As the pandemic progresses, the difference between the pre- and post-COVID-19 world becomes more and more emphasized. Months into socially distancing, it’s increasingly hard to imagine how the world will operate once the virus has finished passing through. And we have no definite answer as to when and whether things will ever return to normal. Experts can give their most educated guesses, but this is a situation unlike anything we have ever faced; only time will tell how this chapter of history will end.

While the general economy has not been faring well, many of those in security have remained optimistic due to its designation as an essential business and many ‘recession-proof’ characteristics.

A new wave of research from Clear Seas, a BNP company, shows how the industry’s outlook on multiple facets of business has fluctuated through the course of the COVID-19 pandemic. The research is based off a survey sent to those in the security and critical facilities industries at four different times: the week of March 24, the week of April 2, the week of April 16 and the week of May 4.

When asked about business concerns, 77 percent of respondents to the March 24 survey said they were concerned about the economy. The amount of respondents concerned with the economy decreased by five percentage points over the next two surveys, but shot up to a high of 79 percent on May 4.

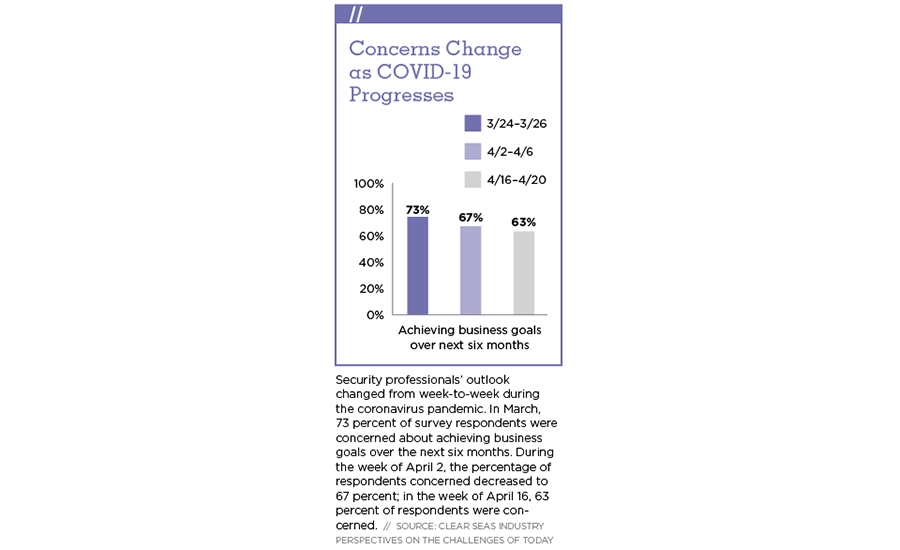

Concerns over achieving business goals over the next six months followed a similar pattern. While 73 percent of respondents were concerned with achieving goals on March 24, 67 percent were concerned April 2, 63 percent were concerned April 16 and 67 percent were concerned on May 4.

In the shorter term, professionals are less concerned with achieving business goals over the next three months. The percentage of respondents concerned over the next three months started at 69 percent in March, went up to 74 percent in April 2, to 68 percent April 16, and then to 61 percent in May.

The number of professionals concerned about business stability over the next 12 months also decreased after a spike on April 2. Sixty-four percent of respondents reported being concerned about business stability over the next year in March, 74 percent were concerned April 2, 67 percent were concerned April 16 and 61 percent were concerned in May.

Security Industry Strengths

“I think the industry benefits from the fact that we provide solutions and services that are going to be required to support the reopening of the country in a safe way,” says Kyle Gordon, vice president of sales and marketing, STANLEY Security, Fishers, Ind. “A lot of the things providers and integrators in this space are doing is going to support a safe reopening. Whether that’s screening technology or analytics, all of the great data we have is going to be able to support end users in the broader community.”

For an industry that was facing a critical labor shortage prior to March, that is one issue that suddenly became less of a worry. The percentage concerned about skilled labor shortages was 32 percent in March but rose to 48 percent in May.

This tracks with the relaxation of shelter-in-place orders, and a reduction in project cancellations. Both active and planned business is the most on schedule it has been since March, according to Clear Seas. Fifty-two percent of the May respondents reported that active business was on schedule, and 42 percent of planned business was on schedule. Thirty-five percent of active business was delayed, and 12 percent was canceled. Forty-six percent of planned business was delayed and 12 percent was canceled. On April 2, 42 and 32 percent of active and planned business was on schedule, respectively.

