The U.S. fire market was steady and strong in 2018, with an equal or better outlook for 2019. While part of the reason was the economy remained good and new construction continued in 2018, one change this year was an emphasis on technology advancements and how they are benefitting both security dealers and integrators, as well as end users. New communication technology opportunities on the horizon also factored into the increasingly rosy picture.

“There have been a lot of changes in the industry and the technology used,” says Richard Roux, senior electrical specialist, National Fire Protection Association (NFPA), Quincy, Mass. “It has changed by leaps and bounds and various companies have come out with products that are really innovative.”

The term “leaps and bounds” is not one usually heard around the conservative and slow-to-change fire alarm industry, and many of these “new” technologies have been in the works for several years. But with the release of the latest version of NFPA 72 (2019) last September, a propensity on the part of Authorities Having Jurisdiction (AHJs) to promote greater enforcement of existing codes, and some new technologies that are designed to bring costs down or solve important issues, all the elements for growth and change have fallen into place. Some fire alarm dealers are even making a conscious decision to go after retrofits and upgrades more than new construction.

One such company is Syosset, N.Y.-based AFA Protective Systems Inc., which saw approximately 15 percent growth in 2018, says vice president of branch operations, Mike Slattery. “We believe 2019 will continue to grow over 2018,” he adds.

“2018 was much better than 2017,” says Tom Karl, vice president, business development, NAPCO Security Technologies, Amityville, N.Y. “One reason is we are in the period where Verizon and AT&T are no longer required to maintain copper phone lines.”

This gives security dealers and integrators the chance to go back to their customers and change a part of their system, and while they are at it ask what more they can do for them — either in services or in a new or upgraded system.

What Will Be New in ’22?

With the latest version of NFPA 72 just published late last year it is now time to think ahead to 2022. It may be three years away, but you only have until next month to submit comments or ideas for changes, says Richard Roux of NFPA.

“Public input opened in January and goes until June 26, 2019,” he says. “Anyone can go to NFPA.org and create public input.” Based on experience, Roux expects to see about 500 comments when the comments period closes.

This means anyone in the security industry still upset about last summer’s vote on where signals can be sent and received being voted out at the committee level (see www.sdmmag.com/nfpa-members-vote-to-accept-updated-language-on-fire-alarm-monitoring for more on this) can now try again, Roux says.

“It failed in 2016 and failed in 2019. Hundreds of people went to the annual meeting to hear on this and vote and it was relatively unanimous to back down, but the committee didn’t go along with that. I have calls weekly from people still upset over this. They need to run it up the flagpole a third time.”

To do that, or make another comment, visit

https://bit.ly/2K1TfsK.

“2018 was a very, very good year for the fire systems market,” says George Brody, president, Telguard, a business unit of AMETEK Inc., Atlanta. “The economy was good and construction was strong. You can’t go anywhere without seeing cranes. Companies are investing in the business and infrastructure renovation; any time there is any type of renovation a lot of fire systems are being brought up to code and there is opportunity for new technology and improved service.” What’s more, he says, 2019 is looking even better, something many others are reporting, as well.

“For 2019 we had set ourselves aggressive and ambitious targets, and the way quarter one is shaping up now, we are going to hit those targets,” says Jurgen Van Goethem, general manager for commercial and enterprise fire, Honeywell, Atlanta.

On a macro level, Rodger Reiswig, fellow and vice president of industry relations for Johnson Controls, Westminster, Mass., sees growth in the market coming from the larger security market trend of integration. “I think what is happening is the convergence of multiple facets and systems coming together,” he says. “We have talked about integrating systems for the sake of integrating systems since the 1980s; but now we are starting to see that happening and becoming a better way of doing things than in the past.”

For fire alarms, this means greater integration between the building, mass notification and suppression systems. But ultimately what drives the fire market is codes and laws, and that will likely never change.

“Fire market performance is linked to building infrastructure, which is continuing to grow,” says Christopher Miers, regional marketing manager, Bosch Security and Safety Systems, Fairport, N.Y. “The fire market will grow as long as life safety system components are required.”

