, Texas. “The growth and the sheer availability of the Internet is making it easier and easier for people to add video surveillance anywhere they want it and manage it as part of a bigger system. I don’t see a saturation point on the short- or midterm horizon.”

What's Hot

In terms of what end users are asking for, as it relates to bidding, Varco says, higher megapixels and multi-sensor technology in cameras are in highest demand. Another popular technology is thermal cameras. “We’ve seen a significant reduction in cost of thermal cameras over the last three years that’s allowing customers to invest now in thermal cameras, which gives them a whole other view of their world, especially in low-light or night conditions,” he describes.

Fredrik Nilsson, vice president Americas, Axis Communications, Chelmsford, Mass., says it is these technologies — improving resolution, better low-light capabilities, and multi-sensor cameras — that are still leading the charge. “We shouldn’t forget that general trend of improving technologies that we think, ‘Well, haven’t we talked about that for the last 10 years?’ Yes we have, but that’s what is driving the market,” he says.

Nilsson says multi-sensor cameras are a big driver in the market and have been selling a lot more in the past two years. “We’ve had some offerings this year that we almost couldn’t ship enough because this became very popular very quickly, and also fisheye technology, which again is nothing really new,” Nilsson says; “it’s now really getting to the spot where a lot of customers really want it, and that’s been a great growth market for us and other companies over the last year as well.”

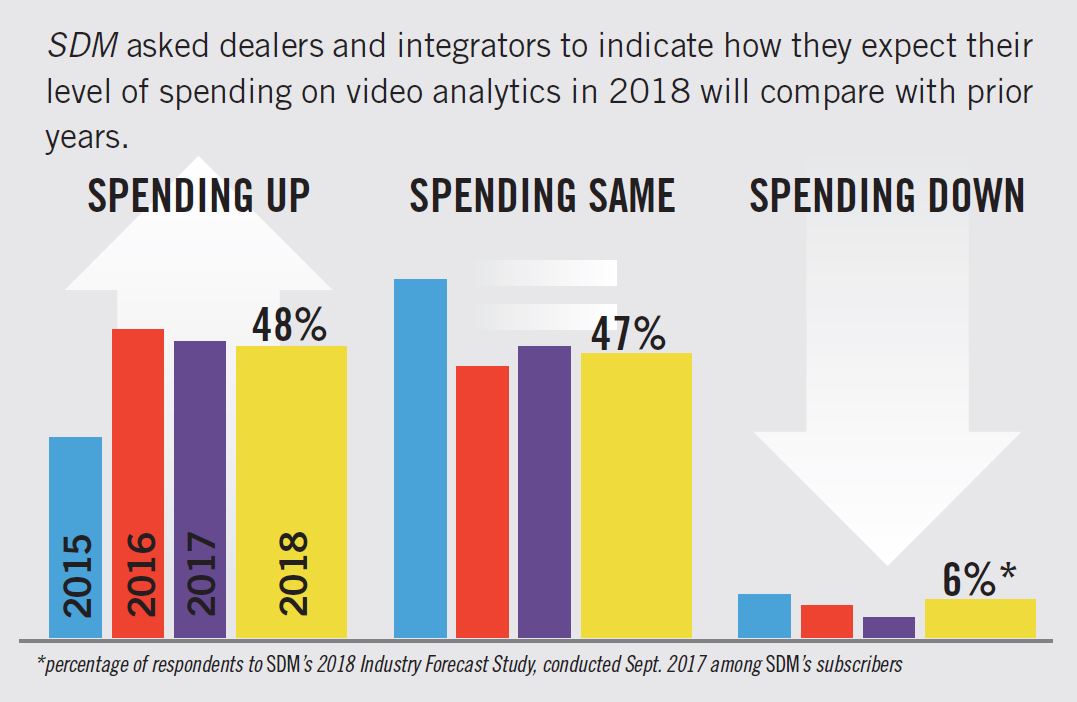

Analytics is another big technology driver. “We’re finding customers are very desirous of analytic technology and specifically analytics that are more to germane to their particular business or their vertical,” Varco says. “So it’s no longer just a trip wire if somebody walks from this way to that way kind of thing, but it’s more analytics that are specific to, let’s say, a utility industry or a police department within a municipality — they’re looking for very specific things, and so more and more analytics are being developed to address specific vertical market needs.”

