Business customers’ security systems, particularly video systems, increasingly rely on networked connectivity. One sometimes overlooked benefit of networked systems is that the network can be used to essentially monitor itself and to report problems to the security dealer/integrator. By enabling network self-monitoring, dealers and integrators can help ensure that any problems are promptly addressed and can even generate recurring monthly revenue — a win/win for the dealer/integrator and for the customer.

We talked with several dealers and integrators about their network health monitoring capabilities.

Are the Cameras Working?

One of the most basic, yet potentially very useful capabilities that a security dealer/integrator can offer is video camera monitoring.

“A lot of customers that have camera systems aren’t looking at them unless something happened,” says Tim Creenan, CEO of Amherst, N.Y.-based Amherst Alarm Inc.

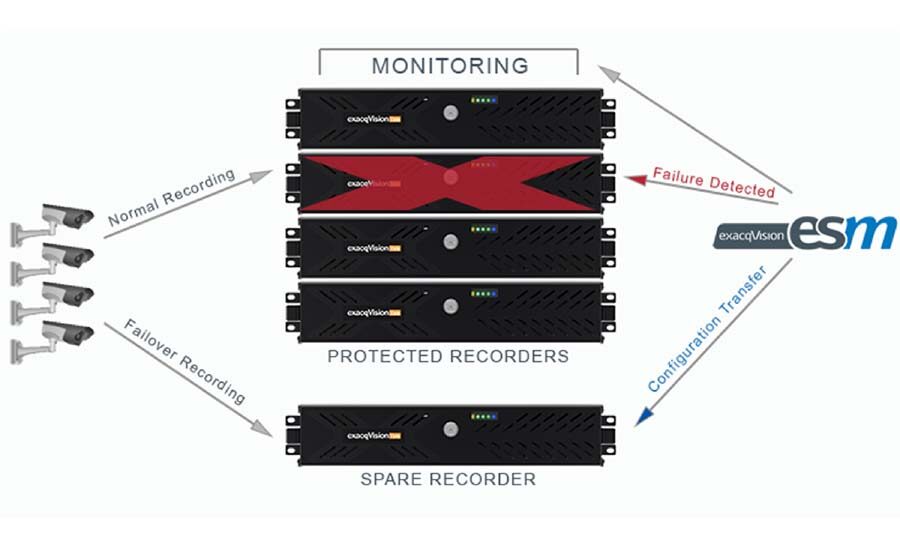

As Creenan explains, the network video recorder (NVR) that Amherst Alarm uses has built-in health monitoring capabilities and is designed to send an alert if any of the cameras attached to it are not functioning. Some customers have asked that these alerts go to Amherst Alarm.

For that service, Amherst Alarm charges $25 per month for the first camera and $5 for each additional camera. Email alerts come into Amherst Alarm’s Manitou central station automation system from Bold Group.

“When operators get the email, they look at the subject line and text that comes next as to what the condition is,” Creenan says. “It comes up on the dispatcher screen the same as an alarm signal.”

The offering has been so well received that Amherst Alarm has plans to pitch the same capability with every camera system sale.

Steve Paley, president and CEO of Sarasota, Fla.-based Rapid Security Solutions LLC, notes that problems with video cameras often can be resolved by resetting the power. Accordingly, Rapid Security includes a SnapAV WattBox that can be used to remotely reset cameras with virtually every camera system it sells.

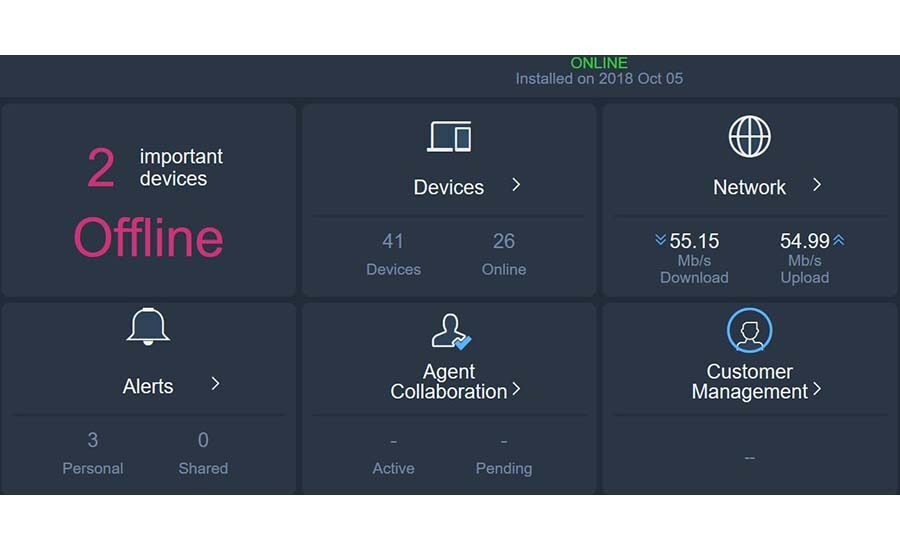

In most cases, Rapid Security installs a separate computer network for a customer’s security system, rather than having the security system run on the same network that supports the company’s business operations. To help in troubleshooting the network, Rapid uses a cloud service designed to monitor network devices so it knows when a camera or other device is down.

