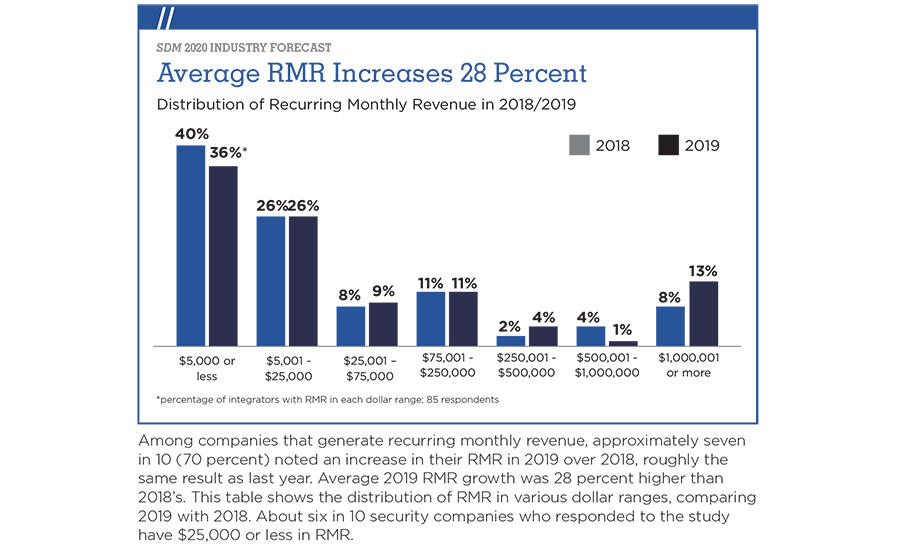

Security integrators expect their brilliant business performance of 2019 to continue into 2020, according to results of SDM’s Industry Forecast Study, a report published each year since 1982. The results of the study — illustrated in the graphs on the following pages and on SDM’s website at www.SDMmag.com/annual-security-industry-forecast — show that there was double-digit growth in both total annual revenue and recurring monthly revenue (RMR) for integrators and dealers who participated in the study. Their total annual revenue increased by an average of 16 percent, while RMR grew by 28 percent, on average, during 2019.

And the start of this decade should be comparably successful for security companies. Two-thirds of integrators anticipate their total annual revenues will increase in 2020 and — among those who foresee expansion — the expected increase is 19 percent, on average.

The SDM Industry Forecast Panel: 2020

Chris Larker is the founder and chief operating officer of S3 Technologies. Based in Akron, Ohio, S3 Technologies is a full-service solutions provider focused on the areas of security, A/V and networks

Mike Mathes currently serves as the executive vice president for Convergint Technologies, headquartered in Schaumburg, Ill. One of Convergint’s founding members, he is responsible for Advanced Solutions and cyber security strategies. Convergint Technologies is ranked No. 1 on SDM’s Top Systems Integrators Report.

Mike Proudfit is CEO of Titan Alarm Inc., Phoenix, Ariz. While attending Brigham Young University, he started a successful manufacturing company as well as an online sporting goods site, which quickly generated more than a million dollars in online sales. He was introduced to the home security industry and in 2008 started Titan Alarm with his brother Taylor Proudfit. The company, now located in 33 states, is ranked No. 93 on the SDM 100.

“We have visibility into about six months of [this] year’s backlog, looking at about a 20 percent growth overall and 15 percent to 20 percent in security,” says Chris Larker, chief operating officer at S3 Technologies LLC, an IT-focused integrator based in Akron, Ohio. “In the first six months, especially, it’s really a flow-through from [last] year and having an existing backlog to work through,” Larker notes.

“We’ve started to bundle our security maintenance with our other services, and that has made an impact that’ll continue to grow. So, if we’re selling an IT service, we’re going to bundle that preventative maintenance (PM) work for the security into those product sets. It’s given us an upsell opportunity in a lot of ways,” he describes.

The Panel Speaks on Total Annual Revenue

SDM: How did your company’s 2019 total revenues change compared with 2018?

Larker: We’re up roughly 36 percent year over year. When it comes to security-related projects, we are up approximately 22 percent.

