For a market characterized as stable, code-driven and conservative, 2015 seemed to be a turning point for many in the fire detection business, marking the true end of the downturn and the return to growth. For others it was a continuation of this trend that began a few years earlier. Much of the response to “How was 2015?” depended on three big factors: what area of the country you are in and whether the new construction market has rebounded there; what version of the NFPA code your local AHJs follow; and what vertical markets you are most involved in. But overwhelmingly, manufacturers, dealers and integrators tended to find one or more positive trends pointing to growth last year and an even more optimistic outlook for 2016.

“2015 was a great year for us in the fire alarm market,” says Brandt Phillips, commercial fire security director of sales, Napco Security Technologies, Amityville, N.Y. “We are actually following a banner year in 2014, so additional growth was really significant.”

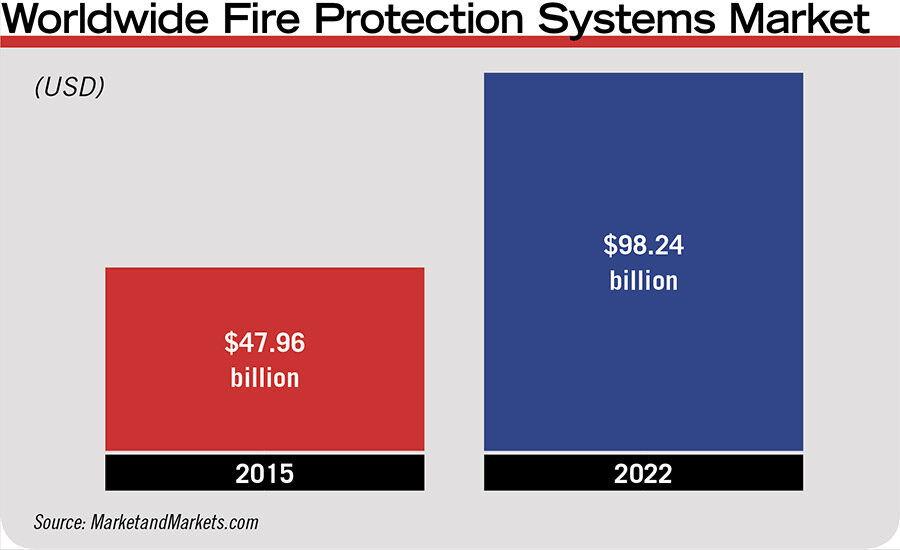

Research supports the idea that the fire market is in a growth cycle. The report “Fire Protection Systems Market by Technology (Active, Passive), Product (Fire Detection, Sensors & Detectors, RFID), Management (Fire Sprinklers, Extinguishers), Fire Analysis & Response, Service, Vertical, and Geography - Global Forecast to 2022,” by research firm MarketsandMarkets predicts the global fire protection systems market size will more than double by 2022, growing at a combined annual growth rate (CAGR) of 10.1 percent from $47.96 billion in 2015 to $98.24 billion by 2022. (See chart, page 60.)