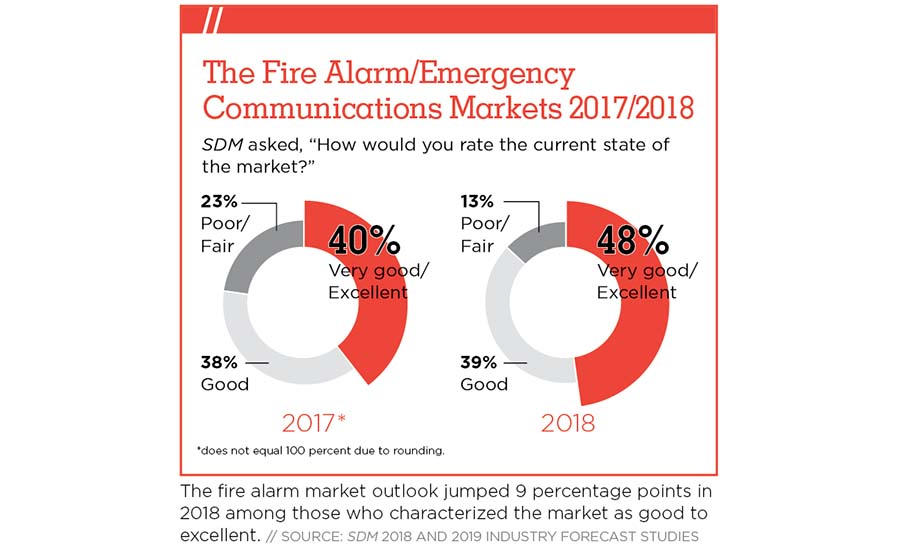

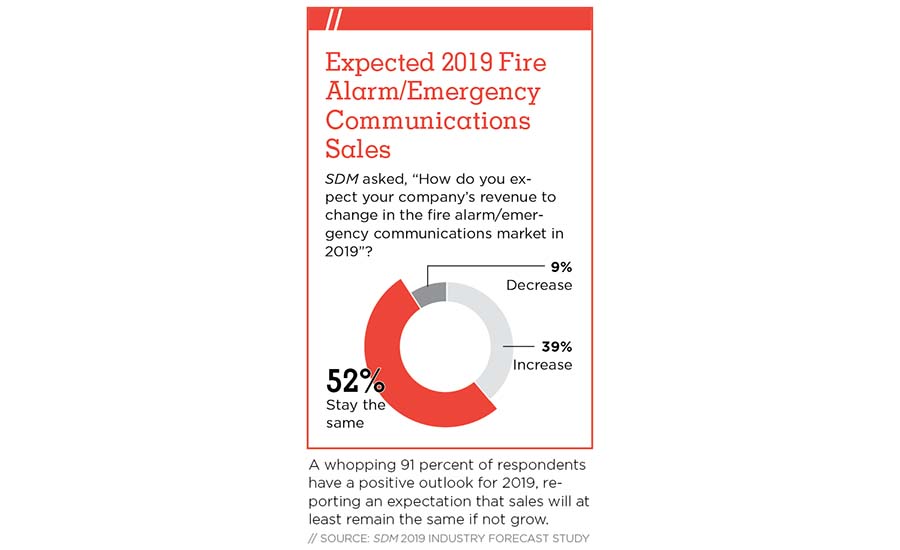

Due to some key drivers, the fire market is indeed continuing to grow, expanding opportunities for security dealers and integrators who operate in that space. This is backed up by responses to the 2019 SDM Industry Forecast Study, which found that the fire alarm/emergency communication market was “good” to “excellent” for a whopping 87 percent of respondents, up 14 percentage points from the previous year’s study. What’s more, 91 percent of security dealers and integrators who participated in the study expect the market at least to stay the same, if not increase (39 percent) next year.

Tech Drivers

Integration and convergence are relative newcomers to the fire space, largely because codes up until recently were resistant to the idea. While “open systems” and fire still are not compatible terms, the sharing of information, either for the purpose of non-fire emergencies or to make installation and service easier, are some of the features newer systems offer.

According to a report by Allied Market Research, the North America fire protection system market was $13.79 billion in 2016, and is expected to reach $25.58 billion by 2023, registering a combined annual growth rate of 8.5 percent from 2017 to 2023. One reason the report cited for this positive outlook was that “technological advancements and innovations in equipment and networking would create new opportunities in the industry in the future.”

Keith Daum, director product marketing, Anixter, Glenview, Ill., says, “Products with integrated technologies provide more opportunities with our customers. Mass notification and fire alarm systems with wireless capabilities all built into one panel allow us to provide more capabilities to our customers and allows installers to provide additional design benefits to end users.”

