Evaluating the state of any market is a tricky thing during a pandemic — things are changing daily; new technologies are being explored; the future is unknown; and it’s difficult to look back at the past clearly.

![]()

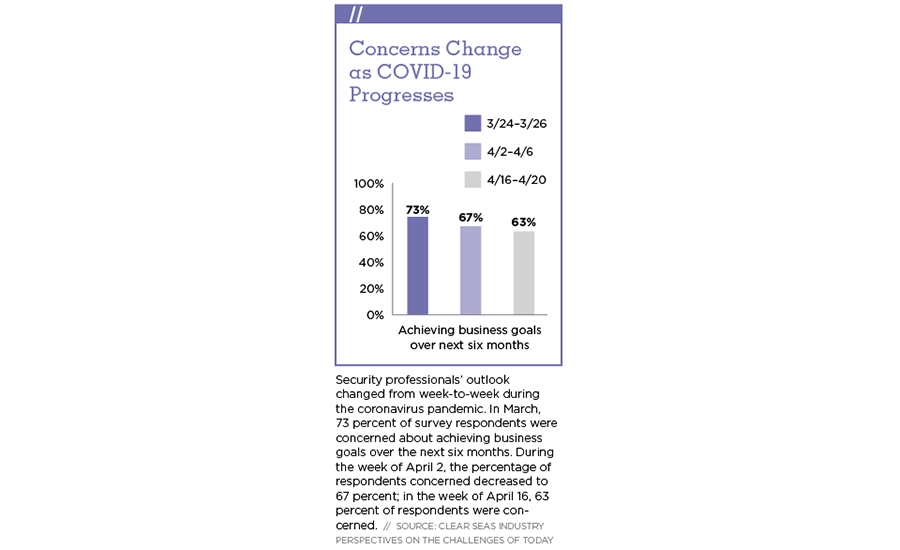

This article was written in April — an especially volatile time in the COVID-19 pandemic. As businesses across the country were forced to close, at least temporarily, security professionals’ outlook changed from week to week, as evidenced by Clear Seas Research.

The survey of those in the mission critical and security industries was deployed at three different points in the pandemic: the week of March 24, the week of April 2 and the week of April 16. In March, 73 percent of survey respondents were concerned about achieving their business goals over the next six months. But in the week of April 2, the percentage of respondents concerned about achieving business goals decreased to 67 percent. Concerns decreased even more the week of April 16, with 63 percent of survey respondents being worried about achieving their goals.

So to start, let’s focus on 2019, when the world wasn’t burning.

2019: A Great Year

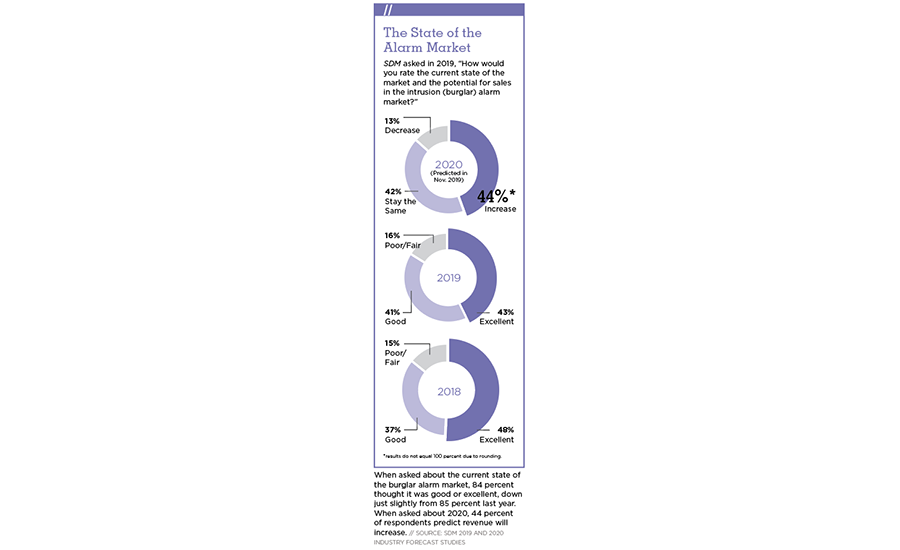

When asked how they perceived the state of the intrusion alarm market in 2019, 84 percent of the respondents to SDM’s 2020 Industry Forecast (conducted in the fall of 2019) categorized it as good to excellent, holding steady from the previous year’s 85 percent.