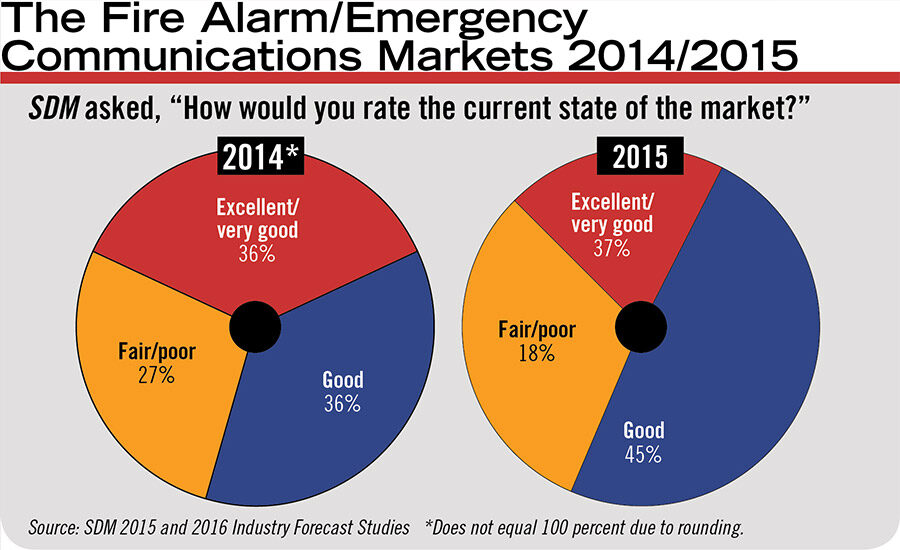

SDM’s Industry Forecast studies in recent years also reflect this bullish stance on the fire alarm market. For the 2016 study, readers were contacted in the fall of 2015 about their experiences in 2015 and expectations for 2016. A whopping 82 percent of respondents characterized 2015 as “good” or “excellent” in the fire alarm/emergency communications market, up 10 percentage points from 2014 and 17 percentage points higher than they predicted in last year’s study. (See chart, page 53.)

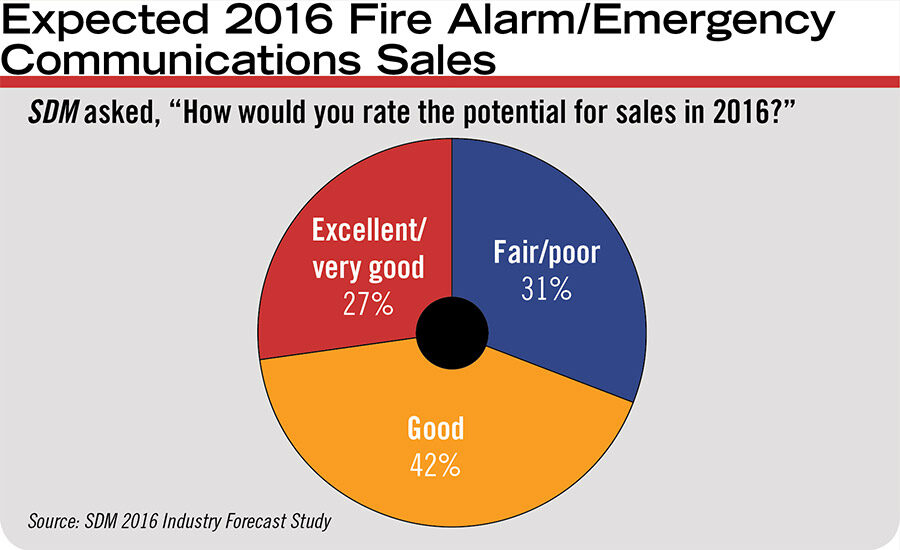

It would seem SDM respondents tend to underestimate future performance, as the 2015 study also showed a significantly better performance than predicted (55 percent predicted in the fall of 2013 that 2014 would be a good year, while 72 percent reported a year later that it was). Accordingly, the almost 70 percent of respondents predicting a good to excellent 2016 (see chart, page 55) may actually be much lower than will turn out to be the case, if the manufacturers and integrators interviewed in April 2016 are any indication.

Scott Sessions, senior vice president of Ogden, Utah-based Mountain Alarm (featured on this month’s cover), for example, says his company’s fire business grew a healthy 22 percent from 2014 to 2015 and he anticipates an even better 2016, with first-quarter growth alone up 9 percent over last year. Sessions points to new construction, retrofits combined with code-driven compliance requirements as some of the reasons for the growth.

“Nobody wakes up in the morning and says, ‘I want to put a new fire alarm system in my four-story.’ But fire alarm systems are wearing out. Mass notification has helped, as well as new construction. Our backlog is humongous and better than last year. 2016 looks bright for us.”

Many of his fellow integrators also saw double-digit growth in 2015 and say 2016 is off to a very promising start. In certain regions a construction rebound is helping that significantly.

