“Manufacturers, we get it. A portion of the industry gets it. The other portion of the industry gets it but doesn’t know how to position their companies to get there,” says Kirk MacDowell, residential sales leader, Interlogix, Bradenton, Fla. “We’re already moving on as an industry from the “new normal” to the “next normal” so we’re focused on teaching all our dealers about what is new through online training, road shows, in-office training and more, and we’re helping them successfully position themselves in the market. The greatest thing is that the market is changing so fast, that we have to keep changing the presentation.

“Dealers can change. Of course, it is easy for us to stand up and say ‘You gotta do it,’” MacDowell points out. “Manufacturers have to follow through with how and support,” he says.

At ISC West, Interlogix will launch an up-sell kit designed for the salesperson or the installer, and the company is equipping its sales force with iPads (an almost universally recommended change by any company succeeding with the new technologies).

Honeywell also has worked through input from dealer meetings and its recent convention to touch base with the industry on what it needs.

“Some dealers are very much ahead of the curve. They understand the technology. They use iPads to sell from. They are focused on how they are selling. Other dealers are just starting out,” says Gordon Hope, general manager of Honeywell Security & Communication’s AlarmNet business, Melville, N.Y. “We’re focused on teaching them pricing, helping them develop a marketing message that works, providing demos to help sell, and more.

CEDIA is also focused on providing support.

“The learning curve does take time and this year we are continuing to try to shorten the learning curve, eliminate frustration and add money,” Shonkwiler explains.

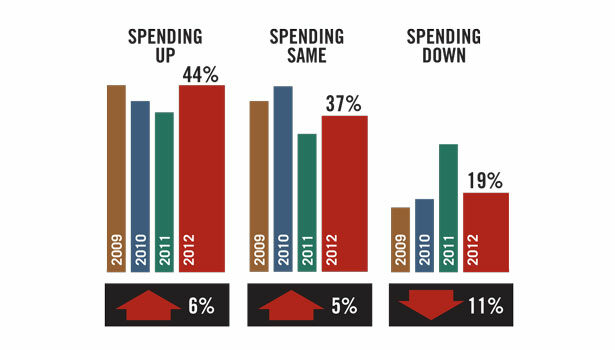

Falling Prices

Falling prices are also helping dealers serve more end users. In 2007, the average respondents to SDM’s Industry Forecast Study revealed the average price of a “mass-market” system sold by dealers as $949. Today, five years later, the price has fallen while the “mass market” has grown.

“All the convergence of the technologies is already there. It just continues to come down in price and hit new markets,” Visonic’s Ingram says.

There is a lot of work to do and careful decisions to make in the coming year. Falling prices don’t make it any easier.

“Pricing of basic security installation and basic monitoring services will continue to fall. Even premium services will face economic pressure and price cutting will continue in 2012, squeezing companies,” Raia says. “Those companies with efficient operations, reasonable customer-acquisition cost, and low debt should be in a better position than highly leveraged companies,” he predicts.

Jason Quam, owner, Dakota Alert, Elk Point, S.D., believes companies can put themselves in a better position by focusing on niches.