Video analytics fall into two categories: business and security. If business is about people, then business-based video analytics and applications fit right in because they are for the most part all about people: how many come in, where they go, where they’ve been, how long they stay in what location, whether they buy, whether their intentions are less-than-honest and much more.

If it sounds simple, that’s because to some extent it’s pretty straightforward, says Willem Ryan, senior product marketing manager for Fairport, N.Y.-based Bosch Security Systems.

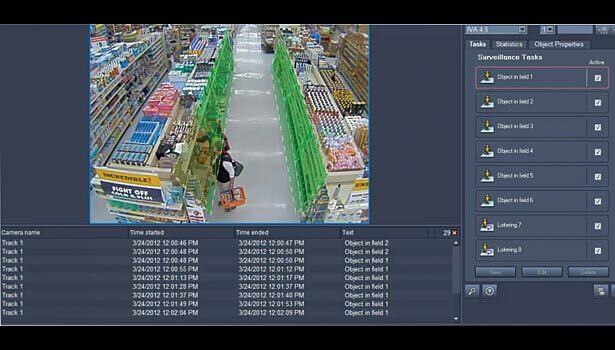

“Video analytics are split up between security-based and business analytics. They’re quite different, although the technology performs the same,” Ryan says. “Much of the technology today with analytics at the edge means that you’re using the same camera and that the analytics are not specific analytics for business and security. You set everything up the same, and then decide what tasks you want the analytics to perform. It’s quite efficient for simple business processes and security.”

As in any business, information is key for retailers, and video analytics can generate a mountain of information gathered from video data. But just having that information isn’t enough. It’s what actions retailers take once they’ve acquired the data that make the difference in business. And the more they know about the people who are coming into their store, the better they can make decisions that will allow them to take advantage of their customers’ behavior to improve the customer experience and potentially convert browsers into buyers.

And today’s analytics are capable of collecting and providing much more information than ever before — and are finally approaching the point where they can deliver on the promises that were made in the past.

“We’re stepping into an era of more complex analytics, and today in retail there are more comprehensive and bottom line-impacting analytics available in the marketplace,” says Jackie Andersen, a retail business development manager at Chelmsford, Mass.-based Axis. “Video content analysis (VCA) is past the early-adopter phase in retail. Ninety-three percent of retail is still in the bricks, not the clicks, and with VCA and video contextual integration into the consumer shopping experience; retailers can get virtually the same intelligence that they can gain from an online shopping session.”

Indeed, it’s crucial for retailers to use both security- and business-based analytics to get the most out of their video system. The best video systems for retailers are those that aren’t skewed toward either the security or business side, says Hedgie Bartol, who is also a retail business development manager at Axis.

“Analytics should be the value-add to the system. Generally speaking, if a retailer takes a purely analytics-based approach to their surveillance solution they are missing as much of the big picture as if they took purely a security approach,” Bartol says. “Additionally, analytics can tend to muddy the waters and distract from the overall long-term strategy if not positioned correctly. If too many people jump on the boat, the boat may sink. Take it one step at a time with analytics while keeping the end goal strategy in mind.”

The challenge for most integrators is to find that balance between the loss prevention and operations sides of a business in making a case for business-based analytics, says Steve Gorski, general manager at New York-based MOBOTIX.

“Security and loss prevention doesn’t care about marketing and other business applications. That’s why it’s important for the integrator to connect with someone on the business side as well. The challenge is getting the message out to both sets of people,” he says.

One area of common ground that could be a good starting point for finding that balance is motion detection. In addition to being part of the overall security system, motion is also at the heart of most business-based analytics, says Shahar Ze’evi, senior product manager, American Dynamics, a Tyco Security Products company

“Most people use motion detection. It’s simple, but it’s not necessarily analytic,” he says. “In a system capable of analytics, you do motion detection differently. Instead of counting pixels, a lot of systems use object instead of pixels. So retailers are looking at more advanced motion detection technology.”

This dual nature of cameras and/or motion detection is a big reason why business-based video analytics are on the rise.

“It allows a camera, particularly for a retail application, to be dual-purpose,” Gorski says. “It can provide surveillance and loss prevention information, as well as functions that marketing, human resources and operations are interested in.”