About 30 percent to 40 percent of customers purchase a service that costs an average of $50 to $60 per month and includes any troubleshooting provided by Rapid Security (such as a camera reset) that requires five minutes or less. Service calls to address more complicated problems, including those requiring truck rolls, are charged at a discount.

Customers without a monthly network health monitoring agreement are nevertheless monitored but are charged each time a reset is required and pay a higher rate for service calls.

“We really went to this model to be more efficient in-house,” Paley comments. “The fact that we can charge for it is even better.”

Network Health Monitoring & Related Vendors

Here are web pages for network health monitoring vendors and other companies mentioned in this story.

|

Vendor |

Web Page |

|

Avigilon |

|

|

Bold Group |

|

|

Domotz |

|

|

eSentire |

|

|

Exacq Technologies |

|

|

Kaseya |

|

|

Milestone Systems |

|

|

Salient Systems |

|

|

SnapAV |

|

|

Viakoo |

|

|

Vunetrix |

Monitoring Other Network Devices

Like Rapid Security, Burr Ridge, Ill.-based MidCo Inc. nearly always installs a separate network for a customer’s security system, rather than connecting the equipment to the same network that supports the customer’s business operations. In some cases, MidCo also provides a separate wide area network connection for the security network, explains Mike Kielbasa, MidCo security division manager.

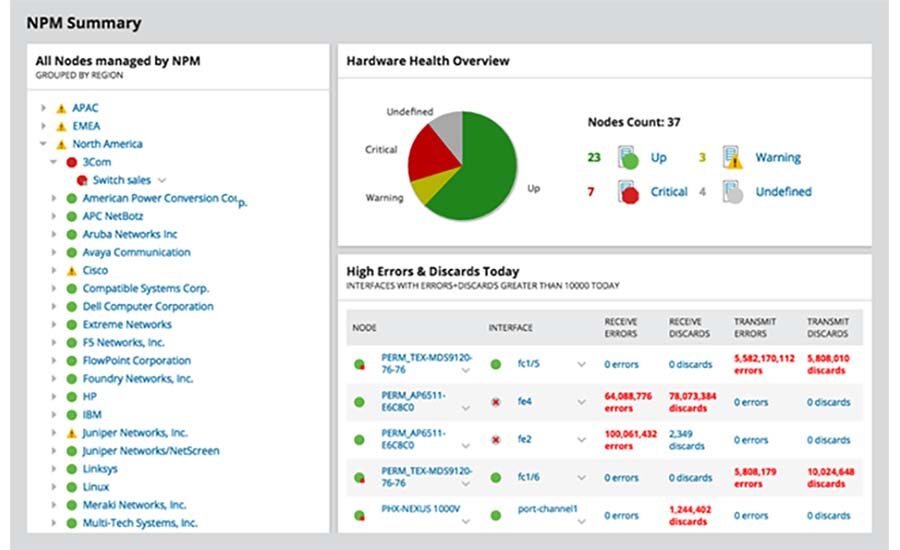

To support the customer’s dedicated security network, MidCo offers a monthly service that is enabled by software from Kaseya loaded onto a network-connected computer. If any device on the network ceases to function, an alert is sent to MidCo’s service department.

Alerts advise MidCo about issues such as what’s going on with the servers and work stations, whether they’re online and whether the hard drive is operational, Kielbasa explains.

MidCo charges $30 per server per month for monitoring and $10 per work station. The company created a new division to focus on networking and offers network health monitoring for customers’ corporate IT networks, as well as for dedicated security networks.