Analytics has become the latest buzzword in the industry, says Hank Monaco, vice president – marketing, building solutions North America, Johnson Controls, Milwaukee. “For those of us who have been in the industry for a while, these buzzwords become something that everyone rallies around for a period of time and then moves on, but it’s really the insights that we can derive and then the ways we can help the customer either save money or increase performance of their systems that really comes into play there.”

He adds, “We have examples on the retail side of our business where applying analytics has helped folks in merchandising and performance or inventory stocking. We think there is a really big opportunity for us to do more of that over time. Those things will also bring us as an integrator up to a different level with our customers in a partnership standpoint because we have an opportunity to reach out and talk to a number of folks at the customer level that we as a security provider may not have historically had the chance to talk [to].”

Deep learning analytics is now replacing traditional video analytics in applications like face and license plate recognition, says Alex Johnson, senior director, analytics and strategy, Verint Systems, Huntington, N.Y. “We expect to see this technology solve unique industry problems that are not currently possible with existing systems. The continued evolution to more cloud-based solutions will allow customers to choose whatever architecture best suits their needs, whether it be a fully on-premise solution, fully cloud-enabled solution, or a hybrid architecture.”

Jake Parker, director of government relations, Security Industry Association, says body-worn cameras are an area to keep an eye on. “So far so good from what I hear from our members who are involved in that,” he says. “The adoption really seems to be picking up in law enforcement agencies. It seems like something that is really going to eventually be literally everywhere. The barriers to implementation there have been mainly on the use-policy side of things — when they’re required to use them, who can access the information, and how much of it is stored and how long, which has taken a few years to get straightened out. It varies based on local politics.”

Jennifer Hackenburg, senior product marketing manager, Dahua Technology USA, Irvine, Calif., says end users are asking about solutions that mitigate risk and create efficiencies across the enterprise. “Specifically, end users are expressing interest in 4K HDCVI Technology, ePoE Technology, PTZ cameras, and multi-sensor cameras, all of which can be applied to create video surveillance systems that deliver excellent cost efficiency and performance that exceed conventional surveillance solutions.” In addition, she says, end users continue to be interested in compression technologies.

Industry Challenges

One challenge in the industry is being able to offer customers more with less. “If I’m spending money on a VMS system and cameras and IP systems,” Elvish says, “what more can I do with that? What data insights can come from that, and what can we do with that data? That’s where the savvy integrators out there will see this as an opportunity to consult and then expand their practice so that they have that ability to go in and talk about intelligence operation and security, and about how to bring things such as software as a service to the table so the customers can really have a very flexible system that they can add to as they need.”

He adds, “The challenge comes back to a sort of inertia in the industry. The challenge for the integrator will be to stop thinking like integrators in 2005. Customers out there are very savvy; their expectations are tuned by companies like Salesforce.com, by Microsoft, Apple — so they’re coming to the table with a lot of expectations, and if what they get is some sort of basic, C-grade software with [cheap] cameras, I don’t get the sense [the integrators] are going to be around for very long.”

Monaco is seeing this trend with customers. “The more sophisticated uses that we’re seeing our customers apply have to do with integrating video with things like point-of-sale, integrating video with other practices that they might have to drive different behaviors in their operations, in addition to the standard applications we see from a security standpoint.”

Something else to consider, Nilsson says, is preference not necessarily for “Made in the U.S.A., but for what jobs can be provided to the economy, and will there be a mandate for more value addition being done in the U.S. instead of products being manufactured overseas. “Have we seen any yet? No,” he says, “but there have been discussions and we have investigated what we need to do — absolutely.”