In the fire detection market, product innovations make for better life safety, Roux adds. In the past, if there was a problem a trouble light would come on and someone would have to call a tech. “Today the manufacturers can listen in on the systems so if the system does exhibit a trouble or fault, they can query the system and find out what is going on.”

Code still requires any changes to the system be made on-site, but being able to know in advance what the trouble is and what is needed to fix it can save fire alarm dealers money in unnecessary truck rolls because they can go out to the site with the correct parts to fix it the first time. (See “Fire in the Cloud” on page 68).

Other technology advancements, such as wireless components, aim to save money at the installation end, Van Goethem says. “Wireless is an ideal product because they can spend less time on installing and more time on more and bigger jobs. What we really want to achieve is helping our dealers become more productive.”

Fire in the Cloud?

With the latest codes and standards the fire industry seems to be loosening up ever so slightly when it comes to cutting-edge technology. How long before fire systems are cloud-based?

In some ways they already are, says Tom Karl of NAPCO. “We are about to roll out the programming for fire alarm in the cloud, where the dealer can program the fire alarm radios or communicators on their iPad or cellphone.”

NFPA does still require they be on-site to actually change the system, however. That won’t change for the foreseeable future. “But the point is when you have simple programming on a cloud-based device you don’t have to learn a different product. It makes it easier to learn competitive products when they are cloud-based.” It also makes maintenance easier, he adds. This programming feature is due out by summer, he says.

Honeywell’s’ Jurgen Van Goethem is particularly excited about the potential benefits of cloud fire. “We all know the residential detectors and DIY. One thing I have observed is there are companies bringing out very high end, good looking detectors with an app. The younger generation very much likes this.”

Van Goethem says it is only a matter of time until that works its way to commercial fire systems. “It will take some time, but technology will get us there. These newer technologies that are surfacing at the residential level will help us to create adoption and acceptance to use those technologies in the commercial space. Think about wireless, which took a long time. It was first used in intrusion. If you had asked people back in 2000, ‘Can you ever see a wireless fire system?’ 90 percent would have said no. The more technology is proven, the more it is ready to be used in life safety and fire detection.”

When that happens they will be ready, he says. “We have our own cloud. The next generation will link seamlessly to that cloud and allow you to have data no matter where you are. The fire system will be able to consume data from other subsystems and vice versa. That will allow our installers to connect remotely and look at what is happening in the panel . . . They will be able to remotely log into the panel and see what they need to do. Before the warning is raised at the end user level the installer will already know there is an issue. This is how we see these connected panels will help solve the issues our dealers are facing today.”

The first release is a gateway due out in the second quarter that will connect any panel in the field to the cloud, he says.

Rodger Reiswig of Johnson Controls compares this concept to OnStar. “Remote diagnostics with new systems let the tech know what parts and pieces he needs. We are trying to make the first time response a one and done. It’s like OnStar, which can tell you what is going on with your vehicle so you can tell the dealer what to fix.”

Wireless is becoming more popular with end users as well, says Richard Tampier, senior director of sales, product strategy and national accounts, Red Hawk Fire and Security, Boca Raton, Fla. “Wireless fire alarm systems have a place as an adjunct to regular systems, particularly in historic buildings and tough-to-reach areas. Battery technology has allowed the price to come down and we have seen more of an adoption.”

Even more important than cost, the attitudes of the AHJs have improved on this technology, he adds. “Frankly, the industry moves at a glacial speed and there are many AHJs that even though these were approved [by code] didn’t allow them in their cities. We are seeing a lot of that go away.”

People are also seeing phone lines are going away and they must do something different on the communications end.

“Landline cutting is really starting to take hold in the commercial market segment,” Brody says. “We have seen a big ramp up in the residential area and we are at the beginning of the commercial market adoption. People are replacing phone lines for cost and performance; there is an attractive ROI to drop the dedicated line you need for fire and security systems and go to cellular technology.” Even better, on the dealer side cutting the telephone company out of the equation lets them participate in receiving RMR, he adds.

Another communication-related advancement is bi-directional amplification, or BDA. BDA is a tool to boost the wireless system inside of a building for emergency responders so they can communicate without having to rely on a hardwired in-building telephone system.