Most retailers, he adds, can benefit from some sort of business analytics.

“Retail is tough because it’s very competitive. That’s why it’s important to illustrate ROI,” Gorski says. “A convenience store owner may say, ‘It’s good to know how many people come into my store, but it doesn’t help.’ Be prepared to fire back with a business case for analytics because that’s not how he’s used to thinking. ”

So what analytics work best for retailers and, more importantly, what can various departments within the business do with the information gathered by video analytics. Here are three of the most common analytic technologies and some ways retailers can use them to optimize their business.

People Counting

In the retail world, people counting is the most common and popular analytic, Ryan says. Among the applications of this technology are determining how many people enter and exit a store and how many people are within a given area at any given time. Using and analyzing this information can help retailers know either where to place certain products or how to direct people to those products.

“From a marketing standpoint, they want to know how many people are in a specific area. That might be helpful for a new display or an area they want to funnel people through,” he says. “It’s not only counting, but it can go beyond that and analyze how long people stay in a particular area to see if they spend enough time to make a buying decision.”

Linking people counting analytics with point-of-sale systems can help retailers determine their conversion rate by comparing the number of people coming into the store with the number of transactions — and then make any necessary changes or take other actions to improve that ratio.

People counting can also be used to improve customer service and satisfaction, such as in the area of queue (or line) counting.

“Lineups at cash registers are always important. Analytics can provide information and alerts when a crowd forms that’s beyond what’s been identified as acceptable, allowing the manager to open another register,” Ryan says. “This isn’t for every retailer; it really depends on the culture.”

And in some cases, retailers can set their analytics to generate an alert when a customer remains in the same location for a certain amount of time, allowing management to dispatch a sales associate to assist that customer (see “No Lingering Doubt” on page 72.)

Heat Mapping

A close cousin (if not a subset) of people counting, heat (or hot/cold zone) mapping provides a graphical representation of how people move through a store and how long they linger in a particular place. This information is presented in color-coded format, such as red for the highest traffic and blue for the lowest, to make it easier for retailers to understand the information that’s being presented, Bartol says.

“Not only does this provide retailers with invaluable information for how to improve store flow and layout, but it also serves as hard data to take back to vendors and merchandisers in order to qualify shelf space and end-cap costs,” he says. “Retailers now have proof where the premium hot areas in their store are.”

And that ability to quantify the ROI on shelf space can directly add to a retailer’s bottom line by keeping a vendor happy and potentially creating a long-term product-positioning agreement.

“In a supermarket where they charge for an end cap display, you’d better believe Coca-Cola is going to want to know how many people are stopping at their display, how long they stay, whether they’re buying anything and what they’re buying,” Gorski says.

Loss Prevention

In retail, controlling shrinkage, theft and other losses that negatively affect a store’s bottom line is a necessary evil.

“If I have high traffic and low sales in a store, what is the shrink like? If shrink is relatively high, there may be other issues there such as collusion,” Bartol says. “If there is an area of my store that is ‘blue’ on the heat map, that is probably a prime area where a deviant would go to conceal something, so I better have video coverage. The cross-functionality of the cameras and the analytics goes in both directions.”

That’s why using analytics for both business and loss prevention purposes just makes sense, Andersen says.

“In retail, it’s all about bottom line. It’s not what you earn it’s what you keep,” she says. “Demonstrating how to increase customer engagement with video while continuing to reduce loss will always capture a retailer’s attention.”

Analytics that combine POS integration “not only lets you follow the money, but when tied into checkout systems can reduce sweethearting, bottom-of-the-basket theft and oversight, as well as self-checkout merchandise loss at the register,” she adds.

Using people- and object-counting analytics can be an effective way to reduce shrinkage, particularly in the case of high-priced or high-demand products. (See “Tracking Shrinkage” on page 68.)

“There may be a drug on the shelf that can be used to make a recreational drug. For two to disappear from a shelf in a certain time period may be normal, but five might be abnormal but not necessarily cause for concern,” he says. “Over a 10-minute period, if 20 to 50 percent of a shelf is emptied, that’s not normal and would create an alarm.”

Monitoring shelves can also help retailers ensure that there are actually products on the shelf for customers to buy.

