Industry Revenue Grows 6% in 2005; Poised for 9% in 2006.

Total industry revenue from the sale, lease installation, service, and monitoring of security systems. Total industry revenue ($ billions)

Total industry revenue from the sale, lease installation, service, and monitoring of security systems. Total industry revenue ($ billions)

Once the home security market began to develop in the 1970s, many alarm companies built their businesses around a model that encompassed a little bit of everything. Hang a shingle, hire an installer, sell a home alarm system one day, a camera system at a convenience store the next. Whatever the customer needed, the tech-savvy dealer would learn it and then install it.

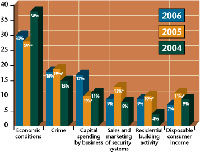

Economy, Spending and Crime Expected to Have Most Impact on Sales This Year

*Percentage of respondents indicating each favor

*Percentage of respondents indicating each favor

As Business Heads up, So Do Hiring Challenges and Containing Costs

*Percentage of respondents indicating each challenge

*Percentage of respondents indicating each challenge

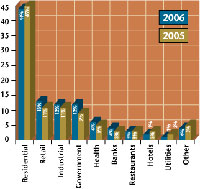

Dealers & Integrators View Government Market as Stronger in ’06

*Percentage of respondents indicating the one market sector where they expect the highest rate of growth for their companies in 2006

*Percentage of respondents indicating the one market sector where they expect the highest rate of growth for their companies in 2006

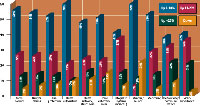

How Dealers and Integrators Will Spend on Equipment in 2006.

Percentage of respondents citing each range of spending change in 2006 compared with 2005

Percentage of respondents citing each range of spending change in 2006 compared with 2005

Dealers and integrators across the board project 2006 revenue to increase at an even better rate – 9.3 percent – to reach $29.5 billion, according to the study.

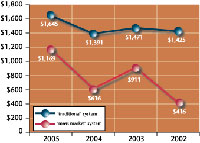

Home Security System Prices Reflect Some Profit Being Included

SDM’s Industry Forecast Study measures the average sold price for two types of residential security systems – traditional and mass-market. For traditional systems, the average surged to $1,645 in 2005. The pricing on mass-market systems also jumped, to $1,169 on average.

SDM’s Industry Forecast Study measures the average sold price for two types of residential security systems – traditional and mass-market. For traditional systems, the average surged to $1,645 in 2005. The pricing on mass-market systems also jumped, to $1,169 on average.

Average Prices of New Non-residential Security Systems low end 2005 low-end average system price: $1,506 compare with: 2004 low end average system price: $1,163

*Percentage of respondents falling into each price range

*Percentage of respondents falling into each price range

Average Prices of New Non-residential Security Systems

high end 2005 high-end average system price: $4,594 compare with: 2004 low-end average system price: $2,950

*Percentage of respondents falling into each price range

high end 2005 high-end average system price: $4,594 compare with: 2004 low-end average system price: $2,950

*Percentage of respondents falling into each price range

Average Monthly Monitoring Prices

*Average price among all respondents

*Average price among all respondents

Non-residential Sales/Installation Takes a Bigger Share of the Pie

*Respondents’ average percentage of revenue per service category

*Respondents’ average percentage of revenue per service category

Integrated Security Systems Gains as a Percentage of Total Systems

*Respondents’ average percentage of revenue per system category

*Respondents’ average percentage of revenue per system category

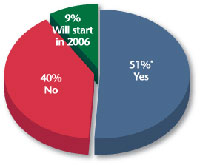

Does Your Company Have a Web Site?

*Percentage of respondents

*Percentage of respondents