“For years you had wired firefighter telephones in the building,” Reiswig says. “This was because their radios or wireless devices couldn’t communicate. There is a strong need for BDAs inside buildings so when [responders] arrive they have full functionality inside the building as well as out.”

Reiswig also points to non-fire related issues as driving fire alarm systems sales, particularly when it comes to mass communication. “A lot of what is happening in our work, such as violence in schools or workplaces, has been a big activator for people to reassess the systems they have. All of this has culminated in looking differently at how installing new systems and putting new programs in place can help.”

Code Drivers

Despite attractive technology options, discretionary spending on fire and life safety systems is still rare. Typically it’s code — NFPA, UL, IBC and other local codes — that drives end users to change or add to their fire system. Recent versions of these codes are helping the industry drive new technology to the market more smoothly than in the past.

On the sensor side, UL-268 (which addresses smoke detector testing) represents a major change in the industry, Daum says. “The 7th edition of this standard is set to take effect in May 2020 and is important for future alarm sales and installations.”

The new standards incorporate three new tests, including the cooking nuisance alarm, or “hamburger test,” as well as two polyurethane foam tests for smoldering and flaming fires, he explains. “These new tests better represent the smoke profiles and behavior of modern building fires to help ensure next-generation sensors are designed to give building occupants enough time to evacuate safely . . . Going forward AHJs will demand the new smoke detectors for any systems prone to false alarms. Older detectors that fail will be required to be replaced with the new UL-listed version. This is critical for our customers to note when it comes to inspections, testing and maintenance.”

Jon Hughes, vice president of marketing and product management, Edwards, part of Carrier, a unit of United Technologies Corp., Bradenton, Fla., agrees. “UL-268, 7th edition, should provide AHJs with an opportunity to speed up adoption in order to improve the performance of detection systems.”

One of the most influential codes is NFPA 72, the National Fire Alarm and Signaling Code, which updates every three years. The 2019 version was released late in 2018; and while few, if any, jurisdictions have begun to use this code, it does contain some key changes that are important to know. Roux points to five big changes in 2019:

- a 2022 deadline on implementing specific guidelines installing the new UL-268 smoke alarms;

- the official rolling into NFPA 72 of the formerly separate carbon monoxide detector requirements;

- a new allowance to be able to use elevators in emergency evacuation in very specific circumstances;

- a clarification on how and where signals can be sent, including recognizing and permitting alternative communications technologies such as wireless, internet and broadband; and

- a simplification of the criteria for Class N (networked) pathways.

For Reiswig the last one is by far the most game-changing. “In the past we have not been able to take off-the-shelf technology and adopt it into the life safety arena because of the way the industry works. Very recently there have been changes to UL and NFPA where they are coming together to say, ‘We don’t want to be stumbling blocks to technology so let’s write codes and legislation that allows us to adopt those without compromising life safety.’ Class N, with off-the-shelf technology being codified and pulled in, allows me as a manufacturer to start to think outside of the traditional life safety bubble where all parts and pieces must be listed for fire alarm use and you can’t use anything outside of that. Now we can communicate more efficiently with building communications and pull in other types of systems, particularly VoIP speakers for mass communication that can integrate with the fire alarm system.”

He emphasizes it is not carte blanche by any means, but even a slight loosening of restrictions can be a major driver in an industry enjoying significant advances in networking and integration. “Now my fire alarm system can communicate through the local area network to HVAC, public address systems and building controls. That is a key game changer in the life safety world.”

This is reflected in the changing terms of NFPA 72, he adds. The 2019 document introduced the term BSIU, building systems information unit, which recognizes this type of system. “It is a green light for us, not to lessen life safety, but to pull in other parts and pieces to enhance it.”