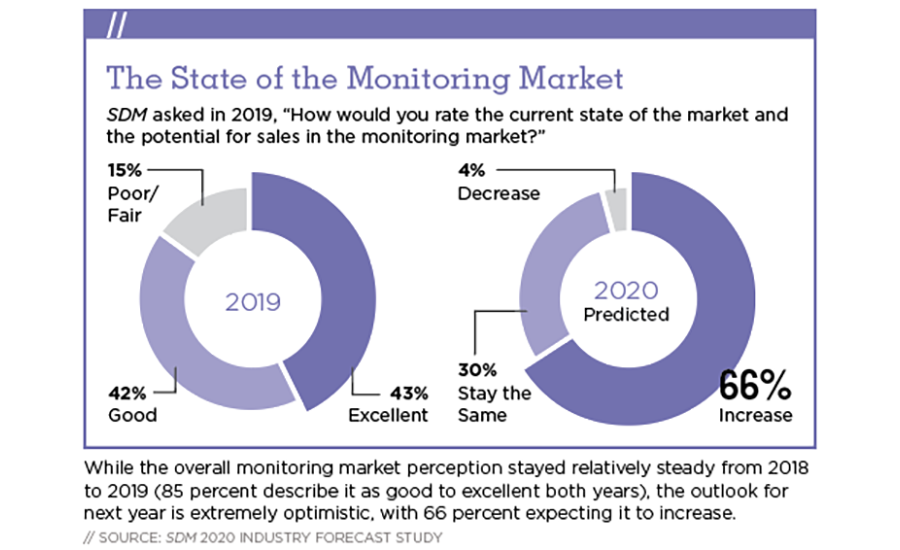

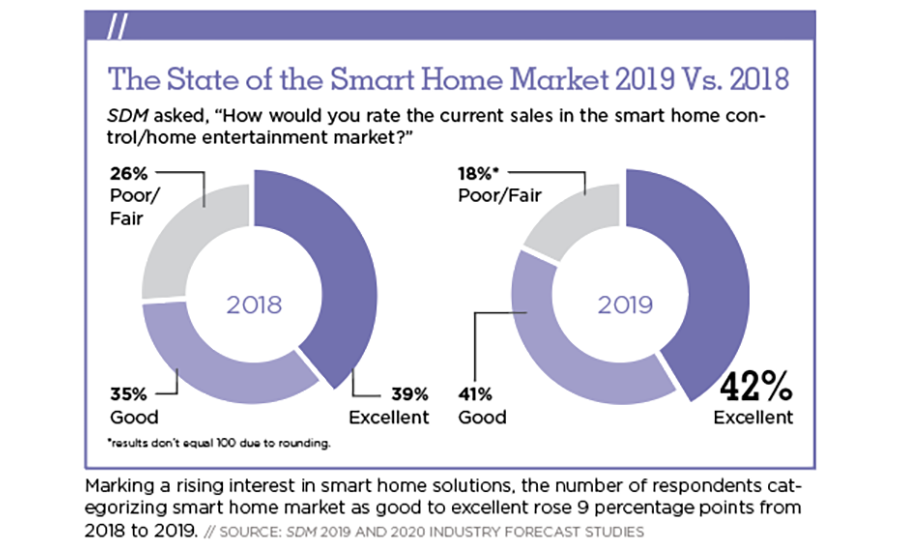

Eighty-three percent of respondents felt positive about the smart home industry, up from 74 percent the previous year. When asked about the state of the monitoring market, 85 percent felt it was good or excellent, the same as the previous year.

Those in the industry were also optimistic when predicting revenue changes for 2020. Forty-four percent of respondents expected an increase in revenue from intrusion alarm products, while 42 percent expected revenue to remain the same and 13 percent expected a decrease. A majority, 55 percent, expected an increase in revenue from smart home products, and 66 percent expected an increase in monitoring services revenue.

Maintaining Quality Over Quantity

The professionally monitored industry experienced significant gains in 2019, going from a 24 percent adoption rate in 2018 to 29 percent last year, according to Parks Associates.

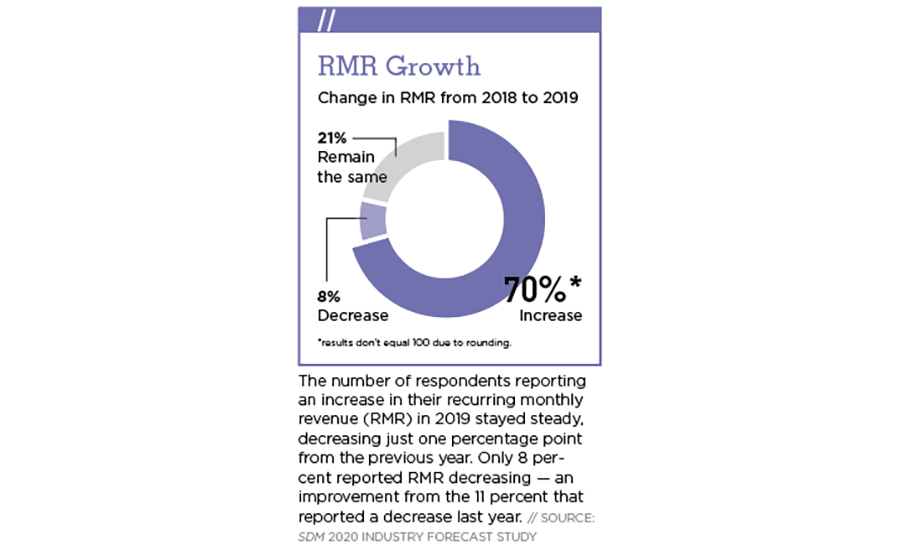

RMR increased as well. According to SDM’s Industry Forecast, seven in 10 respondents reported an increase in 2019 RMR compared to 2018, with average growth being 28 percent.

And even through the pandemic, RMR is remaining strong for some.

“Our RMR is very strong in spite of all the things that have occurred,” says Hank Groff, Dynamark Monitoring. “And we’re still upward in 2020 — we haven’t had any dips, and we’re continuing to grow.”

Dynamark is one of multiple monitoring companies that benefited from a growing dealer base in 2019 as well, since it gained 80 new dealers. EMERgency24 also saw growth in its dealer base.

“[Our] 2019 growth was the largest in five years,” says EMERgency24’s Kevin Lehan. “We gained new dealers, and collectively they added many new accounts while attrition was at its normal level. If there were sufficient numbers of trained technicians, our dealers tell us their growth could have been even greater — they needed more labor to complete all of their jobs.”

The central station is attempting to maintain this growth through the pandemic by thinking outside of the box — like asking schools if their contractors can do inspections and testing now.

“The year started out gangbusters and halted, so of course our outlook has changed and so did our expectations,” Lehan says. “That said, we are still seeing accounts put online and services being performed. Depending on where you are located, some alarm contractors are doing their school testing and inspections now, which will free them up for other work during this summer. Hopefully by then, the world is open for business again.”