We are an integrator and positioned with an IT focus. Our philosophy is that everything layers on a network, so for us it doesn’t necessarily matter what the technology is; it just is overlaid … When we meet with clients, we’re leading with either security or AV or network and network infrastructure. What allows us to keep our growth moving in that direction is an IT managed support layer that helps us manage that across our different product sets.

We’ve entered some new markets, and really grown in the senior living space and education. We’ve built a business model that brings value to our clients. This has given us an opportunity to make strides in the two verticals we were previously just dabbling in. Now, we’re more intentional and that has been key.

[Our team has] grown as a group, and [we] have a great culture. I’d put them up against anybody. Our whole mission is to bring value to our clients and help them grow and protect their businesses. Doing that, we’ve been successful in growing our business and our sales.

Mathes: Our growth rate will be probably in the 22 percent to 23 percent range as far as a revenue increase.

We have two main avenues of growth — one is acquisitive and the other one is organic. The acquisition market remains relatively healthy and we’ve had great success in acquiring companies with a similar culture to our own. The other one is through organic growth. The opportunities for us to continue to acquire companies in the market remains robust, so that will help our acquisition strategy. On the organic front, a number of the strategies that we’ve put in place along with our ever-expanding footprint on a global basis continues to provide us with new opportunities and new customers who are looking for global coverage, advanced solutions or vertically focused security solutions. Those strategies have continued to create an increased demand from our customer base.

Proudfit: I think we’re going to end up at $6.3 or $6.4 million in revenue, which would be roughly an 8 percent to 9 percent increase over the previous year. We’ve grown pretty aggressively; we started in 2008, we did six acquisitions in 2016 and 2017, and the growth last year was organic growth.

I anticipate having around 13 percent growth [in 2020] without acquisitions. I do think we’re going to have one or two acquisitions, which would slingshot us past that.

If you ask what our growth is attributed to, I would say No. 1 is our culture, meaning if you walk through our doors you get the feeling of these 50 people want to work her; they like what they do.

No. 2 has been a commercial shift. At end of year 2019 we were around $260,000 in recurring revenue. Of that recurring contracted revenue, in 2018 we were 46 percent residential/54 percent commercial. In 2019 we [ended] with 38 percent residential/62 percent commercial — an increase in installation revenue and recurring revenue overall.

Phoenix, Ariz.-based Titan Alarm Inc., at the time of this writing in mid-December, expected to end 2019 at between $6.3 million and $6.4 million in total annual revenue, which is 8 percent to 9 percent higher than the previous year. “We’ve grown pretty aggressively,” says Mike Proudfit, CEO of Titan Alarm, adding that it was all organic growth. He anticipates approximately 13 percent growth in 2020. But, he adds, “[one or two acquisitions] would slingshot us past that. We have a $15 million line of credit this year from a private party who helped us grow through acquisitions, so we are heavily focused on organic growth, but also acquisitions. We anticipate … some great acquisitions in 2020 and 2021.”

Mike Mathes, executive vice president at Convergint Technologies, No. 1 on SDM’s Top Systems Integrators Report, says the company’s 2019 revenue growth was anticipated to be about 22 percent to 23 percent. “I would say that we’re expecting very similar results [in 2020], with growth between 20 percent and 25 percent at a top line from a revenue perspective,” Mathes says.

The Panel Speaks on Factors Affecting Sales

SDM: What is the one factor you feel will most significantly affect sales of security systems by your company this year?

Larker: Economic conditions are going to be a variable in what you do, no matter what. Our business is in a growth phase, so the ability to effectively provide value to our clients is ultimately going to determine the success regardless of the market conditions. We’re able to bring value whether there’s a downturn in the market or an uptick, like we’ve been seeing over the last couple of years. I think we still have a value play for them, as far as how we bundle our solutions. We haven’t marketed ourselves up to this point but will be implementing a plan in 2020.

Another important factor that will have a positive impact for us is the purchasing decisions shifting to IT. For us, that’s where we want it to be; we’re very OK with that. We expect the trend to continue and trust it’s a positive shift.

Mathes: While economic conditions are always important for all companies and can impact us all equally, I think our primary challenge is our ability to find the resources to both develop business and deliver the services that we bring to the marketplace. Our growth is limited by how quickly we can resource additional people to be able to deliver.