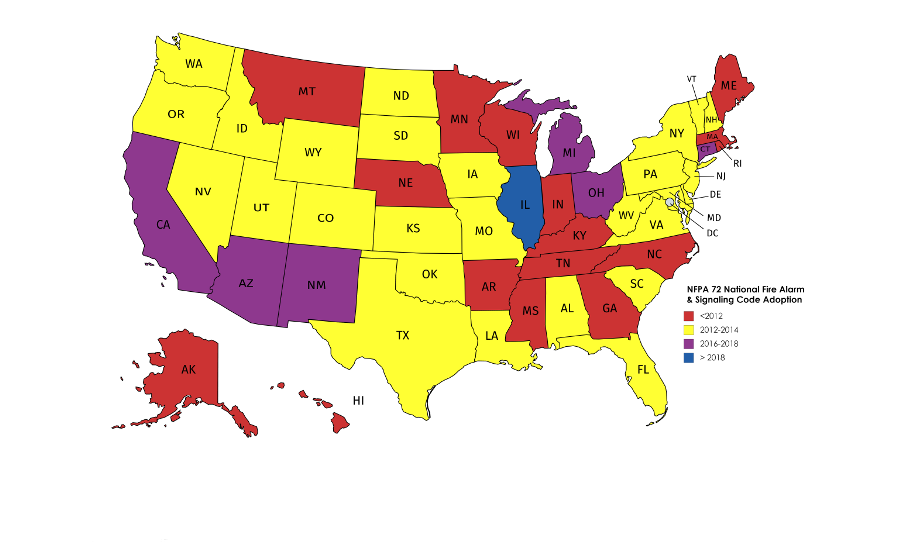

NFPA 72 is a living document, and the organization is currently taking public comments and input on the next version (2022), Roux adds. (See “What Will be New in ’22?” on page 56). Meanwhile NFPA is currently in the process of educating AHJs and others about the 2019 code. There is also a handy new feature on the website called Codefinder that lets you find by zip code or town which version of NFPA 72 they follow. Currently, two states still follow 2002, the majority are on 2013 and several are looking at adopting 2016.

It is not unusual to be behind the code, as it takes time to change requirements, Roux explains. However, NFPA provides provisions for accepting newer versions. “If someone has newer technology they can bring it to the AHJ and they will have to consider it,” he says. “Nothing in the code should prevent the use of equivalent or superior technology . . . The code encourages AHJs to look at newer developments.”

That is one reason AHJs have shown increasing willingness to accept newer versions, even if their local area is on a much older version. Roux compares it to buying a new car. “Your 2010 car may be still working but you want the latest and greatest. Engineers are pushing the newer codes and they understand code development.”

Hughes has noted that trend, particularly in mass communication systems. “While emergency communication/incident management has been around for some time, more AHJs are accepting the value and necessity of the systems,” Hughes says. They are also better understanding the complexity of integrating all the systems together to provide accurate information, and allow for quick, concise actions, he says.

Craig Summers, vice president of sales, fire and security division, Potter Electric Signal Company LLC, St. Louis, Mo., sees this as a fast growing trend. “The latest NFPA and IFC codes are now requiring that public safety radio systems be enhanced with a BDA system or equivalent within the building to ensure adequate radio coverage for first responders. Due to the fire alarm contractor’s familiarity with NFPA and other codes and standards, we are starting to see BDA installations being performed by fire alarm contractors instead of radio systems installation companies.”

This is one retrofit opportunity. Another one is mass communication, Tampier adds. “Buildings are more concerned about mass communication. If we can use speakers that are already in the building to announce an attack or weather issue, that static fire alarm system brings a lot of value.”

Slattery says AFA Protective Systems has had good success approaching the retrofit fire market in the past year. “As a company we made a strong effort to focus on recurring revenue growth and working to address the needs of existing end user customers. That, combined with public acceptance of the end of POTS lines, gave us the opportunity to present better options, do more business and upgrade systems.

“Because we have a good customer base of end users that have been with us for a long time, we saw the opportunity and it was something that paid off almost immediately in higher margins and better sales than when we were competing primarily in the new construction market.”

Wireless is another technology that is helping the retrofit side of the market. While he says his company has not done anything with wireless fire systems yet, Jackson recently came upon the perfect application for it. “We are working on an existing apartment building where a wire has been damaged and repair would require the owner to tear open drywall in lots of apartment units to run new wire. So we said, ‘There is this new wireless technology we can use,’ and they were very interested.”

Stricter Code Enforcement Drives RMR

Many manufacturers, security dealers and integrators are noting a change in the AHJs themselves — not just in willingness to accept newer technology that is now allowed in the latest code, but in stricter enforcement policies of existing code.

“While adoption rates vary, trends are toward stricter enforcement policies,” says Mike Troiano, president and CEO, Advanced Fire Systems Inc., Hopkinton, Mass. “For example, one trend with AHJs seems to be that they are having much less patience with improper responses to legally mandated time periods for nuisance trouble conditions and malfunctioning fire systems. They are taking a tough, harder stance with repeat offenders. The message is ‘get it right,’ or we will take whatever action we deem necessary to ensure fire and life safety.”

