Security dealers, systems integrators, manufacturers and distributors express optimism regarding the outlook of the access control marketplace in 2007. Dealers and integrators see their access control business increasing regardless of the technology chosen, as end users update older systems and introduce increased security to their facilities. They note that concerns about school security are resulting in installation of various types of access systems in schools and universities throughout North America.

“I see a huge opportunity in access control,” declares Kevin Estes, president of Sonitrol of Indianapolis, Indianapolis. “Access control is a gift to us that just keeps on giving, so I don’t see any short-term end to this growth. I see us continuing to grow 10 to 15 percent a year.”

Manufacturers cite the Federal Information Processing Standard (FIPS) 201 for smart cards as one reason for optimism as the cards are introduced to government and industrial facilities.

“We are anticipating continued smart card growth,” relates Tam Hulusi, Ph.D., executive vice president, HID Global, Irvine, Calif. “Our more experienced and sophisticated customers are seeing the value of convergent applications. Today’s buyers see security as an infrastructure investment.

“We see continued growth in security applications due to global macroeconomic conditions and sustained growth in established product lines for a number of years,” he concludes.

Manufacturers also point to the slowly but steadily growing market for biometric access devices.

Sales were up for dealers, integrators, manufacturers and distributors in 2006. Despite this, dealers and integrators interviewed for this article reported pricing and competitive pressures that are keeping the lid on margins and profits. Some are overcoming this through their volume of sales and others by selling more integrated systems to their customers instead of just what the customers say they need.

“Our profit level is down, but our sales and new accounts have increased,” reports Kevin Fitch, director of security sales, Sound Inc., Naperville, Ill. His customers are integrating multiple technologies with their access systems. “So that’s why for us the sales have grown, because we’re doing more than just providing a lock at that door,” he explains.

Additional services Fitch lists are monitoring how many people enter a door and providing mustering reports during emergencies. Maintaining long-term relationships with customers also can build business over time, Fitch points out.

“It’s more competitive and the revenue is not what it used to be, but what we are focusing on is maintaining the relationship to get recurring revenue from the same account,” he reveals. Fitch notes that many of the job sizes for his company have increased from the usual $20,000 to $30,000 range to $4 million projects.

GLOBALIZATION IS BEING FELT

Profitability is down, agrees Raymond Dean, president, PEI Systems Inc., Long Island City, N.Y., but his company gets more revenue per job with the quality of its employees.“I really believe all equipment is going to be vanilla in the future,” Dean asserts. “What I

mean by that is that DVRs are going to look the same, all those things are going to be pretty much vanilla. The difference will be the quality of the individuals you have taking care of customers and what’s going on with the intelligence aspects of your systems.

“So we’re really focusing on getting our people better trained and better equipped to deal with this world,” he resolves. “I think the biggest thing all companies in my market are facing is the whole convergence issue. We better get smarter and learn to do things better and be better at what we do. And the only way to do that is by raising the bar on the quality of personnel that you hire.”

Another aid to profit is becoming skilled in the convergence of physical and logical security, Dean points out. “We’re seeing a lot more work that has to do with globalization and enterprise systems where we’re talking access control. We have done a lot in terms of the

IT world and have embraced what we will call convergence,” he says. “So what we’ve found is a lot of our customers are calling on us to assist them in that transition, to move toward the IT side of convergence, and we’re doing a lot of access.

“We’re seeing that with the major Fortune 100 corporations. I’m talking large financial institutions. Everybody seems to see the network as being the place to solve the problem of moving information around the world, and we project our business is going to continue to go up,” Dean predicts.

PRODUCT COMPLEXITY REQUIRES INCREASED TRAINING

David Dalby, vice president of operations at TransAlarm Inc., Burnsville, Minn., reports a small decline in profit (approximately 2 to 3 percent), which he attributes to greater competition.“The competition is becoming better, the products are becoming easier to install, and the sophistication level for the installation has gone down a little, so more companies are able to compete and install access control systems,” Dalby declares. “We’re also seeing more competition with the smaller players. In the past, for example, we hadn’t seen locksmith companies now installing under-10-reader access systems.”

But he maintains that end users do not have the expertise to purchase access control systems over the Internet and try installing them themselves, as some end users do with video surveillance systems.

“Your IT people can’t put in door hardware and put in readers,” Dalby asserts. “They can mount cameras, but when you need access control, you need a higher level of installation expertise.”

Despite the pressure on profits, TransAlarm’s recurring monthly revenue (RMR) is on the rise. “RMR definitely has increased dramatically over the last two years — a strong 15 percent, maybe even greater — from 2006 to 2004,” he reports.

Dalby gives another explanation for a decline in profits as the need for additional technical training. Fitch agrees, citing up to $2,500 per employee for an IT certification course. “Our guys have to have these certifications to represent the products we’re working with,” Fitch insists.

