The Panel Weighs In on Factors Affecting Sales

*percentage of dealers and integrators indicating each factor; factors that received less than 5 percent response (including “controlling costs,” “inability/difficulty to obtain credit,” “training employees” and “diversifying my business”) are not shown; 103 respondents

“Finding/retaining employees” is the No. 1 challenge faced by dealers and integrators as they look out over the business landscape of 2018. Thirty percent of survey respondents selected this answer, up from 18 percent last year, putting it in the No. 1 spot for the first time since 2008 during the start of the Great Recession. This may reflect the fact that all of the dealers on the SDM Industry Forecast Panel indicated they are in an excellent sales period; further growth could be hindered by a lack of skilled workers.

SDM: What is the one factor you feel will have the most impact on sales of security systems by your company in 2018?

Susan Weinstein: My one answer is economic conditions, for my market. Again, we follow consumer spending trends. So with our high-end residential client base, if the economic conditions are strong — they’re tearing down homes, they’re building new ones; they’re putting additions on their homes — they are just really willing to spend and to spend on security.

And in the Chicago market the second thing we look at is crime, because that affects our camera division more so than consumer confidence does.

Tommy Smith: Actually, because we’re so tied to new construction — like Ray said, the commercial growth and capital spending is so much higher than it was a couple of years ago — for us I would say residential building and capital spending are two that I would highlight.

Steve Sopkin: I would probably say economic conditions; and I hate to bring up President Trump, but I do think that the overall confidence in the economy across the board for us has been really great. I’m a pretty staunch Republican. I don’t appreciate Trump in any way, but everything that he’s put into place is really driving the economy forward. I see new homes in the area, new buildings in the area, which creates a larger tax base for the cities to grow. And we do a lot of public sector stuff with prevailing wage, and that’s all a trickle down from the very top. So, economic conditions — 100 percent.

Also sales and marketing of security, a little bit. Crime, a little bit. But we just see a really, really strong growth here in Southern California.

Ray Cherry: They’re definitely the top two, but I believe I’d go with capital spending by business, just barely ahead of economic conditions. People are turning loose some money now where they hadn’t been in the last few years for businesses.

SDM: Specifically looking at recurring monthly revenue (RMR), how do you expect your company’s 2017 RMR will have changed compared with 2016? And how do you expect 2018 RMR will change compared with 2017?

Susan Weinstein: Our RMR is up about 12 percent this year, primarily because we had a rate increase. We don’t necessarily initiate an annual rate increase. We do it every three or four years, and only in certain categories of RMR. So maybe service plans would have a percentage increase one year, and then we would go maybe a couple years with no increase; and then increase the base monitoring for everybody, then take a little break. We also charge a little bit more monitoring fees for environmental devices such as carbon monoxide detectors, low-temperature sensors, and water detection sensors, so we might increase that a small amount.

So I don’t anticipate 2018 RMR having any major jump other than the increase of our account base just a small percentage, because this year we had our big rate increase.

Tommy Smith: This year we had about 35 percent increase in RMR. A lot of that has to do with bringing on some sales staff, adapting some of the product lines to the changing needs. The big factor for us was adding automation services; more and more people are asking for it, and that’s what’s increasing the bottom line.

In 2018, I expect [RMR growth] to be about 15 percent to 18 percent. We brought on an additional sales guy towards the end of the year. We expect with what they’re doing and the packages that we put together, we should see, again, about 15 percent next year.

Steve Sopkin: Our RMR has been pretty flat this year. I’m not so worried about it because our net profit has gone up so much. But in 2018 I see us adding an automation platform. And we’re also in negotiation to purchase another local security company with about $15,000 in RMR. So that will give us a boost towards growth.

In our area, we probably get 50 calls a month asking, “Can you beat zero?” Our residential market is kind of flat. So we’re going to add the whole automation platform with lights, locks, thermostats, etc., to see if we can’t gain a little bit more market share that way and serve the customer a little bit better.

Ray Cherry: Our monitoring — it’s been pretty flat. It was up 3 percent. It’s a very stable base, but there’s not a whole lot of up or down on it. Now, we break out maintenance agreements separate from monitored systems, and maintenance agreements were up 7 percent, so people are catching on to doing that a little better now.

The sales we have are installs from that big increase, and much of them have montoring attached to them, but you know, you lose a few, then you gain. Hopefully you gain more than what you lose.