A key driver for growth at NMC is the company’s Netwatch Proactive Video Monitoring (PVM) service. “With security and surveillance technologies continuing to evolve at a rapid pace, more and more end users are becoming aware of and entrusting these intelligent video surveillance systems to optimally secure and protect their businesses and reduce costs,” says Woodie Andrawos. “As we continue to educate the market about remote video monitoring, we expect to see even more growth opportunities moving forward.”

SDM’s 2020 Industry Forecast shows that remote video monitoring is the primary managed/cloud-based service both currently offered and planned to be offered in the near future; 72 percent of respondents said they currently offered remote video monitoring, and 67 percent said they planned to.

NMC actually experienced growth in March due to its remote video monitoring offering.

“Year-to-date revenue growth is in the double digits from PVM sales,” Andrawos says. “In March, we acquired a record number of PVM subscribers through our channel partners, and we’re forecasting a similarly strong showing [in April] as well.”

NMC has seen an increased demand from businesses such as car dealerships while they are temporarily closed. Video monitoring is a much more cost efficient form of security than the traditional guards they may typically use.

Brian Gartland and Charlie Tebbs of Vyanet are hopeful that the increased emphasis on alarm verification will maintain the quality of the monitoring industry.

“Some companies are in a race to the bottom — quantity over quality,” Gartland says. “It’s a threat that could make monitoring a commodity. Our focus is on being a premium provider where our people and services separate us. We’re also seeing jurisdictions putting more emphasis on verification requirements before response, which we think is a positive for the industry, as it only provides more and better information for our first responders.”

Other research shows similar findings. According to Omdia (formerly IHS Markit), a research company out of London, the residential alarm monitoring industry performed well in 2019 compared to 2018, with an estimated growth of 2.4 percent for monitored accounts.

However, according to Blake Kozak, senior principal analyst, smart home & appliances, Omdia, this marks a slowdown for the U.S. residential alarm industry, since there was 7 percent annual growth in accounts in 2018 compared to 2017. But that isn’t necessarily bad news for the industry.

Kozak says one reason for this slowdown is the decline of telcos offering alarm monitoring and home automation solutions.

“With AT&T Digital Life seemingly being phased out and others such as Lowes, Iris and Spectrum shuttering their alarm business units, the market seems to be shifting back to traditional alarm companies in combination with DIY newcomers such as Ring,” Kozak says. “Overall, Omdia had expected some of the less traditional players to ride the momentum that had been generated to truly challenge traditional alarm companies such as ADT, but this has not come to pass.”

Dina Abdelrazik, senior analyst at research firm Parks Associates, says the adoption rate of residential security is a sign of the health of the market.

“The residential security market has made significant efforts to expand the market beyond the roughly 30 percent of broadband households that have a security system,” Abdelrazik says. “The entrance of tech giants and MSOs raises awareness of security solutions; new business models emerged as a result of changing consumer preferences; and technology advancements such as video analytics, audio analytics and voice control are improving the user experience. As a result, the security industry is finally able to reap the benefits of increased security system adoption.”

While security system adoption held steady at 26-27 percent from 2016-2018, a 5 percentage point increase moved the arrow to 32-33 percent in 2019, according to Parks Associates.

Vyanet, the Bend, Ore. alarm business featured on SDM’s cover, experienced great growth in 2019.

“2018 was good, but 2019 was better,” says Charlie Tebbs, head of M&A. “Having completed our largest acquisition to date, we’ve never been as big as we are now.”

Acquisitions of alarm dealers in the Western U.S. and Hawaii have been the primary source of growth for Vyanet over the years. But in 2019, the family-owned company also saw a boost from a large quantity of system upgrades and the continued development of a tiered warranty program to cover service needs, among other benefits such as loss protection and fine reimbursement.

“We saw a gain in momentum in 2019,” says Mitchell Klein, executive director of the Z-Wave Alliance, a group of industry leaders dedicated to increasing the interoperability of smart home products. “There was a lot of activity in terms of mergers and acquisitions — ADT did a bunch, Vivint did a bunch — and with companies like Ring going direct to consumer, the alarm industry has been growing, at least in penetration.”

How Big is the DIY Bite of the Pie?

The smart home sector is taking up quite a big piece of the security pie — and continues to grow year after year, particularly with the rising influence of DIY.

In SDM’s 2020 forecast, 57 percent of respondents said they currently offered smart home products, up six percentage points from the previous year.

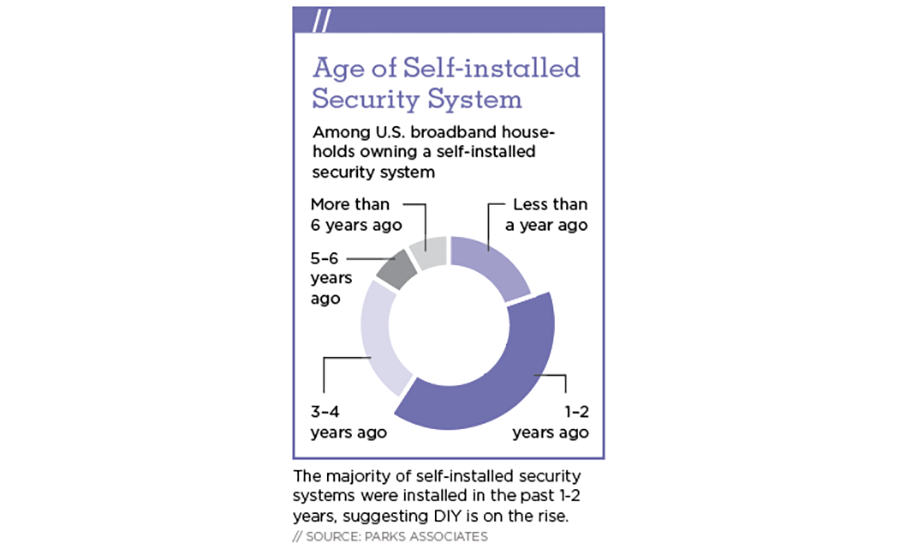

“While the emergence of smart home products extends the value of a security system, it also increases competition, as smart devices are often sold independently of a traditional security system,” says Dina Abdelrazik, Parks Associates. “Many are self-installable, meaning consumers increasingly will become accustomed to self-installing systems. DIY security systems continue to be on the rise.”

