Every new year always starts off with speculation. The interpretation of several noticeable changes impacting the alarm industry in 2012 depends on whether one subscribes to the philosophy of “glass half empty” or “glass half full.” What do you think as you read through the following list?

|

Every year SDM gets to talk to dealers, installers, distributors, manufacturers and analysts regarding the state of the alarm market. The conversation in 2012 reveals an industry that continues to adjust to these noticeable changes and many others, as well. While all of the changes have several sides to them, for the most part, predictors see the glass as “half full.”

Mobile Connectivity

Mobile connectivity and remote access remain huge drivers for 2012 growth. Parks Associates recently previewed yet-to-be released research from “The Next Service Provider Race: IP Monitoring, Access, and Controls” for SDM of what U.S. broadband consumers want in remote access. Home security and monitoring service ranked on top as “most appealing,” beating out energy management and control.

According to Parks Associates’ previous research on the appeal of remote home monitoring: 32 percent expressed interest in home automation and control and 28 percent of consumers expressed an interest in home security.

“The alarm industry is poised to capitalize as new technology becomes available and users seek more sophisticated solutions. End users are seeking more from their security system, and integrated solutions are providing positive results for dealers. Consumers have become more tech savvy and are interested in add-on solutions like wireless capability, remote access and video verification that integrate with smartphones and handheld devices,” says Andy Morra, vice president, marketing at ADI, Melville, N.Y.

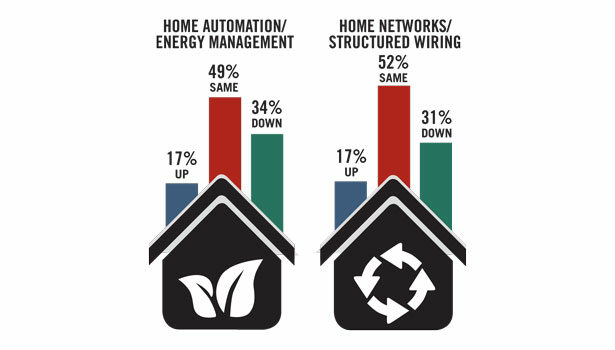

Home services, including home automation, and remote access are perpetually spurred on by the non-stop growth of smartphones and apps.

Industry research firm Berg Insight predicts global revenues from shipments of home automation systems will grow from $2.3 billion in 2010 to $9.5 billion in 2015. More importantly, Berg Insight forecasts the number of cellular connections used for home automation also will surge, increasing from 0.25 million in 2010 to 5.5 million in 2015.