“2015 was good,” says Ken Hoffman, CEO, Dynafire, Casselberry, Fla. “It was about a 10 percent increase over 2014. But 2016 looks extremely good. We are up 45 to 50 percent [from this time last year].” Hoffman attributes the strong construction recovery in Florida to the boom. “The construction market has changed in Florida. Projects that were on hold for a long time are starting to develop and proceed forward.”

Texas is another state that is flourishing in construction, says David Ringenberger, president, Protection Systems LLC, Dallas. “The economy and construction in Texas is white-hot,” he says. “We have done very well in data centers, healthcare and commercial office buildings. The lion’s share of our business was new construction — I would say 80 percent.”

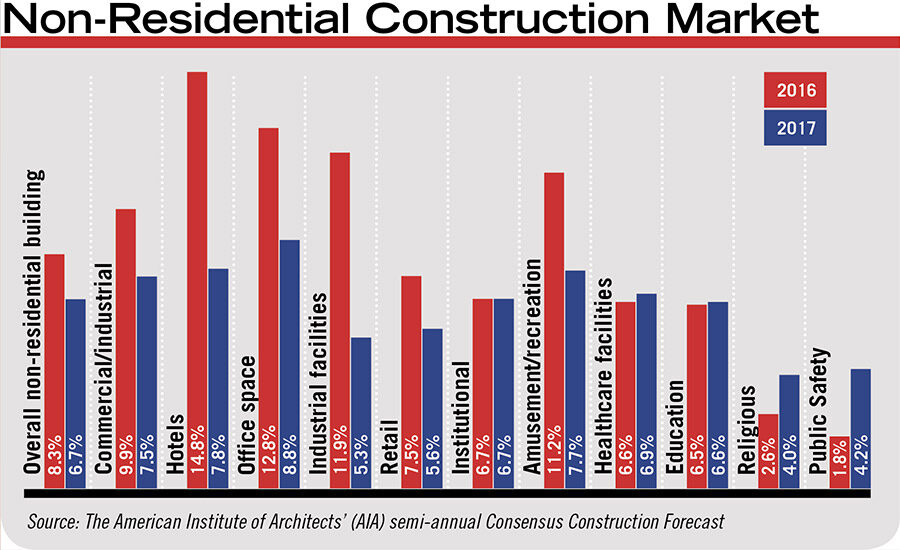

The American Institute of Architects (AIA) semi-annual Consensus Construction Forecast, a survey of the nation’s leading construction forecasters, reported in February 2016 that construction spending in the non-residential market greatly exceeded expectations in 2015, particularly in hotels, office space, manufacturing and amusement/recreation. The AIA is further projecting that spending will increase just more than 8 percent in 2016, with next year’s projection being an additional 6.7 percent gain. (See chart, page 56.)

The Bay area in California is also booming, but it is retrofits that are shaping up to make 2016 a good year, says Steven Lewis, senior account executive, RFI Enterprises, San Jose, Calif., a Security-Net integrator. “High tech is continually growing and companies are building and expanding, which is good for business. We had a really good year last year in fire and life safety, also from education and healthcare. It was about 60 percent new construction. Both last year and 2014 were essentially good years. But 2016 is exceeding that, more because of head-end upgrades and migration programs.”

While new construction may be up overall, not all areas of the country are feeling the full effects yet. For those manufacturers and integrators, retrofit and code opportunities are more in line with what they are experiencing.

The cranes are starting to come back in Pennsylvania, but it is legacy upgrades that are boosting business for fellow Security-Net member J. Matthew Ladd, president of The Protection Bureau, Philadelphia. “We are not seeing the tremendous building yet on the East Coast. In the meantime a lot of our work has been fire alarm upgrades, such as smoke detectors that have been in longer than the manufacturer would support them.”

John Haynes, global director, Simplex product management, Tyco Fire Protection Products, Westminster, Mass., says retrofits and upgrades are strong overall. “We have been able to offset any weakness in new construction with a strong focus on upgrades and migration programs.” Chris Woodcock, director of marketing communications for Tyco SimplexGrinnell, the integration side of the business, called 2015 “a really solid year.”