SDM: Are there more opportunities now in residential than there are for commercial in terms of monitoring unique things and adding on extra services to increase the monthly?

Ray Cherry: Well, yeah. Everybody calls now about residential and asks about wireless cameras. And the ones we’ve tried, I hate to say — I don’t want to mention any names here.

Susan Weinstein: They don’t work.

Ray Cherry: They don’t work. I’ll tell you what. We put a nice alarm system with cameras in it for a fella that’s a prominent businessman here. We put the cameras in there and they didn’t work. I mean, we made it right — believe me — but, oh my gosh. I hadn’t wanted to look at a wireless camera in a house since, you know?

Susan Weinstein: It’s one of the things that we looked at about five years ago, and realized that they don’t work. And therefore, they’re going to cause service drag. Because when they don’t work, my after-hours service technicians are going to need to respond to those calls. And we can’t charge for it, because it doesn’t work.

My camera division does a lot of work in the city, in the residential neighborhoods. And we sell high-end, expensive cameras.

Ray Cherry: You all run cable to them, I’m sure, don’t you?

Susan Weinstein: Absolutely, yeah. They’re not wireless.

SDM: Are you referring to the wireless technology failing or the quality of the image, or both?

Susan Weinstein: Both.

The Panel Weighs in on What Keeps Them up at Night

SDM: What is the one factor you think will present the biggest challenge to your company in 2018?

Susan Weinstein: Well, I’m going to start with my old stand-by, which is finding and training employees. We can never find enough technicians.

We hire them young and we hire everybody that walks in who’s qualified to be hired. All they need is attitude and aptitude. No skills. I’d rather have no skills.

Steve Sopkin: No skills.

Tommy Smith: I would tend to agree with that. It’s very tough, and honestly, we’d like to hire people that don’t have any skill set in this field because they usually think they know everything, and then they do it different than we want it.

We’re always recruiting. We’ve got Lincoln Technical College here; we’ve got a relationship with them and a couple other schools. We’re always recruiting because part of our business — the builder business — the guys don’t really like to do. The residential installation, it’s the tougher work, I would say. Pulling wire and that kind of thing is where we have a hard time finding guys. The commercial [jobs], they’ve been with us; they don’t leave.

Number two would be protecting profit margins. With the market that we’re in, so many companies are giving away equipment. It’s hard to protect that margin when you’re having to do things for zeroes. We try not to do those deals, but sometimes we just have to; it’s about building RMR.

Steve Sopkin: If you asked me today, it would be keeping up with customer demand. We’re about six weeks out right now for installations, and it’s tough keeping customers happy. That’s today.

But I think over the next year there are just so many different options of where the industry is going and I think figuring out how to diversify my business in an intelligent manner without getting too spread out is going to be one of my greatest challenges, which directly relates to generating recurring revenue.

Ray Cherry: I’m going to go with keeping current with technology. The way these manufacturers change the software, it’s just a scramble to keep your techs up-to-date on everything they’re doing. The big camera manufacturers, they’ll come in and make something an end-of-life of product, and then you’ve got to upgrade everything. It’s quite a deal to keep up with.

The Panel Weighs in on Competition

*percentage of dealers and integrators indicating each choice, 103 respondents

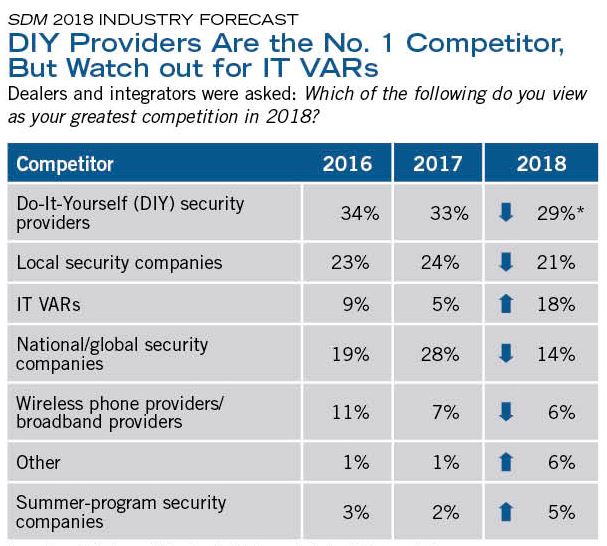

For the third consecutive year, SDM's Industry Forecast Study respondents selected DIY security providers as their foremost group of competitors. Local security companies are always a formidable competitor, but the category to watch this year is IT companies: 18 percent of respondents selectetd them as their greatest competition, up from 5 percent last year.

