Systems integrators’ revenue growth skyrocketed in 2005 due not only to their sales efforts but also to acquisitions.

The average 2004 revenue increase of 12 percent was nearly doubled in 2005 to 23 percent by systems integrators ranked on SDM’s 11th annual Top Systems Integrators Report. Their gross revenues, when totaled, were 23 percent higher in 2005 than the combined gross revenue total of the top systems integrators who responded in 2004.

SDM’s report ranks by revenue the largest firms that contract electronic security projects for commercial, industrial, institutional, government, and other non-residential markets. These systems integration firms are businesses that derive more than half of their revenue from the sale, design/engineering, installation and service of multi-technology electronic security systems, such as access control and video surveillance.

The 15 percent growth anticipated by the companies ranked last year was far exceeded by those ranked in this year’s report, who mostly are the same companies but with some newcomers.

Those reporting triple-digit increases include IR/Ingersoll-Rand Corp. (No. 7), Securitas Security Systems USA Inc. (No. 10), Sigcom Inc. (No. 25), and Trans-American Security Services (No. 44).

Other notable increases include ADT Security Services Inc. (No. 3), Jacksonville Sound and Communications Inc. (No. 33), and Integrated Controls USA Inc. (No. 64).

ACQUISITIONS ADD REVENUE

Some of these sizable increases were aided by acquisitions. Securitas Security Systems USA acquired Hamilton Pacific L.P., Pasadena, Calif., which reported $38 million in revenue in 2004 and was ranked No. 17 on last year’s report. Other acquisitions in 2005 included Securus Inc., Denver, which was ranked No. 83 last year and was acquired by Henry Brothers Electronics, which changed its name from Diversified Security Solutions Inc. This year, Henry Brothers leapt from No. 21 to No. 16 on SDM’s Top Systems Integrators Report.Aerwav Integration Services Inc., ranked No. 28 last year, was acquired by Haig Security Systems, Green Brook, N.J.

Video Master Inc., ranked No. 69 on last year’s Top Systems Integrators Report, was bought by Initial Electronics Inc. The acquisition was partially responsible for moving Initial Electronics from No. 30 last year to No. 23 in this report.

Tour Andover Controls, Carrollton, Texas, acquired the energy management company Abacus. Stanley Security Solutions, Indianapolis, acquired ISR Solutions Inc., Chantilly, Va.; Pinnacle and Sielox, all systems integrators. This contributed to Stanley’s move to be the No. 1 systems integrator for 2005.

These are just some of the largest acquisitions in 2005 and not an all-inclusive list.

INTEGRATORS TUSSLE AT TOP

This year, reporting considerations hampered some of the larger ranked companies from breaking out their systems integration revenues separately from total company revenues.Therefore,SDMapplied percentage increases from 2004 to 2005 for larger divisions of the companies or the entire company to estimate systems integration revenues for 2005. The companies with estimated revenues this year are IR/Ingersoll-Rand Corp., Johnson Controls Inc., and Siemens Building Technologies.

The percentage increase provided by the Siemens annual report for its entire building technologies group from 2004 to 2005 when applied to the figure the company reported for 2004 systems integration revenue contributed to its drop from No. 1 to No. 4, along with acquisitions by some of the other top companies.

EXPECTED GROWTH BULLISH

Some of the companies just making the cut intoSDM’s Top Systems Integrators Report are aggressive in their revenue expectations for 2006. For example, IK Systems Inc., which is ranked No. 98 this year with $4 million in revenue in 2005, expects a 75 percent to 100 percent increase because of the shift to digital video technologies such as DVRs and an increase in integrated solutions.Another integrator, ranked No. 97 this year with $4.16 million in revenue, Dillard Door and Entrance Control, expects 30 percent growth based on a new marketing plan, sales strategies and employee training. Both IK Systems and Dillard qualified for the report for the first time this year.

LISTENING UP TO THE LEADERS

The biggest systems integrators are bullish on the market, too. FirstService Security Division, (doing business as SST and Intercon Security), which ranked No. 8 with $151.29 million in 2005 revenue, is expecting $178 million in revenue globally in 2006.“SST has expanded our service, project management and installation capabilities to work with international clients,†the company explained in its report form.