Other rising costs are due to the increasing complexity of access control jobs. “We are having to run jobs with more project management instead of an account manager running them,” Fitch points out. With previous technology, technicians could install the equipment and program it themselves, he maintains.

“With the level of programming and training necessary, we need another group of people to go out and represent the company and do training and setup, and explain to the customer, ‘Here’s the information I need from you,’” Fitch describes. “Those changes had to be made internally — there’s no way we could support systems without it,” he emphasizes.

He is optimistic about the access control market’s growth because of users’ increasing sophistication about the product category’s capabilities. “People are using [access control] for more than keeping people locked out of buildings,” Fitch says. “They are managing people in their buildings and in certain areas of their buildings. It’s becoming more IT-driven, and the budgets are there.”

MANUFACTURERS AND DISTRIBUTORS OPTIMISTIC

The dominance of IT can bring a boost to security budgets, thinks Peter Boriskin, director of product management for access control in Tyco Fire and Security’s access control and video systems business unit, Boca Raton, Fla.“Since IT has a larger budget and more visibility, the vertical nature of it is such that it definitely bubbles up through the ranks a lot more quickly than physical security has in the past,” Boriskin asserts. “What that has allowed us to do is really get a lot more visibility for physical access and security management within the domain of IT.”

Boriskin does not think that commoditization of access control products is a threat yet. “The line is usually wherever your intellectual property ends, that is the point where commoditization starts,” he maintains. “Readers that have intellectual property in them do things your inexpensive reader can’t do.

“As you move up to the highest level of the security management system, that’s where the intellectual property resides, and that really is the barrier to entry for the low-cost provider,” Boriskin asserts.

The competition among readers with significant intellectual property in them remains keen, concludes Shamus Hurley, president, Bosch Security Systems, Fairport, N.Y.

“There certainly are plenty of competitive offerings in the marketplace for all those customers looking for access control,” Hurley points out. “If you look at the traditional electronic access control with a photo badge system, what we see is about a 10 percent compound annual growth rate in that specific segment. If you get into smart cards and different types of cards, you’re looking at probably closer to 20 percent,” he estimates. “Because of the barriers to entry, distribution and marketing, if you’re doing 10 percent and making a profit, that’s very good.”

Different segments of the access control market also are experiencing varying rates of growth at Schlage Electronic Security, Carmel, Ind.

“We participate in multiple parts of the access control market, and it’s different for each subcategory,” reports Martin Huddart, Schlage’s strategic business unit manager. “Overall, for us it’s probably in the range over one year of 10 to 20 percent, but there’s a big difference in families,” he says. Huddart explains that online peripheral devices are up significantly more than that, while some more mature parts of the market are not up that much overall.

Vineet Nargolwala, director of strategic marketing and global product management, Honeywell Access Systems, Louisville, Ky., agrees with Huddart on the differences in growth.

“In the recent past, smart cards have experienced more growth than prox,” he reveals. “We’re looking at close to double-digit growth in number of units shipped 2006 over 2005.

“Overall, at some level, the access business is tied to commercial construction,” Nargolwala says. “The soft nature of commercial construction globally except in the Middle East, India and China is a head wind for the access business. I think a lot of the access systems tend to be proprietary in nature and that could potentially be a drag on the growth of the industry.”

Huddart sees a need for better service. “I think people always have been concerned about service,” he asserts. “It continues to be a big issue for end users, not just the product, but the whole service experience. I think they’re increasingly aware and sensitive to open architecture technologies, and they understand how they’re locked into a particular product over the long term.

Distributors are pleased with the progress of the access control market. “I think it’s going to be another great year,” predicts J.R. Hentschel, director of access control for distributor Boyle and Chase, Hingham, Mass. “2005 was our biggest year in history, and in 2006, we were way ahead of it.”

Sidebar: Which Vertical Markets Will Help You Grow in 2007?

“For us, it’s commercial, industrial, education. We do petroleum plants. Our large scope of work is through pharmaceuticals. Everybody has their niche — we are heavily involved in the pharmaceutical market. That’s where our relationships have taken us, and we kind of found our niche.”—Kevin Fitch, director of security sales, Sound Inc., Naperville, Ill.

“We’re looking at the pharmaceuticals. You’re going to see a lot more there. Airports and ports and financial institutions will continue.”

—Raymond Dean, president, PEI Systems Inc., Long Island City, N.Y.

“Property management — we see that as one of the biggest growth areas for access control — commercial buildings, no residential.”

—Kevin Estes, president, Sonitrol of Indianapolis, Indianapolis

“Our vertical markets are health care, utilities and food production. Those are giving us the greatest growth now and will continue to be strong in 2007.”

—David Dalby, vice president of operations, TransAlarm Inc., Burnsville, Minn.

“What we see is government in terms of homeland security. Other areas we’re experiencing enormous growth in are financial institutions, big-box retail and transportation.”