DIY security has been a perceived threat to traditional security since it hit the market. But, according to Omdia, DIY has not had as big of an impact as originally expected.

“Systems installed by the consumer but professionally monitored continue to grow, but remain a small percent of overall accounts,” Blake Kozak says. “Omdia estimates that in 2019, about 5 percent of the 27 million monitored accounts in the U.S. were DIY installs with professional monitoring, up from 3 percent in 2017.”

New research from Parks Associates suggests that DIY could soon be much more than 5 percent of monitored accounts, though. The study shows that among consumers who acquired their security system less than two years ago, 60 percent are self-installed, compared to only 7 percent of systems purchased more than six years ago.

Abode, San Francisco, Calif., was one of the first DIY players to hit the scene.

“We had pretty explosive growth in 2016, 2017 and 2018, and then 2019 was a bit slower in growth,” says Chris Carney, co-founder and CEO. “It was due to the competition in our space. We were one of the earlier players, so some of the bigger companies hit their stride, and so it became a lot more competitive and innovative in ways to grow. It became very expensive, too, to compete at the top of the funnel, because they had all these deep pocket companies that didn’t really care about profitability — they were just kind of buying market share — so they were just throwing tons of money at advertising, even Super Bowl commercials. It’s become increasingly competitive, where only the strong survive.”

Mountain Alarm, Ogden, Utah, has also been affected by these big players entering the DIY market.

“The DIY market has become very crowded, and marketing expenses have skyrocketed as all the DIY companies are competing for the same lead sources,” Eric Garner says.

Vince Raia of EMC Security, Suwanee, Ga., says DIY is the company’s fastest growing segment, as it represents about 15 percent of their new system activations. Still, he says tech giants pose a very real threat to businesses like his.

“There are several very good, highly visible, affordable alternatives that are available in the market, such as Ring, SimpliSafe and Comcast,” Raia says. “They are able to provide smart systems at a very low monthly cost. This may cause a reset in the minds of consumers on what they are willing to pay for monthly monitoring and connected services. Companies will have to adjust to this changing demand for affordable and simple-to-activate self-installation packages.”

And as the popularity of DIY products increases, more companies will start offering DIY services.

“The forward thinking dealers in our space have already adopted a self-install solution alongside their pro-install model — these are early adopters,” says Brad LaRock, Alula. “Most have indicated they are considering this adaptation, but COVID-19 will drastically fast forward the self-install option, as it will allow them to reach new markets and shine a light on what separates them: professional expertise and a local touch.”

Brad LaRock, vice president of marketing at Alula, an all-in-one security and home automation platform based in St. Paul, Minn., says 2019 was a year of transition, partially due to big companies such as Interlogix closing their doors.

Alula took advantage of the instability by creating new solutions, such as the Connect-XT, which helped professional installers upgrade Simon panels after the Interlogix shutdown.

“Innovations like this led to over 50 percent growth in activations for Alula Interactive,” LaRock says.

Interlogix closing has also highlighted the value of stability at industry stalwarts such as EMERgency24, Des Plaines, Ill.

“With 50+ years of growth and experience, we offer stability,” says National Sales and Marketing Manager Kevin Lehan. “With our proprietary software and in-house engineering team, we offer flexibility to those with unique requirements.”

DMP, Springfield, Mo., has also benefited from the instability of others.

“As a U.S.-based manufacturer that has been in business for 45 years under the same family ownership, we do feel that our stability and consistency, combined with a strong background in innovation, serves us well,” says DMP’s Executive Director of Business Development Jon Adams. “In an industry that has seen some instability and disruption among manufacturing partners, we’ve been able to gain new business from alarm dealers that want to feel comfortable in knowing they have chosen a stable partner for the long term. This is a benefit.”

Lehan says a healthy housing market also contributed to growth in 2019.

“The building market was robust, while new businesses were opening and existing ones expanded,” Lehan says. “The growth of our economy played to EMERgency24’s strengths.”

“The economy was good,” agrees Scott Harkins, vice president and general manager of connected home at Resideo, an Austin, Texas manufacturer that had a big year, spinning off of Honeywell in late 2018 and establishing itself as its own company. “At least in the residential market, what drives security sales is new construction and the sale of existing homes; and those numbers were quite good last year.”

Maintaining Quality Over Quantity

The professionally monitored industry experienced significant gains in 2019, going from a 24 percent adoption rate in 2018 to 29 percent last year, according to Parks Associates.

RMR increased as well. According to SDM’s Industry Forecast, seven in 10 respondents reported an increase in 2019 RMR compared to 2018, with average growth being 28 percent.

And even through the pandemic, RMR is remaining strong for some.

“Our RMR is very strong in spite of all the things that have occurred,” says Hank Groff, Dynamark Monitoring. “And we’re still upward in 2020 — we haven’t had any dips, and we’re continuing to grow.”