In general, while video analytics can provide retailers with key information for optimizing their businesses, integrating the video with other systems to add more context makes that information much more powerful — and actionable.

“Analytics is just one type of data in the system, and we use the video to analyze. On its own, sometimes it’s not enough. Combining it with POS, RFID, intrusion detection and other systems gives much more analysis of data beyond just of video data. Correlating to more data provides customers with much more,” Ze’evi says.

For integrators looking to sell video analytics to their retail customers, the advice is simple: be honest and be realistic. For more, read “Making the Business Case for Analytics in the Retail Space” at www.SDMmag.com/analytics-business-case.

“Analytics in the past was oversold. For integrators, when selling to customers, step back and remember how people were taken aback in the past,” Ryan says. “We’ve come a long way from the ease of deployment, efficiency, accuracy and cost. We’re not where we used to be. We’ve made great strides, so it’s a good time to get into analytics. You should not sell the ‘CSI’ effect. That’s just TV nonsense.”

That’s why educating customers has to be as much a part of selling analytics as the technology itself — if not a larger part.

“Analytics cannot do things it cannot do. Explain how it works, what it does and what the customer is going to get,” Ze’evi says. “If you say, ‘I can give you the world,’ it will collapse. Call it as it is: a cross-functional system that’s not just loss prevention and security.”

While future generations and incarnations of video analytics may or may not reach the “CSI” level, they will provide retailers with even more actionable information, allowing them to supercharge their business optimization. The list of possible applications of video analytics for retail is seemingly endless, Bartol says. “The real question might be asked to the retailer, ‘What would you do if you had all this data and knowledge in real time? How would it enhance your operations?’ When done correctly, it’s like having a dedicated operational- and sales-focused employee reporting from a bird’s-eye view of the store floor.”

Tracking Shrinkage

“Analytics can be helpful for inventory control tracking to reduce shrinkage, such as when objects are removed for a high-visibility product a retailer wants to look at. For example, one of our large retail customers had an item that was going to be a big-ticket product for Christmas. When that product started hitting the loading docks, they had a specific area where it was stored and handled. The video analytics generated an alert whenever someone engaged with that product to make sure the inventory that was supposed to be coming in was the actual amount coming in.” — Willem Ryan, Bosch Security.

Are Retailers Really Using Video Analytics?

For the Loss Prevention Research Council’s (LPRC) “CCTV in Retail 2012” report (commissioned by Axis Communications and released in January), loss prevention executives from 47 national and regional retailers completed an online survey about video surveillance. As seen in the below results, some of the report’s findings provide a good benchmark for the state of video analytics in retail.

• Of the retailers who use IP-based video systems for cross-functional benefits outside of security and loss prevention, 93 percent have seen a positive impact on operations, while 40 percent have seen a positive impact on merchandising.

• Nearly one-quarter named “integration with business intelligent video, such as analytics and POS integration” as a main driver for adopting a network/IP system.

• People counting was by far the most used non-LP analytic application, with 46.3 percent of respondents deploying this feature, up from 27 percent in 2010.

• Dwell time analysis (20 percent) and heat map or hot/cold zone (18.2 percent) usage increased in 2012, while 38.3 percent of respondents used video analytics to detect POS fraud.

• Queue counters are used by less than 10 percent of companies surveyed, yet 50 percent say they may use this application in future. Similarly, while no respondents said they utilize out-of-stock alerts today, more than 56 percent say they may use them in the future.

• Nearly 32 percent of respondents utilize surveillance to help analyze “shopping and buying behavior,” with 20 percent using video to measure shelf and product placement effectiveness.

• More than 60 percent of respondents said that having no one to monitor or analyze video data was the biggest drawback of a video surveillance system, suggesting the need for improved intelligence and proactive alerts.

No Lingering Doubt

“We had a customer who requested to use a linger alarm in one aisle. They have a product that’s a higher sell, and if people don’t buy, it can translate to a high loss. This is their main product, which accounts for their highest sales. Now if someone is in that aisle for 30 seconds, management receives a notification to send an associate to that aisle to assist because the customer is struggling in that aisle and will walk out. So just by lingering, they’re asking for help.” — Shahar Ze’evi, American Dynamics