Michael Lohr at Red Hawk has seen this problem with end users. “A lot of end users when their fire alarm is in trouble will put a piece of tape over the yellow light to make it go away . . . The only time it is an emergency is when the sounder is going off. If it is a trouble light you have to build a fire under them to go work on them.”

AFA Protective System’s Mike Slattery has seen AHJs getting tougher on this, however. “For us, because a good portion of our business is ongoing inspection and monitoring of systems, the fact that more and more AHJs are becoming stricter about code enforcement and regular inspections . . . that becomes an opportunity to grow our business.”

Opportunities aren’t just limited to the commercial fire side, either. Resideo, Austin, Texas is investing heavily in professionally installed and monitored residential fire systems, particularly with the advances in smoke and carbon monoxide detectors. Alice DeBiasio, vice president and general manager, pro security products, Resideo, says, “We believe it is a growth category that will allow our dealers to differentiate themselves in a competitive market. You will see an expanded line of sensors such as heat detection, standalone CO, indoor and outdoor sirens. We want to create a very robust system that does traditional security but is capable of much more, including life safety and water management.”

Kevin Piel, global marketing manager, Resideo, adds, “[Security dealers’] business is RMR but they might tend to not take it to the next level with professionally monitored life safety. It offers peace of mind knowing someone is coming if there is a fire. When you look at it like that, there is a huge opportunity to add in monitored life safety.”

Reiswig believes opportunity lies with what else the fire system can do now, particularly for larger customers, citing the mass communication trend that started with the code change in 2010. “Fire alarm has become the backbone for these systems. Rather than going out and purchasing additional equipment, they might decide to upgrade the fire system. They can leverage that with what more it can do.”

SDM asked, “How would you rate the current state of the market?”

Source: SDM’s SDM 2018 & 2019 Industry Forecast Study

The fire alarm market outlook jumped 9 percentage points in 2018 among those who characterized the market as good to excellent.

SDM asked, “How do you expect your company’s revenue to change in the fire alarm/emergency communications market in 2019”?

A whopping 91 percent of respondents have a positive outlook for 2019, reporting an expectation that sales will at least remain the same if not grow.

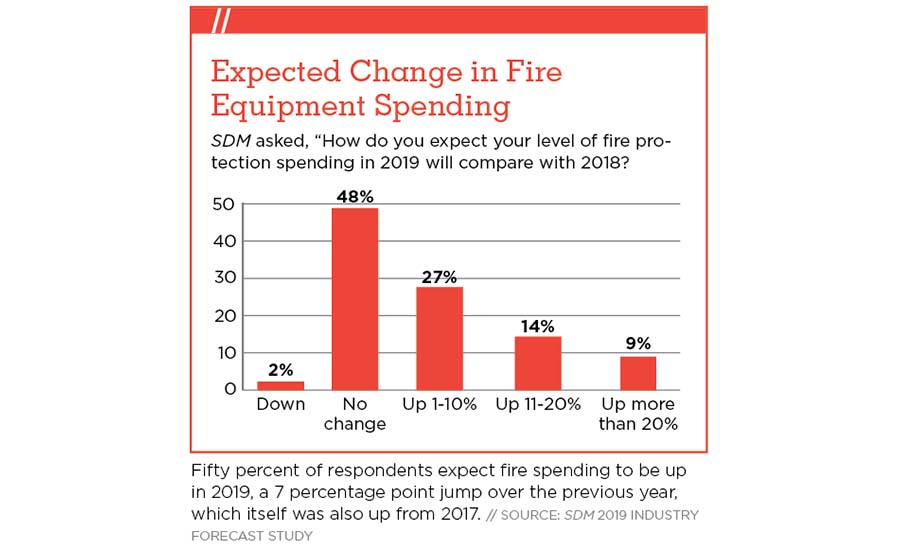

SDM asked, “How do you expect your level of fire protection spending in 2019 will compare with 2018?

Fifty percent of respondents expect fire spending to be up in 2019, a 7 percentage point jump over the previous year, which itself was also up from 2017.

Codefinder, a new feature at NFPA.org, allows you to find up-to-the-minute information on state, local and city-wide codes, including NFPA 72 and others. This map represents a general indication of the most recent code at least one county or jurisdiction is following in that state.