Dynamark is one of multiple monitoring companies that benefited from a growing dealer base in 2019 as well, since it gained 80 new dealers. EMERgency24 also saw growth in its dealer base.

“[Our] 2019 growth was the largest in five years,” says EMERgency24’s Kevin Lehan. “We gained new dealers, and collectively they added many new accounts while attrition was at its normal level. If there were sufficient numbers of trained technicians, our dealers tell us their growth could have been even greater — they needed more labor to complete all of their jobs.”

The central station is attempting to maintain this growth through the pandemic by thinking outside of the box — like asking schools if their contractors can do inspections and testing now.

“The year started out gangbusters and halted, so of course our outlook has changed and so did our expectations,” Lehan says. “That said, we are still seeing accounts put online and services being performed. Depending on where you are located, some alarm contractors are doing their school testing and inspections now, which will free them up for other work during this summer. Hopefully by then, the world is open for business again.”

A key driver for growth at NMC is the company’s Netwatch Proactive Video Monitoring (PVM) service. “With security and surveillance technologies continuing to evolve at a rapid pace, more and more end users are becoming aware of and entrusting these intelligent video surveillance systems to optimally secure and protect their businesses and reduce costs,” says Woodie Andrawos. “As we continue to educate the market about remote video monitoring, we expect to see even more growth opportunities moving forward.”

SDM’s 2020 Industry Forecast shows that remote video monitoring is the primary managed/cloud-based service both currently offered and planned to be offered in the near future; 72 percent of respondents said they currently offered remote video monitoring, and 67 percent said they planned to.

NMC actually experienced growth in March due to its remote video monitoring offering.

“Year-to-date revenue growth is in the double digits from PVM sales,” Andrawos says. “In March, we acquired a record number of PVM subscribers through our channel partners, and we’re forecasting a similarly strong showing [in April] as well.”

NMC has seen an increased demand from businesses such as car dealerships while they are temporarily closed. Video monitoring is a much more cost efficient form of security than the traditional guards they may typically use.

Brian Gartland and Charlie Tebbs of Vyanet are hopeful that the increased emphasis on alarm verification will maintain the quality of the monitoring industry.

“Some companies are in a race to the bottom — quantity over quality,” Gartland says. “It’s a threat that could make monitoring a commodity. Our focus is on being a premium provider where our people and services separate us. We’re also seeing jurisdictions putting more emphasis on verification requirements before response, which we think is a positive for the industry, as it only provides more and better information for our first responders.”

The 3G to 4G Transition

After a strong 2019, there were some challenges facing the industry in 2020, even before the coronavirus crisis. One of the greatest of these challenges is the switch from 3G to 4G or LTE before 2022.

“The deadline for 3G to LTE migration is fast approaching, and many companies do not have a solution to deal with this problem,” says Rob Davis, general manager, intrusion, global security products, Johnson Controls, Milwaukee, Wis. “This creates not only an operational problem, but also a competitive one as it creates an opening for new security providers.”

Vince Raia, president of EMC Security, Suwanee, Ga., is especially concerned about the cellular sunset in the midst of the COVID-19 pandemic.

“With many customers reluctant to allow technicians in homes and businesses, we may experience a pent up demand phase for service or new activations, and there may be a shortage of personnel to perform this work,” Raia says. “Add 4G radio replacements, required in the coming 20 months, and there could be a real problem with attracting capital from traditional sources, as they have become skeptical of the traditional model.”

Mitchell Olszewski, director of marketing at Telguard, Atlanta, sees the sunset as an opportunity for growth.

“Landline cutting in both the residential and commercial markets continues to accelerate, allowing new business opportunities for the alarm industry cellular ecosystem,” Olszewski says.

Kozak points to how the switch can be a good thing for the industry.

Moving Beyond the Basics

The biggest trend in the industry right now is moving beyond basic alarm monitoring, according to Omdia. Although there were nearly 17 million monitored accounts that did not include a mobile app offering for the customer in 2019, the top brands were all looking for ways to offer additional use cases for the consumer, from energy management to whole-home analytics.

Immix, formerly SureView Systems, Tampa, Fla., was founded and based upon interactive services. The company recently launched a new mobile app that is more feature-rich than the previous version, giving customers more control over the monitoring of their sites. In addition, Immix has developed a new feature called Immix AI Link which enables enhanced AI verification within the Immix platform. The company performed well in 2019, experiencing tremendous growth and outpacing its 2018 performance.

“We see a more distant opportunity to make our software platform easier to access for smaller monitoring operations that do not want or are unable to make large capital investments, by hosting a version of Immix in a Platform-as-a-Service model,” says Immix CEO Chris Brown.

EMERgency24 also recently started offering interactive services.

“We continue to see more demand for our two-way texting capacities during the past year it’s been available,” says Kevin Lehan. “It’s a simple, immediate, non-invasive communication channel that everyone is comfortable using. Younger customers will not pick up their phone, and demand text communication. It’s very popular among our subscribers now.”

Rapid Response released rapidSMS in March, a service that notifies the customer instantly of an alarm, providing an app-like experience via text message, allowing critical decision making in real-time.

“Video and interactive everything is going to be big this year — dealers are already asking about what we can do in these areas,” says Rapid Response’s Morgan Hertel, vice president of technology and innovation. “We are in a great position to offer the services that are now in higher demand.”

And adaption of interactive services will only increase, says Jon Adams of DMP. “Interactive services will continue to be a driver of the customer’s decision making; and as such, manufacturers like ourselves will continue to make our apps and browser-based features as customizable and intuitive as possible,” he says.

“When we think about interactive security, one of the biggest drivers is about creating connection,” adds Anne Ferguson, Alarm.com. “And that has never been more important than it is right now.”