SDM: Which type of company do you view as your greatest competition in 2018 and why?

Susan Weinstein: Our true competition is local security companies and security integrators. Our perceived-by-our-customers competition is either do-it-yourself or wireless phone providers, or broadband providers. The most calls that we get regarding competitors in our space is always my cable company, my phone provider will do it for this much. They really aren’t our competitors in the end because those providers can’t service our customers.

But that takes an education, and sometimes they will cancel services with us — and they’re back within a year. But they will still try to make that breach into the broadband providers.

Tommy Smith: There’s a lot [of competition] in Atlanta. But honestly, this is kind of a toss-up between the local security and the national, because in Atlanta, all the locals are having to adapt to what the national companies are doing, unfortunately. I can name one after another; so many of them give so much equipment away. And I was stating with RMR growth; a lot of it has to do with automation.

The reason I say that’s one of the bigger problems is because I felt like we had an opportunity in the industry to change the industry where you didn’t have to give equipment away when the automation started making its way into the market. And some of these companies already have taken that approach, which has ruined the opportunity to make money up front.

So in Atlanta, all the ads from your wireless providers, your national companies, and now even your local companies are all saying the same thing: “Get automation, we’ll give you security.” They’re giving away all the automation equipment as well.

Steve Sopkin: I think for our commercial division, it’s probably local security companies and systems integrators. We’re about an hour outside of Los Angeles so it’s really local competition. For residential, it’s more the national companies that are doing the race to zero that we are in competition with for our residential client base.

For the most part, we are more of a high-line company, and our average age of a customer is probably 45 to 65. The under-45 market for us is rapidly going away. I think that anybody under 30 will never have somebody else do their own alarm system. These systems are becoming easier and easier to put in themselves. And they’re a little bit more tech-savvy, so I don’t foresee a future for residential alarm systems. It’s just going to be a really, really small section as time goes on.

Residential cameras have now been overshadowded. Where we would sell a $5,000 residential camera system, now people are putting in a Ring for $200. So, you know, things change. It may not be exactly the same setup, or the best level of security, but it is close enough for a lot of customers that I think that they are satisfied at some point.

SDM: What about monitoring? Do you think that they’re going to be satisfied with “monitor it yourself”? Or do you think that there will still be a need for professional monitoring, either on a full-time basis or an as-needed basis?

Steve Sopkin: I think it goes both ways. But I do see a problem with more and more police departments up in arms, and false alarm fines, etc. One of the alarm systems I just saw this past week on Indiegogo sends a text to you and 10 people in your neighborhood. So if your whole neighborhood put in this $10 motion sensor in their house and then [it activated], the app sends a text to all 10 of you in the neighborhood and everybody can look out. It’s brilliant. I think it’s a smashing idea; I wish I had thought of it.

I do see things changing more rapidly today than ever before for electronics. To be honest with you, I can’t tell if it’s my age or it’s actually this tidal wave where the electronics industry has finally gotten to a point where they’ve figured it out for manufacturing to make it smaller, cheaper, more reliable, etc. Before, you needed a technical person with 15 years’ experience to put this camera in. Today, you plug it in, you do the QR code on your phone, then you downloaded an app, and boom, you’ve got a camera. It’s changing. You’ve got to be smart enough to change [with] it, and figure out where your core market is, and where you’re making your money, where your expenses are going — and that’s what we’ve really, really concentrated on this past year.

Ray Cherry: I’m going off just a little bit here: it’s the IT value-added resellers. In this business, you knew who all your competitors were, and you actually knew who you were dealing with and all that. But now, these companies get out there and they’ll run all the cable for a business, and they may or may not be licensed with the state like they’re supposed to be, and they’ve got the business before you ever have a chance at it. That’s something you’ve got to really watch on the commercial side here. They’ll have a great-looking website, and can do security. In Texas you’ve got to have a license, but they skirt it and then by the time you report them they’ve already got it and they’re gone.

And they’re not paying the insurance and doing all the CEU credits and all that like we do. But they get in there and they’re gone, and that’s what we’ve really got to watch for.

Susan Weinstein: We find it helpful to notify our customers of that risk — because they don’t know and they don’t understand. That’s one of the things that we will put in our newsletter periodically.

Ray Cherry: Yeah, you can go online and see if they are licensed.