For the security industry, closed businesses were not necessarily a bad thing.

“We have a few facilities that have shut down completely and we now have free reign to install our systems without any hindrance that we normally would have on a regular day,” says Renee Schwab, CEO of Care Security Systems, Montebello, N.Y.

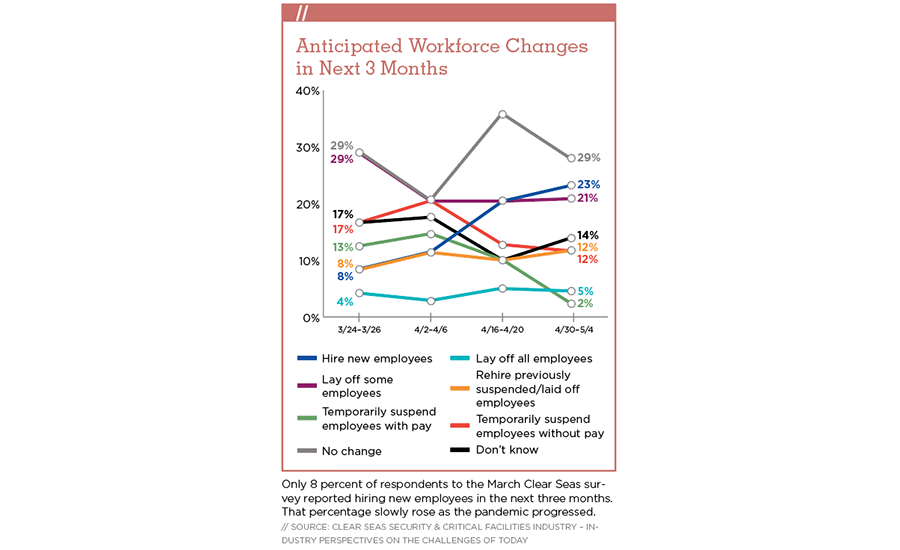

There has also been an increase in hiring. Only 8 percent of respondents to the March Clear Seas survey reported hiring new employees in the next three months. That percentage slowly rose as the pandemic progressed. Twenty-three percent anticipated hiring new employees in the next three months in May. Those anticipating lay-offs are also down, from 29 percent of respondents in March to 21 percent in May.

Allied Universal and G4S both announced they were planning on hiring thousands of employees in response to increased business from COVID.

The U.S. government’s Paycheck Protection Program (PPP), which covers eight weeks of payroll, did not apply to all of security industry, but helped those that got it. Fifty-three percent of respondents to the fourth wave of Clear Seas’ survey said they didn’t qualify for small business stimulus loans, but 15 percent said they had applied and received money. Nine percent of May respondents said they applied and were waiting for approval; 6 percent said they had applied, were accepted and waiting for money; 9 percent said they applied and were denied; and 9 percent said they were qualified but not planning on applying for stimulus loans.

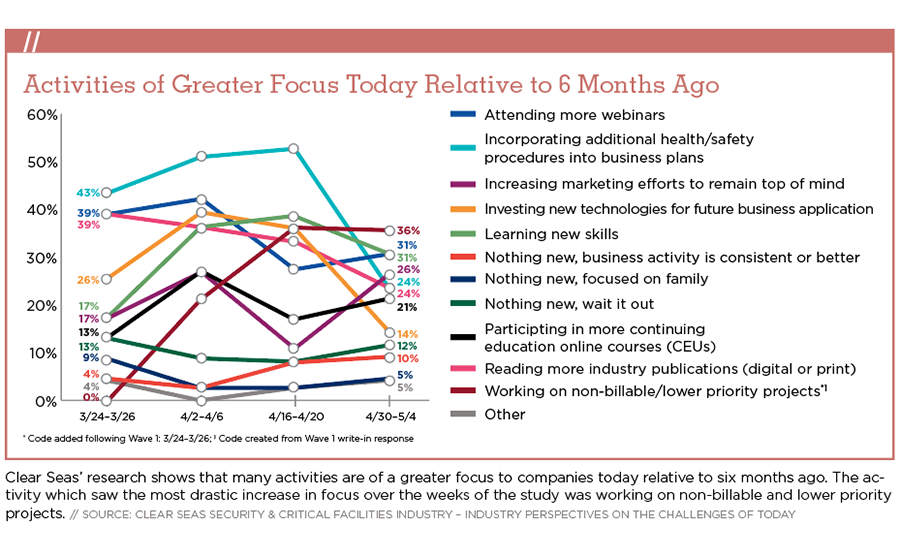

Clear Seas’ research also shows that many activities are of a greater focus to companies today relative to six months ago. The activity which saw the most increase in focus over the weeks of the study was working on non-billable and lower priority projects. Twenty-one percent reported a greater focus on it April 2, and 36 percent reported a greater focus on non-billable and lower priority projects in May.

