|

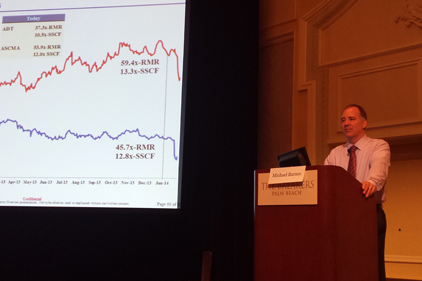

| At the 19th annual Barnes Buchanan Conference, Michael Barnes presented his popular Market & Industry Overview, delving into industry growth, competitive structure, operating metrics and market value of security dealer businesses. |

With new players such as AT&T, Comcast, Verizon, Cox and, potentially, Google, as well as a do-it-yourself market, which some think is growing three times as fast as the professionally installed market, who wouldn’t consider security an attractive market and wonder, Who are the winners going to be?At the 19th annual Barnes Buchanan Conference held earlier this month, Michael Barnes, founding partner of Barnes Associates, as part of his “Industry & Market Overview” presentation, explained why security is an appealing market for these giants (sticky customers with low attrition, for one).

“The latest chapter that the industry has to think about is all of these new players — and they are very, very big,” Barnes said, illustrating by example, AT&T with $129 billion in revenue compared with ADT at $3 billion in revenue.

Barnes reminded conference attendees of AT&T and the Regional Bell Operating Companies’ prior attempts to make a play in the security industry, which failed. “This time it is very much different. When [RBOCs and other big players] first came into the industry before, they had huge penetration in their core markets, but it was because they were protected. What they had no success with was bundling other competitive products.

“This time around, that is not the case. These [companies] definitely come to the market with huge success in open, competitive markets. These are not slow, behemoth, protected, deregulated companies. They are highly competitive, highly successful companies with huge success in other market segments like wireless internet. What they see this time is that your security alarm customers are very sticky — with lower attrition rates and a much higher value-added service. But they also see a huge market opportunity with the security residential market segment at 20% penetration. Even when you look at the commercial market segments — low penetration. If you think about the industry having the ability to increase that penetration rate up closer to some other services — such as wireless, Internet, HDTV and landline telephone — where these other players have been very successful, you’re looking at a market opportunity that is at least three times the size of the existing market,” Barnes described.

Barnes also put forth an interesting competitive analyses, focused on two potential scenarios for how it may play out for the telcos and cable companies, summing up how they may fare and what the end result may be for many of them.

In the “In and Out” scenario, consumer skepticism prevails because the average consumer is not convinced that their cable or telephone provider can deliver the super high-quality service demanded by the critical function of security. The perception of most people is that cable or phone companies are not the most user-friendly, highly responsive businesses, Barnes said. These new competitors also learn that their existing customer base is not as great an advantage as they thought it would be and does not offer returns in terms of higher take rates.

Another negative factor in the “In and Out” scenario is that the new players may find there is no advantage to offering security as part of a bundled offering because they cannot compete on price due to having the same operating costs as a traditional player. Finally, as they find there is a slow build in customer numbers, along with very little earnings and diluted cash flow, they lose interest and exit the industry. “They may have success, but you have to define success by their size requirements,” Barnes suggested.

In the “Game Changer” scenario, consumers embrace the offerings of the telcos and cable companies because their marketing message of an enhanced lifestyle has appeal, especially with components such as automated lighting, residential video, and interactive services. Not only do consumers embrace it, but the new competitors find that a sizable percentage of their existing customer base is interested in purchasing security. In this scenario, the telco and cable providers learn that not only does security give them a lower churn rate, but when they attach security to their overall bundled offering, it actually brings the attrition rate down on their core offering.

“At the end of the day, if they can say, ‘The value of my core customer goes up by $1,000 by attaching security to it,’ that is a very distinct competitive advantage,” Barnes said. That cost advantage, plus the value of the attrition, could potentially be offered back to the customer in the form of lower pricing — thereby becoming a game changer by destroying the economics for traditional security dealers. In this scenario, it is likely that one of the companies could buy ADT, instantly becoming the single-largest player in the industry. These companies also have the wherewithal to disrupt the traditional flow of product through the channel by introducing their own slick, proprietary product line, Barnes noted.

“These are the arguments that we hear and, in your own mind, I think you’re going to have to make a decision about where you think it’s going to go,” Barnes suggested. He said that last year he thought they outcome leaned more to the left-hand or “In and Out” scenario. “We [thought] that they are going to have some success… but just can’t get big enough quick enough and they won’t have any material advantages and they’re likely to lose interest. They may be here for, instead of two or three years, it might be five or six or seven years.

“But now I think we’re leaning more towards the middle to the right. We’ve seen some success from these guys and the more we think about it, I think they are going to be serious competitors in this space,” Barnes said. “Time will tell.”

Barnes said that despite his attempts to get the new players to attend the conference or share information, he was able to estimate some figures for their installation and monitoring activity (including AT&T, Verizon, Cox, Comcast and a couple of other smaller players).

“On a collective basis, we actually think they’re bigger than most people think. We think they are, at least, today with 200,000 to 500,000 monitored security accounts. That’s roughly $8 million to $20 million of RMR. It means that they are potentially 1 to 2 percent of the market — and this is after them really launching only within about the last three years. They were ramping up to that, but I think they are just starting to get some traction.

Collectively they are installing about 15,000 to 30,000 accounts per month, which means somewhere between $600,000 to $1.2 million per month in RMR, Barnes estimated.

“It looks like collectively they are about the size of Vivint in terms of their origination activity. I do think, actually, that they’re growing quicker than Vivint,” he said.

Check back at www.SDMmag.com in the coming weeks for more coverage from the 2014 Barnes Buchanan Conference.