The security industry is also counting on its expertise and position as a trusted source as an advantage in the competition with cable/telco/wireless companies.

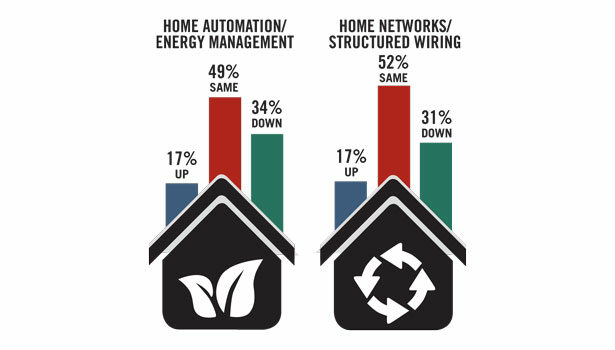

“What mass market companies like Verizon and Comcast offer is a start — a taste of home control — but it doesn’t compare to an integrated home, an entire smart home that can be controlled from a smart device. As more people start to have the technology in their home from mass market, it increases the demand for the electronic lifestyle. Traditional companies need to use the mass marketing to up-sell themselves as the channel for additional integration,” advises Erica Shonkwiler, market research manager, Custom Electronic Design & Installation Association (CEDIA), Indianapolis.

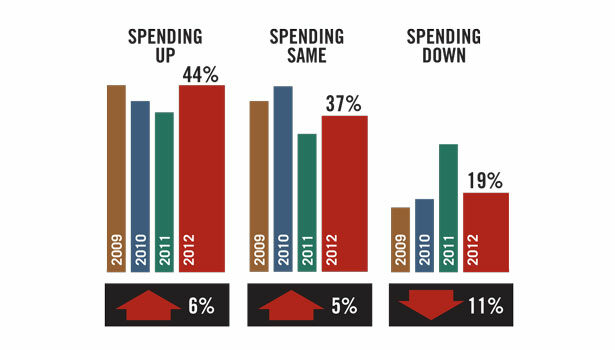

Mastering the argument for additional services or integration will help dealers find business in 2012 in existing homes. That’s business they are hard pressed to find in new construction. New construction remains flat in most areas around the country.

“New construction is almost non-existent in greater Atlanta market at present. Once one of the hottest building markets in the country, we no longer enjoy the benefits of installing systems for the builders at time of construction, and then signing on customers for monitoring when the home was sold,” Raia says. “We have compensated by expanding our residential and commercial programs, and continued focus on recurring revenue products and services.”

That’s the good news: today’s new technologies and service offerings offer a golden opportunity to connect with current customers and sell upgraded systems to existing homes.

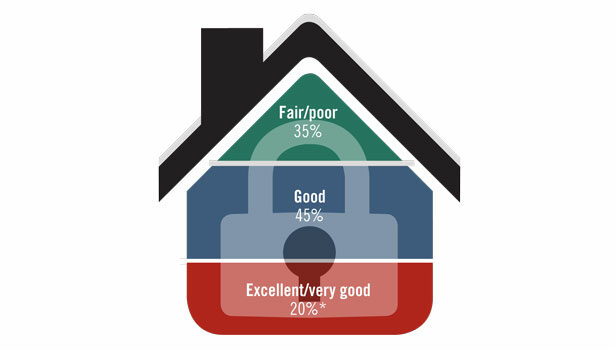

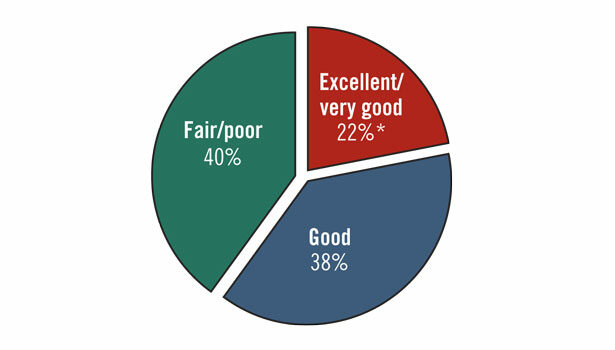

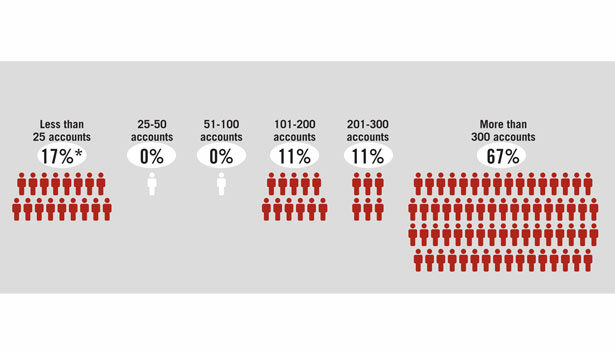

In SDM’s 2012 Industry Forecast Study when SDM asked dealers and integrators, “In which one residential market segment do you expect to see the highest rate of revenue growth for your company in 2012?” the answers, while spread between high-end, middle market, and low-end homes, attributed a resounding 76 percent of revenue growth to existing homes.

This same trend is reflected in a study conducted by CEDIA, which SDM supported through collaboration on the survey base. The study, “Size and Scope of the U.S. Residential Electronic Systems Installation Market 2011,” showed security dealers participating in CEDIA’s study reported 72 percent of installs would be retrofit this year.

Wireless

Retrofits benefit from ever-growing wireless technologies that are making it easier to upgrade or install new systems in existing homes.

Wireless is another area predicted to grow in 2012.

“To put a wired alarm system in a house is expensive and in older homes it can also be complicated. Wireless is what we’re finding to be the up-and-coming player. We carry 2GIG, and you have ease of installation, and, more importantly than that, the complexity of what it is able to do. People are really responding and loving the features,” says Dennis Holzer, executive director, Powerhouse Alliance. The PowerHouse Alliance is a national consortium of 11 regional distributors providing technology products, including alarm products, to dealers nationwide. Powerhouse Alliance expects its intrusion/wireless offerings to grow substantially in 2012.

“We’ve seen significant increases every month, and we think we will continue to see that in 2012,” Holzer says.

“We believe the intrusion market in 2012 will be different than 2011 due to clients more rapidly adapting Web-based interfaces for their systems, both PC and mobile,” says Steven Paley, president, Rapid Security Solutions, LLC, Sarasota, Fla. “We see 2012 as an expansion year for these technologies and we are proactively reaching out to our clients to show them what additional features they can add to their platforms, including video surveillance and home and lighting control.