With the strategies we put in place, particularly around our global footprint, our advanced solutions and our vertical market focus, we’re seeing a great deal of demand in the marketplace for our services. Our top challenge is one of staffing, to be able to respond to those requests —from an ability to develop the business and convert it into proposals, and then convert that into actual projects we can do with the customers and lastly, following up from a delivery perspective. So our growth is going to be limited by how quickly we can resource people to address the demand that we’re seeing in the marketplace.

Proudfit: The most significant factor that will affect sales will be capital spending by businesses. That’s our favorite type of bread-and-butter customer, $5,000 to $30,000 — that mid-range customer. As their capital spending improves, budgets get approved, more customers are signing off on bids and proposals and more work is flowing through the hoppers. As smaller businesses do well, capital spending by business will increase and that will have a significant effect on our sales.

The economy is strong; businesses are spending. There is a lot of new business growth here in Arizona, where they’re needing cameras, access, intrusion, fire — and we do it all under one roof. As they’re doing better as a business and growing, we’re helping them with their growth needs. As they have good budgets, they’re able to do all the suggested security measures that we advise them to do.

“We have two main avenues of growth: one is acquisitive. The acquisition market remains relatively healthy and we’ve had great success in acquiring companies with a similar culture to our own. The other one is through organic growth,” Mathes describes.

(To read more about the strategies of each of these security professionals, see the sidebars throughout this article and on SDM’s webs story, “The Panel Speaks,” at www.SDMmag.com/annual-security-industry-forecast.)

While the foresight of these security integrators into 2020 performance aligns well with survey responses from the Industry Forecast Study, it also shows that integrators have no shortsightedness about the factors that will affect their sales this year and the challenges their businesses will face, including the critical need for more labor to deliver the intelligent security solutions the marketplace is demanding.

The Panel Speaks on Recurring Monthly Revenue

SDM: How did your company’s 2019 recurring monthly revenue change compared with 2018? And how do you expect 2020 RMR will change compared with 2019?

Larker: As recurring contracts, preventative maintenance agreements fall into this category. We currently contract quite a few and it’s a major mission for us to stay on the RMR side and grow. We’re now leading with RMR type of solutions consistently and up about 24 percent on the security side year over year. We’re taking advantage of cloud applications more often, and offering this maintenance or management to our clients, so on the preventative maintenance side we’re able to use those applications, leverage them for the upsell and save on rolling a truck — and most clients familiar with the IT world are used to that, so it’s an easy sell that makes sense for everyone.

Our expectation is 18 percent to 20 percent growth in RMR [in 2020]. We’re in a pretty major growth mode.

Mathes: We have seen our recurring revenue mirror our overall top-line growth very closely, and we would expect that it is going to follow suit in 2020, as well. As we expand the number of clients and customers that we work with on a project basis, there is a component of service that we pursue as well, and so our consistency in that area allows us to grow our RMR revenue … in lockstep with our project revenue.

Our primary services fall mainly around break-fix and ongoing maintenance of access control and video monitoring systems, in addition [to] a fair bit of software support requirements with our customers. We don’t delve very much into the alarm monitoring business.

Proudfit: This year we’re going to end right around $255,000 in recurring revenue, that’s around 9.5 percent recurring revenue growth with no acquisitions. For 2020, organically, I think we’re going to break the $300,000 recurring revenue mark, which would put us at around 15 percent recurring revenue growth, before acquisitions.

It has nothing to do with price increases. I attribute that to employee retentions, meaning happy staff. At Titan the employee comes first above customers. Some people may disagree with that, but we believe in focusing on happy employees and happy staff, meaning their surroundings, their environment, how they’re treated in the office between each other — the culture. We really care what our staff are going through, and we try and increase their benefits and their lifestyle every single year so they want to work here.

We have goals to add three more sales staff [in 2020], which would represent a 20 percent increase in sales staff. We feel like we have the model to put them into. I don’t think good salespeople turn around bad operations, but when you have strong business operations and processes and it’s going well and it’s flowing, when you plug good staff into the model it works and it works well.