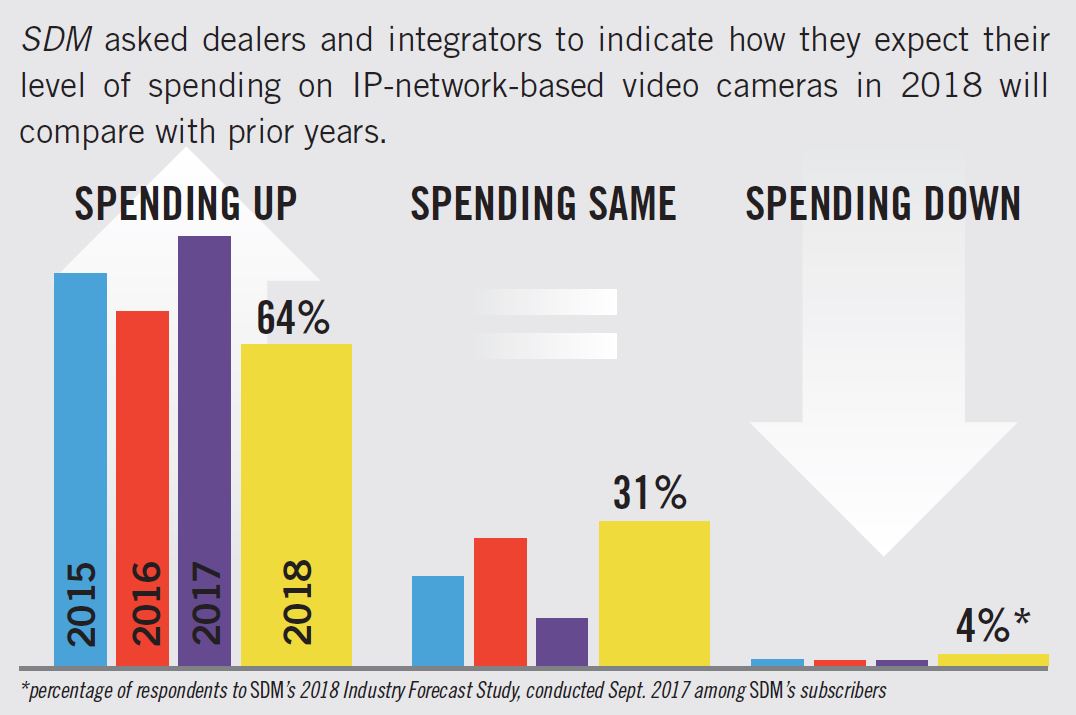

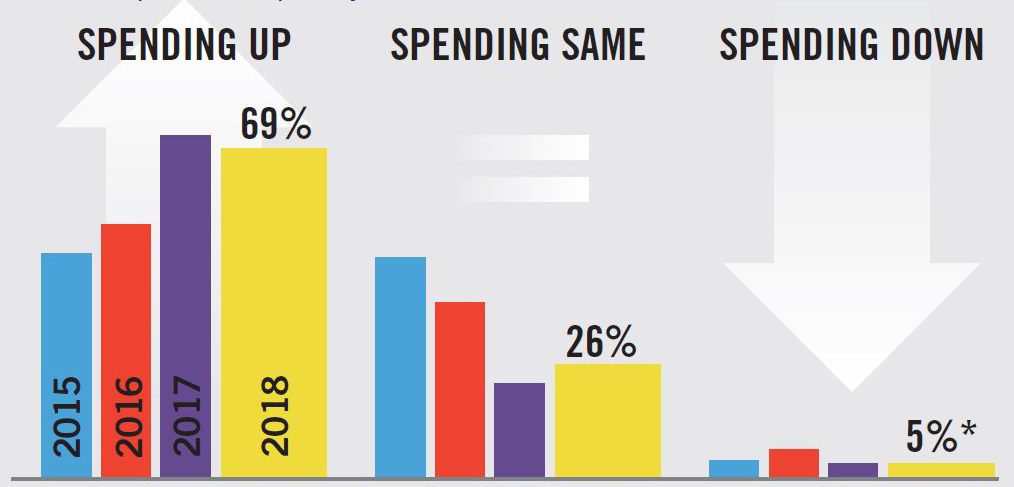

Another challenge may be to replace the shift to IP which is almost complete. By now, nearly everyone who is going to change over to IP cameras has, but that doesn’t mean the opportunities aren’t there to continue capitalizing on IP. Getting into other areas such as IP-based intercom, IP-based audio, IP-based radar detection, Nilsson says, “not only provides new market opportunities for the integrators and better solutions for end customers, but also augments video solutions to make that a lot more useful for the end customers, which is again, what we’re interested in doing — making their life easier and safer and smarter.”

Murphy agrees: “Growth in 2018 is still likely to be centered on IP solutions that are able to seamlessly integrate with other systems and that are targeting specific issues for vertical markets. These are the beginning steps into IoT.”

Another major challenge is the dropping camera prices, which are having real effects on security integrators. “We believe over the last two years or so we’ve moved quite a bit of inventory, but it didn’t translate like it did in years prior because of constant price dropping,” Monaco says. “Hopefully we’ve hit bottom and we’ll be able to predict a little better.”