As a national distributor, Tri-Ed Distribution, an Anixter Company, headquartered in Woodbury, N.Y., saw a broad spectrum of trends, according to Keith Daum, director of product marketing and supplier relations. He describes 2015 as “modest growth in a mature market,” which translates to a good year. But he is most excited about what he sees happening for 2016.

“Even though the growth in 2015 was modest there are some key indicators in the industry that have been around for a couple of years and continue to gain momentum. That is one of the leading factors why I think 2016 is going to be much different than even 2015. What I am seeing already five months in is the growth will be in the excellent range for fire as these emerging trends become more prevalent and integrators and end users understand that they exist and things need to be updated to meet code and compliance.”

Code requirements are definitely ramping up, says Samir Jain, general manager of enterprise solutions business, Honeywell Security and Fire, Northford, Conn. “So far 2016 is shaping up quite well. Code requirements such as low frequency sounders or carbon monoxide detectors got a nice boost in 2015 and I don’t see that slowing down.”

Ontario-based Mircom also expects to see double-digit growth in 2016 after a “significantly better” 2015 than 2014, adds Tom Minerich, vice president of U.S. sales for Mircom. “2015 was a year of rebuilding as we invested heavily in new employees and infrastructure that positioned us for a very strong finish for 2015 as well as put us in the position to react to 2016’s projected growth. The economy seemed to be on our side as well.”

Jeff Klein, vice president of marketing for Honeywell Security and Fire, points to three key parts of growth, which typify what many in the market are seeing. “One is the general state of the economy [which impacts new construction]; two are the new codes that come online; and three is what we can do that better services the customer so there is a demand for what we are providing.”

The Impact of Code Changes

For dealers and integrators working in the fire space, NFPA 72 is “like the Bible,” Sessions says. And like the Bible, fire code is open to a wide variety of interpretations. Codes drive everything in fire, so every revision is closely scrutinized for changes and what that might mean for the market. NFPA 72, for example, is revised every three years. The most recent version, 2016, was released in fall 2015 and NFPA is now taking comments for the 2019 version, which will be ironed out in a rough draft later this month. (See “A Conversation with NFPA,” online only at www.SDMmag.com/NFPA-conversation.)

Starting in 2010 there were a number of changes in the code that have had wide-ranging impact as these versions have slowly been adopted across the country.

“There are six major trends right now,” Daum says. “One is emergency communications, emergency command centers or mass notification; CO detection, low-frequency sounders, alternative communications and wireless detection are the major drivers that will really continue to drive the industry and let us see higher growth in the fire market compared to the last couple of years.

“There have been a lot of newer products that have come out tied to these growth drivers over the last 24 months. It is these products picking up momentum, mindshare and market share.”

Change brings business, Ladd says. “When codes are clear there is more growth.”

Clarifying code is an ongoing process, says Richard Roux, senior electrical specialist, National Fire Protection Association (NFPA), Quincy, Mass. “Mass notification really came into being in the 2010 edition. Then we went back in 2013 and 2016 and refined it, cleaned it up around the edges. Some of the major things that have occurred are on the communications side. Within the building, technology went from a lot of hardwired to more addressable and wireless. When you get to the outside world that is where things have really changed. How you send the signal to the station has been revolutionized since 2007.” Other changes that have occurred include low-frequency sounders, which are more easily heard by hearing-impaired individuals; and the requirement for carbon monoxide detection in sleeping areas.

“Out here in California we are enforcing NFPA 72 2013 edition; 2016 will be enforced after the first of the year,” Lewis says.