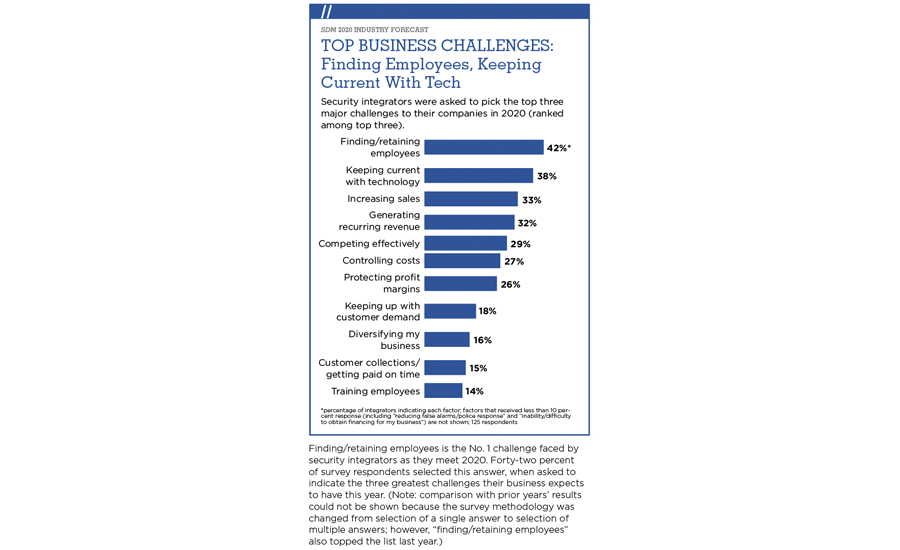

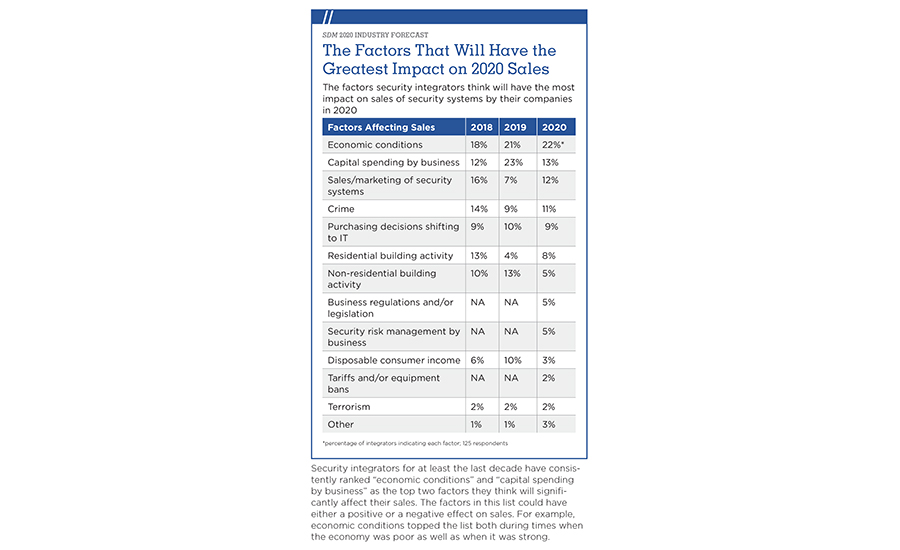

Security integrators for at least the last decade have consistently ranked “economic conditions” and “capital spending by business” as the top two factors they think will significantly affect their sales. And “finding/retaining employees” is the No. 1 challenge for security integrators in the study, selected by 42 percent of respondents.

“While economic conditions are always important for all companies and can impact us all equally, I think our primary challenge is our ability to find the resources to both develop business and deliver the services that we bring to the marketplace,” Mathes describes. “So our growth is going to be limited by how quickly we can resource people to address the demand that we’re seeing in the marketplace.”

