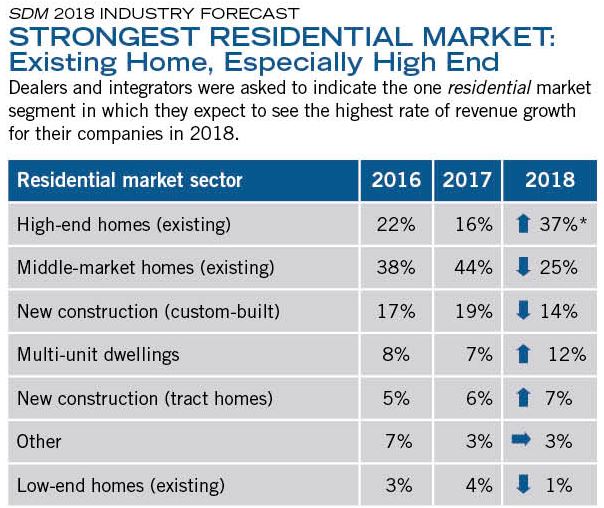

The Panel Weighs in on Productive Market Sectors

*percentage of dealers and integrators indicating each market; 77 respondents

The results of SDM's 2018 Industry Forecast Study show that 62 percent of dealers and integrators look to existing homes for their residential sales. However, more than 20 percent of companies rely on new construction. There are approximately 126 million households in the U.S.

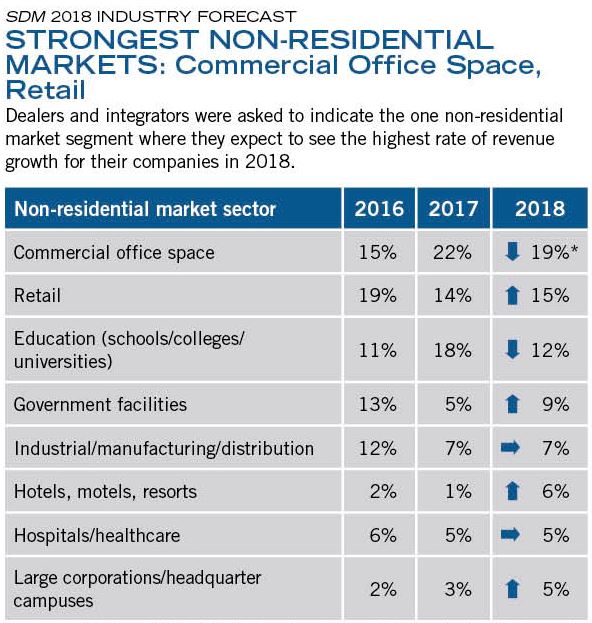

*percentage of dealers and integrators indicating each market, markets that received less than 5 percent response in the 2018 study are not shown; 77 respondents

The integrator channel expects its top three most fruitful segments in 2018 to be commercial office space, retail, and education. These are the same top three as last year; however, retail moved up from the No. 3 spot to No. 2, replacing education. Making the vertical market list for the first time is the category of “hotels, motels and resorts.”

SDM: What market sectors do you expect to have the most success with in 2018? Where do you see the growth coming from?

Susan Weinstein: I anticipate our greatest growth is going to be in our camera division, which is primarily monitored cameras; but we also do some high-end, standalone (just record). We do have recurring attached to those because we also internally monitor the health of the camera and the functionality of the cameras. So that’s going to be, I’m certain, our greatest area of growth in the Chicago market.

And then within that area of growth, I believe it’s going to be the city of Chicago. We’re getting a little bit of crime in the suburbs, which is where our primary office is and most of our business. But there is so much crime, especially with the high-end residential homes — in the Lincoln Park area, the Gold Coast area [of Chicago] — where the homeowners have detached garages and need to be able to safely come down the alley, pull into the garage, exit their vehicle, and get into their home.

I really feel that regardless of what happens in my market, crime is increasing in Chicago and police presence is decreasing.

I don’t want to say everybody has a burglar alarm, but my customers — a lot of them have security detail — so this is just another tier. This is something that we talk about with them: Where are the security tiers around their home? Maybe it starts with a wrought iron fence and then some bushes, and on and on and on. So every time one of those layers is penetrated, the homeowner has the opportunity for early warning that there’s somebody out there who has bad intentions. We have customers now that are going as far as to have cameras installed that monitor the sidewalks around their house.

So that’s going to be our greatest area of growth.

Tommy Smith: I would say, going back to what we talked about earlier with the economic activity in the commercial market, video and access are probably the two primary products with the video being monitored. There are several different services out there that do that.

