Blink and you’ve passed it. While this saying is about small towns in rural America, the burglar and fire alarm industry can give that saying a twist: “Blink and it’s passed you.†Quick-changing technology has made obsolescence commonplace, as a growing array of complex new products is brought to market. Now, more and more, integration and providing a plug-and-play integrated “solution†to dealers is the wave. Without a doubt, this brings with it both an opportunity and a challenge to distributors to offer a higher level of training.

The logistics of distribution are changing along with the technology, with distributors managing more of dealers’ inventory. Also having an influence is electronic processes, such as electronic data exchange and Internet ordering, which have created cost efficiencies not possible in the past.

Most distributors agree that with regard to the burglar alarm segment, distributors carry more products today than 12 months ago. There are three primary reasons for that, notes Randy Teague, vice president of marketing, ADI, Melville, N.Y.

First, “the residential funding cycle has returned, though perhaps with more rationality with credit versus risk at the installer/central station level.â€

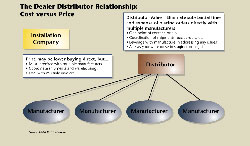

Second, “some manufacturers really understand the cost to serve an account and the value that distribution brings to both the manufacturer and the dealer. For the dealer, the purchase order, logistics, collections, inventory costs and processes are better served by the experts – distributors. Manufacturers’ operational profitability increases. On the dealer side there are usually more favorable credit terms, there’s usually only one purchase order/shipment per job, and there’s no cash tied up in inventory. Dealers’ operational profitability and risk is reduced,†Teague emphasizes.

And third, Teague notes that although ADI doesn’t seek to add brands that overlap, “there are more brands being added to fill niche markets or growing markets that are not typically served by the traditional burglar and fire alarm products – mobile/portable systems and PERS are just two,†he says.

Value-added services is a hot button for Steve Roth, president and CEO of Tri-Ed Distribution Inc., Woodbury, N.Y.

“The complexion of security wholesale distribution has changed markedly over the last several decades. Once a business enterprise conducted on a local level, today’s security products distributor now services every market segment, from the small, medium and large sized company to regional and national entities. The role of wholesale distribution in the security industry must continually evolve to accommodate the demands of a segmented dealer/integrator customer base and the technology driven manufacturer/supplier community. Maintaining a real value proposition is key to the continued success of wholesale distribution and its relevance to those it serves,†Roth believes.

He says there are myriad value-added services that today’s distributor provides in order for them to be a true business partner with their dealer-customers.

“Inventory, for starters. Every product they need, when they need it, is available and stocked by the distributor,†Roth remarks. “Credit terms. Customers working on limited capital can conduct business now, and pay for the product later.

“Technical training and support,†Roth delineates. “Any distributor worth their salt keeps you apprised of the latest product offerings and how to properly use and install them. Warranties. If there’s a problem with a particular piece of equipment, your distributor replaces it and handles the warranty work for you.â€

Jeff Hyndman, marketing manager for Atlanta, Ga.-based Systems Distributors Inc., finds it difficult to determine if more manufacturers are selling directly to dealers, but his guess is fewer. “In general, the larger manufacturers, especially, do not want the burdens of inventory, receivables and first-line questions on their expensive overhead structures. This is not to say that certain government and large integrators they won’t sell to direct; they will, just as they always have, but it is not their preference. Sometimes the competition forces them to do what they would rather not do.â€

John D. Hopper, chief administrative officer for the Monterey, Calif.,-based dealer Sentry Alarm Systems Inc., says, “There are now many more players at the table, flexing for our dollars.†While Hopper has seen some manufacturers selling products directly, rather than through distribution, he thinks most see the value of partnering with distributors rather than attempting to sell directly to dealers.

“I appreciate having a single source of contact for our purchasing needs, particularly when the distributor is bringing talent to the equation with quality reps that can speak knowledgeably about many different lines of products,†Hopper says. “I think the distributors’ reps have the ability to look at the total value of our purchasing power and bring resolution to issues with manufacturers.â€

Hopper says the overhead savings of dealers not having to stock as much inventory makes up for the prices distributors charge.

“Rarely is there much of a difference, not to mention the accounting nightmares with multiple vendors, multiple reps, multiple credit policies, variances in shipping cost. When a manufacturer does come to the table with better direct pricing, we will always entertain a serious price differential, but usually we do not see that. In fact, it is annoying when manufacturers do not give you the option to purchase through distribution,†he says, because taking inventory, entering it into a database, shrinkage, and other factors are labor-intensive. “It just makes absolutely no sense to stock anything other than common parts you will use up in a few weeks and other emergency service parts. [It] really helps cash flow,†Hopper adds.