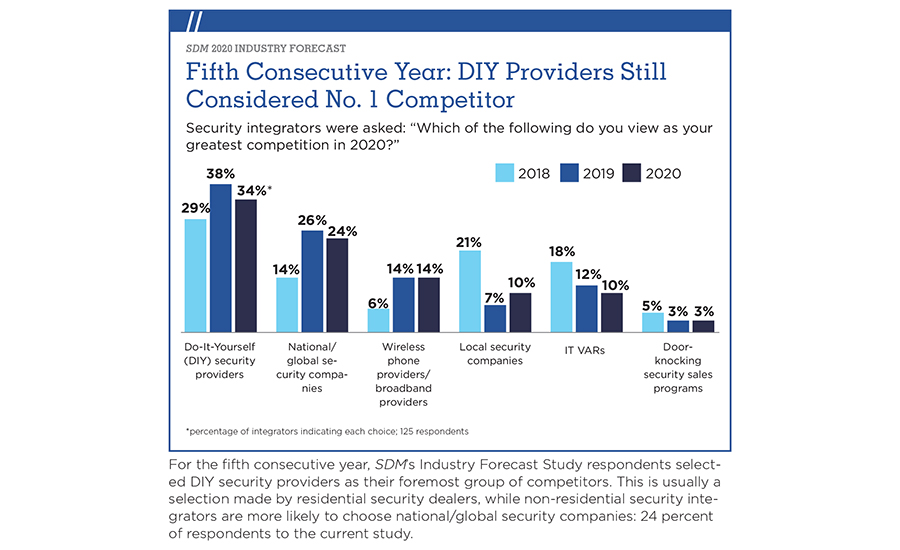

The Panel Speaks on Competition

SDM: Which type of company do you view as your greatest competition in 2020 and why?

Larker: We’re sandwiched between national/globals and local security companies. We are getting invited to larger projects now, so the larger nationals are starting to become more of a consistent competition. And with our middle-market projects, we’re always running into electricals or other integrators trying to compete at a budget level.

We don’t play in the residential market much; it’s about 5 percent of our business. I think if you were in the residential market you would be feeling the do-it-yourselfers, the wireless phone and broadband providers out selling security solutions and cameras. That competition just can’t provide a viable solution for the commercial market, although it does touch some small businesses.

Mathes: The local security and systems integrators [are] our largest competition. Convergint Technologies was founded based on the idea that we wanted to integrate the good aspects of large companies and the good aspects of small companies.

The corollary to that is the challenges and problems you might see in a large or small company were ones we didn’t want to bring with us. We bring a very professional approach to the marketplace that would mirror what you would see from a big company, but we also bring a customer intimacy and high service level that we see from local systems integrators. On the national/global side, we’re more than capable of competing because we brought the sophistication, the process and the management approach that a large global company expects, while providing that sense of local service.

We like to say that we offer global reach but local service. Our individual offices that we call Convergint Technology Centers (CTCs) have a very strong mandate at a local level to provide a high level of service locally.

Proudfit: Our business model is recurring revenue. Our focus is not installation revenue; our focus is recurring contracted services. Our biggest competitors are the broadband providers. Cox would be No. 1 in our area because they have the customers’ attention for bundled services. Their product is not better; their service is not better. They purely have the attention and the lead-generation method of hundreds of thousands of customers a year — a captive audience. They’ve got customers that are signing up for TV, internet, all services, and they bundle with security for next to nothing. And the customer looks past good service, they look past product — they just think price, price, price — and they end up bundling.

We scream and shout and we get excited when we see customers coming back after they’ve tried the cable companies.

