The concept of access control hasn’t ever been a hard sell. Most people know its value, and more than likely need it. The hard part is navagating the obstacles the recent recession has put in their path.

“People see the benefits of access control fairly readily,” explains Brett Bean, president, F. E. Moran, Champaign, Ill. “They always want it and are ready to do it. It is just a matter of whether or not they can do it.”

Take your pick—lack of funding, reduced personnel—there were plenty of problems created for both end users and the industry to overcome this year. Still, a majority of the dealers, integrators, manufacturers and analysts SDM spoke with say that there are solutions to the problems and the market is more than capable of growth—growth that Global Industry Analysts Inc. estimates will push the global market for electronic access control systems from $5.7 billion in 2009 to a projected $6.3 billion by 2012.

It is a positive projection, but will it really occur? The state of the construction market and the unemployment rate are two areas to watch as the industry waits to see how much of that growth the access control market will actually experience this year.

“What will dictate whether it’s a decent 2010 is what happens with unemployment,” says Dwight Gibson, vice president and general manager, Connected Home Solutions, Schlage, Carmel, Ind. “We’ll need to see not just moderation but meaningful reduction in unemployment in North America that could build momentum, particularly on the residential side.”

It is similar with construction. According to IMS Research market analyst Blake Kozak, “Access control is impacted by the construction market because, as the construction market rebounds, there will be more available buildings needing access control. However, new construction’s impact is lessened because there are still older, preexisting buildings that need access control or projects where installations that were previously postponed can now be done. As we are come out of the recession and more funding becomes available, more end users will refocus on things like security and access control, whereas they may not have been able to before, consequentially generating growth apart from the construction market.”

So how is the construction market doing so far in 2010? The “Construction Spending Report” for January 2010, published by the U.S. Census Bureau of the Department of Commerce, shows January 2010 was 9.3 percent below January 2009. December 2009 was 9.9 percent below December 2008.

The unemployment rate is much the same story. Bad, but getting better—last reported at 9.7 percent, down from 10 percent.

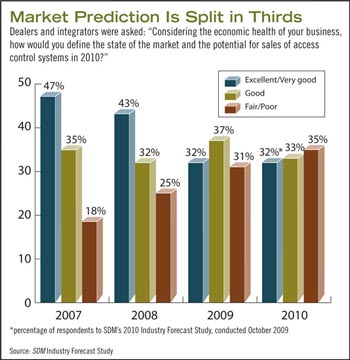

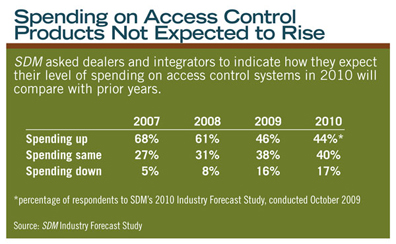

Not the best stats to see, but not the worst. With the marginal good news, it is not a surprise that respondents’ to SDM’s 2010 Industry Forecast Study were equally “marginal” in their opinion of the market, split almost evenly into thirds when predicting whether the access control market would be excellent/very good, good, and fair/poor (see chart above for how this compares with prior years’ data). While a fair number of them don’t have high hopes for the upcoming year, there are many who think 2010 has plenty of potential, and they are seeing growth already.

Bill Nuffer, president of Deister, Manassas, Va., sees overall growth for physical access control systems (PACS), but he thinks it will vary by technology. “While we expect modest (greater than five percent) overall PACS growth, growth in the more advanced technologies (PIV-II, AES encrypted credentials, and PACS expanders such as AVI and key management) will grow at a much faster rate (perhaps 30 percent) while more traditional technologies (basic proximity and high-cost door hardware, for example) will modestly decline.”

David Barnard, director of dealer development at RS2 Technologies LLC, Munster, Ind., says RS2 Technologies is already having an excellent year—up more than 30 percent over the same period last year with peaks reaching in excess of 40 percent —and the growth is related to the investments the company made last year.