And then in residential, because of how much new construction we do, we get about — this year — 1,800 homes with some type of wiring. We wire all of them for some national builders. That’s really helped us. Because we’re in there wiring their homes — their cables, their data jacks, or whatever they’re wanting. And that’s when we can get them the security deals as well.

How many different builders do you work with?

Tommy Smith: We’ve got about eight primary ones, and then some smaller [builders] that do custom and so forth.

In Atlanta, the new construction market is back almost as strong as it was pre-2008. Again, we’ve gone from 1,200 houses one year, to 1,500 the next, to 1,800 this year total. We probably service 70 or so communities throughout metro Atlanta.

We’re pre-wiring the services all the way down to the cable jacks. Any other low-voltage services that the builder includes in the houses are sold as options.

SDM: What percentage are you converting?

Tommy Smith: Most of them, we’re not doing security. Out of the houses we do, about 25 percent we sell security to right now. We don’t actually meet with the clients, seeing as they chose not to buy at the design center; they carried on with the service they had. And that’s why we’ve increased sales staff for next year to focus on that 75 percent that we’re not capturing.

Steve Sopkin: Our residential side is more the home automation. We’re going to give that a shot. For the second [market] our commercial is really the public sector with city and county work, public schools, all prevailing-wage applications. All of the cities locally here in Southern California are putting more money into it. They have more money because of houses being built, etc. That’s where we’re going.

Ray Cherry: I hate to say this, but what I’m getting a lot of calls on is churches needing better security. I hate to throw that out there with what’s been going on, but we’ve gotten some calls and they’re serious about it. They’re coming up with the money from the congregation to put in what they need to have done.

They’re locking the doors — you know, access control. Almost always in a church you’ve got to put crash bars where they can get right out. Then, they’re heavy with both access and cameras. Of course, y’all know it can be much harder to run wire in a church.

Susan Weinstein: We’ve seen that as well, at some of the local temples here.

You know, there’s Homeland Security money available for them.

Tommy Smith: We have had an extreme number of calls about it. We’ve done churches that have schools in them — we’ve added access control.

The Panel Weighs in on New Products & Services

SDM: What, if any, new revenue generating services or products did your company add in 2017?

Susan Weinstein: Ours would be within our camera division; and that would be our SolarWinds, where we monitor the health and the functionality of the cameras. [For example,] for cameras that are recording on a local level we can receive early notification when the cameras are not functioning properly. Otherwise, by the time the customer finds out there’s a problem, it’s after they’ve had some type of an incident.

That’s been good for us. It also takes me back to modifying my earlier statement when we talked about forecasting for RMR [in 2018]. But…if our camera division continues to grow at the rate we anticipate and then some, that will really greatly impact our recurring, because we charge recurring for everything we do, and the camera recurring is fairly substantial.

And then additionally we provide monitored cameras. And that’s a relatively hefty monthly fee.

Tommy Smith: Some of us [on the Industry Forecast Panel] are Honeywell houses, which we have always been. We have integrated using Alarm.com now, as well. Some of the other competitors in Atlanta also use Honeywell, so we wanted to have an alternative product line to combat that so that we don’t lose a sale just because we’re both selling the same thing.

We have incorporated more video monitoring services. I think that’s going to be a big future. Again, I think the DIYs and all these things are great, and I think there’s a market for it. But I truly believe that as much as people think they want to do it themselves, they realize after a little while, they don’t want to be at dinner and get that call and try to figure out what to do. So I strongly believe that there will always be a need for professional monitored systems.

And then the other thing we’re looking at is we’ve added several different maintenance agreements to our product lines as well.

SDM: When it comes to video monitoring, what are the different types of services that you offer?

Tommy Smith: It depends on what it is. For the construction industry, we use the Videofied product for video verification, which we were using before Honeywell purchased it. And the I-View Now product; we’ve got a few customers on that as well. It’s very similar; it just connects to a DVR instead of straight wireless technology. It sends you the video clips and all that. It’s actually being monitored by the central station, similar to Videofied, but it actually connects through the DVR.

Steve Sopkin: About the only thing we added was [a video doorbell product] and it was just a really big fail for us. It’s been tough and here’s the reason why: it depends on the customer’s Wi-Fi speed and connectivity and type of doorbell (electronic versus not). And it is a consumer product that they can buy off the shelf for $25 more than I can buy it for. I mean, we make $20 bucks on it. We’ve been back to almost every single client. I’ve given them money back for some of them. It’s just been tough. That’s been the only thing that we’ve tried.

Hey, would you like to buy some? I have a couple in stock.