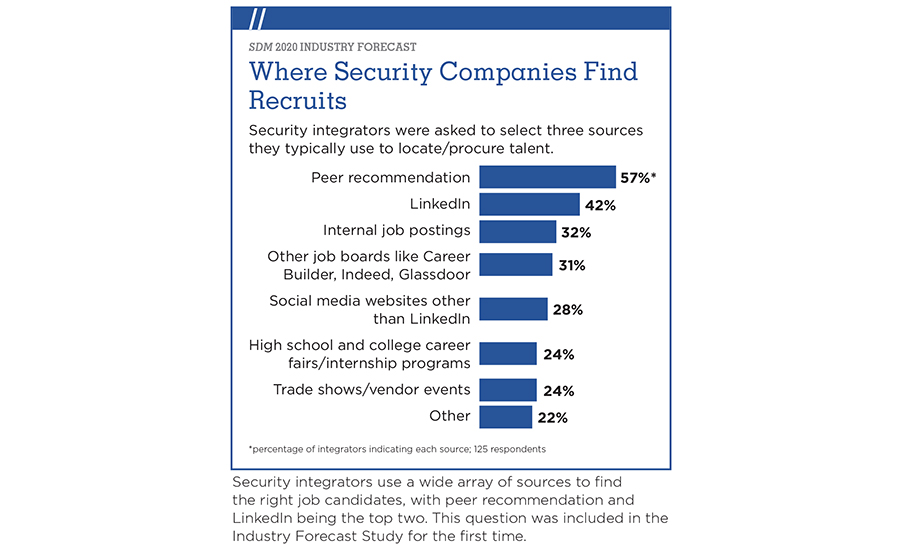

For the first time this year, the SDM Industry Forecast Study asked respondents what sources they typically use to locate/procure talent. “Peer recommendation” was the single-most cited answer (see chart on page xx). In addition, security integrators increasingly are working with their local educational institutions in a variety of ways, such as sitting on school boards, helping develop curriculum, participating in career fairs, hosting students for professional days, and more. (See sidebar, “Where Security Professionals Find Recruits,”).

“At the end of the day, our whole mission is to bring value to our clients and help them grow and protect their businesses,” Larker says. “Our business is in a growth phase, so the ability to effectively provide value to our clients is ultimately going to determine [our] success regardless of the market conditions.”

The Panel Speaks on What Keeps Them up at Night

SDM: What is the one factor you think will present the biggest challenge to your company in 2020?

Larker: One hundred percent it’s finding employees. We have, for better or for worse, decided to not rehire people that have been through the industry. Most of the people we’re bringing in are from outside the industry because we want to train them in the S3 way. Culture and mindset are very important. Now, with employment being so tight, it’s really tough to acquire the right entry-level people. We’re strategically looking to grow through training, local outreach at universities and high schools; building out a funnel.

Good employees at good companies don’t leave in this market, generally. We’re looking for people that are long-term employees where they have been. It’s very rare that we’ll bring a tech in who has been in the industry long-term, partially because skillsets are changing. They need to have more of an IT-type of approach, and we try to get that instilled early in our technicians. When you talk about advanced roles, we’re still growing and promoting from within. We consider “A-list” people from the industry if they fit.

Mathes: For us the big challenge is understanding where the next disruption in our marketplace will come. Markets and industries are disrupted all the time; the last time we saw a big disruption in the security marketplace was the move from analog video to IP video, and we feel that there’s going to be another coming.

In all likelihood it’s within the realm of artificial intelligence; and this time around, artificial intelligence will be driven more from an ROI perspective. The analog-to-IP transition was based more on a lifecycle upgrade perspective, which meant that analog to IP happened over the course of a decade. We see things like AI providing a disruption that’s going to happen more in the two- to three-year range. That’s a market driver that we as an organization need to really understand as we move forward to 2020 and beyond.

Proudfit: Our biggest challenge will be finding [employees]. We look for culture fit, so we are not looking for a butt in a seat. We do three or four interviews; we have panel interviews and we’re looking for people that think the way we think, and that would mesh and operate well with the staff we already have. Finding a few more good sales staff that will fit into our organization, it’s hard — it really is! And we pay well, but it’s hard to find the good people that fit into our organization — experience or no experience.

The second part, retaining employees, I don’t feel we have a problem with that. We have amazing employee retention. I don’t feel that retaining employees will be a challenge for us in 2020. But finding the good employees is the hard one. We could hire four or five more sales staff right now, but we can’t find them.

Editor’s Note: This article is based primarily on a report produced by Clear Seas Research, “SDM Industry Forecast,” produced November 2019. To learn more about the report or to purchase, visit https://bit.ly/2PBvuh0.

Clear Seas Research is a full service, B-to-B market research company focused on making the complex clear. Custom research solutions include brand positioning, new product development, customer experiences and marketing effectiveness solutions. Clear Seas offers a broad portfolio of primary, syndicated research reports and powers the leading B-to-B panel for corporate researchers, myCLEARopinion Panel, in the architecture, engineering, construction, food, beverage, manufacturing, packaging and security industries. Learn more at clearseasresearch.com.

The Panel Speaks on Recruiting Talent

SDM: What are some methods you have adopted to identify and recruit talent in your company?