“The transition to 4G has been a positive opportunity for some providers as it allows dealers to enter homes and upsell consumers on new technology and services,” Kozak says. “Although it can be expensive to roll trucks, dealers should use this opportunity to lock customers into a smart home solution that is actionable for the consumer and provides insights for the dealer to offer a more tailored package when the renewal comes around.”

Alarm.com, Tysons, Va., is working with its partners to make sure systems get upgraded to 4G in time, including helping with ways to minimize having to enter homes in this time of social distancing.

“It can be very expensive for service providers to get that upgrade, and now that we find ourselves in a situation where partners are getting clever around self-installation and do-it-together opportunities, we are still concerned around getting those upgrades and helping service providers get those upgrades,” says Anne Ferguson, vice president of marketing at Alarm.com. “But COVID-19 has pushed us to think of ways to make this happen in a way that is less cost prohibitive, and easy for consumers as well.”

Financing Woes

Another issue that was starting to impact the industry even before the COVID-19 crisis was financing. Jim McMullen, president of COPS Monitoring, Williamstown, N.J., says his dealers have struggled to find financing from banks.

“Generally, 2019 started off the same or slightly better than 2018,” McMullen says. “However, in the end of 2019, our dealers experienced a little more volatility with new accounts as lenders either increased financing requirements, or stopped financing alarm contracts altogether.”

Dynamark Monitoring, Hagerstown, Md., is facing the problem head-on by partnering with major financial institutions in order to provide a solution for its dealers.

“Over the last year, many of the banks have been resistant to providing loans to alarm companies,” says Hank Groff, senior vice president of sales and business development at Dynamark Monitoring. “With the funding programs drying up, a lot of people are finding it harder to get money. I’m seeing a vast increase in the number of alarm dealers who can’t sell their contracts, and they’re going to look to consumer financing. … We currently have over 700 dealers, and they’re always looking for ways to stay competitive.”

National Monitoring Center (NMC), Lake Forest, Calif., is providing a financing solution for dealers in need of assistance that was developed through a strategic alliance with GreatAmerica Financial.

“This plan intends to provide our dealers and channel partners with a simple payment plan for monitoring projects,” says Woodie Andrawos, president of NMC.

Groff considers financing to be the greatest challenge at the moment — even greater than the coronavirus.

“If the banks aren’t willing to loan the money to the alarm industry, it forces the selling of equipment instead of financing it out, and that gets difficult when customers don’t want to pay the realistic $1,500-$3,000 it would normally cost to own a system outright,” Groff says. “So if we see that go away, it’s going to create a challenge for dealers.”

The Land of the Giants

While the security industry has historically been one where small businesses thrive, recent entrants have caused quite the shake-up.

“Without the COVID-19 pandemic, we perceived the biggest threat of the coming year to be increased competition from new entrants driving higher marketing costs, lower response rates, downward pressure on pricing and pressure on margins,” Johnson Controls’ Davis says. “These threats are creating a diluted definition of security, and in order for us to overcome the threat we must clearly define what ‘true’ security is and what value it has for end users.”

The prevalence of big tech companies is the perfect opportunity for dealers to show what separates them, says Judy Jones-Shand, vice president of marketing at Napco, Amityville, N.Y.

“While mass marketers and big companies in search of recurring revenue subscription-based business models are tough competitors, their equally huge ad spends and deep pockets have created unprecedented awareness and interest in security systems amidst the buying public,” Jones says. “So what a good residential alarm company needs to succeed in their own local market was simply a better, more efficient mousetrap to which they can apply their hard-fought security expertise.”

Klein says that while these big name companies bring added awareness to the security industry, their big marketing budgets make it difficult for others to compete.

“There’s been a lot of direct advertising to the consumer — both by DIY companies like Ring and SimpliSafe, but also on the professional side, with ADT doing some [direct to consumer] advertising as well,” Klein says. “I think the awareness has gone up significantly in a segment of consumers that perhaps had not considered doing security.”

Oren Kotlicki, founder and CEO of Intellithings, Tel Aviv, Israel, says that this has helped his company better market its wireless solution, as both dealers and consumers have become more familiar with and have gained trust in those solutions.

“In the last several years, we’ve seen consumer giants such as Comcast, Amazon and Google entering the market with wireless alarm systems that created two trends for the market,” Kotlicki says. “The first is the use of open-standard RF technologies instead of proprietary RF technologies; and the second is systems that aren’t just alarm systems, but offer integrations with smart devices to create smarter smart home experiences by enabling the automation of smart home devices based on motion events and home/away indications, provided by the alarm system.”

New entrants have also caused consolidation, says Morgan Hertel, vice president of technology and innovation, Rapid Response Monitoring, Syracuse, N.Y.

EMERgency24’s dealers have been consolidating like crazy, Lehan says.

“We’ve recently started picking up accounts in bulk because dealers are consolidating their accounts into one central station and in some cases, buying accounts from distressed businesses,” he says. “Consolidation is happening right now in earnest.”

The Coronavirus Effect

According to Omdia, many alarm companies were optimistic in March that the impact of COVID-19 could be small in the U.S., since many were seeing an increase in calls and installations. But with new lockdowns implemented, consumers have had to put off installs.

“I think 2020 was going to be as good as 2019, but the coronavirus is quickly bringing everything to a halt,” says Eric Garner, president and CEO of Mountain Alarm, Ogden, Utah. “We have lots of jobs in the pipeline, but more and more customers want to postpone their installation …We are having to be more thoughtful about our scheduling and my technicians aren’t getting as many hours. I’m sure it’s a matter of time before we see sales decrease.”