Diebold Inc., which ranked No. 5 with $661.61 million in 2005 revenue, expects growth organically and globally through acquisitions.

Tour Andover Controls, which ranked No. 2 in this year’s report with $794 million in 2005 revenue, anticipates approximately 18 percent growth through existing markets and acquisitions, and has set an aggressive goal for 2006 of $1 billion in sales.

Stanley Security Solutions Inc., which took the No. 1 spot this year with its 2005 revenue of $810 million, predicts a revenue increase in 2006 of approximately 15 percent.

“The market is growing at 8 percent, and our value proposition (made up of our national footprint along with our staff competencies, products and services) is enabling us to grow at just under two times the industry growth rate,†the company asserted.

MARKET NICHES EXPANDED

Although not expecting sky-high increases, some integrators are concentrating on growing technologies.For example, Energy Control Inc. (ECI), ranked No. 72 this year with $7.2 million in 2005 revenue, said on its report form, “We anticipate substantial growth in the upcoming year of 3 percent in light of the initiatives being put forth to promote intelligent and integrated building technology for security and energy efficiency in both private and public facilities, which is our primary market focus. ECI has taken a leadership role in bringing integrated systems along with renewable energy and efficiency measures to customers via system technology.â€

Another market niche is being sought out by Advanced Electronic Solutions Inc., which ranked No. 53 this year with $10.15 million in revenue. The company revealed, “While 9/11 brought security to the front of offices and base buildings, we are now seeing more assessments for the back-house detail. Security trends are also leaning towards IP solutions and redundant storage. We anticipate a 10 percent to 15 percent increase in both areas.â€

Henry Brothers Electronics, Saddle Brook, N.J., which ranked No. 16 this year with $42.20 million, expects, “Revenue will increase to between $45 million and $48 million based on market needs, increased Homeland Security spending and revenue trending over the past six years.â€

Convergint Technologies LLC, Schaumburg, Ill., which ranked No. 14 this year with $65.16 million in 2005 revenue, is forecasting 30 percent to 35 percent revenue growth from 2005 to 2006.

“The electronic security market continues to grow double digits, especially in the areas of IP video, video management and enterprise card access solutions,†the company reported.

HOMELAND SECURITY

The amounts spent on Homeland Security seem to be increasing as more funding is released. The number ofSDM’s Top Systems Integrators reporting higher percentages of projects from Homeland Security funds increased in 2005 over 2004, the first year this question was asked. For more details, see the chart on page 56.Overall, few systems integrators predicted decreases or level growth. Most seem more optimistic than last year and some are positively aggressive in their forecasts for additional revenue growth opportunities in 2006.

Editor’s Note: SDM’s Top Systems Integrators Report defines integrators as businesses that derive more than half of their revenue from the sale, design/engineering, installation and service of multi-technology electronic security systems, such as access control and video surveillance. Some companies ranked in this report are part of larger corporations that encompass more than electronic security systems integration. In these cases, the reported revenue reflects only the systems integration portion of that company’s business.

Source: SDM Top Systems Integrators Report, July 2006

Sidebar: 23 Percent Revenue Growth in 2005

This year’s revenue growth from reporting companies has been substantial and bodes well for the industry. Many of the largest companies have reported substantial increases in revenue.Some of these are from acquisitions of companies previously ranked on SDM’s Top Systems Integrators Report. When this occurs, the income of those companies is included in their new companies’ revenues and new companies take their place.

The result of this could be that this year’s total represents the income of 105 to 110 companies from last year because of the new companies on the report that were excluded before the acquisitions.

More companies reporting higher percentages of jobs from Homeland Security funds also may have raised the revenue figure this year.

Sidebar: More Revenue from Fewer Employees

Despite substantial increases in revenue and the number of new systems reported in 2005 compared with 2004, the number of employees has decreased for the companies reporting this year.The decrease in employees could indicate greater productivity over more projects. The revenue increase could also indicate projects are becoming more costly and elaborate.