“The investments that we made in early 2009 in the face of a tough year are already showing a nice return in 2010,” says Barnard. “These include adding another regional sales manager, our first annual dealer conference, expanding our white paper series, the addition of new product sets including IP locksets and power over Ethernet (PoE) system control panels and readers, etc.”

IP and PoE are both technologies predicted to have strong sales in 2010. It is because of what they offer, including the ability to grow, according to ADI.

“Access control technologies that offer ease of expansion are experiencing faster growth rates. Wireless modular door solutions allow dealers to add additional doors without having to rewire the entire system,” says Stacy Deveraux, senior product manager for Access Control North America at ADI.

Developments in wireless are contributing to its growth in the upcoming year, points out Justin Boswell, president, Stanley Mechanical Access, Indianapolis.

“Utilization of wireless technology across the industry has accelerated over the past one to two years due to improvements in power consumption and wireless protocol security. Wireless-based solutions are driving lower cost per opening and at the same time are offering in many cases the level of functionality that the customer is looking for,” says Boswell.

End users are also focused on the way their systems work together.

As Sean Leonard, director of marketing, Access Control Systems, Honeywell, Melville, N.Y., points out, “Customers expect to take information from one system and migrate it into another system—because their systems actually work together—and use it all to make the right decisions. Whether you call it convergence or integration or open platforms, I think we are all trying to get at the same concept, which is bringing these separate systems together into an environment where these end users can make better decisions faster.”

IP also offers a long list of selling points in 2010, potentially increasing sales of access control.

Amber Tester, director of marketing, Security Solutions, Anixter, Glenview, Ill., explains, “Sales in IP-enabled security systems will improve this year due to the flexibility, scalability, and reliability of network-based applications. The network-based, PoE-enabled door controllers are also making a large impact with end users because they enable easier deployments and save time and the cost of additional cabling.”

It is really a benefit for end users and dealers, says Leonard.

“End users are able to take advantage of the infrastructure and the cost savings from an installation perspective,” he says. “Then, having intuitive Web interfaces for people to use minimizes training costs. For dealers, they get to take advantage of new technologies to dial into the system remotely, so they can provide remote diagnostic and remote servicing of these technologies. Where in the past, they probably had to roll out a truck and go onsite, now they can do it offsite.”

In fact, another key trend in 2010, managed access, involves meeting people’s needs offsite.

“Hosted and managed services are becoming increasingly popular as more and more users are looking for their access control solutions to be managed offsite to decrease the expense of owning and maintaining their own servers and eliminate the need of additional headcount to administer the system,” says Deveraux.

Eliminating headcount through managed access really helps make access control possible for understaffed companies.

“Our typical customer in 2010 has less staff doing more work. We work hard to help them understand that by installing access control we can help alleviate some of their headaches and provide a return on investment (ROI) without adding to their workload. This discussion is key to closing sales in 2010,” said Bean.

It is working, according to the numbers F.E. Moran is putting up.

“Managed access systems represent 55 percent of our new access control business now compared to 25 percent two years ago,” added Bean. “There is a definite trend toward managed access, especially in the smaller systems (fewer than 10 doors) market. We host the software application in our central station with our dispatchers ready 24/7 to add or delete users and provide a seamless, easy interface with a live person. Another factor driving customers to managed access is the lower initial cost of ownership. We have made the investment in servers and software, allowing them to take advantage of the benefits of access control with a lower investment.”

While managed access lowers the investment for end users, it requires a lot of resources and investment from dealers and integrators, and some see that as a reason the technology’s impact won’t be as great.

“Managed access control has been around and talked about for a long time. I think there is a niche market for this type of product but I do not see it having a big impact on the marketplace,” says Doug Robinson, managing partner, at RS2 Technologies. “Most manufacturers, with the exception of a few, do not want to host managed systems themselves. Most dealers and integrators do not have the resources available to properly offer managed access. Server farms, redundancy, security of data, and offsite backups are generally expensive systems to set up and maintain.”

As Leonard describes it, “Transitioning to an RMR business involving something like managed access requires some changes in terms of how that customer goes to market. It requires changes in how they incentivize employees and requires changes in support available at facility. It also requires changes in pricing models — so there is support that has to happen along the way.”

