So, that while the annual SDM Forecast Study for 2004 finds security dealers, installers and systems integrators cautiously optimistic about how things will turn out by the end of this year, most report pretty darn good performance last year, throwing caution to the wind.

Total industry revenue driven through that dealer, installer, integrator base jumped more than 8 percent (8.2 percent) from 2002 to 2003, according to the survey, mailed to a random sample of SDM subscribers.

Caution returned when dealers were asked to project revenue growth this year, compared to 2003. Their guess: a smaller 3 percent. However, when asked to project 2004 revenues compared to last year, almost seven in 10 (68 percent) expect some type of increase.

Analysis of the survey results, comments from respondents and follow-up interviews point to a handful of success factors.

Growth of Video

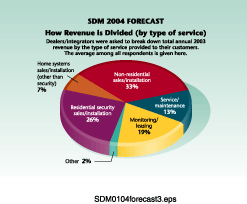

Video surveillance components and systems now grab 20 percent of total revenues, when survey respondents break down total revenue by type of system. Looking at revenue from a service perspective, respondents peg non-residential sales and installation at about one-third of the total pie. Dealers and integrators installed more non-residential security alarm systems last year as compared to the previous year. They significantly increased business in non-residential video surveillance systems. And, although sales and installation of residential video is still a small amount of total revenue, it more than doubled last year.

No one disregards the sale and installation of a typical home security system, especially with continued strength of new home construction and existing home sales in the United States. Still, the average price of a home security system was flat last year ($1,471) when compared to an average price tag of $1,425 in 2002. Previous high prices ($1,995 in 1998 and $2,000 in 1999) occurred just before the economy started to slow and overall consumer prices started to soften. For those that define themselves as serving the mass market, the price of an average home security system is $911 compared to that $1,471 across all types of dealer firms. About a third of dealers (32 percent) believe that the average price of home security systems will increase this year; most believe pricing will remain the same.

It's the Economy

The economy and then crime, without a doubt, will continue to most significantly impact sales this year, according to the dealers, installers and integrators responding to the SDM Forecast. There is an increased feeling that capital spending by business as well as non-residential building activity will be more important factors this year. Only time will tell; there's a glimmer of confirmation coming from productivity, confidence, technology and business purchasing measures by the Federal government. Independent sources show that capital spending is growing, with non-residential business activity more selectively growing in certain types of businesses and geography regions.

More dealers plan to take a micro view of potential business this year, saying they will focus more on the mom-and-pop small commercial sector and the high-end residential customer.

Since the SDM Forecast first started in 1982, top challenges remain the same, although the order of the top four challenges shifts slightly each year. Top challenges: increasing sales, protecting profit margins, controlling costs and finding/retaining employees. Not surprising, employee challenges were ranked less important than controlling costs in 2003, thanks in some measure to more people available in the labor pool.

Annually, SDM surveys a random sample of magazine subscribers. Late last year, SDM mailed 2,000 questionnaires and received usable responses from 15 percent of those receiving the survey.

The security industry, overall, defines its size based on the SDM Forecast, and details of the annual survey can often help individual security firms fashion strategies or refine missions and plans.

Competitor Changes

The survey details, for example, show how competitor players have changed over the last few years. Almost half of firms (47 percent) see the stiffest competition coming from the large or national alarm companies, reflecting the outcome of a decade-or-more of consolidation. Ironically, hardly any respondents (1 percent) see telephone companies as alarm competitors anymore. Neighbors of alarm firms, those small or local alarm companies, continue to be a natural competitor, while 16 percent of respondents believe that competition – no matter the source – has little or no effect on their business.It's also obvious from the survey results and news reports that the purchasing of security-installing companies has slowed significantly. Only 6 percent report they have made such purchases during the 12 months previous to the survey. In some years during the 1990s, for example, more than 10 percent said they purchased another security-installing company.

The independent nature of the industry still remains, however. In terms of belonging to an authorized dealer program, half of SDM Forecast survey respondents do not belong. Still two in 10 (20 percent) say they belong to three or more of such programs.

Monthly home monitoring fees, the meat to product sales potatoes, remain static on average, with the average monthly fee pegged at $22.80, although 30 percent of dealers who monitor report billing higher than the average. About two in 10 (21 percent) expect that the price of monitoring will increase this year. That's less than the number of respondents who expect the price of an average home installation to increase.

The survey also measures the important element of turnover of customers.

Last year, for instance, surveyed dealers say they lost, on average, 59 customers, with about one-fourth reporting that the number of lost customers increased as compared to 2002. Still, on average, dealers say they sold 150 monitoring contracts last year, with about one-fourth saying the number of monitoring contracts sold in 2003 increased compared to 2002.

Emerging remote video monitoring services, which some claim may one day replace or overtake traditional alarm monitoring, have grown and bring in higher monthly monitoring revenues, thanks in large part to the increased monthly expenses inherent in the service. A healthy 26 percent of respondents say they now sell remote video monitoring services and the average monthly video monitoring price charged is $101.

Dealers who provided additional comments when completing their SDM Forecast Survey questionnaires suggest that the growing popularity of the Internet will drive even more interest in remote video monitoring services.

Striking a somewhat inconsistent note, almost half of dealers (48 percent) say they do not have a Web site. Most every firm, however, does use the Internet for business purposes, with research, location of manufacturers and distributors, and obtaining of technical/product information the most often cited reasons to go online.

Who Took the Survey?

Results of the SDM Forecast Study 2004 are based on valid responses from a mail-out, mail-in survey to a random sample of SDM subscribers who are dealers, installers and system integrators. A mailing to 2,000 subscribers was conducted in mid-October 2003, with a useful response rate of 15 percent.Sidebar: Devilish Delight in the Details

Respondents to the SDM Forecast Study 2004 have some good advice to colleagues, in addition to the survey results.The stiffest competition? They are the buyers who select incompetent companies to do business with.

Impact on sales of security systems? More advertising locally and more community involvement will make a difference.

While selling more at a higher margin is obviously a shared goal of all dealers, many see home building and a closer relationship with home builders as a key element to meet that goal this year.

Some firms plan to add more sales people; others see the need to readjust their sales strategies in areas as varied as direct marketing, commercial customers, homeland security, video security and card access control.

A significant minority of dealers gets revenue from outside the traditional security and life safety mission. These revenue streams include computer services, contract labor, electrical work, telephone systems, home office needs and even garage storage systems.