And even when technicians are allowed in the home, customers and even technicians themselves may not be comfortable.

“Eclipsing even the tangible threats posed by the new goliath residential competitors and mass marketers, such as Amazon, Google and SimpliSafe, COVID-19 has been formidable,” Jones-Shand says. “With virus fears, not only are dealers in need of a truly compelling reason to get to enter a home — masked or not — but alarm techs, too, may be equally uneasy about subjecting themselves to an unfamiliar residential premises.”

Multiple companies noted that a shortage in talent — the number one challenge cited by professionals in SDM’s 2020 Industry Forecast — is no longer an issue with COVID-19.

“Going into this year, there was the issue of finding workers and getting them trained,” Klein says. “In 2020 I’m going to expect that’s probably not an issue; rather there is too much labor on hand, so that’s going to be a big impact.”

While the maintenance of security systems is considered essential business, the industry could suffer because new installations are not considered essential in certain states and municipalities.

Embracing a hybrid DIY approach involving pro-guided self-installations may be the key to surviving shelter-in-place orders and social distancing guidelines.

“A lack of professional installations and in-home consultations doesn’t have to mean a big decline in business for alarm monitoring,” Kozak says. “It could mean a temporary increase in DIY options for consumers, where the system is pre-configured in a facility and shipped to the consumer. Video chatting and other methods could be used to offer a high level of professional involvement with installs.”

Alula has seen increased interest in adoption of its pro-guided, contactless install model since the pandemic started.

“The industry had already started dipping a toe in self-install models to compete with big tech DIY brands, but with the sudden onset of social distancing, we expect this trend to markedly accelerate with every company exploring new ways to reach customers without face-to-face exposure,” LaRock says.

McMullen says he has seen COPS Monitoring’s dealers try DIY for the first time during the pandemic.

“There’s no question DIY has a strong foothold in this industry, and they’ve had a definite advantage during the shutdown,” McMullen says. “We’re seeing dealers try DIY for the first time by shipping or hand delivering new equipment to customers’ doorsteps. By doing so, our dealers not only have the benefit of creating new relationships during this tough time, but they can back it up with professional assistance when the world returns to normal.”

But while getting creative with installations may save residential business, those with commercial accounts are left with no easy solution.

“The COVID-19 event has significantly curtailed commercial demand from 2019 levels,” EMC Security’s Raia says. “Residential business is down, but not as drastically as commercial business.”

Raia adds that he is expecting collections to become a growing problem as more businesses are unable to pay their bills.

“We’re coaching customers to make sure they have a retention program in place,” says Resideo’s Harkins. “Businesses that are closed might not want to pay a monitoring bill, so we’re making sure our customers have retention programs that help their customers.”

As the threat of customers’ budgets becoming smaller becomes more real, Johnson Controls is focusing on providing more affordable security services.

“It will become increasingly important to have products to service the lower end of the market, as well as giving our dealers the opportunity to create customers at a lower cost,” Davis says. “The circumstances will challenge our models, but we are responding by working toward scenarios where the consumer has different needs and our dealer partners are challenged to service those consumers differently … I suspect there will be a new normal requiring all of us in the industry to rethink how we market, sell, install, monitor and create value for our customers.”

Others agree it may be necessary to change the way they communicate with customers, both in sales and advertising.

Parks Associates says that pivoting messaging toward safety rather than security, and positioning oneself as a ‘servant to the community’ rather than a salesperson could work — and that this type of messaging may be more effective in the long run.

Helen Heneveld of Bedrock Learning, Holland, Mich., predicts the opposite might happen, with companies using fear in their advertising in order to emphasize that crime rises in times of desperation.

Harkins says Resideo’s customer base didn’t feel it was appropriate to reach out to customers at the start of the pandemic, but as they started to make calls, they began to see opportunities develop, and that customers value security as an essential service.

“We believe [communicating with the customer more frequently] will work and help drive revenue, and also stick over the long-term,” Harkins says. “If it’s good to talk to the customer when times are bad, it’s probably good to talk to the customer when times are good.”

DMP, too, has increased its amount of communication with customers.

“The biggest impact [of COVID-19] is how we support our dealers when being face-to-face isn’t an option,” Adams says. “What we are trying to do is take that thought a step further, and see how we can help our dealers’ salespeople continue to meet the needs of their customers when they themselves can’t meet face-to-face with potential clients.”

And like many other companies, DMP is exploring different ways to educate and communicate with customers virtually.

“We are currently relying on the full breadth of technology available to communicate with and support customers,” Adams adds.

At Rapid Response, finding creative ways to interact virtually proved even more important after major industry events such as ISC West and ESX were delayed or cancelled.

“Our sales and marketing teams have shifted to a 100 percent remote approach with a focus on social media, email, phone calls, video chats and webinars,” Denniston says. “It’s also changed hiring, training and how we all interact … It’s a very different time for sure.”

Looking Ahead

According to Omdia, security won’t fare nearly as bad as other industries, though Q2 and Q3 will likely be difficult.

“Unlike other industries that are being impacted by COVID-19, alarms could be less susceptible overall to decline, since the uncertainty could lead to a stronger demand for alarm monitoring and security in general,” Kozak says. “Consequently, alarm monitoring companies that continue with a business-as-usual approach could be hit harder than those that can be more agile in terms of getting in front of customers and offering professional services in new, creative ways.”

Most other security professionals agree the turbulent economy and rising unemployment could create a stronger demand for security.

“The safety concerns of our customers will continue to be magnified,” says Brent Duncan, CRO, Interface Security Systems, St. Louis, Mo. “Unfortunately, such a shock to the economy of this magnitude will only increase crime, theft, burglary and fraud. We are well positioned with our solutions to help businesses combat these challenges.”