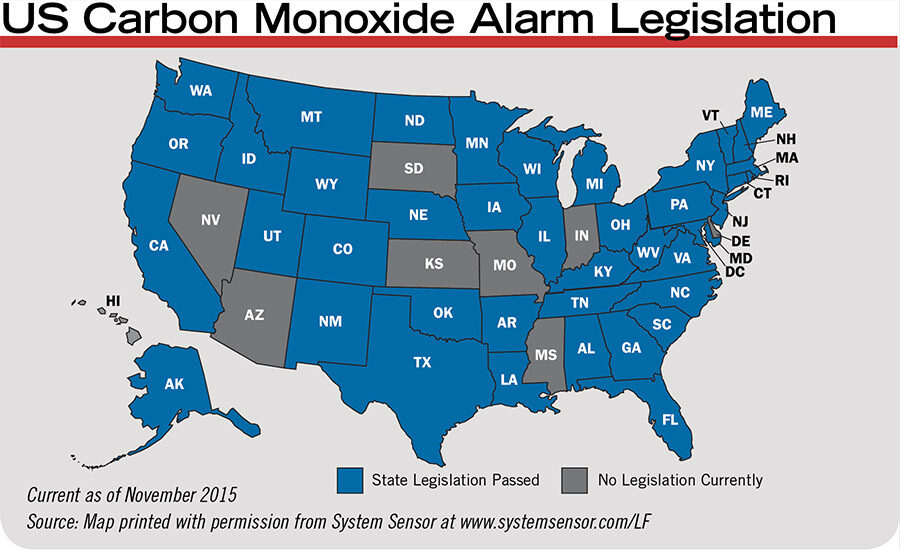

Code and compliance is becoming more of a mandate, with more and more state legislation being passed, particularly with the sounders and carbon monoxide, Daum says. “More than 75 percent of states have passed CO legislation. The number of states is lower for low-frequency sounders, but there are many more than there were a year ago.

Carbon monoxide detection and wireless were two code-related changes that helped Honeywell grow steadily over the past few years, says Todd Rief, president of North America, Honeywell Security and Fire. “Forty-one states now mandate some sort of CO protection in buildings with sleeping areas. (See map, page 64.) Also, wireless in the commercial market is more accepted. Now with our mesh wireless technology we are convincing engineers and fire marshals that this technology is very safe and allowed in the codes.”

Napco’s Phillips has seen similar results with his company’s wireless products. “The progression of 2013 to 2016 has been great for the industry. If and when jurisdictions begin adopting those standards it is a very positive change for the industry.”

The challenge with code-driven compliance is a lack of consistent application. In some cases dealers and integrators find themselves following one version of the code in one city and a different version in a neighboring city. Then there are jurisdictions that implement their own codes based on two or three different standards. It can get confusing.

“California tends to jump on newer versions fairly quickly,” Phillips says. “But certain jurisdictions like Los Angeles do their own thing. As soon as you think you know who follows what, it will rear its head. There is no real rhyme or reason to it.”

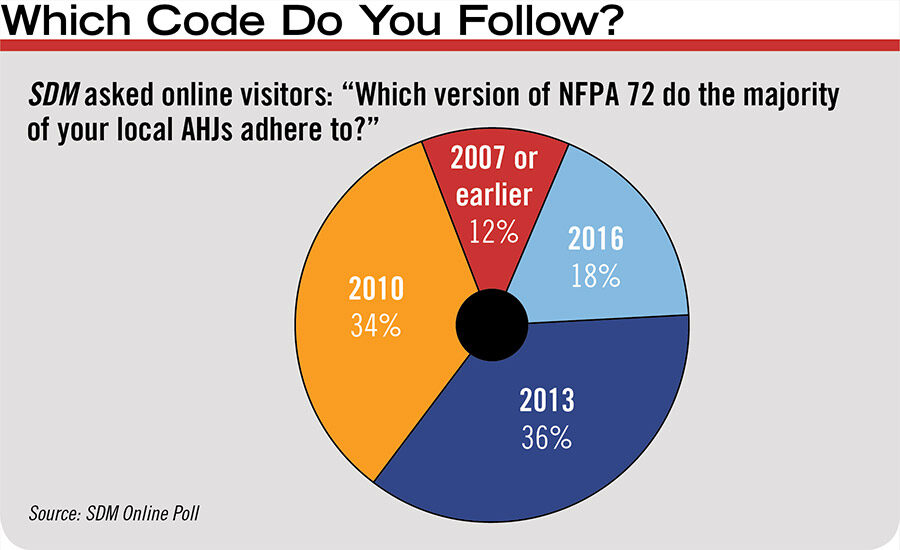

SDM conducted an online poll in April/May, asking readers which version of the code the majority of their AHJs follow. At press time, the majority reported following 2013 and 2010, with 2007 at 20 percent. Not surprisingly only a few reported following the latest edition, 2016. For the latest results, visit www.SDMmag.com/which-code-do-you-follow/results.