CATCHING UP TO MOVE FORWARD

In addition to managed access, new technologies and advanced solutions throughout the industry are bringing with them a need for support and training in the upcoming year—another predicted focus of companies in 2010.

“Training is key right now. The systems we’re installing today are very software and IT dependent, but a lot of technicians are still behind the curve in this area,” says Bean. “We have an in-house IT department, which is a necessity when you get into hosting access control systems. There seems to be a gap in knowledge transfer, however, between IT and the technicians, which the manufacturers can help fill through increased training.”

Honeywell is one of the manufacturers offering increased training this year with a new support program aimed at helping dealers set up managed access.

“We have developed a robust program that steps these dealers through the process with a playbook. It is not enough to say, ‘here’s a great opportunity to go make RMR for your business.’ They need help in the transition, and we provide that for them,” says Leonard.

KNOWLEDGE IS POWER

End users need transition help too, especially in the transition that is happening this year from proximity to smart card technology. Hybrid systems can help.

“Hybrid access control systems are often overlooked,” says Robinson. “I define a ‘hybrid’ access control system as one that can handle all types of user environments. This includes ‘traditional’ access control via RS-485 communications and panels, IP-based access control, wireless access control and managed access control. I think that a common user interface for a system that can support all of these environments is often overlooked and can win additional business,” Robinson says.

A report from IMS Research, The World Market for Electronic Physical Access Control Equipment, predicts strong, sustained growth for multi-technology readers. Despite the global economic slowdown, multi-technology readers are forecast to account for more than $35 million of global reader revenues by 2013.

According to Kozak, the report’s author, “The transition from proximity to smart card technology is an ongoing process. While new installations are increasingly requiring smart card technology, the large installed base of proximity readers suggests it will take some time before smart card readers replace proximity readers. As a result, the market is forecast to see a continued trend towards multi-technology readers as this transition continues.”

The transition to smartcards isn’t slowing down, especially with continued emphasis by the HSPD 12 mandate.

“Although not a new federal legislation, the continued adherence to the HSPD 12 mandate signed by the Bush Administration in 2004 is still heavily influencing the access control market. The biggest impact of this standard is that it led to a redesign of most leading edge access control systems to adopt smart cards and PKI-based authentication into access control system infrastructures. New software, readers and control panels were designed to handle the more sophisticated communications needed to support the PIV. That has resulted in a new generation of commercial PACS solutions that the security industry has developed and is now marketing to the commercial market. More corporate CSOs are now requiring that their PACS and LACS security meet the federal standard which has created new demand for more advanced PACS solutions from vendors,” says Randy Vanderhoof, executive director, Smart Card Alliance, Princeton Junction, N. J.

While Kozak also thinks HSPD 12 will impact the market in 2010, he cautions the industry not to view its impact as providing a major influx of business.

“While a lot of manufacturers and integrators thought it would be a spike, it has actually provided gradual growth. HSPD 12 is fairly implemented, and for those projects remaining there are funding issues and implementation issues that are slowing it down,” he explains.

Still, Vanderhoof contends the advance of smartcards is a trend in 2010.

“The access control market is going through a major refresh of its core security infrastructure around smart card credentials and tokens. The smaller solutions providers and dealers are going to need to learn a whole new system architecture and installation design to keep up with the changing market. The days of low-end RF cards and simple tap and go access readers are nearing the end of their product life, and new intelligent readers with integrated biometrics are becoming the new standard,” Vanderhoof believes.

Advanced solutions can mean more money and investment, which will stop end users in their tracks. Rental programs are another way the industry is planning to offer end users cost savings.

“We’ve created programs to help people manage the cost, such as rental or leasing programs,” says Travis Moss, marketing director, Safeguard Security and Communications, Scottsdale, Ariz.

Chris Bird, Dillard Door & Security, Memphis, Tenn., says taking a different approach to system design is also on his company’s list to help win business this year.