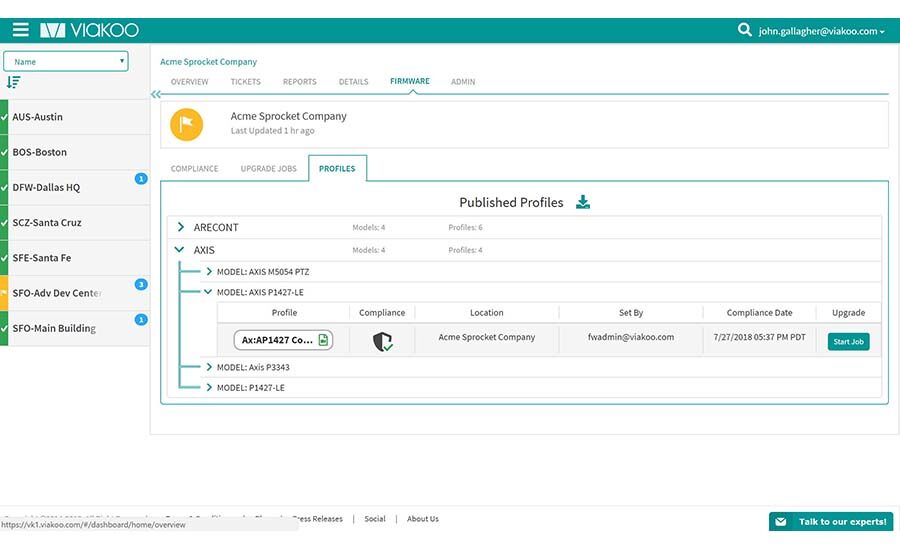

Integrators that belong to Westminster, Colo.-based consortium PSA Security Network also have the ability to offer a monthly monitoring service for video equipment and for a range of network equipment. The offering is based on a cloud service from Viakoo that can look at any devices on the network and make sure they’re operational, explains Dan Dunkel, managing director of PSA’s Managed Security Service Provider program.

This could open up a range of health monitoring opportunities for PSA members, some of whom have customers that are using intelligent sprinkler systems, traffic lights and other networked devices, Dunkel notes.

The service generates alert tickets that can be routed to anyone who has log-in credentials on the system via email or push notifications to a mobile app or can be routed to third-party dispatch systems.

Cyber Security

Through an agreement with cyber security-as-a-service provider eSentire, PSA integrators also will soon be able to offer a monthly cyber security monitoring service to their business customers.

As Dunkel explains, PSA members will act as a sort of referral service to eSentire by building on existing customer relationships.

“Small and medium enterprises are in the crosshairs of sophisticated cyberattacks,” Dunkel says. “They’re also 80 percent of the customer base for PSA’s membership.”

The PSA member will ask certain questions to qualify the customer for a cyber security risk assessment from eSentire. Typically, eSentire finds vulnerabilities that it can work with the customer to address. In addition, eSentire offers a monthly cyber security monitoring service and will share with the PSA member in monitoring revenues generated by the PSA member’s customers.

Dunkel advises PSA members to tell their customers, “I protect you on the physical side. Now I want to help secure your business on the digital side because you’re at risk and I don’t want to see you get hurt.”

New Competitors

Security dealers and integrators may face a new type of competitor as they offer network health and cyber security monitoring services — companies that focus primarily on providing information technology (IT) products and services. Sources interviewed for this story have different takes on this new competition.

With regard to a customer’s dedicated security network, Kielbasa advises dealers to explain to customers that, unlike a potential IT competitor, “We’re also controlling the apps that are running on those particular servers.”

Paley has a bit different view, as Rapid works closely with its own IT firm in pursuing the network health monitoring opportunity. Rapid purchases the network health monitoring solution that it offers customers from its IT firm and has no plans to pursue network health monitoring services beyond a customer’s dedicated security network. Instead, Paley notes that Rapid would refer that business to the IT firm. He adds that the IT firm passes on leads from its customers that ask about physical security to Rapid.

Dunkel doesn’t see all IT firms being so cooperative, however. He advises dealers and integrators to get into network health monitoring and cyber security as a means of blocking IT competitors from potentially stealing a customer’s physical security business. He notes, for example, that an IT company is likely to handle Cisco Meraki video equipment.

“[Integrators] will see aggressive competition if they don’t start to get with the [IT] market space,” he observes.

A Win/Win

Dealers and integrators have numerous decisions to make regarding network health monitoring, including how to implement it, what to charge and what to include in the service. A variety of options may be viable, depending on a dealer’s IT resources, the customer’s IT sophistication and other factors.

As the experiences of those interviewed for this story illustrate, network health monitoring can come in a variety of forms — and all of them seem to have the potential to be a win/win for the dealer/integrator and its customers.

More Online

For more on network health monitoring visit SDM’s website where you will find the following stories:

“The Top 3 Misconceptions About Cyber Security Access Control”

www.SDMmag.com/top-3-misconceptions-about-cyber-security-access-control

“3 Keys to Video Network Monitoring Management”

www.SDMmag.com/keys-to-video-network-monitoring-management

“Who’s Watching the Network?”

www.SDMmag.com/whos-watching-the-network