Training & Selling

COVID-19 has also changed the way the security industry approaches both training and sales — for example, webinars have become a dominant tool from every corner of the web. But response to them has been mixed, according to the research. While 42 percent of respondents reported a greater focus on attending more webinars on April 2, 28 percent reported greater focus on webinars April 16, and 31 percent in May.

In the same vein, 13 percent of Clear Seas survey respondents reported a greater focus on participating in continuing education online courses in March, while 27 percent reported a greater focus on the activity April 2, only 17 percent reported a greater focus April 16, and then 21 percent reported a greater focus on online learning in May.

Selling tactics are predicted to shift.

“As you adapt to a new way of selling, you’re going to find new things that work that may drive incremental growth,” Scott Harkins, vice president and general manager of the connected home, Resideo, Austin, said at the company’s town hall on the state of the security industry during COVID-19 on April 8. “These might have legs that last over the long haul. It will be an uncertain market for the next few months, but the things we are doing today as an industry and as individuals will help turn the tides.”

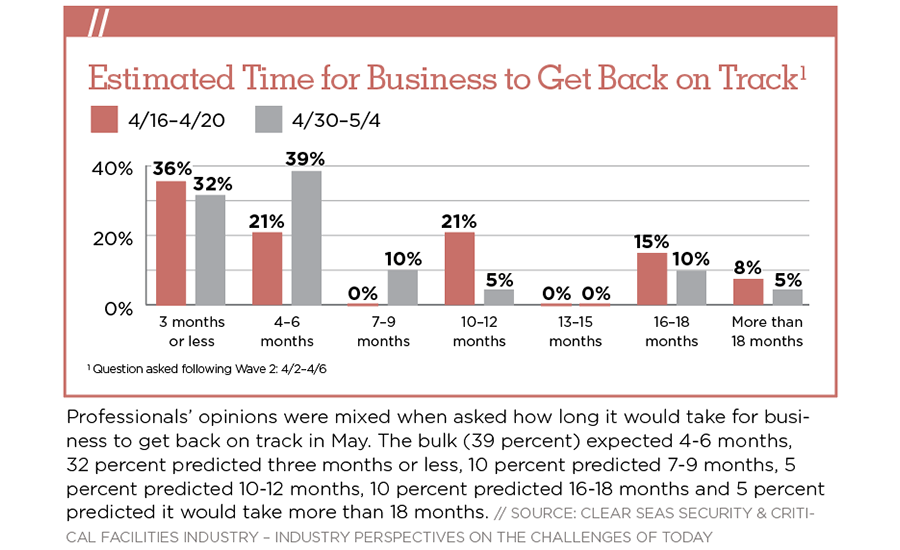

Professionals’ opinions were mixed when asked how long they estimated it would take for business to get back on track in May. (See chart above.)

No matter how long it takes, there is a sense that the security industry overall will survive this bump, as it has others.

“[The] security company will survive,” Gordon says. “I’m hoping this will push us to continue to evolve faster. Maybe having a bigger purpose will give us all something to rally around.”

MORE ONLINE

For more up-to-the minute coverage on how the coronavirus crisis is affecting the security industry, go to www.SDMmag.com/Coronavirus-Coverage.

Figure 1. Professionals’ opinions were mixed when asked how long it would take for business to get back on track in May. The bulk (39 percent) expected 4-6 months, 32 percent predicted three months or less, 10 percent predicted 7-9 months, 5 percent predicted 10-12 months, 10 percent predicted 16-18 months and 5 percent predicted it would take more than 18 months.

Source: Clear Seas Security & Critical Facilities Industry – Industry Perspectives on the Challenges of Today

Source: Clear Seas Security & Critical Facilities Industry – Industry Perspectives on the Challenges of Today

Figure 1. Professionals’ opinions were mixed when asked how long it would take for business to get back on track in May. The bulk (39 percent) expected 4-6 months, 32 percent predicted three months or less, 10 percent predicted 7-9 months, 5 percent predicted 10-12 months, 10 percent predicted 16-18 months and 5 percent predicted it would take more than 18 months.

Source: Clear Seas Security & Critical Facilities Industry – Industry Perspectives on the Challenges of Today