Falling prices are forcing the industry to adjust, but they certainly don’t spell certain doom. “While price pressure from Chinese manufacturers remained a challenge,” says Distelzweig, “it led to greater innovation from premium, U.S. security companies and the introduction of new, competitively priced solutions. As a result, state-of-the-art video monitoring, detection and verification technology became more available to the small and medium enterprise markets.”

The cyber security challenge has also driven some back to more trusted brands, says Brandon Reich, surveillance business leader, Pivot3, Austin, Texas. “Data security has become the No. 1 concern in the industry, widely because users are moving back to more trusted brands that focus on implementing cyber security protocols into network devices. In the coming year, cybersecurity has to be a primary focus for all product vendors, integrators and end users. The adoption of standards and guidelines around data security for physical security technology will be imperative to ensuring data integrity.”

A disparity in the way industry standards have been interpreted and applied has been a challenge in the industry, though. “Up to this point the standards have not really been the standards; they’ve always been some twist or variation,” says Tony Mucci, director of product management and engineering, building solutions North America, Johnson Controls, Milwaukee. “Hopefully there will be more of an emphasis internally — we’re trying to influence that. We’re trying to participate in the associations and the groups and committees that try to develop these standards so that we can rely on them more. Right now they are not very reliable.”

A challenge that could provide an opportunity as well is the efforts by some of the skeptics of facial recognition technology that are trying to limit how that can be used, Parker says. “That’s an opportunity for the industry to address misconceptions about how that technology works, which obviously depends on video surveillance technology in many cases.”

Where policy is at now actually enables facial recognition to be used more widely for public safety purposes and other purposes, Parker says. “So I think there is a need for the industry to clarify some misconceptions out there about how that works, and there’s a potential challenge there if those that are seeking to limit its use are successful in convincing policymakers to put legislative or regulatory limits on it.”

Looking Ahead

While megapixel technology is still a leading driver in the video surveillance industry, Varco says that when it gets to 4K, he believes that is hitting a high point in terms of resolution. “Somebody literally said to me the other day about 4K, ‘It is better than real life.’ How much better do we need it?”

Varco says the focus will begin to shift to compression and the challenge of keeping pace with transmission and storage of these larger files. “H.265 is going to be significantly more important this coming year and over the next couple of years because the pipe is just not big enough, and their network is not robust enough to be able to handle [all the megapixel cameras].”

In the near future, video must be looked at as an added utility to the entire security portfolio — as kind of a force multiplier, or leveraging the number of things that video can do, says Joe Gittens, director of standards, Security Industry Association (SIA).

You have video in the processing of all these images, and that’s enabling a lot of the identification/verification solutions, the biometrics, to work,” Gittens says. “So if you imagine an all-in-one video surveillance and access control system that harnesses the power of high-resolution video to perform recognition or badge identification, and that doubles the utility of video surveillance systems — you have a video surveillance system that acts as your access control system. It might not be an opportunity within the next year or so, but that’s where you can see these things going.”

As far as what’s going to continue to drive the market in 2018 short term, Miguel Lazatin, product and channel marketing director, Hanwha Techwin America, Ridgefield Park, N.J., says there’s been a lot of talk about AI and deep learning. “I don’t know if 2018 is actually going to be a year when we see this take off; I think there are a lot of things that need to be resolved still with deep learning: reliability, accuracy, which maybe isn’t there yet. I think a lot of manufacturers are looking at that and ways to improve it, and there is not a situation where 90 percent reliability or accuracy is going to suffice; it’s got to be very accurate.

“So I think a lot of companies including us are working toward that and trying to figure out how best to increase the accuracy of object classification, object recognition,” Lazatin adds.

Stuart Rawling, director of business development, Pelco by Schneider Electric, Fresno, Calif., says smarter video across many sectors will drive growth. “The education, retail, gaming, ports and transportation, healthcare, oil and gas, and government markets will continue to look for more advanced security solutions designed to help reduce risks and liabilities and in many instances maintain compliance,” he says. “More generally speaking, all market segments will benefit from emerging surveillance innovations that provide higher-quality video and increased amounts of data for both physical security and business applications.”

Ultimately, the challenge for the integrator in 2018 will be the same as it always has been: making the camera work for the customer in any way they need it to. “No longer simply security devices, cameras are of huge interest to customers to address a variety of needs,” says Rick Tampier, senior director sales and product strategy, Red Hawk Fire & Security, Boca Raton, Fla. “As an integrator it’s up to us to rise to the challenge of meeting that increase in demand by delivering the best systems and services for the client.”