Larker: Building this plan out has been a major initiative for us this year and will continue into next year. We sit on the board of a few high schools to build technology tracks that are hopefully going to pre-train a lot of individuals. They may not go to college, but have the aptitude and eagerness to learn. We’re looking to build our bench from that level. We’re also working with the local universities that have engineering technician-type programs.

We’re hoping that it helps the community, too. It’s great community outreach that opens the eyes to something that some just haven’t considered as an option. I think that’s half the battle of our industry; they don’t know that techs can be making $50,000 to $70,000-plus per year after a couple years if they’re good. I think if we promoted that more, we’d probably see an increase in people wanting to come into our trade.

This fall we took part in a job share where students came out and job shadowed. We built out an Axis camera setup; showed them how to configure the cameras, some basic-level design, like where would you put cameras in a school, and did a five-hour session with the students from the local high school. These students are looking at an IT track, and you could see the light bulb go off as they understood more about what we do and how it relates to what they’re learning.

Mathes: To me the logical follow-up to the challenges of finding and retaining employees is: So what are you doing about it? First and foremost it starts with the culture of the company, and Convergint Technologies has put a great deal of effort into our culture and our values and beliefs. We live by our values and beliefs every day and to those on the outside it may sound a little bit trite; but for those that work within the company, it very much resonates with them and drives them. It also resonates very strongly for our customers, and our culture and values and beliefs are a big part of us attracting and retaining colleagues.

That drives some very specific actions within. It runs the gamut from us looking at our HR policies relative to personal time off, 401K programs, health coverage — and all of those are maintained at a very competitive level. In addition, Convergint is investing a great deal of energy around the recruitment, onboarding, training and coaching process with new people coming into the company. We realized that we can’t keep recruiting just from our competition, but we need to go look for where is the new talent. So we have created quite an extensive program to reach out to many colleges and universities across the country, recruit new talent and bring them into what we call our Convergint Development Program (CDP). The CDP is a one-year program that takes college students into their first job and helps them to acclimate to both Convergint and to professional life.

In addition, we’re training them on all the various skills and knowledge that they’re going to need to be successful in their roles at Convergint. We have people within our organization who are specifically focused on working with those groups, from the recruiting perspective to onboarding them, to training them; and after they’re trained, follow-up coaching, as well. We found that that’s been an excellent source of additional resources for [us]. That gives you an example of one program we have to overcome the challenges we face with finding and retaining good-quality colleagues.

Proudfit: Our most successful and highest retention strategy is incentivizing our current staff to recruit. Rather than one person going out and recruiting on Indeed, Craig’s List, Monster, all these recruiting agencies, No. 1 is to have the staff work with people that we know, like and trust.

As the CEO, I don’t mind doing the initial interview but I by no means want to be the final say in who is hired, because I’m not going to work with them. The staff are going to be working with them. So they perform panel interviews and hit them up with questions to see what kind of person they are. We can train on skill; we cannot train on personality. So we want to make sure we get the right attitudes and good personalities in here. We can train them how to sell; we can train them how to understand security, fire, access and surveillance; but we cannot train how they think, how they act, their work ethic and how they treat others.

Our No. 1 recruiting method is through our current staff. We pay them incentives and bonuses to find friends that want to come work. It’s been effective on the installation side and on the sales side.

No. 2 has been hiring from within. We have really focused on that over the last few years and it has paid dividends. Meaning when spots open up we consider our staff first to fill those positions. Most companies … want to bring outside people in and I think that really hurts your organization. It deflates the staff’s vision of being able to grow within the company. As our staff see their peers around them get brought up to the big leagues or being asked to [take on] more responsibility, they instantly think, “That’s going to be me some day — and I hope I get pulled up or I hope I get asked to [have] more responsibility.”

Our project manager came from within; our sales manager came from within; our technician manager came from within; our bookkeeper came from within. The list goes on and on and on. We train them here in the office and as they solve problems we ask them to solve more problems. I think it hurts companies when people hire people from outside and bring them in to manage others. No one likes that.

More Online

Are you using SDM’s Industry Forecast Study data for 2020 business planning? More than a dozen tables and graphs from the 2020 Industry Forecast Study are available online at https://www.sdmmag.com/annual-security-industry-forecast.

SDM 2020 INDUSTRY FORECAST