“An indisputable fact in defining security market revenue in general is that it captures the numbers of monitored alarm accounts. Residentially, that number isn’t growing much, given the lack of new construction starts and the large inventory of houses and foreclosures on the market today. However, affordable, apartment-based solutions may be a future remedy to that, and one that we are working on. Commercial sector security sales, which are generally more extensive, more product-intensive, and more profitable to security dealers and integrators, are improving and doing so at a faster, solid pace today,” Jones says.

Oh, The Telcos

2012 will be the first year the industry will feel (or not feel) the impact of all the telcos, wireless companies, and cable companies entering the industry in customer takeover or loss.

Raia’s EMC Security is located near one of the hot beds of cable activity —Atlanta — and he’s expecting to feel the impact in 2012.

“2012 may very well see the most competitive year since our company opened in 1998. Every major cable company is entering the fray with huge advertising budgets and millions of embedded customers that they already have a relationship with. (Comcast has 1.3 million customers in the greater Atlanta market alone.) I hope companies don’t underestimate the customers they can take. They can bundle voice, entertainment and broadband products at will, making it difficult for a customer to determine how much a new security offering really costs in comparison to other companies,” Raia says.

ABI Research’s Foster has the same reservation.

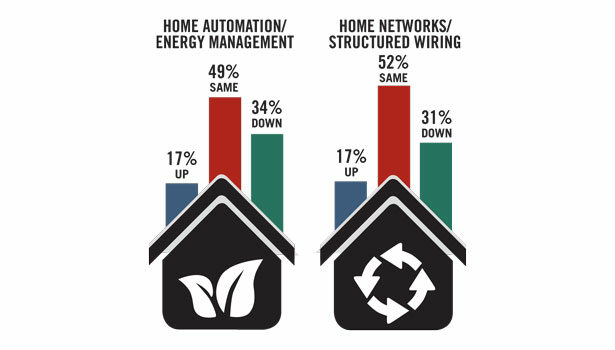

“Home automation is also a natural extension to the core offerings of telco and cable operators who can leverage existing infrastructure to transition easily from quadruple play to quintuple play (voice, data, video, wireless and now, home automation). Because of this, home security/automation can be offered at a discount when taken as part of a bundled service offering,” Foster explains.

Still, many companies still feel safe in the negative reputation held by cable companies. The The American Customer Satisfaction Index (ACSI) rates companies based on thousands of consumer satisfaction surveys. In addition to Cox Communications (17) on the list, Charter Communications (5), Comcast (4), and Time Warner Cable (3) all made the top five in “The 19 Most Hated Companies In America” published June 29, 2012 by Business Insider, based on the results of the ACSI.

The additional “glass-half-full” viewpoint, according to some dealers, is the marketing dollars spent by the cable/telco companies’ “deep-pocket” marketing departments, resulting in more educated end users and free marketing that dealers and integrators can use to their own advantage.

EMC isn’t resting on that marketing alone. “We are dramatically increasing our marketing and advertising to keep our share of voice in an increasingly crowded field,” Raia shares.

Mark Ingram, president of Visonic Inc., Bloomfield, Conn. (now a part of Tyco), also advises focusing on the customer experience. “Cable companies and telcos are locked on enhancing the customer experience with their new services. Dealers have had an issue with attrition in the past when end users simply stop using their systems. If alarm dealers put more emphasis on the end users’ experience they will experience less attrition and gain a better and happier customer,” he says.