—Shamus Hurley, president, Bosch Security Systems, Fairport, N.Y.

“I would say that any vertical market that has to deal with critical infrastructure, whether related to government, the FIPS 201 mandate or related to airports, seaports or chemical plants. Anything that is critical infrastructure which would be regulated by government mandate or that requires them to upgrade security, such as financial and banking.”

—Vineet Nargolwala, director of strategic marketing and global product management, Honeywell Access Systems, Louisville, Ky.

“Government is one of the big areas, as well as any company or agency that has requirements for auditability and accountability. So financial, health care, pharmaceutical, those having strong compliance requirements.”

—Peter Boriskin, director of product management for access control in Tyco Fire and Security’s access control and video systems business unit, Boca Raton, Fla.

“Overall, education I think will continue to do well. We’re definitely seeing a lot of interest in security and video products within the K-12 market. The institutional market still looks pretty strong in particular. They’ll do better than commercial markets overall. We’re fairly optimistic about that market next year.”

—Martin Huddart, strategic business unit manager, Schlage Electronic Security, Carmel, Ind.

“We expect to see continued convergence in many domains (retail banking, logistics, vending).”

— Tam Hulusi, Ph.D., executive vice president, HID Global, Irvine, Calif.

“Anywhere the level of security has increased, you’ll see a lot more access control being added. Any of the drop ships we do for authorized dealers are to a lot of hospitals and school systems, because it’s important for us to protect our children. By the same token, we saw a lot of health care facilities adding access control for Alzheimer’s patients.”

— J.R. Hentschel, director of access control, Boyle and Chase, Hingham, Mass.

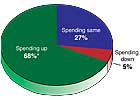

*percentage of respondents to SDM’s 2007 Industry Forecast, conducted November 2006

Sidebar: More than 8 in 10 Security Executives Expect ‘Good’ to ‘Excellent’ Results in Access Control Sales this Year

SDM asked dealers and integrators: “Considering the economic health of your business, how would you define the state of the market and the potential for access control sales in 2007?”Dealers and integrators are highly optimistic about sales growth in access control in 2007. As many as 82 percent surveyed by SDM expect their sales to be “good,” “very good” or “excellent.”

Sidebar: A Strain on Training

The increasing importance of IT in access control is putting a strain on the training of dealer/integrators and their installers, thinks Vineet Nargolwala, director of strategic marketing and global product management, Honeywell Access Systems, Louisville, Ky.“As the business becomes more IP-centric, the skill sets and the training levels of the integrators need to improve,” Nargolwala maintains. “Additionally, there is still a discomfort factor in selling to IT people, and in installing and configuring software more complex than the standard access system. This could hold the industry back.”

*percentage of respondents to SDM’s 2007 Industry Forecast, conducted November 2006

Sidebar: Two-Thirds of Dealers & Integrators Plan to Spend More on Access Control in 2007

SDM asked dealers and integrators to indicate how they expect their level of spending on access control products and services in 2007 will compare with 2006.Good news for the industry: More than two-thirds of security dealers and systems integrators surveyed by SDM expect to increase their spending on access control products in 2007.

Sidebar: How Security Firms Are Drawing RMR from Access Control

Some dealers and systems integrators are making access control a source of recurring revenue similar to monitoring fire and burglar alarms. David Dalby, vice president of operations, TransAlarm Inc., Burnsville, Minn., has been promoting the company’s access management center to customers.“We control the customer’s system from our central office,” Dalby explains. “The customer doesn’t actually own their system. For a monthly fee, we manage it. They e-mail or fax us the information, and we take care of the changes and programming from our central station.

“Some people call it remote access management,” he explains. “Our focus is recurring monthly revenue. We’re a hybrid company — we do access control, we do CCTV, we do integrated systems, but we also have our own UL central station, so we do intrusion and fire alarm monitoring.”

The company has promoted this service and updated software for corporations that manage their own access.

“We did a full court press on our access management center,” Dalby reports. “We also looked at our customer base that had their access management software they were managing themselves on smaller systems and targeted them for upgrades to more current products, if they didn’t want to bring it into our office.”

Sonitrol of Indianapolis, Indianapolis, does similar work. “All access systems we provide are supported by ongoing support agreements, so as our sales increase, our recurring revenue will follow proportionately,” points out Kevin Estes, president, Sonitrol of Indianapolis.

“Many times, an IT buyer initially will want to manage the users and access levels themselves, and then later realize that might be impractical for them for a variety of reasons and choose to outsource that service to us,” Estes relates. “Setting, adding and removing users on a 24-hour basis can be a burden to them, especially if they’re printing photo IDs and have to drop what they’re doing to take a photo of a new employee.

“They realize it’s more practical for them to outsource that service,” Estes concedes. “They wouldn’t have to support that card printer out there.”