Some technologies that are now accepted by code are showing potential to be a more discretionary — or at least outside of the new or retrofit construction cycle — purchase.

“The 2016 revision has some terminology in there that says you are not to install two phone lines without the express permission of the AHJ,” Phillips says. “What it really means is if you are going to use a phone line you need to have a second, unrelated form of communications. It acknowledges that phone lines are a problem.” (See “Fire Has Sunsets, Too” on page 54 for more on communication paths.)

Mass notification is another area that can potentially move beyond a code purchase, says integrator Tim Lumley, account manager, SMG Security Systems Inc., Elk Grove Village, Ill. “In the last five years that has really started to pick up. That is where fire is becoming more than just fire.” (See related story, “Easing the Fear of Fire With Technology” on page 67.)

“Mass comm is becoming more critical for an end user than even a fire system,” Daum adds. “They must have a fire system if they want permits. But the real selling card these days is the mass communication capabilities…. This is driven more by current world events than code.”

Rick Tampier, senior director of sales and product strategy at Red Hawk, Boca Raton, Fla., agrees. “We are seeing some growth and opportunities in mass communications, coming out of the fire alarm business for evacuation. Now it is allowed by NFPA to use it for scenarios other than fire. Frankly there is some great technology out there such as louder speakers that are less expensive.”

Overcoming Market Challenges

Looking at the industry from the outside, fire seems a “sure thing.” It can be lucrative, as well. But the one thing all agree on is it is definitely not easy. That is why, although there are challenges and competition, those who specialize or have a heavy concentration in fire feel confident going forward.

While competition is nothing new, it really accelerated in 2014/2015, Ringenberger says. “What we have experienced is a mass influx of companies and people coming down here and finding that opportunities abound.”

Competition from related fields such as electrical contractors and sprinkler companies is most common, says Craig Summers, vice president of sales, fire and security division, Potter Electric Signal Company, St. Louis. “[These] companies are trying to get into an already overcrowded market and will create additional competition. But I don’t see drastic changes due to the necessary codes, standards and licensing.”

In other words, not just anyone from off the street can suddenly decide to open a fire alarm business. But that doesn’t stop others who think they have what it takes from trying.

“We definitely have more competition,” Sessions says. “Locksmiths, sprinkler companies, fire service companies are all getting more active. The problem is they come in pounding on price, then they go out based on price. Fire is such a different ballgame because the sales cycle is so long. If you are selling strictly on price and not value-added sales, it creates problems.”

Lumley adds, “Everybody wants to get into the industry but they are frustrated when they can’t be successful. Permit fees have gone up in cost. The price for a consultant to review is in the hundreds. Fire is code-driven, yes, but it is not about price; it is about relationships. You have these companies trying to come into the industry that are not making the relationships, thinking you can sit behind a desk and estimate it and come in at the lowest price.

“[New companies] run the numbers and think if they quote 50 fire alarm projects they are going to get five. But in this industry you can quote 500 and get zero because there are so many people involved.”

Sessions and his fellow fire integrators aren’t too worried about these competitors, however. “Fire is in our DNA,” Sessions says. “We have been that way for 60 years. You have the ‘wanna-bes’ that jump in and we don’t know how successful they will be. We will see if they are still here 30 to 60 years from now. Meanwhile we will keep building deeper, more solid relationships based on service, and individualized attention to the systems we sell and install.”

Time and experience bring perspective, adds David Kleinman, vice president, AFA Protective Systems Inc., Syosset, N.Y. “The biggest threat to AFA in the fire alarm market is price competition. We rely on our long-standing performance record to enable us to continue to serve our customers at reasonable rather than cut-rate pricing.