Reported employment has dropped substantially from last year. In 2005, 62,286 full-time employees were reported compared with 94,276 last year. Incomplete responses by some systems integrators may have resulted in part of the decrease. But cost-cutting through staff attrition and leaving positions unfilled or staff cutbacks may also have played a part.

Source: SDM Top Systems Integrators Report, July 2006

Total gross revenue (2005): $6.25 billion

New systems started in 2005: 43,103

Total full-time employed: 62,286

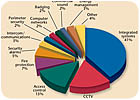

Sidebar: Revenue by System Type for Top Systems Integrators

SDMasked its top systems integrators to break down their total revenue by several different system types to show sources of revenue from different technologies.Integrated systems continued their growth in 2005, accounting for an additional 1 percentage point of revenue over 2004. Other changes were a 1 percentage point increase in access control and a decrease of 2 percentage points in CCTV. Most of the other figures remained the same. However, energy management gained 2 percentage points and commercial sound increased 1 percentage point over 2004 figures. Combined, integrated systems, CCTV and access control accounted for 73 percent of the top systems’ integrators’ jobs in 2005.

Source: SDM Top Systems Integrators Report, July 2006

Sidebar: Health Care Strongest Vertical Market

Asked to choose the markets in which a significant portion of their 2005 revenue was generated, integrators again picked health care as their top market as they did in 2004, but others shifted position over last year. Education and government gained markedly; property management and utilities dropped; and airports, law enforcement, correctional and entertainment increased, some substantially.*Percentage of Top Systems Integrators who named this market as a significant source of 2005 revenue.

Source: SDM Top Systems Integrators Report, July 2006

Sidebar: The Source of the Top Systems Integrators’ Report

SDM’s Top Systems Integrators Report is compiled from questionnaires answered by more than 100 com-panies which then are ranked by their 2005 total annual revenue, which is rounded to the nearest ten-thousandth. Included in the table beginning on Page 49 is:- 2006 rank and 2005 rank

- Company name and headquarters location

- Other names under which the company does business

- 2005 gross annual revenue. (The letter “v†indicates that the company submitted a separate document, such as an income tax form or a reviewed or audited financial statement.)

- The percentage revenue change from 2004 to 2005

- Number of new systems started in 2005, plus the largest and smallest new projects

- Percentage of jobs resulting from Homeland Security funds

- Number of full-time employees

Sidebar: Percentage of Jobs Funded by Homeland Security Dollars

The number of SDM’s Top Systems Integrators reporting higher percentages of jobs from Homeland Security funds increased in 2005 over 2004, the first year this question was asked.SDM’s 2006 Top Systems Integrators Report asked: “What percentage of your jobs was funded by Homeland Security dollars?â€

The largest number of the top systems integrators who responded to that question, 16 percent, reported that 2 percent to 5 percent of their jobs in 2005 were funded by Homeland Security dollars.

But the next highest percentage reported was 6 percent to 10 percent of jobs, which was cited by 11 percent of the integrators responding. Only 8 percent reported that range last year.

Another significant change from last year was the number of largest systems integrators who responded that 21 percent to 50 percent of their jobs were Homeland Security – that figure this year was 9 percent, up from 5 percent in last year’s range of 21 to 40 percent of jobs.

That final range was higher this year because one integrator reported 50 percent of jobs were from Homeland Security.

A total of 57 percent of integrators reported zero dollars from Homeland Security funds, did not respond to the question or maintained they did not know the source of funds from all their jobs.