Tommy Smith: I’m sorry to hear that, because we actually just got one of our builders to agree to put them in standard, but they don’t use any kind of digital doorbells.

Steve Sopkin: Yeah, it’s digital doorbell, but even more important it’s the speed of the Internet for the customer. And that’s where the expectation comes in because they want the camera to come up immediately. It doesn’t come up until the guy rings the doorbell, they get the notification, and they look at it. And they’re looking at it and looking at it, and finally they see the photo and the guy’s gone.

So then you’ve got to go back in the history. It doesn’t meet the customer expectation quite yet unless you ensure that all the other systems that you’ve tied to are 100 percent working for you.

Ray Cherry: I guess you could say we’ve taken on some more access and camera product lines without any trouble. We used to kind of just keep it to a few minimum, but we’ve opened it up and it’s really helped to generate more sales without any problems.

You’ve got to get more training in there for everybody, but it’s worked out okay.

We’ve always been a huge DSX dealer because of our relationship there. We still sell a ton of DSX, of course, but we’ve taken on other access control lines. You used to worry about getting all the techs trained on the different [systems]; but it hasn’t been a problem — and it’s helped sales quite a bit.

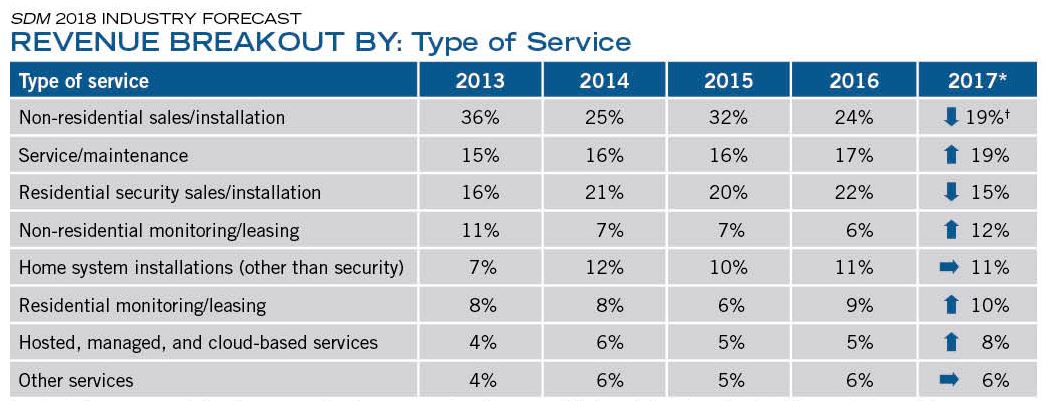

*year in which revenue was counted

†average percentage of revenue per service category among all dealers and integrators participating in the survey; 92 respondents

SDM’s Industry Forecast Survey tracks how dealers’ and integrators’ total revenue is distributed among types of services. Together, 34 percent of revenue comes from non-residential and residential sales/installation; however, this is down from 46 percent in 2016. The share of revenue from hosted/managed/cloud-based services is finally inching up, comprising an average of 8 percent of survey respondents’ revenue.

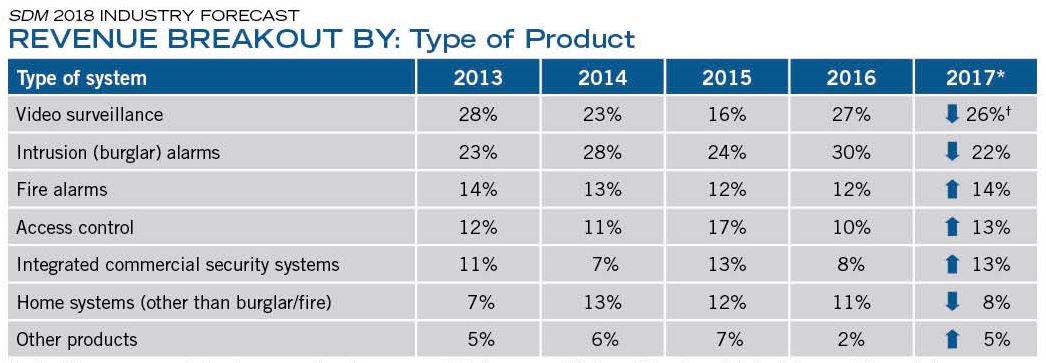

*year in which revenue was counted

†average percentage of revenue per product category among all dealers and integrators participating in the survey; 99 respondents

SDM’s Industry Forecast Survey tracks how dealers’ and integrators’ total revenue is distributed among types of products. The 2017 results show how the channel is strongly diversified in its product offerings, with video surveillance and intrusion alarms being the top two categories.