“When your business has been around for over 143 years, you get used to businesses coming and going. The surprise is when they stay around for a long time.”

If anything, working with AHJs has gotten more complicated, not less, over the years, Lumley adds. “Of all the years I have been doing this, in the last three years pressure has increased because municipalities have cut so many people, including fire reviewers and inspectors. They are so stretched out it takes a long time to get a fire system approved. Electricians are pushing us harder. It is all about time and how fast you can get it done.”

Lewis says fire departments and permitting departments are underfunded. “Third-party consultants are being hired to approve plans and perform inspections.”

One of the biggest challenges dealers, integrators and manufacturers alike face is one that will feel familiar no matter what segment of the industry you are in: hiring good people.

“Finding ethically based, honorable people that actually want to work is the biggest challenge,” Sessions says. “That is generally true in this country we live in. But in fire it is not whether you have the best widget. We have that. We have a ton of RMR every month. From a growth standpoint we are in great shape. But finding people that actually want a career as a fire alarm tech or designer is very difficult.”

That this is getting tougher is not a surprise. But when it comes to fire, there is an added twist, Ladd says. “The level and the quality of technicians working on systems is growing. I am having to bring in guys with NICET Level IV and tremendous certifications just to work on fire alarm systems. It used to be as long as someone on the project was certified that was OK. Now they have to be in the field. Even the inspectors have NICET training. That changes the scope of the guys doing the work.” It also changes the pay grade, he adds.

There is a positive reason for all this, however, Lewis adds. NICET introduced new classes for inspectors and others working on fire alarm systems in response to inconsistencies and issues. “I am seeing the bar being raised in supporting and maintaining systems, where the industry in general hasn’t been up to par.”

While it may add to the expense and complexity, ultimately the AHJs are driving quality and keeping out the “riff-raff,” Tampier says. “I think it is good for our industry. It makes it harder to justify the cost of entry. It’s relatively easy to get into security. It’s harder on the fire side and there are [fewer] people that were pulling wire one day and now own a company designing life safety.”

Tech, RMR Opportunities & Beyond

Given the challenges the integrators in the fire space are facing, particularly with competition and finding good technicians, the manufacturing side trends are helping, both on the front end with labor-saving products and on the back end with apps and other automated service options. In addition, many talk about technology that — eventually — could tip the market in the direction of increased integration and even the Internet of Things (IoT).

“One of the things we hear from our dealers and integrators all the time is the lack of good talent, or the shortage of technicians,” Honeywell’s Jain says. “Given the state of the market, how do we develop products to make them more efficient? One of the ways is wireless devices that can install more quickly, with less labor. Another is the notion of an app to make dealers more efficient with their service and inspection of the fire alarm systems.”

In an increasingly competitive world with tighter margins, the right technology can help, Summers adds. “For our dealers right now it is very competitive. Many talk about single-digit margins on new construction. There is not a whole lot we can do to pull cost out of the equipment because that is code-driven. But we can put features in that reduce installation labor.”

Mike Troiano, president and CEO, Advanced Fire Co., Hopkinton, Mass., says choosing the right product line can make or break the dealer’s profit. “Let’s say you are trying to choose a product line to meet codes and standards. You want to look for something that goes in seamlessly, cuts cost down to put the product in and, after it is in, will help you maintain it for a lifetime.”

On the back end, dealers and integrators increasingly are trying to make up margins by going after the mandatory test and inspection business, which is guaranteed revenue — if you can get it.

“After the downturn many dealers and integrators were forced to tighten belts as new installation contracts became few and far between,” notes BuildingReports’ David Spence, marketing manager for the Suwanee, Ga.-based reporting and compliance software company. “To survive they had to become more cost efficient while finding innovative ways to add value over the competition in a recurring revenue model. Inspection, compliance reporting and maintenance services became much more important to the company bottom line.”

Automation has touched this portion of the business as well. “New technology reduces the burden and provides compliance reporting in a Web-based format,” Spence says. (See “Mobile Inspection & Electronic Reporting Technology: Is it Time to Adopt?” online only at www.SDMmag.com/mobile-inspection-electronic-reporting.)