“We’re trying to listen to our customers. They’re saying, ‘We don’t have the money but we’ve got this requirement.’ So this opens dialog. They’re saying, ‘Can you design something that will get us by?’ While we still provide a good system, we scale it back from what we normally do. If we don’t, someone else will.”

And then there’s F.E. Moran’s proactive approach of helping potential customers apply for grants.

“We are trying to be proactive in helping customers find revenue that will pay for the access control systems they need,” says Bean. “We are pursuing helping customers write grant applications. We don’t take ‘No’ very well when someone wants a system but can’t afford it. We can’t afford to. People see the benefits of access control fairly readily. You don’t have to do much to help them understand its value, but it almost always comes down to other obstacles, like funding. And we work with them to remove the obstacle.”

Removing obstacles for end users also helps remove the industry’s obstacles to growth and success in 2010—problem solving at its best.

SDM Asked: "What Technology or Service Do You Think Will Create the Most Potential for Growth in the 2010 Market?"

“Software as a service, maintenance on remote monitoring, and other models of recurring monthly revenue are going to be the big thing more and more for larger integrators.—Chris Bird, Dillard Door & Entrance Control

“Something we do on a daily basis, but that maybe our customers don’t, is system administration. They’re outsourcing to us to help manage their systems and keep up with software revisions, reports, generation, clerical and service centers.” —Tim DeWeese, Security Solutions

“Selling services will be what we concentrate on. We’re trying to get rid of just selling a black box and move toward bundling it with support.” —Jeffrey Taylor, Advanced Control Concepts Inc.

“IP-based systems, whether video or access control, have a lot of potential for growth. Newer access control systems are more cost-effective, powering off of the network switches.” —Jim Geyer, Unlimited Technology Inc.

“The stage is set for strong performance around access control, especially with new remote capabilities. You can lock, change codes, manage lighting, see live video, and more—all without making big changes in homeowners’ routines and using technology they’re already familiar with like cell phones and computers.” —Dwight Gibson, Ingersoll Rand

“Rental programs have been the most successful avenue to implement for this market. We’re managing solutions in-house, requiring end users to have less equipment. We host and they pull off our enterprise center. It’s a need-based service. It’s all about lowering the up-front cost so more people can do it.—Travis Moss, Safeguard Security and Communications

“Biometrics. More customers are in need of more verification than a card or a PIN. We’re getting a lot of requests for biometrics. High-end corporate customers are using it more, not so much in everyday businesses. And that’s retinal recognition systems too, not just fingerprint systems.” —Henry Olivares, APL Access and Security

SDM Asked End Users: "What Are You Looking For This Year In Your Access Control System?"

“I would like to see access control systems linked heavily into casino gaming applications. We currently have the ability to simultaneously view point of sale transactions superimposed onto preexisting camera coverage; however, I would like to enhance our internal monitoring system and apply the same concept to various parts of the casino from a gaming perspective.” —Maria Chadwick, Wynn Casinos

“We’re looking at consolidating and centralizing our access control system on a global basis to better manage the credentialing process.” —John Martinicky, International Truck and Engine Company

“We are interested in the continued development of IP-based readers and controllers similar to what is occurring with IP cameras. I’d like to see the access control industry evolve as we are seeing with the camera industry. The IP camera is a commodity that typically works with many different manufacturers’ complimentary applications for forensic review, analytics, storage, video wall, etc. The reader and door controller should evolve as a similar commodity so organizations are not forced to rip and replace to transition from one access control system to another. The proprietary communication structure within access control has to go. An IP-based reader/controller with integrated high PoE powered lock, REX, door contact has to be where we are headed.” —Brent Mast, Carolinas HealthCare System

“I am in the process of planning for a pilot program where we will be installing biometric thumbprint readers at one of our high schools. Currently our high schools have significant integrated access/security systems in place and one of the under-utilized parts of the system during business hours is the use of the reader system. My goal is that we utilize these systems to create a virtual closed/open campus that allows the students to come and go but helps keep threats out.” —Guy Grace, Security and Emergency Planning, Littleton (Colo.) Public School District