Often, dealers cannot buy products directly from manufacturers, but must purchase them through distributors. Manufacturers such as DMP (Digital Monitoring Products), Springfield, Mo., however, always have been sold directly to the dealer. Gary Kallman, vice president of sales and marketing, explains: “We’re not trying to leverage scale and penetrate mass markets.†DMP selects its channel partners and trains its dealers to be competent in its products, which Kallman says are more complex than traditional equipment. “We don’t have a dealer program per se. We are a dealer program.â€

Kallman says the trend he has seen has been more products being sold through distributors. “More manufacturers are going through wholesale. We run contra to the trend.â€

Bruce Nagy, manager, marketing and communications services for Tyco Intrusion Security, says installers feel that distributors add value. “The vast majority of security products are purchased from distributors. We agree distributors add value and deserve our full support and partnership,†Nagy says. “A very few well-delineated products, such as our complex Sur-Gard monitoring station receivers, are sold directly to central stations because they require full installation, technical support and training from our technical team. If we develop some receivers that are less complex, they may be also sold through distributors.â€

Added Value

Just what value can dealers get from their distributors? At ScanSource Security Distribution, Greenville, S.C., president John Gaillard says distributors provide education. At his company, that includes not only training in products, but how to run businesses more efficiently. Distributors should provide product training, sales and marketing, and financial training, he says, as well as a level of pre-sale and post-sale technical support. If a dealer buys a product from a distributor and it arrives malfunctioning, he wants to be able to get it back to one source.A distributor has to provide more efficient ways to help, Gaillard says. That can include a robust online ordering system with real-time shipping and tracking information. Financial help also is essential. The function of the distributor, he says, is to help the dealer grow the business. That can include providing storefronts to cut costs of sales. Online technical tools, design tools and configuration tools at a central point on the Web can help dealers make sales and increase efficiency.

How has the Internet affected the behavior of the dealer with respect to product research, training and ordering? Roth asks. “Product catalogs and specs are at the dealer’s fingertips, anytime, via the Internet. Webinars make training far more accessible and convenient.â€

ADI also has plans to broaden the type of training offered to dealers, Teague says. For example, ADI Expos will include more business-related seminars – such as marketing, operational/cash management, and human resources – in addition to technical/product seminars. It also plans to announce an upgrade to myADI, the online ordering and account management tools.

Internet sales of security products offers convenience for dealers, but also has created pricing pressures in the market. According to Hyndman, “Internet sales are growing and will continue to, but it is unclear at this point if that reflects any change, really, on who is selling to whom. Distributors are also now selling to their customers on the Internet, but they are still their customers. It is just another service and convenience for those who like that vehicle.â€

ADI’s Teague stresses that dealers need to take advantage of all the programs and services offered by a distributor. “Ask them how to grow their installation business. Provide feedback on what you want from a distributor,†he says. “Distribution relationships should be broader than just price and fulfillment.â€

Sidebar: How Does EDI Provide Value?

Electronic Data Interchange (EDI) takes the burden off of purchasing and inventory control staff, as computer prompts can now maintain inventory and calls for re-orders, says Steve Roth, president and CEO of Tri-Ed Distribution Inc., Woodbury, N.Y. He says that larger companies, especially, can take advantage of the EDI services a distributor provides to assist with the logistical work of product management.“One of the greatest benefits of EDI all around is that it takes significant labor costs and errors right out of the equation,†Roth explains. “Customers who have evolved to an integrated sales, purchasing and financial IT system can order electronically, on a job-by-job basis or as inventory levels dictate. The distributor processes customer orders electronically and, in turn, orders from the supplier electronically.â€

Sidebar: 6 Trends that Affect Distribution

Over the course of a year, many obvious as well as subtle changes occur that influence the way in which products are distributed to dealers. SDM asked Randy Teague, vice president of marketing, ADI, to identify some of the changes he has witnessed in the distribution of burglar and fire alarm products during the past 12 months.- 1. The funding cycle has returned for residential burglar alarms. This is a positive for dealers, manufacturers and distributors.

- 2. Cross-segment actions are moving the industry to more of an integrated installer – consumer electronics, IT, and electrical channel dealers are interested in burglar/fire; security dealers are moving into A/V.

- 3. IP, IP, IP – it started with CCTV products, but it’s moving across all segments, both residential and commercial. Training interest from dealers is highest here.

- 4. Consolidation on both the manufacturer and dealer sides seems to be slowing.

- 5. Fire products are trending towards addressable panels and away from conventional.

Copper and oil prices are driving significant increases in wire/cable costs/prices. It’s becoming a larger percentage of equipment cost on each job.

Sidebar: 5 Questions You Must Ask a Distributor

What’s the best way to evaluate a distributor with which to do business? Naturally, the distributor must carry your standardized product lines, offer acceptable prices and terms, and be able to deliver products within a reasonable time frame. There are many other factors to consider. SDM asked Randy Teague, vice president of marketing, ADI, for the top five questions dealers should ask in order to choose a distributor with which to partner. Teague offers these ideas:- Can the distributor help me grow my business?

- Does the distributor have knowledgeable staff who are committed to supporting me?

- Is the business experience easy and error-free?

- What services does the distributor provide that add meaningful value to my business?

- Does the distributor have sufficient product breadth and delivery capabilities to allow me to minimize my operational costs (one-stop shop, and I can order when I want and receive the product when I need it)?

The best dealer-distributor relationships combine the financial, operational and service aspects. Every day, a distributor should be working to prove its value to each individual customer, Teague says.