McMullen adds, “It’s tough to say how COVID-19 will affect 2020 and beyond. On one hand, one could easily speculate the unprecedented unemployment and repressed economy could mean customers may have less money to spend. On the other hand, when the economy suffers, not only does crime tend to rise, people also want greater security and the peace of mind that an alarm system provides.”

So while shelter-in-place orders may have technicians’ hours shrinking for now, that could change quickly.

“When we can all go back to work again, we are going to be very busy,” EMERgency24’s Lehan says. “And the longer the lockdown is, we expect more movement of accounts in bulk.”

Johnson Controls hopes that after a challenging April and May, the industry will start to see green shoots in June and a rebound as we move into the second half of the year.

“When demand starts to rebound, firms will have to adjust many aspects of their operations to meet the overdrive of expectations combined with the busiest time of the year,” Davis says. “Being able to recover from a pandemic driving a deep recession quickly could put real pressure on systems at companies that were finding ways to merely survive just a few weeks prior. Businesses coming out of the depths of the crisis best prepared for recovery could likely find many opportunities.”

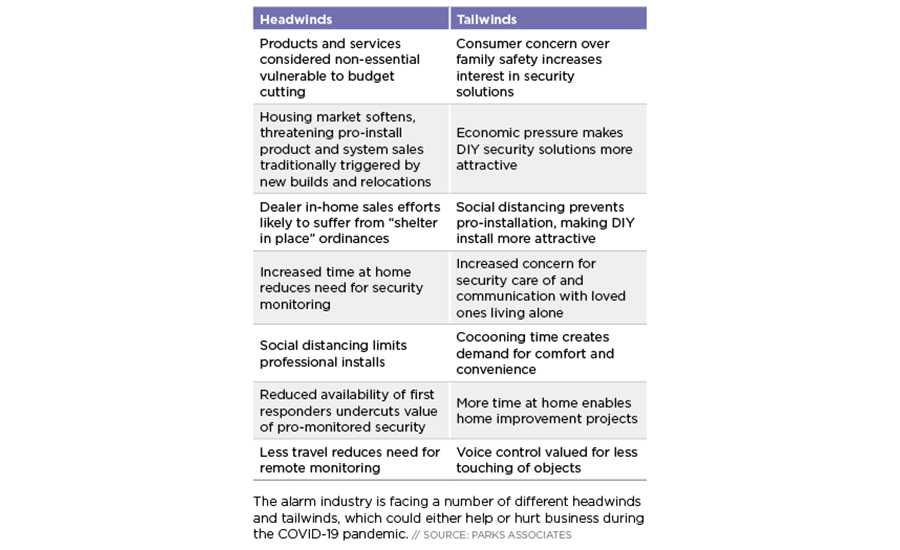

Parks Associates has identified a number of tailwinds and headwinds the industry is facing at the moment (see graph on page 42). And there are lessons to be learned from the recession of 2008/2009.

“The security industry was long thought to be recession-proof, but 2009 proved otherwise,” Abdelrazik says. “The Great Recession took a toll on the security industry as conditions hit it vigorously. These included foreclosure, unemployment, declining home values, a lack of mortgage availability and, for many years, very low moving rates. However, it does have recession-resistant characteristics, as concern for the safety of one’s family and possessions often strengthens in times of uncertainty and struggle. The industry is resistant, but not immune.”

Innovate or Die

Parks Associates research shows that if companies want to grow, they have to offer more.

“Companies that are augmenting their business models and strategies to expand the market and appeal to shifting consumer behaviors will win the market,” Abdelrazik says. “The inclusion of DIY to traditional offerings, ad-hoc or month-to-month monitoring contracts and monitoring verticals such as water/leak detection add value.”

Alarm.com is one company that has helped its dealers benefit from offering whole-home protection services.

“We talk in this industry about providing full protection, but historically, it’s only been intrusion protection, and we really want to think about the whole home,” Ferguson says.

DMP’s Adams says it’s important to innovate in order to meet customers’ changing needs.

“Our ability to adapt to the changing landscape of security needs as well as how to support and deliver our product message to our dealers has proven to be beneficial,” he says. “There are things that we have learned and practices we have put in place we will continue to use beyond the current circumstances caused by the coronavirus.”

Heneveld says companies can adapt the technologies they already have to work in different ways.

“We don’t even know what the new monitoring opportunities are going to be [in the world post-COVID-19]” Heneveld says. “I don’t think it’s going to be new technology and new products; it’s going to be a shift in applications of existing technologies.”

Two sectors Heneveld sees as becoming more popular are health and independent living.

Klein of the Z-Wave Alliance agrees. “This whole conversation about aging-in-place is going to be a big topic of conversation,” Klein says. “I think that is an enormous opportunity not just for security, but for the device makers, the cloud people — everyone.”

And it’s easy to imagine an unlimited number of possible applications from technologies such as AI, video analytics, machine learning and edge computing.

“A lack of innovation and aggressive effort to bring new products to market can become a brutal error for anyone,” Adams says. “You also have to combine that with clearly defined product messages that explain to the market the benefits of those products.”

And while we may be living in a world of unknowns, it’s safe to assume consumers will want to come out of this more secure and connected.

“There are a tremendous amount of unknowns, but the increased focus on security certainly has us optimistic coming out of the COVID-19 situation,” Ferguson says. “The increased expectation and need consumers will have around connection and wanting to stay connected to the home, the business, the people in the home — that is so much more palpable for all of us now, and I think it will drive additional opportunities. Our service provider partners are saying they’ve never been as busy, and are getting more call volume than ever before.”