* Percentage of jobs funded by Homeland Security dollars

** Percentage of integrators

Source: SDM Top Systems Integrators Report, July 2006

Sidebar: Alphabetical Index to Companies

Company: 2006 RankAccess Control Technologies Inc.: 40

Access Control Technologies Inc.: 47

AccuTech Systems Inc.: 70

Actcom Inc.: 46

Adesta LLC: 20

ADT Security Services Inc.: 3

Advance Technology Inc.: 91

Advanced Control Concepts Inc.: 88

Advanced Electronic Solutions Inc.: 53

Advantor Systems Corp.: 40

All Systems Designed Solutions, Inc.: 84

Allied Safe & Vault Co. Inc.: 26

Arcom Systems Inc.: 92

ARK Systems Inc.: 32

ASSI Security Inc.: 31

ATC International Holdings Inc.: 50

Atlantic Coast Alarm Inc.: 87

BCI Technologies Inc.: 36

BCM Controls Inc.: 52

Benson Security Systems Inc.: 38

CHS Inc.: 75

CompuDyne Corporation: 9

Convergint Technologies LLC: 14

Corbett Technology Solutions Inc.: 45

D.L.S. Ventures LLC: 93

D/A Central Inc.: 68

Deterrent Technologies Inc.: 41

Diebold Inc.: 5

Dillard Door & Entrance Control: 97

Dowley Inc.: 61

Egan Companies Inc.: 62

Electronic Security Services Inc.: 95

Electronic Security Systems Inc.: 85

Energy Control Inc. (ECI): 72

Engineered Security Systems Inc.: 86

Facility Robotics Inc.: 94

Ferndale Electric Co. Inc.: 63

Firstline Security Systems Inc.: 76

FirstService Security Division, DBA SST & intercon Security: 8

Genesis Security Systems LLC: 51

Henry Bros. Electronics: 16

Idesco Corp.: 57

IEP Ltd.: 39

IK Systems Inc.: 98

Initial Electronics, Inc.: 23

Integrated Controls USA Inc.: 64

Intelli-Tec Security Systems: 79

IR/Ingersoll-Rand Corp.: 7

Jacksonville Sound & Communications Inc.: 33

JBP Security Systems, Inc.: 89

Johnson Controls Inc.: 6

Kastle Systems: 15

Koorsen Protection Services Inc.: 30

LVC Technologies Inc.: 99

MAC Systems Inc.: 43

MidCo Inc.: 34

MSE Corporate Security: 49

National Security Systems Inc.: 22

NetVersant Solutions Inc.: 18

North American Video: 19

North American Video Corp.: 21

Operational Security Systems Inc.: 54

Pacific Security Alarm Inc.: 90

Paladin Protective Systems: 81

PEI Systems Inc.: 58

Philadelphia Protection Bureau Inc.: 48

Pro-Tec Design Inc.: 82

Red Hawk Industries LLC: 11

RFI Communications & Security Systems: 17

Sec Sol Inc.: 66

SecureNet Inc.: 35

Securitas Security Systems USA, Inc.: 10

Security Corp.: 29

Security Design,Inc.: 65

Security Equipment Inc.: 67

Selectron Inc.: 80

Sentinel Security & Communications Inc.: 83

SFI Electronics Inc.: 42

Siemens Building Technologies: 4

Sigcom Inc.: 25

SimplexGrinnell LP: 12

Simpson Security Systems Inc.: 78

SNC Inc.: 96

Sound Inc.: 37

Stanley Security Solutions: 1

T & R Alarm Systems Inc.: 60

Tech Systems Inc.: 28

TEM Systems Inc.: 59

Thompson Electronics Co.: 71

Tour Andover Controls: 2

Trans-American Security Services: 44

Tri-Electronics: 55

Trinity Security Inc.: 73

Tri-Signal Integration Inc.: 24

Universal Security Systems: 74

Unlimited Technology, Inc.: 69

Utah Controls Inc.: 56

Videotec Corp.: 100

VideoTronix Inc.: 27

Will Electronics, Inc.: 77

Wireless Facilities Inc.: 13

Sidebar: More From the Report

To gain additional information beyond that published in this issue and online, the completeSDMTop Systems Integrators Report and Database is available in Excel format. Included are contact names, mailing addresses, telephone numbers, Web site URLs, branch office locations, and more.SDM’s Top Systems Integrators Report and Database contains the data needed to target products and services to the systems integration market.

The cost of the report is $495.00. It may be ordered directly fromSDM’s Web site at www.sdmmag.com (click on Exclusive Industry Research), or by calling Heidi Fusaro at (630) 694-4026.

Click here for the 2005 Top Systems Integrators Report: Continuing the Climb