Unlike the security market where apps seem to proliferate daily, on the fire side they are still in their infancy, primarily because code doesn’t allow anyone to remotely change anything on the fire panel. Industrious dealers and manufacturers, however, are increasingly turning to apps for a different purpose on the fire side.

“For our dealer base we have mobile apps to help them perform annual inspections and maintenance much more cost effectively,” Rief says. “It is saving the labor through technology and helping them deliver service more effectively.”

Dynafire’s Hoffman says his company is leveraging technology to help in the field. “Each of our techs is carrying a smartphone and an iPad with software to track their activity. We get daily reports from the field so we can better schedule and utilize our manpower.”

RMR is very important in the fire business, more so than security. In most cases it is required. Somebody has to do it. “I think the ideal situation is a company that not only installs but services with their own people,” says Michael Lohr, senior director of marketing, Red Hawk Fire and Security. “There are a lot of integrators out there that subcontract all their service. Having it all in-house is a real differentiator, as well as quality control.”

Services are, perhaps, under-offered by some integrators, Daum says. “More fire dealers need to diversify into that post-installation revenue model, including putting together a program for service and inspection and testing and maintenance. ”

Other opportunities could be coming up as well, particularly with technology advancements that have potential future implications along the lines of some of the high-level trends the rest of the security industry is seeing.

“We are starting to see a lot of interest in big data and how software can leverage it to get ahead of the curve in fire prevention,” Spence says. “There are so many potential applications for that data that it’s mind blowing. From understanding what devices and systems are the most effective or at risk, to calculating risk based on overlaying detailed data from past incidents with existing environments, the implications are nearly endless.”

Summers is starting to see some future planning in this direction. “In general there is no change in who is buying fire, but I have seen specific instances of future thought leadership. A major university came to visit us and they brought a risk officer, CFO, fire safety leader and a security leader to talk about the whole integration together. There are pockets of greatness.”

Just because the fire alarm industry is slow to adopt change, it doesn’t mean it can’t be forward thinking, adds Kevin Montgomery, product manager for detection and control products, Fike Corp., Blue Springs, Mo. “Fire is a code-driven industry and slow to adopt newer technologies, but I personally think we would be crazy if we don’t plan for and anticipate the need for IoT. Where people are using inputs and outputs based on fire alarm, HVAC and security, we are going to have a fully integrated smart building eventually. You must plan for this integration appropriately. If not, you will be left behind and eventually become irrelevant.”

Honeywell merged its security and fire divisions last year with this direction in mind, Rief says. “We are trying to lead the curve.” Jain adds, “We see customers who have a need where they didn’t before, which is that in an emergency communications situation they want to communicate to all occupants in the building. Can they use access control to know who is in the building? Can they use cameras to see who is in the building? Can they integrate the entire system to be more effective? There are nice opportunities for us in integration.”

Even NFPA seems to be laying the groundwork for future code changes in this direction. “The buzz in the industry is the ability, or future ability, to use Ethernet connections and other non-traditional, non-fire network connections in fire alarm applications,” Lewis says.

In the 2013 edition of NFPA 72, a new classification appeared, “Class N,” which stands for network. “Under all the rules and regulations of NFPA 72 you can use the network infrastructure of the building to provide some of the wiring between the equipment,” Roux explains. While still light on specifics, Class N is looking toward smart buildings, he says.

“There is no real detail in this new classification but there will be more in 2019, I believe,” Lewis says. “We see these new words in the code almost like a neon light. We know where it is going. I don’t know that things will go fully cloud-based, but I will be able to put remote power supplies or panels over an Ethernet connection, which will be huge for us. So much of the costs are related to construction and installation. If you can put more sophistication in at lower cost, you can do a lot more.”

While all this future talk is exciting, for the integrators who live and breathe this space Sessions stresses there is one thing that will never change: Fire is at its core about saving lives. “We are passionate about what we do and the technology of being able to keep people out of harm’s way. You can sell ‘heartware’ or hardware and we strive to stay in the heartware space.”